During the pandemic, the Department of Education suspended student loan payments and interest for millions of borrowers. One estimate found this significant benefit to borrowers costs at least $100 billion. Much of the debate about student loan forgiveness centers on equity, particularly for communities of color.

In one of the largest surveys on student loan forgiveness ever performed, Student Loan Planner surveyed over 6,200 high-debt borrowers on April 18, 2022. Black, Hispanic or Latino borrowers might disproportionately need to borrow money to finance their education, but they're underrepresented at the graduate school level and take out less student debt, compared to white and Asian American borrowers.

Suspending interest provides a larger subsidy to those who borrow more debt. Due to the demographics of borrowers who take out large student debt balances, it's clear that Black, Hispanic or Latino borrowers received less student loan relief during the pandemic than other ethnic or racial groups.

Our survey findings also suggest that if the White House cancels $10,000 to $50,000 of student debt, these borrower groups would have a higher share of their overall debt burden eliminated.

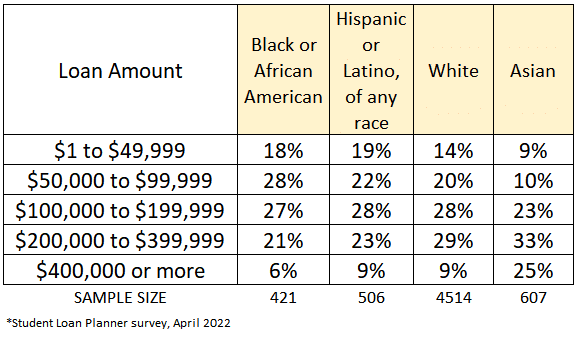

Student debt burden by racial and ethnic group

Although our survey disproportionately represents high-debt borrowers, the different amounts of borrowers by each racial and ethnic group were striking. We use Census-defined definitions of racial and ethnic groups.

Borrowers in the Asian and white categories had significantly higher debt amounts than those in the Black, and Hispanic or Latino categories.

Here’s the share of borrowers in each category who borrowed less than $100,000:

- Black or African American – 46%

- Hispanic or Latino – 41%

- White – 34%

- Asian – 19%

Because the administration is considering canceling a student debt of “less than $50,000,” these survey results suggest that Black and Hispanic or Latino borrowers would have a higher degree of their student loans canceled by this action.

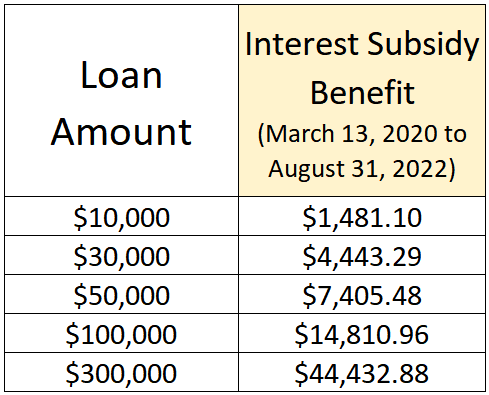

Example of interest subsidy benefits during the pandemic

One of the primary ways the government helped student loan borrowers during the pandemic was by suspending interest on federal student loans.

During the pandemic student loan pause between March 13, 2020, and August 29, 2023, this is the amount of interest eliminated at different debt levels assuming a 6% interest rate.

Since Black and Hispanic or Latino borrowers have smaller student debt balances, these groups of borrowers have received fewer interest subsidy benefits during the pandemic.

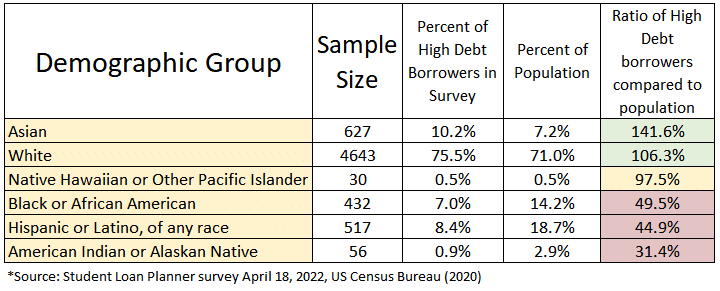

Distribution of high debt borrowers as a percent of the population

When we look at the distribution of high-debt borrowers by self-reported racial or ethnic group, we find that Asian and white borrowers are overrepresented compared to their share of the population, while Black, Hispanic or Latino, and native/indigenous borrowers are underrepresented.

This could be due to these borrower populations being underrepresented in graduate school and doctoral degree programs.

This breakdown also strongly suggests that Black, and Hispanic or Latino borrowers received a smaller dollar amount of student loan relief than other borrowers during the pandemic.

Black, and Hispanic or Latino borrowers might be more likely to need to borrow for undergrad. If you looked at the student debt relief benefits in isolation among borrowers who exclusively borrowed for undergrad, you might find a disproportionate benefit to these communities.

However, the pandemic student loan relief was not structured in this way.

How this finding lines up with other studies on race and student loan debt

Some data sources find that Black, and Hispanic or Latino borrowers are more likely to borrow for graduate school as well as undergraduate.

How could that be consistent with our survey findings that white and Asian American borrowers benefitted more from the student loan pause and owe more debt overall?

According to Educationdata.org, 40% of Black graduates have debt from graduate school while only 22% of white college graduates have debt from graduate school.

Black, and Hispanic or Latino borrowers are also more likely to borrow for undergraduate programs, and they carry more debt from those programs.

However, of the individuals who borrow, it appears that white borrowers have significantly more debt due to their overrepresentation in doctoral and professional schools where debt loads are the highest.

Other studies might have limited themselves to looking at undergraduate programs only instead of the pool of student debt overall.

Without cancellation, the fact remains that undergraduate borrowers of any race haven't benefitted significantly due to the pandemic student loan policy, compared to graduate degree holders and parents with large PLUS Loan balances.

How cancellation could disproportionately benefit Black, and Hispanic or Latino borrowers

In addition to uncovering that Black, and Hispanic or Latino borrowers owe less than high-debt borrowers overall, we found that cancellation is more meaningful to this borrower group as it eliminates a higher percentage of their student loan debt.

That said, white and Asian American individuals attend college at higher rates than Black and Latino students, according to the Department of Education.

What’s clear is that the current student loan payment and interest pause is more regressive and has provided fewer benefits to Black, and Hispanic or Latino borrowers than student loan borrowers overall.

Refinance student loans, get a bonus in 2024

| Lender Name | Lender | Offer | Learn more |

|---|---|---|---|

|

$500 Bonus

*Includes optional 0.25% Auto Pay discount. For 100k or more.

|

Fixed 5.24 - 9.99% APR*

Variable 6.24 - 9.99% APR*

|

|

|

$1,000 Bonus

For 100k or more. $300 for 50k to $99,999

|

Fixed 5.19 - 10.24% APPR

Variable 5.28 - 10.24% APR

|

|

|

$1,000 Bonus

For 100k or more. $200 for 50k to $99,999

|

Fixed 5.19 - 9.74% APR

Variable 5.99 - 9.74% APR

|

|

|

$1,050 Bonus

For 100k+, $300 for 50k to 99k.

|

Fixed 5.44 - 9.75% APR

Variable 5.49 - 9.95% APR

|

|

|

$1,275 Bonus

For 150k+, $300 to $575 for 50k to 149k.

|

Fixed 5.48 - 8.69% APR

Variable 5.28 - 8.99% APR

|

|

|

$1,250 Bonus

For 100k+, $350 for 50k to 100k. $100 for 5k to 50k

|

Fixed 5.48 - 10.98% APR

Variable 5.28 - 12.41% AR

|

Not sure what to do with your student loans?

Take our 11 question quiz to get a personalized recommendation for 2024 on whether you should pursue PSLF, Biden’s New IDR plan, or refinancing (including the one lender we think could give you the best rate).