Mike Bloomberg released his plan for higher education on February 18, 2020. Mostly, it’s a mashup of other policy proposals from the moderate wing of the Democratic party.

It’s not a moderate proposal though. The Bloomberg student loan plan would cost $700 billion over 10 years and massively expand loan forgiveness. That’s a little more than half the cost of Elizabeth Warren’s $1.25 trillion student loan plan.

Here are some of the key components of Bloomberg's plan for student debt:

- Cap tax-free loan forgiveness for non-PSLF borrowers (Some articles are mistakenly saying he wants to cap loan forgiveness, which does not appear to be the case)

- Keep and expand PSLF so public servants with the wrong kind of loans or payment history can qualify in addition to current borrowers

- Drastically decrease required payments for undergraduate borrowers, incentivizing millions more to pursue student loan forgiveness

- Double Pell Grant funding and eliminate student loans for low income students in 2 and 4 year programs

- Eliminate legacy preferences in admissions so more lower income students attend schools with the best financial aid packages

- Push through mass forgiveness for students defrauded by for profit colleges

- Triple funding for HBCUs and other minority serving institutions

1. Cap Tax-Free Forgiveness of Student Loans to Undergraduates Only

Capping tax-free forgiveness is very different from limiting student loan forgiveness in general.

We already have student loan forgiveness plans like PAYE and REPAYE that allow you to receive student loan forgiveness after 20 to 25 years of on time payments.

That forgiveness is taxable though unless you pursue the PSLF program. For most borrowers, you must pay income taxes on the forgiven balance in the year that it’s forgiven.

Bloomberg wants to forgive up to $57,000 tax-free after 20 years of payments for undergraduates only.

Nowhere in his plan does he call for elimination of student loan forgiveness for graduate borrowers pursuing IDR plans. He also does not propose capping loans forgiven under the PSLF program.

He seems to expect that graduate borrowers would need to pay income taxes on the forgiven balances.

In other words, the current forgiveness regime would become more generous, not less generous.

Borrowers with the largest balances would likely need to rely on the insolvency rule to have their student debt forgiven without taxes.

Otherwise, they would receive a 1099-C and pay their tax hit from funds saved up over time in mutual fund accounts.

Again, this is more generous, not less generous than current rules.

2. Expand and Protect Public Service Loan Forgiveness

Bloomberg wants to:

“Extend debt relief to all qualifying public servants who’ve applied for forgiveness in good faith under the current policy. More generous terms will be piloted for students going into professions that fill targeted labor-market needs.”

The “more generous terms” part to me suggests Bloomberg would look at accelerated forgiveness faster than the 10 years required by PSLF for critical need areas like teaching, firefighters, nurses, etc.

Current forgiveness programs like Teacher Loan Forgiveness are horribly designed anyway, so that would be a positive.

Also “more generous terms” implies he would not eliminate PSLF.

Making sure that PSLF goes to all public servants who applied in good faith is what the What You Can Do For Your Country Act cosponsored by Senator Klobuchar and Senate Democrats have proposed.

That bill anyone with non qualifying federal loans on any payment plan whatsoever to consolidate into a Direct Loan and receive student loan forgiveness.

3. Undergraduates Would Not Pay Very Much at 5% of Discretionary Income

Bloomberg borrows from the Biden student loan plan, which would allow borrowers to pay only 5% of discretionary income instead of 10%.

However, Bloomberg restricts this to undergraduate borrowers only. He’s basically acknowledging that graduate student loans are a totally different animal than smaller undergrad balances.

There’s one big problem with this proposal though.

It would incentivize millions of undergraduates to not pay back their loans.

Why Would Undergraduates Pay Almost Nothing Under Bloomberg’s Student Loan Proposal

Pretend a borrower left school with $35,000 of student debt, which is close to the average student debt for the class of 2019.

- Imagine that this borrower (let’s call him Jim) also earned $50,000, which grows with inflation over time.

- Bloomberg would pull that payment out of Jim’s paycheck, likely not including his spousal income information.

- Jim would need to pay 5% of his discretionary income (which is approximately $50,000 minus 1.5 times the $12,000 federal poverty line for his family size of 1).

- 5% of a discretionary income of $32,000 is about $1,600 a year, or $133 a month.

- For comparison, the standard 10 year payment for Jim would be $371 a month with a 5% interest rate.

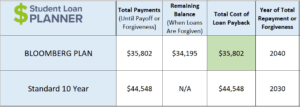

Here’s how this cost would look over time.

Would you rather pay $35,802 over 20 years or $44,548 over 10 years? Remember the remaining balance up to $57,000 would be forgiven tax-free.

Even if our hypothetical borrower Jim got raises, his terminal income would need to be over $100,000 a year before paying back his student loans would make sense (assuming he could earn at least 5% on investing his money instead).

We project this would drastically reduce the number of borrowers who successfully pay off their federal student loans.

Why Did Bloomberg Limit Tax-Free Forgiveness to $57,000?

That’s approximately the $57,500 maximum that undergraduate borrowers can take out under their own name under the Stafford loan program.

If you are not claimed on your parents’ tax return, then you can borrow closer to the $50,000 level.

If you’re a dependent, you’d likely end up in the $30,000 debt level.

Perhaps many more borrowers would opt to be independent for tax purposes since most college graduates do not earn six figures during their careers with solely an undergraduate education.

The current state of student loans for undergrad requires payments of 10% of your income for 20 years before receiving forgiveness. Also, that forgiven debt is taxable.

Hence, receiving forgiveness is difficult for undergraduate degrees in 2020 under present rules.

Graduate borrowing is not subject to caps, and thus graduate borrowers can easily benefit from student loan forgiveness currently.

Bloomberg does not seem to want to limit forgiveness for graduate borrowers in the private sector, but rather just leave them alone. He'd also likely tax the forgiven student debt if that borrower had enough assets to do so.

Since this change would make student loan forgiveness for undergrads vastly more financially appealing, millions more undergraduates would be rewarded for not paying off their student loans.

If student loan limits were not carefully limited, the same problems of massive student loan balances among graduate and professional students could befall undergraduates too under this plan.

4. Eliminate Student Loans for Low Income Borrowers in 2 and 4 Year Programs

Bloomberg continues the trend among Democratic presidential candidates of making community college tuition free.

In addition, 4 year public colleges would be tuition free for low income borrowers.

Of course, low income students still need money for housing, food, and other expenses besides tuition, and many turn to student loans for that support because of caps on Pell Grant funding.

That’s why Bloomberg would double Pell Grants, just as Senator Amy Klobuchar suggests.

He would also provide enough funding to essentially eliminate the need for student debt for borrowers with low incomes.

Although, it’s not clear that doubling Pell Grants and eliminating tuition for low income borrowers would actually achieve the goal of zero student debt for low income students completely.

5. Eliminate legacy preferences in admissions, allowing more lower income students to attend the most selective schools

Ivy league institutions and other selective schools frequently give legacy candidates similar admissions boosts as students from underrepresented backgrounds.

That reduces the spots available for lower and middle income students.

If you can get into a school like Princeton, you don't have to pay a dime if your income is modest.

The problem is how hard it is to get accepted in the first place.

By eliminating legacy preferences, Bloomberg says this would increase the enrollment of students of color and lower income students at the schools with the most money to give away.

Bloomberg donated $1.8 billion to his alma mater Johns Hopkins, so this is a plan that’s unique to Bloomberg’s particular passion for giving all students the opportunity to attend the best schools without regard for the cost.

6. Forgive Student Loans for Students Defrauded by Failed and For Profit Colleges

It’s hard to describe exactly who would receive forgiveness under this provision, as Bloomberg says he would cancel student debt for borrowers who attended “failed and predatory for profit colleges.”

Are all for profit colleges predatory? Or just some of them?

Clearly students from schools like ITT Tech and Corinthian colleges would not have to wait for forgiveness under a Bloomberg administration. But what about schools like University of Phoenix, which was fined by the FTC for alleged deceptive advertising?

In practice, this policy plank probably just means that the backlog of student loan forgiveness under “borrower defense to repayment” that’s happened under the Trump administration would end.

If your school closed or you can prove the school defrauded you, then your student debt would likely be forgiven under a President Bloomberg.

7. Triple funding for HBCUs and other minority serving institutions

Most of the other Democratic candidates have specific plans for increasing funding for HBCUs and other institutions of higher learning that service primarily students of color.

Bloomberg’s plan would triple federal Title III funding, provide one time forgiveness of debt from capital projects for struggling institutions, and increase financial aid while incentivizing increases in graduation rates.

Bloomberg Focuses on Student Debt Proposals Democrats Agree On, Stays Silent On Key Questions

Bloomberg’s plan is a mix of Vice President Biden and Senator Klobuchar while adding in more generous terms for HBCUs and attacking legacy admissions.

A cynical person might say that he’s aiming to attract minority voters to his coalition once Biden falters and protect himself against attacks based on his billionaire status by speaking out against legacy admissions that disproportionately benefits millionaires and billionaires.

His proposals overall are in line with the Democratic mainstream.

However, he stays silent about what to do about parents and graduate and professional students who owe more than $100,000 of student loans.

Presumably, that means he would support the status quo of PSLF and IDR forgiveness for this group. He might also be open to Republican proposals to eliminate the Grad PLUS and Parent PLUS loan programs.

What do you think of Bloomberg’s student loan plan?

Do you support it, oppose it, or think that it doesn’t go far enough?

Let us know in the comments.

Refinance student loans, get a bonus in 2024

| Lender Name | Lender | Offer | Learn more |

|---|---|---|---|

|

$500 Bonus

*Includes optional 0.25% Auto Pay discount. For 100k or more.

|

Fixed 5.24 - 9.99% APR*

Variable 6.24 - 9.99% APR*

|

|

|

$1,000 Bonus

For 100k or more. $300 for 50k to $99,999

|

Fixed 5.19 - 10.24% APPR

Variable 5.28 - 10.24% APR

|

|

|

$1,000 Bonus

For 100k or more. $200 for 50k to $99,999

|

Fixed 5.19 - 9.74% APR

Variable 5.99 - 9.74% APR

|

|

|

$1,050 Bonus

For 100k+, $300 for 50k to 99k.

|

Fixed 5.44 - 9.75% APR

Variable 5.49 - 9.95% APR

|

|

|

$1,275 Bonus

For 150k+, $300 to $575 for 50k to 149k.

|

Fixed 5.48 - 8.69% APR

Variable 5.28 - 8.99% APR

|

|

|

$1,250 Bonus

For 100k+, $350 for 50k to 100k. $100 for 5k to 50k

|

Fixed 5.48 - 10.98% APR

Variable 5.28 - 12.41% AR

|

Not sure what to do with your student loans?

Take our 11 question quiz to get a personalized recommendation for 2024 on whether you should pursue PSLF, Biden’s New IDR plan, or refinancing (including the one lender we think could give you the best rate).

This plan sucks. Do the math. If you have a $57k balance today, and you do income based repayment for 20 years, your balance would be $170k+. If that balance is “forgiven” you would pay over $57k in taxes. So you would pay your student loans for 20 years then owe the original balance or more to the IRS. Anyone with a student loan balance over $30k needs to leave the country as soon as Bernie and Warren are eliminated from the race. It would be the most financially prudent thing you can do. Just do income based repayment and take the foreign earned income exclusion.

That might seem like the case but the interest grows linearly not exponentially even if you’re paying 0 under PAYE. So I don’t think we would see any balances after 20 years more than say 100k.

This plan sucks. Mathematically most people with student loan balances would be better off financially by leaving the country. Do IBR + foreign earned income exclusion for 20 years. Just make sure you keep your money somewhere that the IRS can’t touch when the 20 years is up.

The only way that wouldn’t be true is if salaries in the US after losing 10 to 20% for student loans would net you more income. Then you’d be better off in the US but that’s the current rules anyway.

It’s extremely disappointing that there is nothing in this plan to help graduate students with their graduate debt. Also, allowing students to pay only 5% for IBR for 20 years coupled with capping non-taxable forgiveness at $57,000 will leave some undergraduate borrowers with a huge tax bill at the 20 year mark.

Undergrads can’t currently take out more than $57,500 and interest grows linearly so very very few people would owe a massive sum. Most would get it forgiven and make approximately interest only payments on their loans.

So you have no response on the lack of help for graduate students? Per Forbes, a whopping 49% of students who attended graduate school and were obligated to start repayment between 2010 and 2012 have not paid back a single dollar of their balance owed. These people owe a significant amount of money, and many will not be able to make more than IBR payments for the majority of their lives. As far as undergraduates, if they ask for more than a few deferments due to financial difficulty/missing the yearly deadline to apply for IBR/ ect., the interest will accrue very quickly, adding to the overall balance due. Bloomberg’s plan comes nowhere close to providing the help needed for many student loan borrowers.

I’d say that the plan helps those pursuing PSLF and leaves the tax bomb question ambiguous. I’m not saying the plan is good or bad, just outlining what he wants to do. Certainly grad student debt is a big problem and there’s not an easy solution.

This is one of the worst possible plans and displays how Bloomberg is a complete fraud. Not every graduate loanholder making 70-150K has the money to pay a $160,000 tax bill on forgiven debt after 20 years of paying 10-15% of their income. Bloomberg is a member of the Ivy elite and it shows in every aspect of his worldview. The correct solution is to have IBR for 15 years for private sector workers and then eliminate the loans tax free. Notice how Bloomberg does not even address high interest rates. He is completely unworthy of the support of the American people, much less those with student loans.

Thanks for sharing your view. Would you suggest limiting the amount graduate students can borrow? If not would there be any incentive to reduce tuition costs? Some folks suggest regulating tuition prices like they do in the UK.