Tax season is upon us once again. But this year, many Americans are facing new tax challenges from a year marked by record unemployment numbers and unprecedented changes to our way of life.

Although you might have a flurry of questions this tax season, there are common questions from student loan borrowers each year, such as:

Do student loans count as income? Are student loans taxable? Do you have to claim student loans on taxes?

In short, you’re not required to report information about your student loans on your taxes since they don’t count as taxable income. But you should definitely take advantage of any tax deductions or credits if you want to keep more money in your pocket.

Here’s what you need to know about each tax benefit that’s available to student loan borrowers and current students.

Tax credit vs. tax deduction

Tax credits and deductions are used to help reduce your overall income tax burden. But they aren’t the same thing.

A tax credit provides a dollar-for-dollar reduction of your income tax liability. For example, if you claim a $1,000 tax credit, you’ll knock exactly $1,000 off your tax bill.

Whereas, a tax deduction provides a partial reduction of your taxable income based on your marginal tax bracket. To keep it simple, let’s say Kristin is in the 10% tax bracket. If she claims a $1,000 tax deduction, it’ll save her $100 in taxes (10% x $1,000 = $100).

To sum it up, tax credits directly reduce the amount of taxes you owe, while tax deductions chip away at the income that you’ll pay taxes on.

What can borrowers claim on their student loan tax return?

There are two education-related tax deductions: the student loan interest deduction and the tuition and fees deduction.

Student loan interest deduction

Student loan borrowers can use the student loan interest deduction to deduct up to $2,500 in student loan interest payments from their taxable income. But there are some limitations.

One of the primary eligibility requirements revolves around your modified adjusted gross income (MAGI).

If your MAGI is more than $70,000, then your student loan interest deduction is gradually phased out until it is completely eliminated at $85,000. However, if you’re married and filing a joint return, your phase-out range is $140,000 to $170,000.

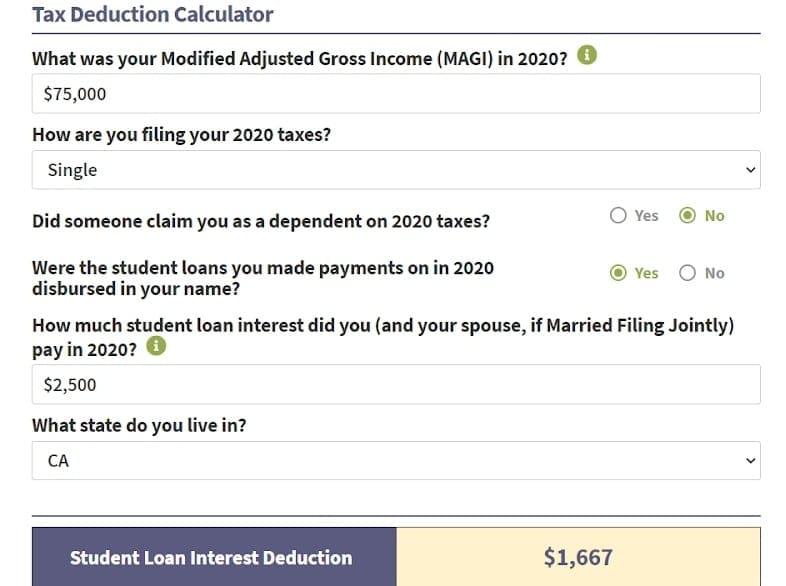

Using our Student Loan Interest Deduction Calculator, we can see this phase-out in action.

Let’s say Lawrence is single, has a MAGI of $75,000 and paid $2,500 in student loan interest during 2020.

Lawrence would be subject to the student loan interest deduction phase-out due to his MAGI, making his deduction $1,667.

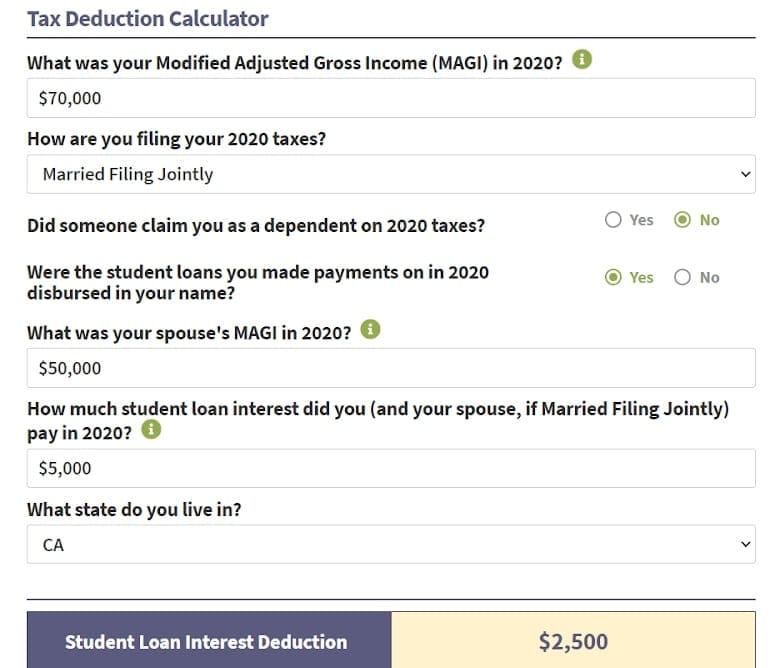

Now, let’s look at how the student loan interest deduction is shared between a married couple.

George and Catherine paid $5,000 total in interest between both of their student loans in 2020. And they plan to file a joint return with a MAGI of $120,000.

They won’t be subject to the phase-out, but they’ll still only be able to deduct $2,500 total for both of their loans — even though their interest payments were higher as a couple.

To claim the student loan interest deduction, use information found on Form 1098-E from your loan servicer to fill out your allowable amount on your student loan tax return.

Tuition and fees deduction

The tuition and fees deduction was extended to 2020, which means you can deduct up to $4,000 of qualified higher education expenses from your taxable income.

Qualified education expenses include any expenses required for enrollment or attendance at an eligible institution, which might include books, supplies and equipment.

But the tuition and fees deduction also has an income threshold that is subject to a phase-out, which is tiered based on your MAGI.

If your MAGI is between $65,000 and $80,000, you can only claim up to $2,000 in education expenses. And your deduction becomes $0 once your MAGI exceeds $80,000.

The phase out range increases to $130,000 to $160,000 for taxpayers who are married and filing jointly.

To claim the tuition and fees deduction, use the information found on Form 1098-T from your school to determine how much you spent on qualified education expenses. Then complete and submit Form 8917 with your tax return.

Tax credits: Opportunity tax credit vs. lifetime tax credit

If you’re a current student, you may be eligible to claim one of two education tax credits.

The American opportunity credit and the lifetime learning credit are available to offset the cost of higher education. And you can claim these tax credits even if you used student loans to pay for your education expenses.

The best part is that both tax credits will reduce the amount of taxes you owe dollar-for-dollar. But you can only claim one of these tax credits each year.

Here’s a brief glance at each of these credits:

- American opportunity credit. You might be able to claim up to $2,500 for qualified education expenses per eligible student. But you can only claim this tax credit for the first four years of college. Additionally, your MAGI must be less than $90,000 (or $180,000 if married, filing jointly).

- Lifetime learning credit. You might be able to claim up to $2,000 for qualified education expenses per tax return, meaning all eligible students are included. There isn’t a limit on the number of years this tax credit can be claimed for each student. But you can only claim this credit if your MAGI is less than $68,000.

To claim either the American opportunity credit or the lifetime learning credit, complete and submit Form 8863 with your tax return.

Get expert help

There are nuances to each of these tax benefits. For example, you can’t claim the tuition and fees deduction in the same year that you claim an education tax credit for the same student.

So, it’s important you reach out to someone you can trust during tax season. We recommend using Student Loan Tax Experts to maximize your return. They specialize in helping professionals with high student loan balances and borrowers on income-driven repayment (IDR) plans.