One of the most prestigious law schools in the U.S. is Columbia Law School. This is reflected in Columbia Law School’s tuition costs. For the 2018-19 school year, tuition is at $67,532 before any extra fees, books or supplies. Add in those extra costs plus room and board, and you’re looking at over $97,000 for a school year.

According to U.S. News and World Report, the average debt of a Columbia Law School graduate (who incurred debt) is $163,736. Despite common perception, not all lawyers command large salaries.

If you’re a student or have graduated from Columbia Law School, you have several options. Some may be a good fit for your situation, and some are better to avoid. Here’s what you should know.

Repayment options for Columbia Law School debt

Columbia University Law School students and alumni have options to repay student loans. This includes many federal and state programs, school-sponsored repayment assistance and refinancing.

Public Service Loan Forgiveness (PSLF)

If you plan to practice law in a public service role long term, PSLF can be a great way to get rid of student loan debt. PSLF forgives remaining student loan debt after 120 qualifying student loan monthly payments.

Another requirement of PSLF is working in the public sector during the time you’re making your student loan payments. The public sector refers to working for a qualifying government or nonprofit organization. Your specific role within those organizations isn’t as important as the organization itself.

How do you qualify for PSLF?

- Your loans must be federal direct loans (or consolidated to direct loans)

- You can’t apply until after making 120 qualifying payments

- You need to move your payments to an income-driven repayment plan

- You must work at least 30 hours a week at a qualifying organization

With Columbia Law School costs so high, it could be worth it to get experience in the public sector and then move on after you’ve taken advantage of PSLF.

Income-Driven Repayment (IDR) loan forgiveness

There’s another federal repayment option. If working for a public or nonprofit employer doesn’t interest you, you could pursue IDR loan forgiveness. This involves signing up for one of the four eligible IDR programs. After making monthly payment for 20 to 25 years (depending on the IDR plan), any remaining student loan debt is forgiven.

Keep in mind that with IDR loan forgiveness, any forgiven debt is considered income for tax purposes. You could get hit with a large tax bomb, depending on the amount forgiven. You’ll need to plan for this ahead of time.

If you end up working for a larger law firm, it may not make sense to sign up for an IDR plan. Since monthly payments are based on your income, an IDR plan may not lower your payments. You’ll need to crunch the numbers to see if it makes sense for you to pursue this repayment path.

Columbia Law School Loan Repayment Assistance Program (LRAP)

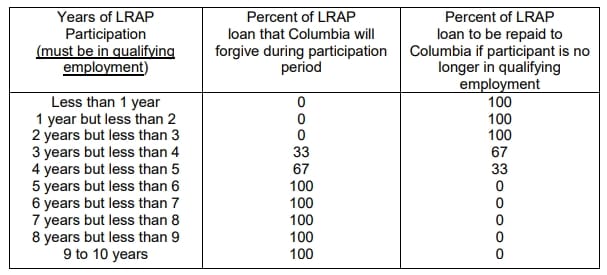

Columbia Law School provides assistance to graduates in the form of LRAP. They provide LRAP loans to pay off student loan debt. Columbia Law School graduates don’t have to repay these loans as long as they remain in qualified employment. Graduates eventually receive forgiveness, depending on how long they remain in qualifying employment.

LRAP loan amounts are determined by:

- Student loan debt amount

- Adjusted Gross Income (AGI) of graduate (and their spouse, if married)

LRAP participants are still expected to contribute a portion of their AGI to their annual student loan repayment obligations. If you make under $55,000 annually, you don’t owe anything. If you make more than $55,000, you’re expected to pay 34.5 percent of any income over the $55,000 threshold.

The program has many guidelines. Be sure to read the Columbia Law School’s LRAP policy guide for all rules and restrictions.

Combining PSLF and LRAP

Something unique about LRAP through Columbia University Law School is the ability to combine LRAP and PSLF. There are two options for this:

1. LRAP benefit eligibility is calculated using a higher AGI threshold. LRAP will cover 100 percent of eligible IDR payments for graduates whose annual income does not exceed $100,000. Graduates must contribute 34.5 percent of income above $100,000 toward their annual debt service on student loans.

2. LRAP benefit is calculated using the traditional $55,000 income threshold. LRAP benefits aren’t capped at the IDR amount as long as you make additional loan payments according to the traditional LRAP schedule. If you don’t make additional loan payments, benefits will be capped at the IDR amount for the remainder of the program.

Both PSLF and LRAP have different requirements. Be sure to look through rules and regulations for each program to determine eligibility.

Federal loan repayment programs

There are federal programs available for Columbia Law School graduates. Each program has its own requirements.

Department of Justice Attorney Student Loan Repayment Program (ASLRP)

The Department of Justice will repay certain federal student loans in exchange for three years of service. According to the Department of Justice, “To receive ASLRP, the attorney must qualify, the attorney’s student loans must qualify, and all statutory requirements must be met.”

A minimum loan balance of $10,000 is required to qualify. The Department of Justice will match payments made, up to $6,000. Check ASLRP qualifications for more details.

The Herbert S. Garten Loan Repayment Assistance Program

This federal program uses a lottery system to offer forgivable loans to qualified lawyers. You must be employed by one of the program’s grantees to qualify. Selected participants can receive loans of up to $5,600 per year for up to three years. See program guidelines for more details.

John R. Justice Student Loan Repayment Program

This program provides assistance for lawyers working as public defenders. Awarded funding depends on your state. Check with your Governor-Designated State Agency for details on funding that’s available. Participants must be employed as a public defender for at least three years.

State loan repayment programs

Beyond federal repayment programs, many states offer repayment programs as well. There are currently 24 states with loan repayment programs (26 programs total).

These include Arizona, District of Columbia, Florida, Illinois, Indiana, Kansas, Louisiana, Maine, Maryland, Massachusetts, Minnesota, Mississippi, Montana, Nebraska, New Hampshire, New Mexico, New York, North Carolina, Ohio, Oregon, Pennsylvania, Texas, Vermont and Virginia.

Nebraska and New York have two programs each. For more information on individual state repayment programs, check out this summary from the American Bar Association.

Refinance your Columbia Law School debt

Many Columbia Law Students choose to bypass the repayment programs mentioned above. Instead they pursue student loan refinancing. Depending on your credit, it’s possible to cut your interest rates significantly. This could drop tens of thousands of interest on your loan.

If you’re able to secure a higher paying job at a medium to large law firm, it may make more sense to refinance your loans and just pay off your debt as quick as possible. When does it make sense to refinance your law school student loans?

- If you have large amounts of debt

- If you aren’t pursuing loan forgiveness

- If you have excellent credit to secure the lowest interest rate

- If you have a stable income

When you refinance your loans with a private lender, you lose access to federal protections. These include forbearance, deferment and IDR options. Make sure you don’t need those programs before making any decision.

If you’re stuck with tons of law school debt and aren’t sure what to do, book a consultation with one of our student loan planners now. We listen to your situation, ask questions and partner with you to come up with the best repayment strategy.

The decisions you make about your student loan debt can have a long term impact on your life. Take the time to get it right by contacting us today.

Refinance student loans, get a bonus in 2024

| Lender Name | Lender | Offer | Learn more |

|---|---|---|---|

|

$500 Bonus

*Includes optional 0.25% Auto Pay discount. For 100k or more.

|

Fixed 5.24 - 9.99% APR*

Variable 6.24 - 9.99% APR*

|

|

|

$1,000 Bonus

For 100k or more. $300 for 50k to $99,999

|

Fixed 5.19 - 10.24% APPR

Variable 5.28 - 10.24% APR

|

|

|

$1,000 Bonus

For 100k or more. $200 for 50k to $99,999

|

Fixed 5.19 - 9.74% APR

Variable 5.99 - 9.74% APR

|

|

|

$1,050 Bonus

For 100k+, $300 for 50k to 99k.

|

Fixed 5.44 - 9.75% APR

Variable 5.49 - 9.95% APR

|

|

|

$1,275 Bonus

For 150k+, $300 to $575 for 50k to 149k.

|

Fixed 5.48 - 8.69% APR

Variable 5.28 - 8.99% APR

|

|

|

$1,250 Bonus

For 100k+, $350 for 50k to 100k. $100 for 5k to 50k

|

Fixed 5.48 - 10.98% APR

Variable 5.28 - 12.41% AR

|