Amy wanted what everyone else in her situation would want. She wanted to build her career as a physical therapist, save for retirement, buy a house in the next couple years, and be student debt free.

The problem is that she had been frozen for 3 years. Her physical therapist student loans were hanging over her head and her payments were too high to afford. She had just gotten married and realized that her student loan payments could jump up significantly.

Amy had been following Student Loan Planner® for a couple months and reached out after reading our article on common mistakes Physical Therapists make repaying their student loans.

She was a little concerned about being able to afford the student loan consult. After delaying and avoiding her debt, she decided it was finally time to figure this out and remove this psychological (and financial) burden that comes with student loan repayment and debt management.

The fee ended up being an incredible investment. We showed her projected savings of 293x the consult fee on her loan payments.

Perhaps more important than that, she could finally exhale the tension out of her shoulders knowing that she was on the path to save the most money and understood exactly why this was her best option for her.

By the end of the consult, we had given her the strategy and action steps to save $86,000 paying back her loans compared to the path she had been on.

I decided to share this DPT student loan to show how we made it happen:

Amy’s Physical Therapist Student Loan Profile

Amy is a physical therapist working in a private practice. She owes $175,000 on her direct federal student loans and had been on the IBR plan (25 years of payments at 15% of discretionary income) for the last 6 years.

She earns $75,000 with projected raises of 3% each year. Her husband Will had no student loans and earned $70,000 with 3% projected raises as well. They file their taxes jointly.

Selecting Income-Based Repayment For DPT Loans

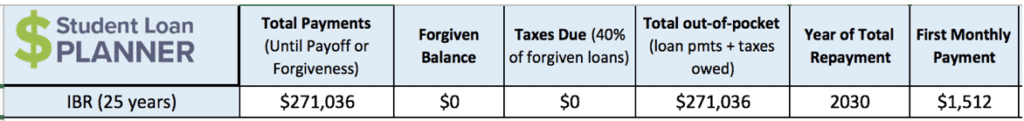

Let’s take a look at Amy’s path to paying back her student loans on IBR (Income Based Repayment):

The first thing that stood out to me during the consult was that Amy was projected to have $0 student loans forgiven. In other words, she’d end up paying off all of her debt by 2030, 7 years before reaching the 25-year mark without student loan forgiveness for therapists.

You might be thinking, “Great! I’d be debt free 7 years earlier than expected!” The problem is that Amy would end up paying back her 6.75% loan over 18 years costing herself tens of thousands of dollars in additional interest.

Would you rather pay $1 today or $0.40 in 20 years?

The goal of being on an income-driven repayment plan like IBR, PAYE, REPAYE is to keep payments as low as possible and maximize the forgiven balance.

Even though the remaining balance becomes taxable income the year it’s forgiven (unless enrolled in PSLF or another tax-free student loan forgiveness program), mathematically it works out that maximizing the amount forgiven is the financially optimal thing to do. Here’s an example.

What if someone had the option of paying down $10,000 of accrued interest today or having it be forgiven 20 years from now and paying 40% taxes on that income? Assuming their tax rate is 40% at that time, they’d only have to $4,000 (40% income tax on $10,000 of forgiven loans) in 20 years rather than $10,000 today.

This concept took awhile for my financial brain to fully absorb. “I actually want the loan to grow over the years?” Yes, if it means paying $0.40 tomorrow rather than $1.00 today.

Bottom line is we’re looking to pay as little as we can and pay $0.40 on the dollar on as much as we can.

Get Started With Our New IDR Calculator

Amy’s Other Student Loan Repayment Options

There are two main strategies to pay off physical therapy student loans that I wanted to mention in this DPT student loan case study.

- Aggressive: Pay it off as quickly as you can at as low of an interest rate as you can get.

- Passive: Keep your payments as low as possible and maximize the amount forgiven.

IBR sits right in the middle of those two. We either want to refinance and pay down these loans in 10 years or less or find an income-driven repayment plan that will substantially lower her payments so that she will have some amount forgiven down the road.

PAYE could be a better income-driven repayment option since the payments are 10% of discretionary income instead of 15% on IBR. If that doesn’t work, then refinancing would probably save her the most money.

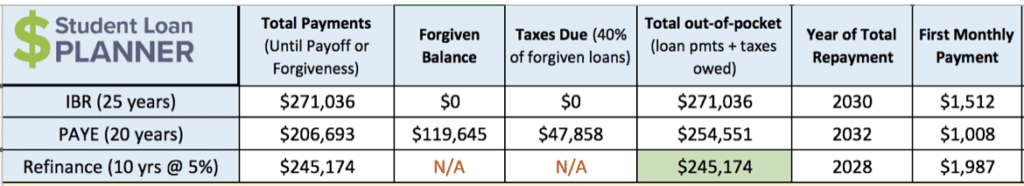

Here’s how those options compare to IBR:

Right off the bat, PAYE (pay as you earn) jumps off the page to me. The numbers look much better than IBR.

Her total payments are about $65,000 cheaper ($271,000- $206,000), and of the $119,645 that’s forgiven and treated as income (assuming a 40% tax rate), she’s projected to owe $47,858 in taxes. At the end of the day, she’d save more than $16,000 paying off her loan on PAYE vs IBR. Nothing to sneeze at.

If she were to take the aggressive approach and refinance the loans at 5% for a 10-year term, she’d end up paying $245,174 on her loans. That’s about $26,000 less than IBR. Even better right?

Some might stop here, but I knew we could do better.

How Would Filing Taxes Jointly vs Separately Affect Her Student Loan Repayment?

Both IBR and PAYE allow student loan borrowers to file their taxes separately so that repayment is based only on the borrower’s income and not the total household income.

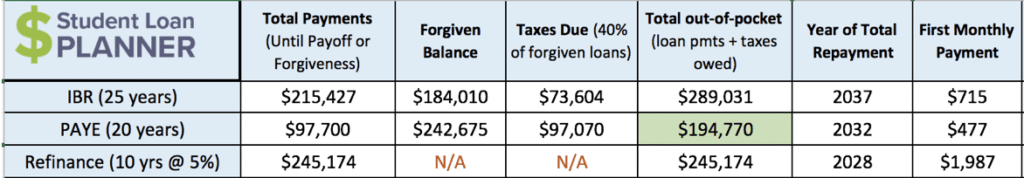

Check out the numbers and how it would dramatically impact Amy’s physical therapy debt forgiveness strategy:

BINGO! Filing separately would save her a ton of money on PAYE. It would cut $60,000 off of her total out-of-pocket payments vs filing jointly on PAYE ($194,770 filing separately, $254,551 filing jointly).

The interesting thing is that filing separately on IBR would actually cost Amy $18,000 more than filing jointly on the same program ($289,031 vs. $271,036). Plus she’d delay being student debt free by 7 years.

Even refinancing for 10 years at 5% would cost $50,000 more than PAYE married filing separately.

As it compares to her original IBR strategy filing jointly which would cost her $271,000 paying back he loans, switching to PAYE and filing taxes separately would give her $76,000 in projected out-of-pocket savings paying back her student loans.

*Side note: Generally couples who file separately pay more in taxes than they would if they file jointly, so it’s important to work with a tax professional to figure out what would be best for your specific situation. These savings are purely on student loan repayment projections and aren’t offset by any potential increase in taxes owed.

Yes! Even More Savings!

Now that we’ve identified the plan to save her the most money, it was time to show her one of the best tricks that can double positive benefits.

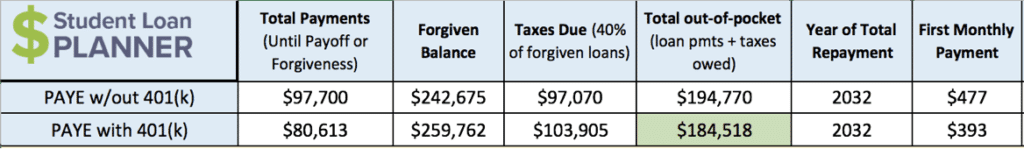

PAYE payments are based upon Adjusted Gross Income (AGI) so if you lower AGI, you lower your student loan payments. One of the best ways to lower AGI is to contribute to a pre-tax retirement plan.

Since Amy’s payments were going to be lower on PAYE compared to IBR, we talked about what to do with that extra money. “Why not put $10,000 into your 401(k) this year?” I then explained to Amy the double benefit.

- She’d be putting aside $10,000 a year and build up her retirement savings.

- Since PAYE is 10% of discretionary income, lowering her AGI by $10,000 would also lower her student loan payments by $1,000 a year too.

As you can see, not only would putting $10,000 per year away for retirement boost her retirement by $140,000 over 14 years before investment performance, she’d also end up paying $10,000 less toward her student loans ($184,518 vs $194,770) vs without the 401(k) contribution.

How To Pay Off DPT School Loans

By working with someone who handles student loans every day all day, Amy was able to find projected savings of more than $86,000 paying back her loans. Not only that, but she’ll have $140,000 in extra retirement savings to boot. Not bad at all!

If this DPT student loan case study has resonated with you and you’re a physical therapist who is struggling to figure out what your optimal student loan repayment strategy could be, reach out to me.

How great would it feel to know that you’ve looked at all the options and know you’re on the right path for your specific situation?

I’d love to help you find significant savings paying back your loans and give you the action steps to make it happen in just one hour. Plus I’ll be there to help along the way with the 6 months of email support included in the consult.

Not sure what to do with your student loans?

Take our 11 question quiz to get a personalized recommendation for 2024 on whether you should pursue PSLF, Biden’s New IDR plan, or refinancing (including the one lender we think could give you the best rate).