The path to becoming a dentist is not the easiest. First, undergraduate students have to take the rigorous dental pre-reqs, take the Dental Admissions Test (DAT), get accepted to dental school and complete the dental school program. Each step is a challenge that must be overcome.

Though most aspiring dentists make it through, there are many who don’t. This tough situation can leave them depressed, anxious and staring at a mound of student debt without the great six-figure income they were anticipating.

Before we go any further, if you are having feelings of despair or suicidal thoughts over student debt, stop reading this and call the National Suicide Prevention Hotline at 1-800-273-TALK (1-800-273-8255).

All is not lost.

Your student loans don’t have to be a burden, and there are other career choices that can provide high job satisfaction and fulfillment .

Available student loan repayment options are extremely flexible, which makes paying back the debt manageable, even for people who failed out of dental school.

I’ll walk you through a few different paths that someone can take if they failed or dropped out and what student loan repayment might look like.

Career options after failing out of dental school

It can be a huge psychological blow to fail out of dental school, and it could take some time to get over it. But at some point, it's time to think about what’s next. The faster you move on, the better.

Getting into dental school is a significant achievement. So, although failing is a tough thing to handle, it doesn’t mean that there isn’t a high-paying, satisfying career ahead for you.

A great place to start is asking yourself questions like these:

- Do I want to stay in the healthcare field?

- Should I pursue something in science or research?

- What drew you to dentistry? Is there another career path outside of healthcare and science that I’m excited about?

After answering those questions, one of three choices will emerge:

- Go to grad school and pursue something in healthcare or science.

- Go to grad school to pursue a totally different career path.

- Jump right into the workforce either in healthcare, science or something completely different.

You might be thinking, why would anyone take out more student loans when they already accumulated a mound of debt to pay for an undergraduate degree and dental school?

This may sound shocking, but taking out more student loans for grad school might not make student loan repayment much more expensive than your current situation because student loans operate much differently than any other kind of debt.

Income-driven repayment options tailor the debt payments to your income for the life of the loan regardless of the amount of debt. So, though it sounds counterintuitive, taking on more debt to pursue a different educational path might be ok. Plus, it could be worth it to pursue a fulfilling career and potentially earn more money with a different graduate degree.

Student loan repayment case study: An aspiring dentist becomes a professor

Here's a hypothetical case study to illustrate what student loan repayment could look like if someone were to start another graduate-level program even if they didn’t finish dental school.

After a challenging road, Michelle fails out of dental school.

It was a big blow, but after a lot of reflection, she decides to become a professor. She’ll have to go back to school and get either a master’s degree or a doctoral degree.

She had $250,000 of dental school debt after nearly three years, so she’s hesitant to take out even more student loan debt.

Becoming a professor could add another $150,000 in federal student loans to pay for school, so it’s possible she could end up with a total of $400,000 in debt. That's actually pretty close to what she would have had if she finished dental school.

The average professor earns around $80,000, so let’s say she’d earn $65,000 at first and her salary would grow at 5% per year for 10 years. Along the way, she’s working full time for an employer that enables her to qualify for Public Service Loan Forgiveness (PSLF).

At first, she's skeptical that this is a good idea until she crunches the numbers.

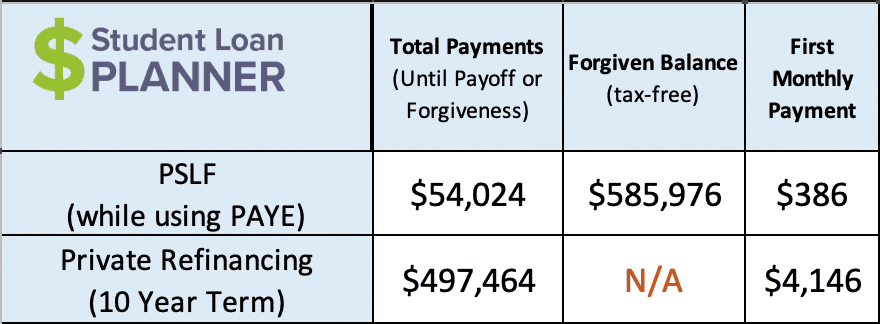

Let’s compare her projected path on PSLF as a professor versus what would have happened if she had aimed to pay off her loans in full by refinancing at 4.5% if she had finished dental school and worked in a private practice.

Both options mean she’d be debt free in 10 years after starting her professorial or dental career:

These numbers show the power of understanding your options. The career change makes Michelle's loans more manageable.

Pursuing PSLF using PAYE is projected to cost her only $54,024 to pay back the potential $400,000 of loans. Her payment for the first year would be $386 per month. That is less than 10% of the payment she’d make by refinancing and is very doable on a $65,000 salary.

Plus, the PSLF path is even less expensive than paying back her current loan amount of $250,000 if she decided not to go back to school.

So, taking out more debt to pursue a career working for a PSLF-qualifying employer could actually be less expensive than paying back the dental school loans on its own.

Just keep in mind that the goal here is to take out federal loans, not private student loans.

With this in mind, Michelle could go back to school and take out more debt and actually save money in repayment with PSLF.

This hypothetical career change example would apply for any PSLF-qualifying job, even ones that she could get with her undergrad degree.

PSLF negates the extra debt accumulated from dental school and makes loan repayment affordable.

Income-driven repayment for former dental students

Let’s look at the path for Michelle if she decides to jump into a new career path that wouldn’t qualify for PSLF without going back to school.

She decides to take a sales position and really excels. The first year she makes $50,000. The second year she makes $100,000, and her salary grows to $150,000 within five years, then levels out. That’s not bad at all.

What is the projected cost of paying back her student loans with that income trajectory?

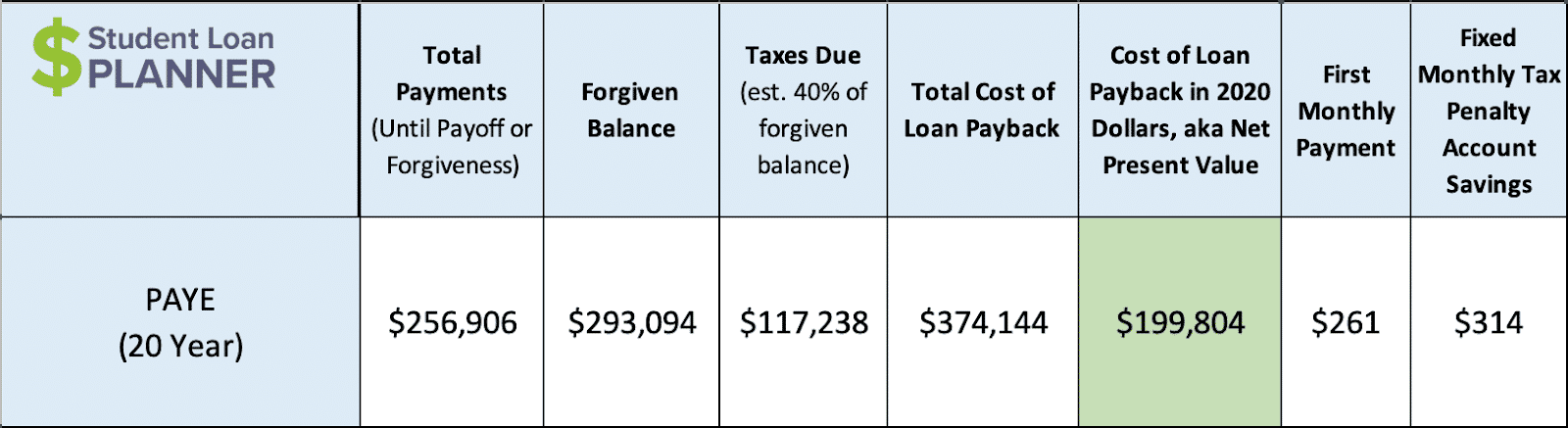

PAYE looks like a good repayment option here. Her PAYE payments would be $261 per month for the first year using her $50,000 income to certify her payments. PAYE is based upon 10% of discretionary income, so as her income grows, so will her payments.

That 10% can be looked at as an extra income tax. Some people don't like looking at their payments going up each year, but looking at it this way makes it more palatable because the payments are only going up over time because she's earning more money.

For example, when Michelle’s income jumps from $50,000 to $100,000, she’ll have to pay a 10% “tax” on that extra earnings in the form of her PAYE payment. In other words, her payment will jump from $261 per month to $673 per month based upon the $50,000 income bump.

What about the ‘tax bomb?’

We’ve talked about the PAYE payment so far but not the potential “tax bomb.” The tax bomb is what happens after federal student loans are forgiven.

Here's how it works: After 20 years of payments on PAYE, the remaining balance is forgiven, but the department of education issues a 1099 tax form. That form says that you must add the forgiven balance as income on your tax return.

Because of that, the borrower has to pay a lump sum of taxes, commonly referred to as the tax bomb, the year of loan forgiveness.

In Michelle's hypothetical case, she is projected to have a tax bomb of $117,238, assuming she’s taxed at 40% on the projected forgiven balance of $293,094.

This amount can seem intimidating at first glance, but remember that she has 20 years to save up for it. All it would take is investing about $314 each month for 20 years (in addition to her monthly loan payments). This tax bomb payment never increases (assuming a 5% annual investment return). After 20 years, that manageable $314 per month would grow to enough money to cover the tax bomb.

There is a way out even after failing out of dental school

After leaving dental school, Michelle was in a real funk and facing $250,000 in debt and feeling like she had nothing to show for it.

But after examining her options and what student loan repayment could look like, it turns out that the student loans won’t get in the way of her pursuing another fulfilling career. In fact, she can feel free to go back to school and everything would be OK, maybe even better than OK.

What was once a depressing time has now become an exciting opportunity to dream again.

Get a customized student loan repayment plan for your dental school debt

Even after failing or dropping out of dental school, you can create a clear path for paying back student loans, one that could save you a bunch of money in the long run.

Student Loan Planner® has done over 4,300 individual consultations advising on more than $1,000,000,000 worth of student debt.

No matter what career path is ahead of you, we can help you figure out the optimal student loan repayment plan in one hour. Plus, we include email support after our call to continue to answer your questions and help you implement the plan.

Check out how the consult process works and book a convenient time for you.

Great article! I failed dental school and was left with $150,000+ in student loan debt with nothing to show for it. I did not have any student loans from undergraduate school; I had scholarships and grants that covered everything during my 4 years of undergraduate school. I did get a masters in public health and right now I am a high school teacher. I’m on the PAYE plan and doing PSLF since I am a public school teacher (I teach high school science). This article made me feel a little better about my situation. I still have thoughts about going into another field (maybe school or mental health counseling), but I don’t know if it would be a good move financially. I am not going to let my student loan debt bother me, especially with about 5 years to go for forgiveness ( I’m praying it happens). I was able to finally purchase a house a couple of years ago despite my student loan debt and debt-to-income ratio. However, I would like to earn more.

That’s great! Sometimes life takes us on a different path. Sounds like you’ve made the best of it!