Are multiple student loans and payment schedules adding a lot of complexity and stress to your life? If so, consolidating your student loans could make your debt easier to manage.

Student loan consolidation is the process of combining two or more student loans into one new loan. If you’re interested in consolidating your student loans, you have two main options: private student loan consolidation through refinancing or federal student loan consolidation through the Direct Consolidation Loan program.

Depending on which path you take, the consolidation process will look different. Below, you’ll see how to consolidate student loans with either strategy, and the pros and cons of each.

How to consolidate student loans with refinancing

If you only have private student loans or would like to combine private student loans and federal loans together, then refinancing is your best consolidation choice. Here are the steps that you’ll need to take.

1. Check your credit score and debt-to-income ratio

Your credit score and debt-to-income ratio (DTI) will both play a role in whether you can qualify for student loan refinancing, as well as the rates that you’ll be offered. That’s why you’ll want to know where you stand before you start shopping around for consolidation loans.

Your credit score will determine interest rates

If you don’t have a credit score of at least 650, you might struggle to get approved for student loan refinancing. And if you want to get the best rates, you’d ideally have a score over 750.

Figure out your DTI

When it comes to your DTI, first calculate how much total debt you owe in comparison to your annual income. Travis Hornsby, founder of Student Loan Planner®, says that if you owe less than 1.5 times your income, you may be a good candidate for student loan refinancing.

Second, you’ll want to calculate your monthly DTI by dividing your monthly debt payments by your monthly household income. For best approval odds, aim for a monthly DTI below 35%. If your DTI is above 50%, it might be difficult to qualify for student loan refinancing.

2. Get prequalified quotes from refinancing lenders

If you meet the general eligibility criteria listed above, it’s time to start getting quotes. With many top lenders, you can check your prequalified rates without any impact on your credit score.

With most lenders, you’ll be quoted two different rates — one for a variable-rate loan and the other for a fixed-rate loan. The variable-rate loan will be typically lower up front, which can be tempting. But, remember, the interest rate on a variable-rate loan can rise over time.

Unless you plan to pay off your student loan in a short period of time, you’ll probably want to lock in your rate with a fixed-rate loan.

One great place to start the refinancing shopping process is Student Loan Planner®’s guide to student loan refinancing. In our guide, you’ll find a full breakdown of the top refinancing lenders on the market today along with their pros and cons.

By using Student Loan Planner®’s referral links, you may also qualify for cash bonuses from $100 to $775.

3. Compare lender rates and terms

Now that you’ve checked your rates, it’s time to compare offers. In addition to interest rates, you’ll also want to consider factors like:

- Fees: Does the lender charge origination fees or prepayment penalties?

- Payment flexibility: How many loan terms are available?

- Forbearance and deferment options: Can you place your loans in forbearance during a period of unemployment? Can you place your loans in deferment if you go back to school or enlist in the military?

- Customer service: Does the lender have an in-house customer service team, and do they have a reputation for responding quickly to issues?

- Cosigner release: If you make a certain number of on-time payments, can you apply to release your cosigner?

- Death and disability discharge: Will your loans be discharged in the unfortunate event that you die or become permanently disabled?

Do your homework on each lender. Consider reading editorial reviews of each lender from Student Loan Planner® and customer reviews on sites like Trustpilot.

Choosing your refinancing lender is a big decision, so you’ll want to take your time.

4. Submit a full loan application with your lender of choice

Once you’ve decided on a lender, you’ll need to fill out a full loan application. Expect this form to be longer than the one for prequalified rates.

Once you submit the application, the lender will perform a hard credit inquiry, which will affect your credit score.

From there, your loan application will enter the review process. In some cases, your lender may reach out for more information or documentation.

What to expect when your application is approved

If your application is approved, your new lender will pay off your student loans directly with your old lender. You should also receive information about how and when to make your first payment to your new lender.

With many lenders, you can also qualify for an interest rate discount by signing up for automatic payments.

Get Started With Our New IDR Calculator

6 steps to get federal student loan consolidation

If you currently have federal student loans and don’t want to lose access to income-based repayment, Public Service Loan Forgiveness, or other benefits, federal student loan consolidation could be the right choice for you. Here are the steps you’ll need to take to consolidate your federal student loans:

1. Use the online Direct Loan consolidation application

The entire application process for a Direct Consolidation Loan can be handled online. Simply navigate to the Direct Consolidation Loan application webpage to get started.

To access the application form, you’ll need to log in with your FSA ID.

Keep in mind that the entire Direct Consolidation Loan application must be completed in one sitting. The Department of Education says that most people are able to finish in less than 30 minutes.

2. Select the loans you want to consolidate

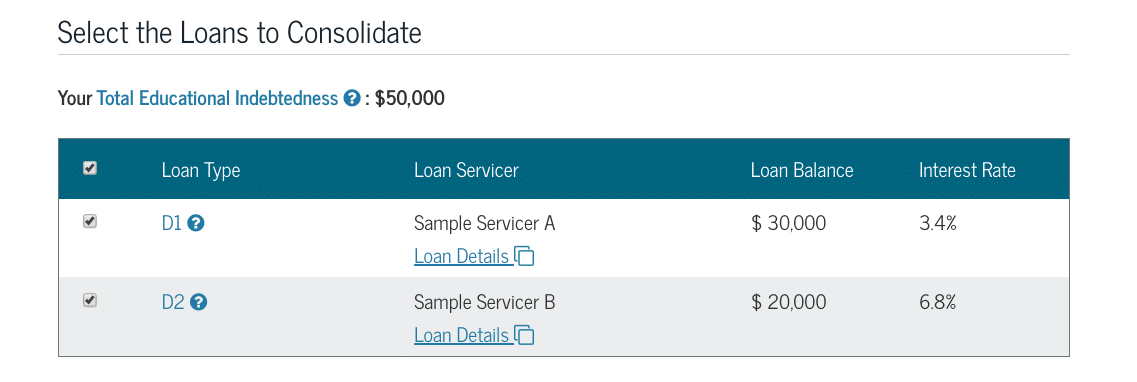

Because you will have logged in with your unique FSA ID, you’ll be able to see each federal loan that have been taken out in your name. The list will look like this:

If for any reason there are certain loans that you don’t want to include in the consolidation, you’ll want to uncheck these. Otherwise, leave all of your federal loans checked and move to the next step.

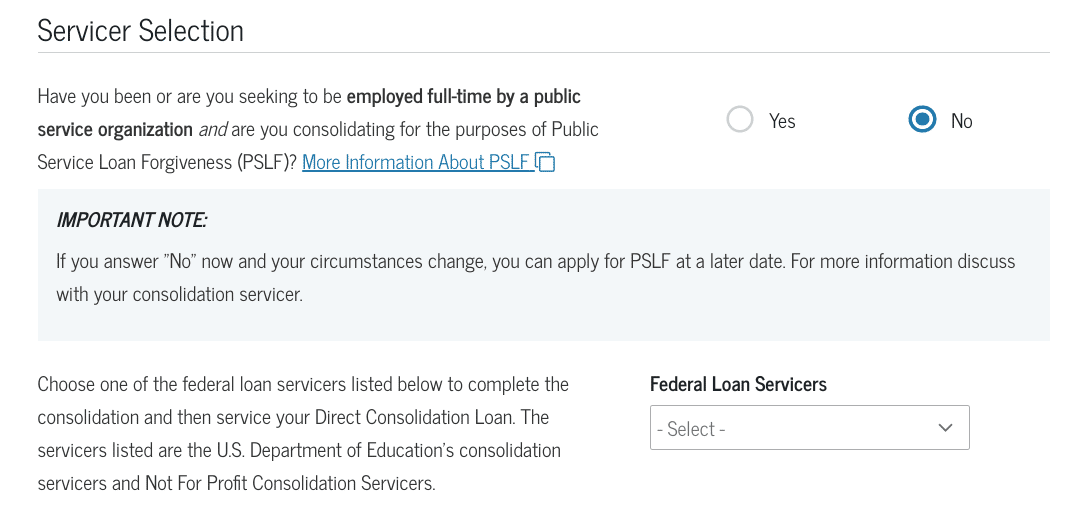

3. Select your new student loan servicer

One of the benefits of federal student loan consolidation is that you’ll get the opportunity to choose your new loan servicer.

Wondering which federal loan servicer to choose?

If you plan to pursue PSFL, you’ll want to choose FedLoan Servicing. Otherwise, check out our guide to today’s best federal loan servicers.

4. Choose your repayment plan

The next step in the Direct Consolidation Loan process is to make your repayment plan request.

For quickest payback, choose the Standard 10-Year Repayment Plan. If you want income-based payments or want to join the PSLF program, you’ll want to choose an income-driven repayment (IDR) plan.

To enroll in an IDR plan, you’ll need to submit income documentation. Or, you can allow the Department of Education to pull your recent tax return information from the IRS.

5. Fill out your personal information

Once you get to this step, the hard parts are behind you. In step No. 5, you’ll simply need to provide your personal information.

In addition to your own contact information, you’ll be asked to provide your employer information and contact information for two references.

6. Review and sign

You’ve made it! Now you’ll just need to look over everything one more time to make sure all of your information looks correct.

You can edit any of your loan, servicer or repayment plan selections if you notice mistakes. Otherwise, certify and sign your application to complete the process.

Congrats! Your work is done.

Now you just need to wait to hear from your servicer regarding the status of your federal student loan consolidation. The servicer will also let you know when your first payment is due.

Questions to ask before consolidating student loans

Wondering which type of student loan consolidation is right for you? These questions can help you make the right decision:

1. Do you want to consolidate private student loans and federal student loans into a single loan?

Unfortunately, you can’t use the Direct Consolidation Loan program to consolidate private student loans. You can, however, consolidate federal student loans with your private student loans in a refinance.

Refinancing is your only option if you’re wanting to combine private and federal student loans into one new loan.

2. Do you want to keep federal student loan benefits?

Federal student loans come with several benefits, such as the ability to make income-based payments and eligibility for student debt forgiveness programs.

When you refinance your federal student loans with a private lender, however, you give up your eligibility for these benefits. So, if the majority of your loans are federal, then federal student loan consolidation might be the better choice for you.

Refinancing private loans can be more of a no-brainer, as long as you qualify for a lower rate. At the very least, you’ll want to carefully weigh the pros and cons of refinancing federal student loans.

3. Have you made qualifying payments toward PSLF?

If you have made qualifying payments toward PSLF, then you might want to stay away from both private and federal student loan consolidation options. If you consolidate, you’ll become ineligible for PSLF after refinancing.

Moreover, you’ll also lose credit for any previous PSLF-qualifying payments you made. In other words, if you consolidate, the clock will reset to zero.

So, if you’ve already made a lot of progress toward getting PSLF, you might want to avoid consolidation altogether.

4. Are you looking for a lower interest rate?

If you’re looking to cut down your interest rate, refinancing is your only option.

With a Direct Consolidation Loan, your new interest rate will be an average of the rates of the loans being consolidated.

When refinancing, on the other hand, well-qualified borrowers could qualify for rates under 3.5%. If you have good credit, choosing a refinance over a federal loan consolidation could save you a lot of money over the life of your loans.

Want to know how much you could save by refinancing? Check out the starting interest rates with the top refinancing lenders.