When people think “lawyer”, they think, “Wow! They must make a nice living!” But does it actually make it a good financial choice?

First of all, it might surprise you to know that the average lawyer salary doesn’t tell the whole story of what any one particular lawyer makes, because that profession has a very widespread income. Two factors that determine income are the type of law practiced as well as the type of firm they work at.

Secondly, this thinking doesn’t take into account the law school debt that so many graduates are burdened with these days. That number is well into the six-figure range. There can also be a big difference in law school debt depending on the law school attended.

Yes, there are a lot of variables here that can impact whether law school is worth the debt or not. We’ll go through the various debt and income circumstances to come to a conclusion.

So, is law school worth the cost? Let’s examine the potential debt, income, and repayment strategies. Ready? Let’s dive in!

Average Law School Debt Depends on School Choice

I recently wrote an article on the 5 Types of Law Schools Ranked by How Much They Destroy Finances. School choice definitely has an impact on how much debt an attorney will graduate with.

Going to an in-state public school is by far the cheapest way to go. According to US News & World Report, the average tuition in this category is just under $27,000. California offers its challenges because I couldn’t find a reputable in-state tuition less than $35,000 per year but most other states have some great options.

The average out-of-state tuition for a public school is $40,000. That’s a 50% premium that a state resident would pay for the identical education!

Private law schools are even more expensive, costing about $47,000 per year on average. That’s a 17.5% premium to the already expensive out-of-state tuition!

A top 20 law school is the priciest of the bunch at a whopping $55,000 per year. That is twice an in-state public school.

If we take these annual tuition rates times 3 years of law school and add 20% for loan origination fees, living expenses, increasing tuition each year, and the interest that will accrue over those 3 years before graduation, here’s what the total law school debt could look like:

- In-state law school: $97,200

- Out-of-state law school: $144,000

- Private law school: $169,200

- Top 20 law school: $198,000

These numbers seem about right to me because the average lawyer we’ve worked with at Student Loan Planner® has $225,000 of student debt (mainly from law school but also with a little from undergrad).

So now that we know approximately what it will cost to go to law school, what kind of income should be expected?

The average lawyer salary doesn’t tell the whole story

The Bureau of Labor Statistics shows that the median lawyer salary in 2018 was $120,910. Seems great right? Again, it doesn’t tell the whole story. There are more than 800,000 attorneys out there so it’s not like everyone is making that amount. The actual salary earned will have more to do with where their specialty and where they live.

Right now, patent and intellectual property (IP) attorneys are at the top of the earnings mountain with annual compensation including bonuses encroaching the $180,000. Public defenders are near the low end at $63,000. That’s nearly a $120,000 difference in compensation just based upon the track someone chose to pursue.

Now, let’s look at how location impacts compensation. Washington, DC has both the most lawyers per capita and is also the highest compensating. The annual mean wage according to BLS.gov is $192,530 ($72,000 above the national median). That’s followed by California, New York, and Massachusetts where the annual mean wage is $165,000 to $172,000.

Most of the higher compensating states are on the coasts while most of the lower compensating states are inland. The lowest lawyer salaries are concentrated mostly in the mountain time zone and the south where you’d find between $100,000 and $110,000. Top to bottom, the state where an attorney chooses to practice could also mean a $90,000 difference in income. For more details, check out this map on BLS.gov.

How to figure out if law school is worth the debt?

Let’s talk through the factors that matter here. First of all, we need to compare the average salary of a college graduate compared to the average lawyer salary. Now obviously, attorneys make more money than college graduates, but they also have a lot more debt, so we have to factor in the cost to pay that back and how long that will take.

Then, because of the diversity of jobs, income, and tuition, we’re going to take a look at loan repayment under a few different scenarios:

- The average lawyer with the average debt

- Government/non-profit lawyers going for PSLF

- Top 20 Law Schools and BigLaw jobs.

Let me show you these case studies, then I’ll summarize whether the cost of law school is worth it.

Case Study 1: The average lawyer with average student debt

Carlos just graduated from law school and got a job at a private law firm making $73,000 and is projected to grow to $125,000 over the next 10 years. He has $200,000 of student debt, almost 3x his current income and nearly twice what his income will be in 10 years. How much will it cost him to pay back his loans?

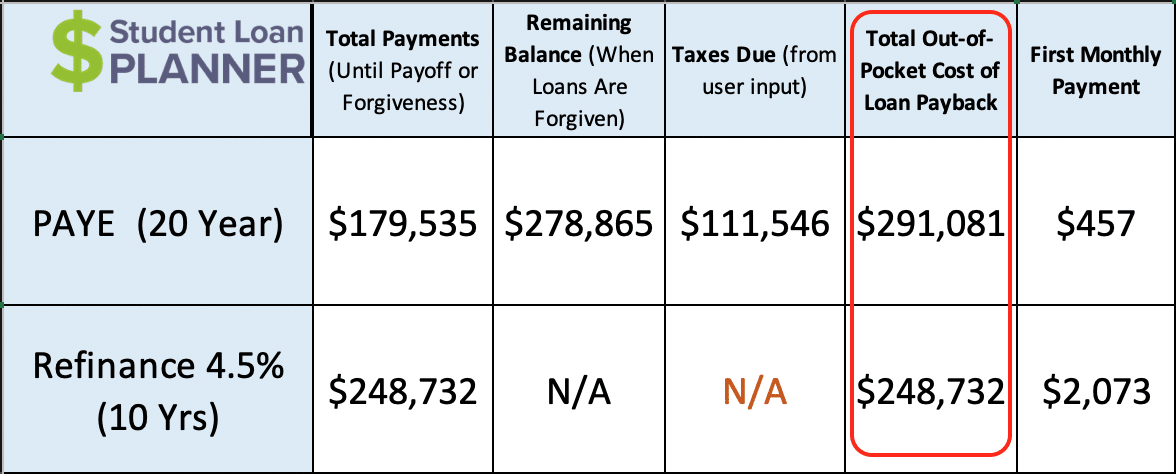

He has 2 options. He can either aggressively pay back his loans by refinancing to 4.5% and paying them off in 10 years or he can go on PAYE and pay based upon his income for 20 years followed by the tax bomb.

PAYE would actually be the more affordable option even though it’s projecting to cost $291,081 in total out-of-pocket cost vs $248,732 with refinancing, the former is spread out over 20 years with the first payments projecting to be in the $400-$500 range vs. a $2,000 refinancing payment.

If we look at PAYE like a tax, then essentially Carlos will pay about 15% of his income in student loan payments and saving for the tax bomb over the years. He’ll need to use about $10,000 of his take home pay in the first year and about $20,000 in year 20.

It’s not the end of the world but it does require paying this “student loan tax” for the first 20 years of practicing law.

Case Study 2: Public Defenders, Clerking, Attorneys in Government Roles, Non-Profit Lawyers and PSLF

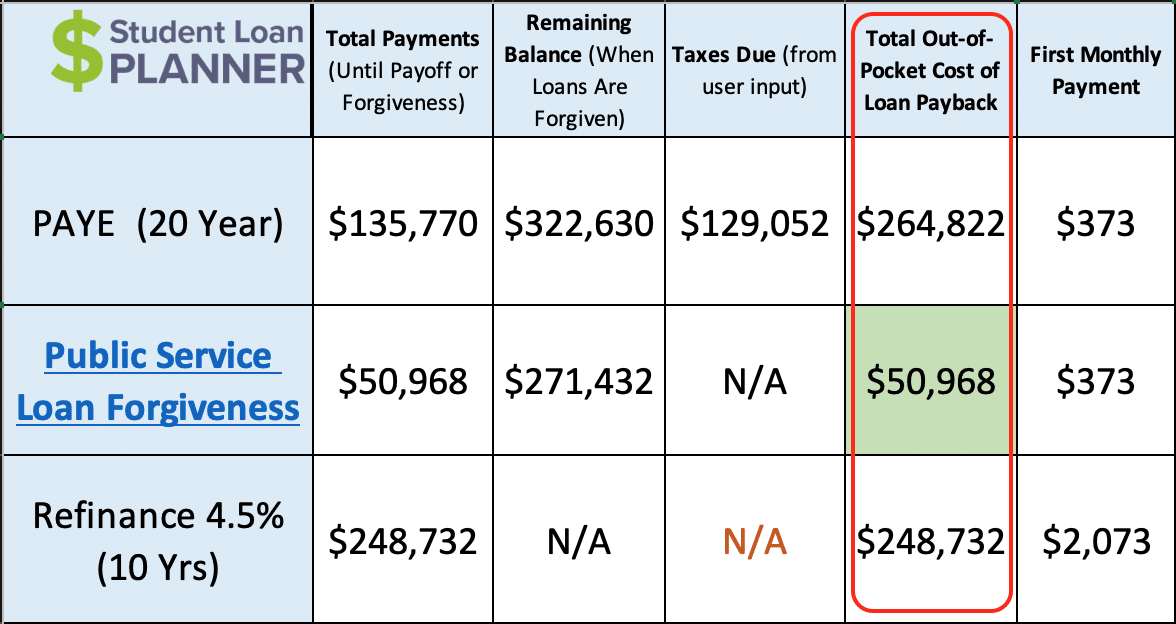

Alina works as a public defender making $63,000 and has $200,000 in student debt.

She has the same debt as Carlos but she has a lower income trajectory growing by about 3% a year.

Even though that’s the case, her loan repayment is actually much more affordable thanks to working for a PSLF eligible employer.

As you can see, PSLF is projecting to cost her $50,968 in loan repayment over the next 10 years. That’s less than her annual income and could be an affordable option as long as Alina is committed to staying in public service for 10 years.

This could be true for any lawyer working for a government employer or non-profit. PSLF is an amazingly powerful program because it only requires income driven payments for 10 years with whatever loans leftover being wiped away tax-free.

Case Study 3: Top 20 Law School Graduates working for BigLaw

Even though a Top 20 Law School might be twice as expensive as an in-state public school, the starting salary could close to triple that of the average lawyer salary.

Might it be worth it to pay an extra $100,000 to get your JD if it will increase your chances of getting a job that pays $127,000 more than the average starting salary? Most likely.

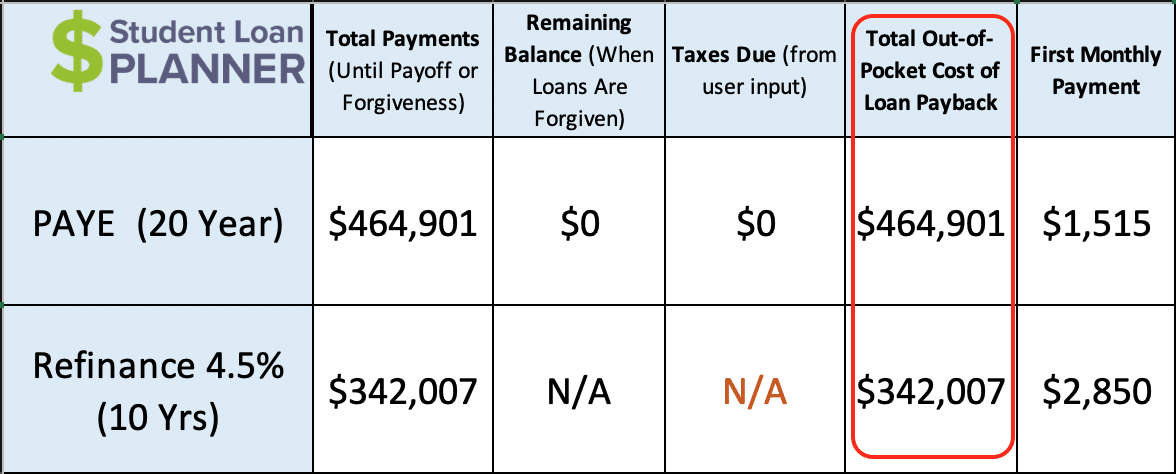

Nia put in the hard work in undergrad and got into a top law school. She then persisted and graduated near the top of her class. Though she has about $275,000 in student debt, she’ll be working in BigLaw starting at $200,000 and is well on her way to earning $300,000 with bonus within 5 years.

Refinancing is the clear cut winner here. It’s the lowest costing option for her and will get her out of debt the fastest. She’d be able to refinance to 4.5% and pay $2,850 a month for 10 years. If she got super aggressive, she could put $5,000 per month toward it and be done in 5 years. After that, she’s making a multiple six-figure salary for the rest of her career with no debt ahead of her.

Is law school worth the debt?

Taking out six-figures of student debt is something that should be done using caution. It might seem like it’s worth it, but depending on what you decide to do within law and where you plan to live, you might have better options.

For those that feel the calling to go into public service, then law school could be worth it with PSLF. Since the loan payments are based upon income, they should be affordable regardless of income. With the tax-free loan forgiveness after 120 qualifying payments, it could mean that the cost of paying back the loan is less than one year of income like in Alina’s case.

For the most part, there’s no correlation between attending in-state or out-of state public law school or private school and income for lawyers. However, top law school graduates end up making more money on average, so it could make sense to pay up to attend a top school if you plan to take a higher paying BigLaw position or by working for a midwestern firm that isn’t quite a big law job but pays a starting salary welli into the six-figure range.

The average law school graduate with no plans for public service, BigLaw, or a highly compensated specialty should seriously consider whether they want to pursue law. It’s not a slam dunk like it used to be. Most lawyers will end up paying back their six-figure law school debt over a 20 to 25 year period.

My wife got accepted to law school but decided not to go. In the end, she ended up pursuing a career as a consultant at a top company then moving into finance. Like her, most aspiring lawyers are hard-working people who could earn more than the average college graduate without having to go to an expensive graduate program.

There are plenty of high paying and rewarding careers out there that don’t require a graduate degree. If you like math, computers, business, finance, etc, chances are you can find something out there.

For those who are passionate about law and have always aspired for a career in that profession, they need to understand what loan repayment entails before diving in. We’ve found that facing six-figure student debt can zap the passion away if they didn’t know what they’re in for.

If you decide to go into law, try to stay in-state and work to be toward the top of your class unless you get accepted to a top school and plan to work for BigLaw or are going for PSLF in which case the debt won’t matter so much in the long run.

Lawyers can get a clear repayment plan for their student loans

Lawyers can find a clear path to pay back their student loans using actionable steps that save them money (regardless of their chosen field of concentration). Student Loan Planner® can help you figure out which repayment strategy is right for you in just one hour. Plus, we also include email support after the consultation to answer follow-up questions and help you implement your plan. Learn more about our consultation process.

If you have a clear-cut refinancing case, there’s no need to get a consultation. But I’d suggest applying for a refinance loan using our cash-back link. You may be able to cut your interest rate and get the most affordable terms for your situation plus get a few hundred bucks cash.

Our team of experts can help anyone, so choose the consultant you think would be right for you based on your individual circumstances and get started.