Residency is an exciting, but tough, several years. Your income will be low, but your stress level and workload will be high. So why prolong the pain with a fellowship?

Rather than assuming a medical fellowship equates to a higher average physician's salary, it’s important to pursue your passion, and consider what you want your future to look like. These considerations will help you decide whether the benefits of doing a medical fellowship are worth it.

Do you have to do a fellowship after residency?

Most doctors your parents’ age didn’t do a fellowship. Back then, General Practitioners delivered babies and Urologists didn’t specialize between pediatrics and adults.

My Endocrinologist is in his seventies and still practices fertility medicine, but he has mused that the OBGYNs have worked to force him out. It’s such an interesting evolution.

Medical fellowships then vs. now

Back then, Urologic residency was five to six years, and Pediatrics was one of the only post-residency fellowships available. Today, a Urologist still needs to complete a five- to six-year residency, but there are fellowships available in Pediatrics, Minimally Invasive Urologic Surgery, Oncology, Male Infertility, and many more. This means you could spend up to nine years or more training after medical school.

In specialties like Cardiology, a fellowship is required after an Internal Medicine residency. Some doctors complete two fellowships to specialize further. Consider your career path before weighing the pros and cons of a fellowship.

Benefits of doing a fellowship

The primary purpose of a fellowship is to specialize in an area of medicine. Here are some additional benefits of doing a medical fellowship:

- Fellowships can translate to more money depending on the subspecialty you’re after (see the first con below, too).

- Fellowships can distinguish you from your peers.

- If you can climb into leadership in academic practice, you’re looking at a substantial income increase.

- A fellowship is further training and experience, which is helpful from a liability standpoint.

- If you choose to pursue Public Service Loan Forgiveness (PSLF), the additional years in fellowship translate to additional years of low payments.

Cons of choosing a medical fellowship

An obvious disadvantage to pursuing a medical fellowship is the additional years of low pay. You’ve worked very hard for seven to eight years already between med school and residency.

Here are some others downfalls of a fellowship:

- Fellowships don’t necessarily mean more money if you land in academic medicine.

- Further training at a low income could put some of your family goals, like buying a house, growing your family, and vacations on hold.

- If you start down the PSLF path, but abandon it for private practice, your loan balance will grow substantially after several years of income-driven payments.

There are pros and cons to every decision, but what if you borrowed $600,000 during medical school? How could a fellowship possibly be a good financial decision for your student loans?

How to repay student loans during your fellowship

There are two paths for physicians to pay their student loans, the active or the passive approach.

Active Approach

In an active approach, you’ll need a higher income as quickly as possible to afford your massive student loan payments and other financial goals.

For that reason, it might feel easier to choose against a fellowship under this repayment approach. It’s tempting to pay the debt off as soon as you leave residency: either by finding a good lender and refinancing your student debt or paying several thousand dollars per month into the federal system.

You might even cross your fingers for widespread forgiveness in the future if you stay in the federal system.

No one hopes for two mortgage-sized payments in their 30s. Although getting rid of the burden ASAP is a money-saving strategy, it can be the biggest mistake a young doctor can make.

Passive approach

This approach is completely different from how we traditionally think of debt. It suggests paying the least amount possible until forgiveness.

PSLF for doctors in residency and fellowship

Public Service Loan Forgiveness credit is available for your residency and fellowship years, as long as you find the right programs. PSLF eligible residency programs are typically 501(c)(3) nonprofit organizations or state hospitals. You can verify your future employer using the PSLF Help Tool.

Your loan servicer might suggest enjoying your grace period after med school graduation, and/or defer payments until after residency. However, PSLF is a huge opportunity to make lower payments in pursuit of forgiveness.

Consolidate your loans as soon as you graduate, ensuring you have only Direct Loans and a maximum of two loans.

PSLF example for those in residency or fellowship

Let’s walk through an example of a Urologist interested in Pediatric Urology mentioned above. He’s got $250,000 of student loan debt. He’s about to start a six-year residency program, where he’ll make about $50,000 per year. He’ll need to complete a Pediatric fellowship that will take three years, where he’ll earn about the same salary.

That’s nine years of a salary of $50,000 per year, but we’ll add inflation of about 3% to gradually increase his pay. After that, he’ll start at an academic hospital with a salary, plus a bonus of $250,000. His wife doesn’t work, or he files his taxes separately so that only his income is considered.

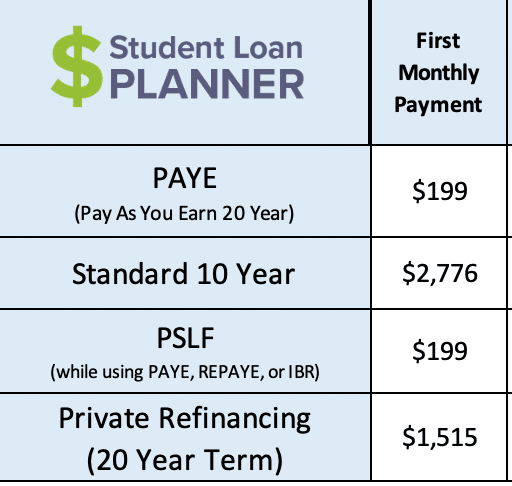

His monthly payment options are as follows:

His standard 10-year payment would be $2,776 every month for 10 years. If he refinanced his loans at 4% over 20 years, his payment would be $1,515 per month. Better than the Standard 10-year plan, but still a difficult payment during residency and fellowship.

Take a look at his monthly payment under the income-driven repayment plan Pay As You Earn (PAYE): $199 per month!

It’s the best part of that low-residency pay. That monthly payment will slowly rise as his income increases, peaking at $1,651 per month when he starts practicing post-fellowship.

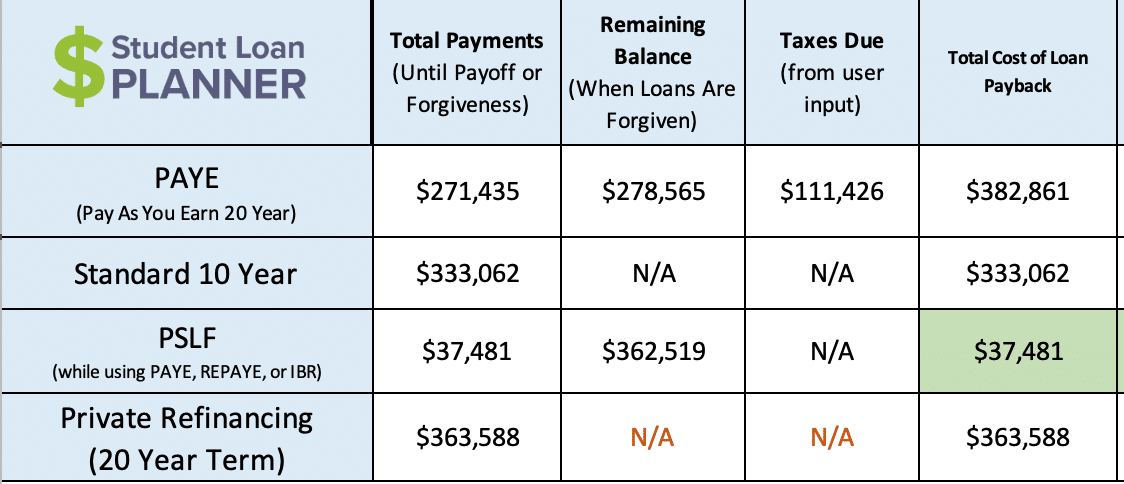

Here’s the cool thing, though — when he starts earning $250,000 per year, he’s already made nine years of payments toward the 10 years required for PSLF. So here are his results:

Look at the green box. You’re reading that right. Nine years of lower income could translate to total payments of $37,481 over ten years, and a balance of $362,519 forgiven, tax-free.

This is a huge “pro” in favor of pursuing a fellowship, but there are obvious downsides to this plan. In the scenario above, I added two kids into the picture in 2025 and 2027. Supporting a family of four on $50,000 per year is certainly possible, but it’s not easy, especially when your peers are sending their kids to private school and purchasing beautiful homes.

How to decide if a medical fellowship is worth it

If it isn’t already clear, choosing whether or not to pursue a fellowship is a multi-faceted decision. Below are a few questions to ask yourself.

Is a fellowship required for your specialty?

If a patient has a choice between a general surgeon or a surgical oncologist to remove complex tumors along her spine or in her brain, she’d likely choose the specialist.

Although it’s up to you to choose a specialty and whether to complete a fellowship, it’s important to consider how you want to build your career. Private practice isn’t necessarily higher paying than working for a nonprofit hospital system anymore.

If you are interested in academic medicine and research, a fellowship is more important. Also, a fellowship is required for some specialties.

Is a fellowship with the financial strain of growing a family?

Here at Student Loan Planner, we can calculate the strength of a PSLF case all day, but if that means delaying much more important decisions like marriage and children, we should talk first. Finding happiness in your life is much more important than your student loan strategy, and we stress that on our calls.

That’s why we model multiple student loan repayment strategies specifically catered to your goals.

Is student loan forgiveness a priority for you?

To be clear — I’m not a doctor. I have multiple doctors in my family, however, and spoke to them as I prepared this article. It came as a complete surprise that none of them had heard of PSLF, or knew that a high-earning doctor could pursue it.

Financial education is still sorely lacking in medical school. Imagine entering medical school with multiple discussions of the financial implications of your decisions. Not only multiple discussions, but multiple financial options for repayment. It’s all out there, but it’s very complicated to navigate alone.

Here at Student Loan Planner, we offer pre-debt consultations and post-debt consultations. Some medical schools are getting better about education as well.

Whether you’ve just started med school, or you’re about to finish residency, remember to make the decision based on your dreams and wishes, and contact us to help sort through the financial side.

Not sure what to do with your student loans?

Take our 11 question quiz to get a personalized recommendation for 2024 on whether you should pursue PSLF, Biden’s New IDR plan, or refinancing (including the one lender we think could give you the best rate).