Over the past few months, many student loan borrowers have been waiting to hear about student loan cancellation. Will Biden cancel $50,000 or $10,000 in student loans? Will it happen at all?

Additionally, there’s been some back and forth regarding the student loan payment pause which is now extended to August 29, 2023. All of these factors are making borrowers naturally weary and some are wondering now, “Is student loan forgiveness real?”

Despite what’s happened over the past year, there are federal student loan forgiveness programs you can take advantage of whether you have loans from your undergraduate or graduate degree. Read on to learn more about student loan debt and forgiveness.

Is student loan forgiveness real?

If you’re wondering if loan forgiveness programs are real, first, let’s go over the student loan forgiveness programs that are available for federal student loan borrowers. Unfortunately, private student loan borrowers aren’t eligible for the same benefits.

- Public Service Loan Forgiveness Program (PSLF). Borrowers can get after working in the public sector full-time for 10 years at a qualifying organization. Bonus: forgiveness is tax-free on student debt given current IRS rules.

- Income-Driven Repayment (IDR). Under all four IDR plans (Income-Based Repayment, Income-Contingent Repayment, Pay As You Earn, Revised Pay As You Earn), if you have a remaining balance after the end of the repayment term, the rest of your loans are forgiven. Note: you might pay taxes on that amount though there’s a temporary provision right now where that’s not the case.

- Teacher Loan Forgiveness Program. This program covers a portion of forgiveness for teachers who qualify. For example, teachers at secondary schools, special education teachers or working at a low-income school or educational service agency might make you eligible.

On top of these traditional student loan forgiveness options, there are also other ways to discharge your student loans through Total and Permanent Disability (TPD), Borrower Defense Discharge, Perkins Loans forgiveness, and in rare cases you can discharge loans through bankruptcy.

Student loan forgiveness by the numbers

As a student loan borrower, having a certain level of distrust about student loan cancellation or forgiveness is understandable. Before dismissing the possibility of loan forgiveness, know that student loan forgiveness is happening. Let’s take a look at the numbers for the PSLF program and other federal forgiveness programs.

PSLF discharge data

The Federal Student Aid website publishes student loan data several times a year.

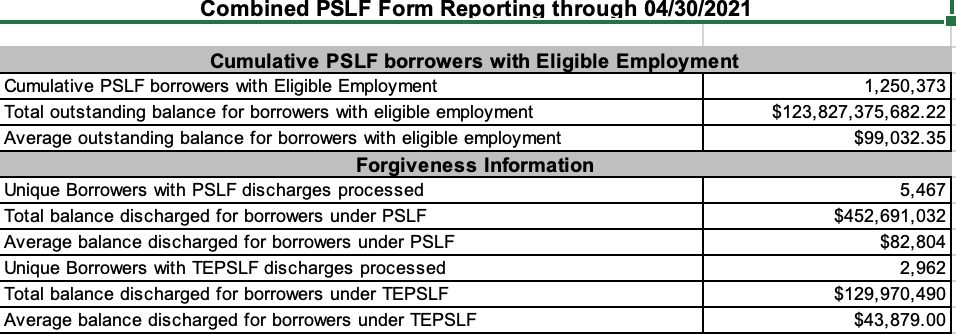

Source: April 2021 PSLF Report

As you can see from the table, 5,467 borrowers have received Public Service Loan Forgiveness. From those borrowers, a total of $452,691,032 has been discharged with the average balance discharged being $82,804. Due to some of the complications and confusion regarding PSLF, the Temporary Expanded Public Service Loan Forgiveness (TEPSLF) was created.

An additional 2,962 borrowers have benefited from the TEPSLF program with a total of $129,970,490 of federal student loan debt wiped out. The average balance discharged under that program was $43,879.00.

We just started seeing forgiveness under PSLF unfold over the past few years and as everyone adjusts to the process it’ll become more streamlined. While earlier reports signified an abysmal approval rate for PSLF, more recent reports have shown that PSLF applications that were rejected are more likely due to missing information or paperwork and not necessarily not being eligible.

IDR loan forgiveness data

Income-driven repayment (IDR) plans have a repayment period of 20 to 25 years, so we don’t have as much anecdotal evidence of published stats. Some borrowers have already experienced forgiveness through this program. Unfortunately, not all of it is good news.

The National Consumer Law Center (NCLC) published earlier this year that only 32 borrowers have received student loan forgiveness through an IDR plan out of two million borrowers. Those numbers aren’t encouraging but as these issues come to light, there is more attention on the problem and hopefully changes will be forthcoming.

Teacher Loan Forgiveness data

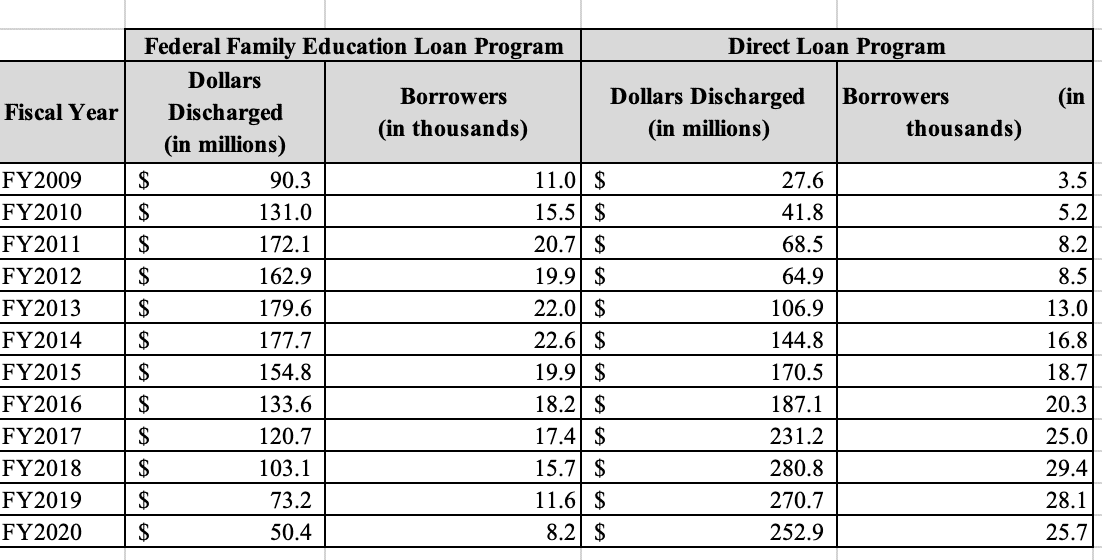

The federal Teacher Loan Forgiveness program has been discharging student loans since 2009. As of 2020, 50.4 million in FFEL loans and $252.9 million in Direct Loans were discharged under this program for a total of over 30,000 student loan borrowers.

Source: Federal Student Aid Teacher Loan Forgiveness Report

If you’re worried whether loan forgiveness programs are real, here’s published data that proves federal loan forgiveness is legitimate. Although you might be concerned about this benefit going away, it’s likely if there are any changes that current student loan borrowers would be grandfathered in.

Real people who’ve experienced student loan forgiveness

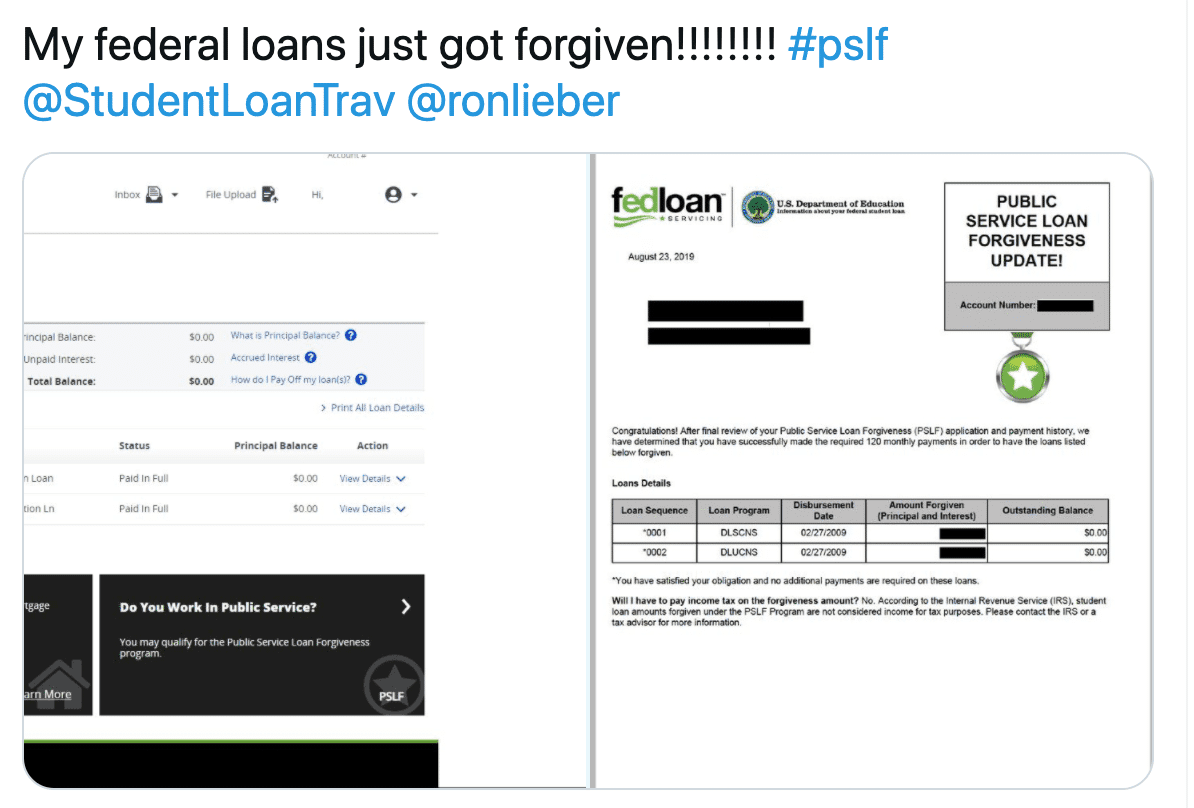

On social media, people are sharing their own student loan forgiveness stories. Though shared publicly, usernames have been omitted.

You can scroll through PSLF success stories like these on Reddit. So when you’re feeling like student loan forgiveness isn’t possible, look at real-life stories and know that although the programs might not be perfect or foolproof, forgiveness is possible and is happening for many student loan borrowers.

Student loan forgiveness isn’t going anywhere. PSLF has been around since 2007 as part of the College Cost Reduction and Access Act of 2007. An act is constituted as law, so it’s difficult to go back. If there are changes it’s highly likely current borrowers would be grandfathered into these forgiveness options.

Checklist for student loan forgiveness

If you’re worried whether student loan forgiveness programs are real or not, use that worry productively by taking action on your student loans and the forgiveness requirements. To achieve student loan forgiveness under PSLF or income-driven repayment, you want to:

- Make sure you’re on the right repayment plan — fill out IDR plan request form, you’ll also need your FSA ID

- Recertify your income on your loans each year

- Review all eligibility requirements

- Make sure your employer qualifies and submit the Employment Certification Form

- Pay monthly payments on time and remain in good standing

- Keep a paper trail and keep track of when you change jobs

- Monitor your student loan payments

- After 120 payments for PSLF, submit a PSLF Application

- Dispute any errors

Taking these actions can make sure you stay on top of your student loan forgiveness so you have the best possible chance of getting your loans discharged.

Bottom line

Student loan forgiveness is a hot button issue right now. Being concerned is understandable if your financial life depends on student loan forgiveness. There’s some encouraging news out there so keep good records, and diligent follow-up can help you along the process.

If you’re having trouble making payments, don’t be afraid to reach out to your loan servicer and learn about deferment and forbearance options. For the long-term, if you’re opting for student loan forgiveness, stay the course.

Not sure what to do with your student loans?

Take our 11 question quiz to get a personalized recommendation for 2024 on whether you should pursue PSLF, Biden’s New IDR plan, or refinancing (including the one lender we think could give you the best rate).