We are seeing the lowest student loan refinance rates in history right now, but they’ve started ticking up.

Have rates bottomed out? How do rising interest rates affect refinancing student loans? Should you refinance now (or refinance again)? We’ll examine these questions to help you figure it out.

How private student loan interest rates are set

Rates are determined by combining the prevailing market interest rates with the characteristics of the student loan borrower and the terms they’re looking for. The main factors that determine a private student loan interest rate offer, include:

- LIBOR,

- Credit score,

- Debt-to-income ratio,

- Job stability,

- Loan repayment term, and

- Fixed vs. variable rate.

A private lender will often start by basing its interest rates on the London Interbank Offered Rate (LIBOR). LIBOR is determined by the rates that global banks charge other financial institutions for short-term loans. Since these are relatively low-risk loans between financial institutions, LIBOR is a low-risk rate and is just the starting point for private student loan rates.

From there, the lender has to determine how risky it would be to lend money to a borrower. The higher the calculated risk, the higher the interest rate will be.

Since student loans are unsecured (meaning there’s no asset or collateral, like a house, attached to it), the rates offered should be higher than mortgage rates, for example.

Next, the student loan borrower’s credit is factored into the equation. The lender will offer a preliminary rate, and then run a credit check to see a borrower’s credit history and credit score. The higher the score, the more competitive the rate.

Related: Does Refinancing Student Loans Hurt Your Credit Score?

A student loan borrower’s debt-to-income (DTI) ratio is also considered. The lender looks at how much student loan debt there is compared to income, and also takes a look at credit card debt, personal loans, mortgage, auto loans and any other outstanding debt. The lower the DTI, the lower the rate that’s offered.

Refinancing lenders also look at the job stability of various professions. For example, a dentist might get a lower interest rate offered than a chiropractor.

The loan repayment term also has an impact on an offered rate. The longer the term of a private student loan refinance, the higher the rate will be. For example, a 20-year, fixed refinance rate will be higher than a five-year term for the same person.

Finally, a fixed rate generally is higher than a variable interest rate. If rates go up, the bank doesn’t want to keep a low interest rate loan on the books, because they can lend that money to someone else at a higher interest rate.

On the other hand, if rates go down, that loan becomes more valuable to the lender. Variable interest rates allow the lender to change the interest rate on the loan (monthly or quarterly, for example) to keep it as a favorable loan in their portfolio and protect them if rates go up.

Where are private student loan refinancing rates today?

As of December 8, 2020, the lowest fixed-rate student loan refinance is 2.79% but all of the ones listed below start at under 3%. The table at this link is our roundup of the best student loan refinance lenders.

When you look at the range that’s offered, low-interest student loan refinance rates are for borrowers with the most favorable characteristics, according to the lenders. The higher-end rates are for borrowers with less favorable characteristics.

These are among the lowest student loan refinancing rates in history mainly due to LIBOR being at, or near, all-time lows.

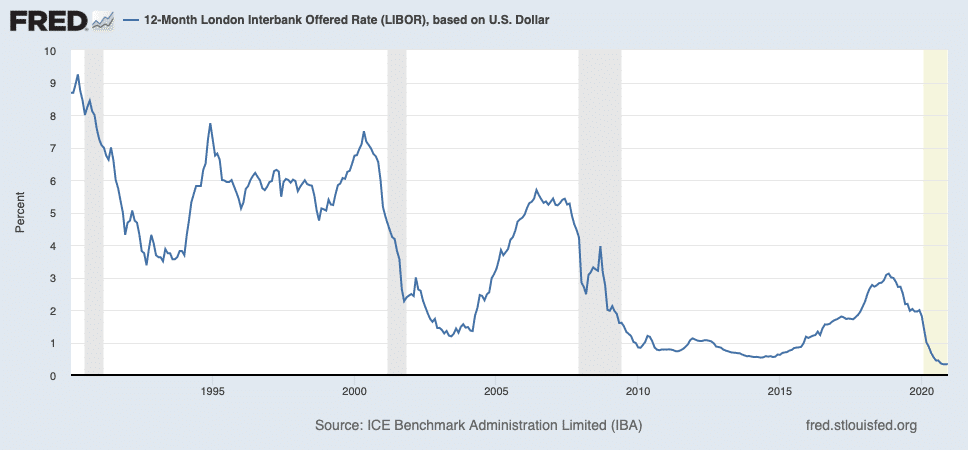

As you can see from this 30-year historical LIBOR chart from the St. Louis Federal Reserve, the 12-month LIBOR is at, or near, historic lows. Since loans with a private lender are based on the LIBOR, refinancing rates are lower than we’ve seen as well.

Have rates bottomed out?

The short answer is no one can say for sure. Yes, rates could, in theory, go lower but just two short years ago, LIBOR jumped up to 3% (about 2.5% higher than it is today).

If I were to weigh the risk of rates going lower versus rates going higher, I’d bet on them going higher. That said, I remember when rates fell dramatically during The Great Recession. Everyone (and I mean everyone) predicted rates would rise quickly coming out of it. But as you can see from the chart, rates stayed near or below 1% for years and years.

Will rates eventually go higher? Have rates bottomed out? I’d say yes. They could go marginally lower, but they could go exponentially higher.

When will they go higher? That’s really hard to know. It could be as soon as next week or as late as five to 10 years from now.

Should you refinance private student loans now (or refinance again)?

If you have private student loans, the answer is easy. Yes — you should explore refinancing if you haven’t done so in the last six months.

Private student loans don’t have origination fees so there are no extra costs to refinancing. If you get offered a lower rate, great! If you’re not offered a lower preliminary rate, then you don’t have to do anything.

Also, if you’re nervous about a high loan payment during the pandemic, you can always explore refinancing to a longer term to lower your required monthly payment. Many private loans don’t offer deferment or forbearance, though some of our refinancing partners do offer this feature.

If you want to get the double-whammy of potentially lowering your interest rate and qualifying for some of the best cash-back bonus offers out there, I’d highly suggest refinancing through Student Loan Planner®.

Should you refinance federal student loans right now?

Federal student loans are a little tricker to figure out, but here are some ideas that could help you make a decision about refinancing.

If you’re going for Public Service Loan Forgiveness (PSLF) or owe more in student loans than you earn, don’t refinance right now.

Chances are that taking advantage of federal income-driven repayment, loan forgiveness, and the current CARES Act forbearance will save you more money in the long run.

Refinancing federal student loans could make sense, if you:

- Owe less than what you make.

- Have a solid emergency fund in the bank.

- Work a stable job even during the pandemic.

- Can afford to take on the fixed, 10-year monthly payment without wrecking your finances.

- Won’t have access to federal loan forgiveness programs.

Remember that once you refinance federal student loans, they’re pulled out of the federal loan program for good and the loans will have to be paid back in full.

If you’re hesitant to refinance until after the CARES Act forbearance ends, take a look at refinancing 30 days before the 0% interest and $0 payments expire. Most private lenders will lock-in your rate for that amount of time after providing your preliminary quote.

Should you refinance if interest rates rise?

Once you decide you’re going to pay back your student loans in full, you’ll want to secure the lowest interest rate you can and then pay them back as fast as you can. That’ll save you the most money and be the cheapest way to pay off your student debt.

If you haven’t refinanced yet and interest rates start to rise, it’s best to refinance as soon as possible to lock-in a fixed interest rate if you’re in a position to do so. That way, you’ve locked in your rate even if rates continue to rise (remember, don’t refinance federal loans if you’re going for loan forgiveness).

What if rates rise, you refinance, then rates go back down? Well, that’s easy. Just refinance again to secure a lower interest rate.

Think of your current interest rate as your cap. It’ll never go higher, but you can lower it by refinancing if rates drop. Remember there’s no origination fee, so you don’t have to weigh any additional costs like you would with a mortgage refinance.

The bottom line is that you should explore refinancing your private student loans today. Rates are at all-time lows and you might not have a better opportunity to secure a lower rate.

Federal student loans are a little more nuanced than that, but use the guidelines I mentioned above and assess your personal circumstances, to do what you feel is best for your situation.

If you have six-figures of student debt and need help figuring out if you should refinance or go for income-driven repayment, we can help. Reach out for a one-hour student loan consult to get started.

Refinance student loans, get a bonus in 2024

| Lender Name | Lender | Offer | Learn more |

|---|---|---|---|

|

$500 Bonus

*Includes optional 0.25% Auto Pay discount. For 100k or more.

|

Fixed 5.24 - 9.99% APR*

Variable 6.24 - 9.99% APR*

|

|

|

$1,000 Bonus

For 100k or more. $300 for 50k to $99,999

|

Fixed 5.19 - 10.24% APPR

Variable 5.28 - 10.24% APR

|

|

|

$1,000 Bonus

For 100k or more. $200 for 50k to $99,999

|

Fixed 5.19 - 9.74% APR

Variable 5.99 - 9.74% APR

|

|

|

$1,050 Bonus

For 100k+, $300 for 50k to 99k.

|

Fixed 5.44 - 9.75% APR

Variable 5.49 - 9.95% APR

|

|

|

$1,275 Bonus

For 150k+, $300 to $575 for 50k to 149k.

|

Fixed 5.48 - 8.69% APR

Variable 5.28 - 8.99% APR

|

|

|

$1,250 Bonus

For 100k+, $350 for 50k to 100k. $100 for 5k to 50k

|

Fixed 5.48 - 10.98% APR

Variable 5.28 - 12.41% AR

|

Not sure what to do with your student loans?

Take our 11 question quiz to get a personalized recommendation for 2024 on whether you should pursue PSLF, Biden’s New IDR plan, or refinancing (including the one lender we think could give you the best rate).