New York University (NYU) is one of the most popular and respected private universities in the U.S. Currently, its student enrollment exceeds 50,000 and it’s enjoyed 14 straight years of record applications.

With fewer than one-in-five undergraduates gaining acceptance into NYU, getting in might feel like winning the lottery. However, soon after the excitement settles, the hefty tuition bills will arrive and families must decide how to pay for them.

Recent data from College Scorecard shows that parents often end up bearing a significant brunt of the financial burden that accompanies an NYU education. Learn more about how much NYU students loans the average family ends up with, and how to handle them.

What’s the median NYU student loan debt?

According to College Scorecard, NYU students graduate with a median total federal student debt of $17,250 to $31,152. If these numbers seem rather reasonable, there are a few caveats to point out.

First, the median student debt numbers listed above don’t include any private loans that students might’ve taken out during their NYU education. Second, they exclude Parent PLUS Loans. And, third, these debt numbers only apply to undergraduate students.

Most graduate students can expect much higher debt totals. For example, the Department of Education says that the median debt for Graduate Dentistry and Oral Science NYU grads is $245,262.

Related: Learn why NYU’s dental school might be the first $700,000 degree in the U.S.

What’s the median NYU Parent PLUS Loan debt?

When experts discuss the rising cost of college, many focus on how this impacts students’ finances. But it’s important to understand that scores of parents are feeling the weight of expensive higher education degrees, too.

Previously, the College Scorecard only reported on how much debt students ended with after graduating from a higher education institution. But, in December 2020, the Department of Education announced that the tool would begin reporting on parent debt levels as well.

In NYU’s case, the data showed that the median parent debt is more than double the median student debt. The median NYU Parent PLUS Loan debt for 2017-2018 and 2018-2019 cohorts was $74,201.

Again, these numbers might actually be lower than reality. First, they don’t include any parents who took out parent loans to help pay for a student’s education who ended up dropping out before graduating. Also, they don’t include private loans taken out by parents.

How does family income impact loan amounts at NYU?

The Department of Education defines a low-income student as one who received an income-based federal Pell Grant. This isn’t a perfect definition as foreign students don’t qualify for Pell Grants. Also, some students who would’ve qualified might’ve failed to submit the FAFSA to apply for NYU financial aid.

Nonetheless, the Education Department’s definition is a good starting point for estimating how many students at NYU come from low- or high-income family backgrounds. For the 2018 and 2019 graduating classes, 20% of NYU students received a Pell Grant.

The median parent debt for those low-income students (including those who dropped out) was $53,513. This is over $20,000 less than the overall median NYU Parent PLUS Loan debt. So higher-income families actually tend to take out more parent loans, perhaps due to fewer NYU financial aid options.

NYU student loans: 3 ways borrowers can manage debt

We’ve seen that many students and parents will end up taking out loans to help pay for an NYU undergraduate degree. But what can you do about it? Here are three options for repaying NYU student loans and NYU Parent PLUS Loans.

1. Join an income-driven repayment plan

Most federal student loans are (or can become) eligible for an Income-Driven Repayment (IDR) plan. And, yes, this does include Parent PLUS Loans. However, the IDR program options are less flexible and attractive for Parent PLUS borrowers.

Students can choose to join any of the four current IDR plans. REPAYE, PAYE, and IBR are the most popular options as they each base payments (for students who took out their loans after July 2014) on 10% of discretionary income. These plans also forgive an undergraduate student’s remaining balance after 20 years.

Parent PLUS borrowers, meanwhile, aren’t eligible to join any of these plans. They can become eligible for the ICR plan, but only after consolidating PLUS Loans via a Direct Consolidation Loan.

Unfortunately, the ICR plan is the least generous of the IDR plans. Payments are generally based on 20% of discretionary income and borrowers must make payments for 25 years before they can become eligible for forgiveness.

Note that some Parent PLUS Loan borrowers can take advantage of a “double-consolidation loophole” to qualify for one of the more attractive IDR plans. Read our Parent PLUS double consolidation guide to see if this could work for you.

If you have NYU student loans, joining an IDR plan could help to keep your payments manageable, especially if you’re dealing with career instability. However, parents who work in the private sector will benefit less from IDR and can consider refinancing their loans instead.

2. Pursue Public Service Loan Forgiveness (PSLF)

If you currently work for a nonprofit organization or the government, Public Service Loan Forgiveness (PSLF) could save you a ton of money on repaying your New York University student loans.

With PSLF, you can earn tax-free forgiveness in as little as 10 years (120 qualifying payments). That’s twice as fast as the time needed to earn forgiveness on any of the IDR plans.

Once again, things are a bit more complicated for Parent PLUS borrowers. To qualify for PSLF, you’ll first need to consolidate your loans and join the ICR plan. It should also be noted that your PSLF eligibility is based on your job, not the job of the student who’s education your loans helped to pay for.

Let’s say you took out Parent PLUS loans to help pay for your child’s teaching degree. Even if they became a teacher, that wouldn’t necessarily qualify your PLUS loan under PSLF. But if you worked as a teacher (or any qualifying, public service position), you’d be eligible for PSLF regardless of your child’s employment.

Related: The Ultimate Guide to Parent PLUS Loan Forgiveness

3. Refinance with a private lender

Benefits of student loan refinancing include the potential to lower your interest rate or choose a more attractive repayment term. But when you refinance federal NYU student loans or NYU Parent PLUS Loans, they’ll no longer be eligible for federal benefits. This means you’ll no longer have the option to join an IDR plan or pursue federal forgiveness programs, like PSLF.

If your income is high (reducing the benefits of IDR) and you don’t work in the public sector (eliminating PSLF as an option), refinancing could make a lot of sense. The upside might be highest for NYU parents who, on average, are borrowing more than students. Also, Parent PLUS Loans come with the highest interest rates of all federal student loans.

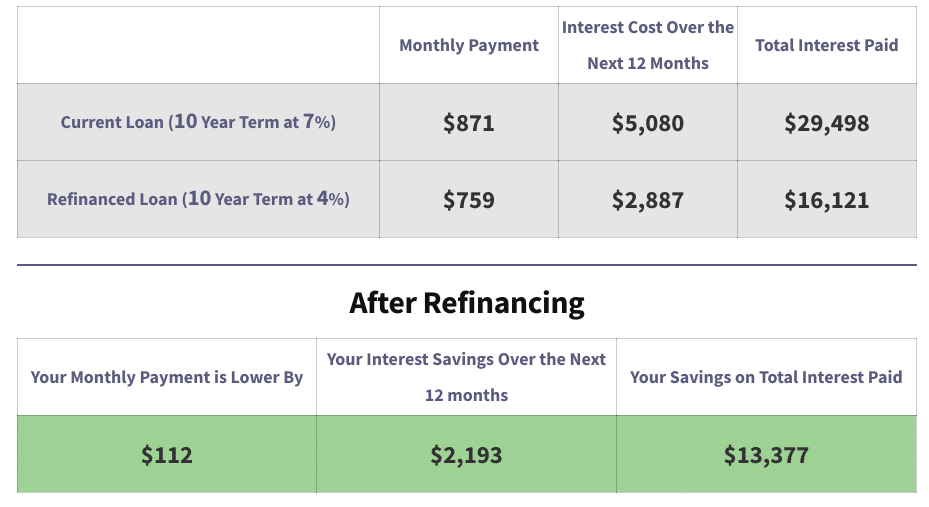

If you’re an NYU Parent PLUS Loan borrower with strong credit, refinancing could save you thousands of dollars in interest over the life of your loans. For instance, let’s say you have $75,000 of Parent PLUS Loans at an average interest rate of 7%.

By refinancing at 4%, the Student Loan Planner® refinance calculator shows that you’d lower your monthly payments by $112 and save over $13,000 in total interest charges.

In the example above, we compared refinancing to the standard 10-year repayment plan. But parents who choose refinancing over consolidating and joining the ICR plan could save much more and could reach debt-free status 15 years sooner.

Several private lenders offer Parent PLUS Loan refinancing and some even allow parents to transfer their loans to the student. Student Loan Planner® offers borrowers some of the highest refinancing cash bonuses available today. If you plan on refinancing your New York University student loans or Parent PLUS Loans, make sure you shop around before making a final choice.

Not sure what to do with your student loans?

Take our 11 question quiz to get a personalized recommendation for 2024 on whether you should pursue PSLF, Biden’s New IDR plan, or refinancing (including the one lender we think could give you the best rate).