Like the 3.4 million parents who borrowed Parent PLUS Loans to help their kids get through school, you may want to help your child in the same way. If you’re a parent who’s considering Parent PLUS Loans, you’ll want to know exactly what you’re getting into. Below is your need-to-know guide for Parent PLUS Loans.

What are Parent PLUS Loans?

Parent PLUS Loans are administered by the U.S. Department of Education and are part of the Direct Loan program.

You may also hear them referred to as Direct PLUS Loans. These loans are offered to parents and grad students, and they’re labelled as Parent PLUS Loans and Grad PLUS Loans, respectively.

Parent PLUS Loans are offered to parents of dependent undergraduate students. Parents can borrow money to cover the full cost of tuition, minus the amount already covered by the student's financial aid package.

This type of loan is based on your own eligibility, and as a parent, you’re financially responsible for the entire loan.

What makes you eligible for Parent PLUS Loans?

Eligible parents can apply for Parent PLUS Loans with any schools that participate in the Direct Loan program. To be eligible for a Parent PLUS Loan, you must be the parent of a dependent undergraduate student. The student must be enrolled in an eligible school at least half time.

Parents can be biological, adoptive or, in some cases, a step-parent. Grandparents could be eligible for Parent PLUS Loans if they’ve legally adopted the dependent student. Otherwise, grandparents and legal guardians aren’t eligible for these loans.

Your credit history is another eligibility factor. If you have an adverse credit history, it’s more challenging to get a Parent PLUS Loan. You’d need to get an endorser or prove extenuating circumstances to the U.S. Department of Education.

Lastly, both you and the dependent student must meet the general eligibility requirements for federal student aid.

Related: How to Strategically Choose Which Parent Should Apply for Parent PLUS Loans

11 steps to apply for a Parent PLUS Loan

If you meet all of the eligibility criteria, you can apply for a Parent PLUS Loan online. There are a few schools that have their own application process, but the majority use the StudentLoans.gov website.

Before you complete the application process, you’ll need to make a few decisions. You can choose to:

- Designate whether the school pays any credit balance to the student or to you

- Request a Parent PLUS deferment while the student is in school

- Request an additional deferment for six months after the student ceases to be enrolled at least half time.

Even in deferment, your loan collects interest. This interest capitalizes, meaning it’s added to your total amount due when you enter repayment. You want to try and avoid capitalized interest if possible. So, if you’re approved for deferment, plan to still make interest payments.

The information you provide in the application is sent to the school you select. The school will then get back to you after processing your application.

Below are the steps to apply for Parent PLUS Loans:

1. The student must complete the Free Application for Federal Student Aid

Since Parent PLUS Loans are part of the Direct Loan program, your student needs to complete the Free Application for Federal Student Aid (FAFSA) to be eligible for federal aid. The student will receive a federal student aid award letter from their school. Then you can determine how much you’ll need to borrow with a Parent PLUS Loan to fill the gap.

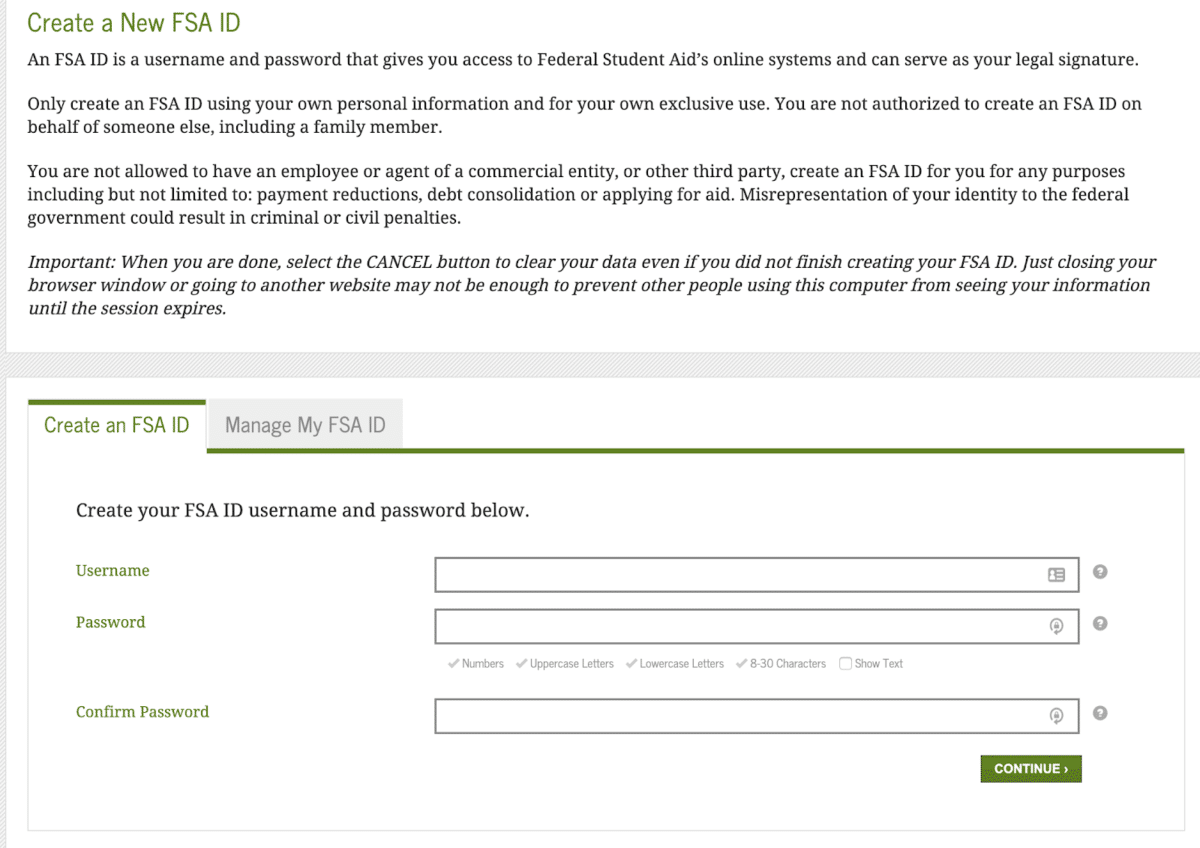

2. Log in with your own Federal Student Aid ID

To begin the application you’ll need to log in with your own Federal Student Aid (FSA) ID. This is a username and password that allows you to safely access FSA’s systems without having to input your Social Security number every time you log in.

Don’t use your student’s FSA ID to log in. If you need to create an FSA ID, you can do so ahead of time. Once you’ve logged in, the application will take approximately 20 minutes to complete.

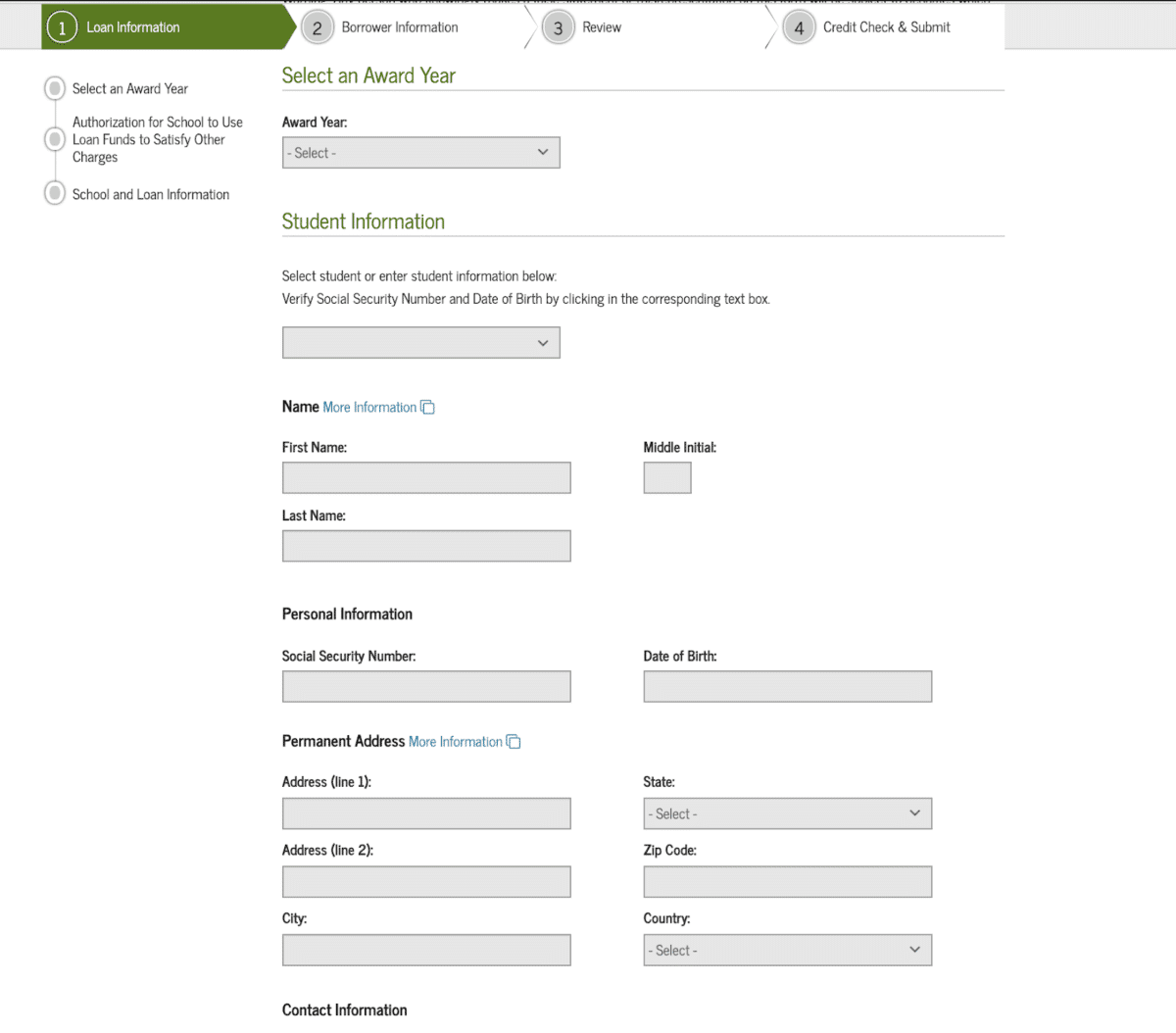

3. Provide the student’s personal information

The first portion of the application asks for you to add the essential information needed to connect the loan to the student. You’ll need to provide:

- The award year for the Parent PLUS Loan

- Your student’s SSN

- Their first and last name

- Their date of birth

- Their permanent address

- A contact number for them

Keep in mind that you’ll provide your personal information as the borrower later on.

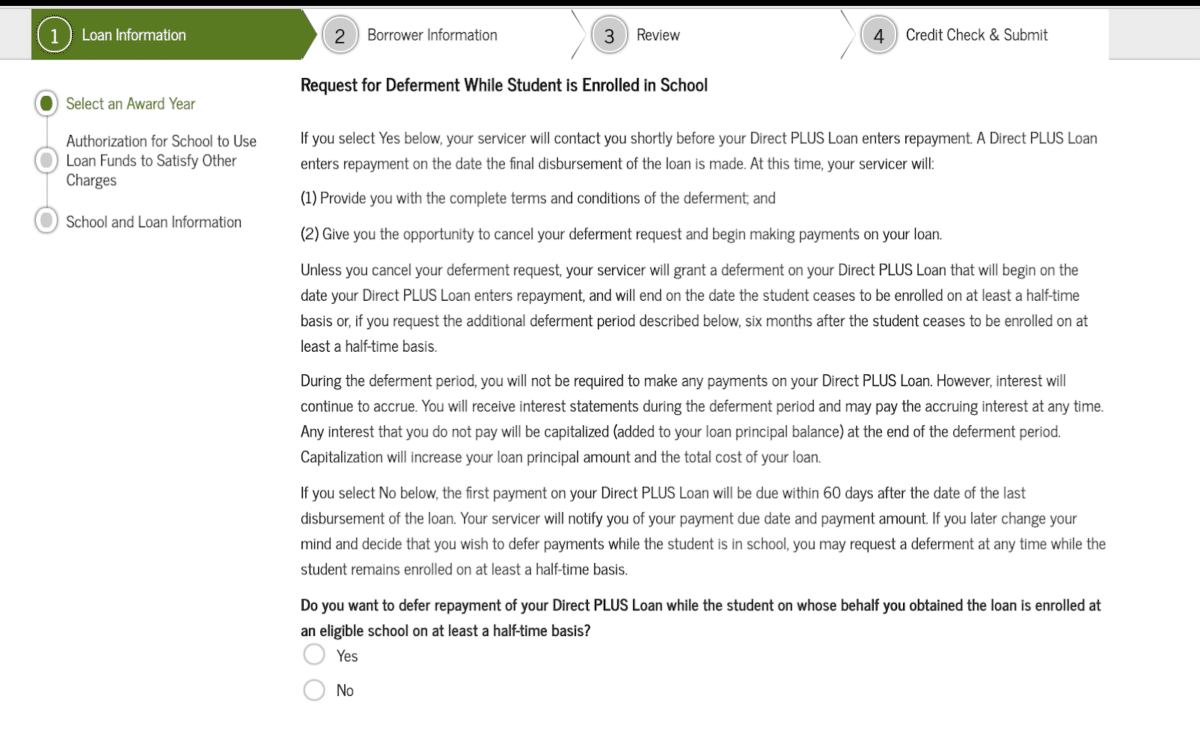

4. Request deferment (if needed)

On the same portion of the application, you can decide to request a deferment. You can ask for a deferment while your child is still in school as well as for six months after they’ve either left school or dropped below half-time enrollment.

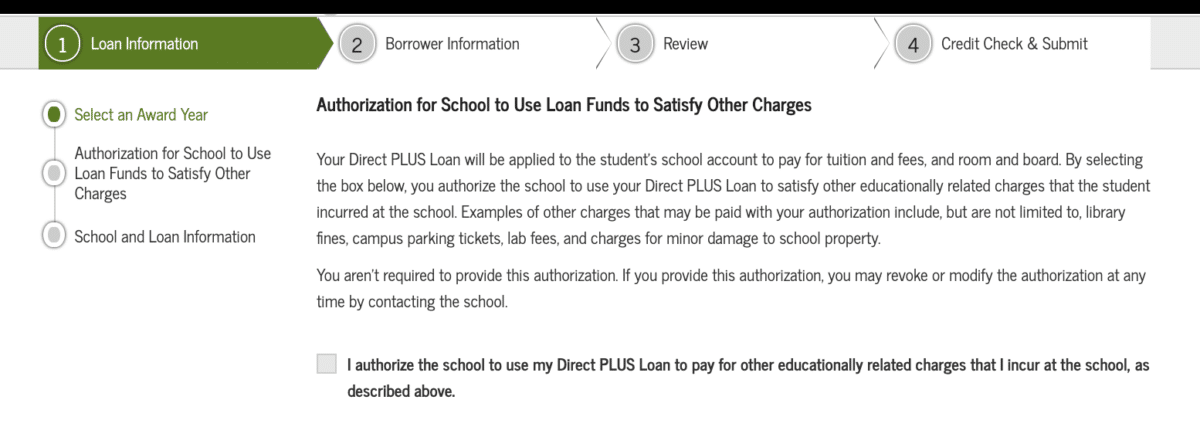

5. Authorize the school to use the funds

You’ll need to authorize the school to use the funds for your child's educational expenses. You must check this box, as the funds can’t be used for any other reason.

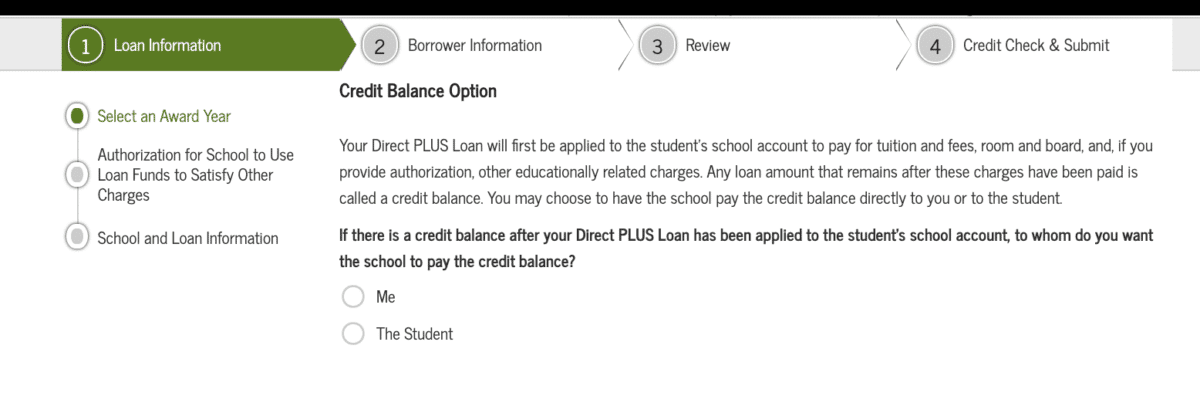

6. Determine who receives the remaining balance

Any amount left over after the educational expenses have been paid is called a “credit balance.” You can decide if the leftover money goes to you or your student.

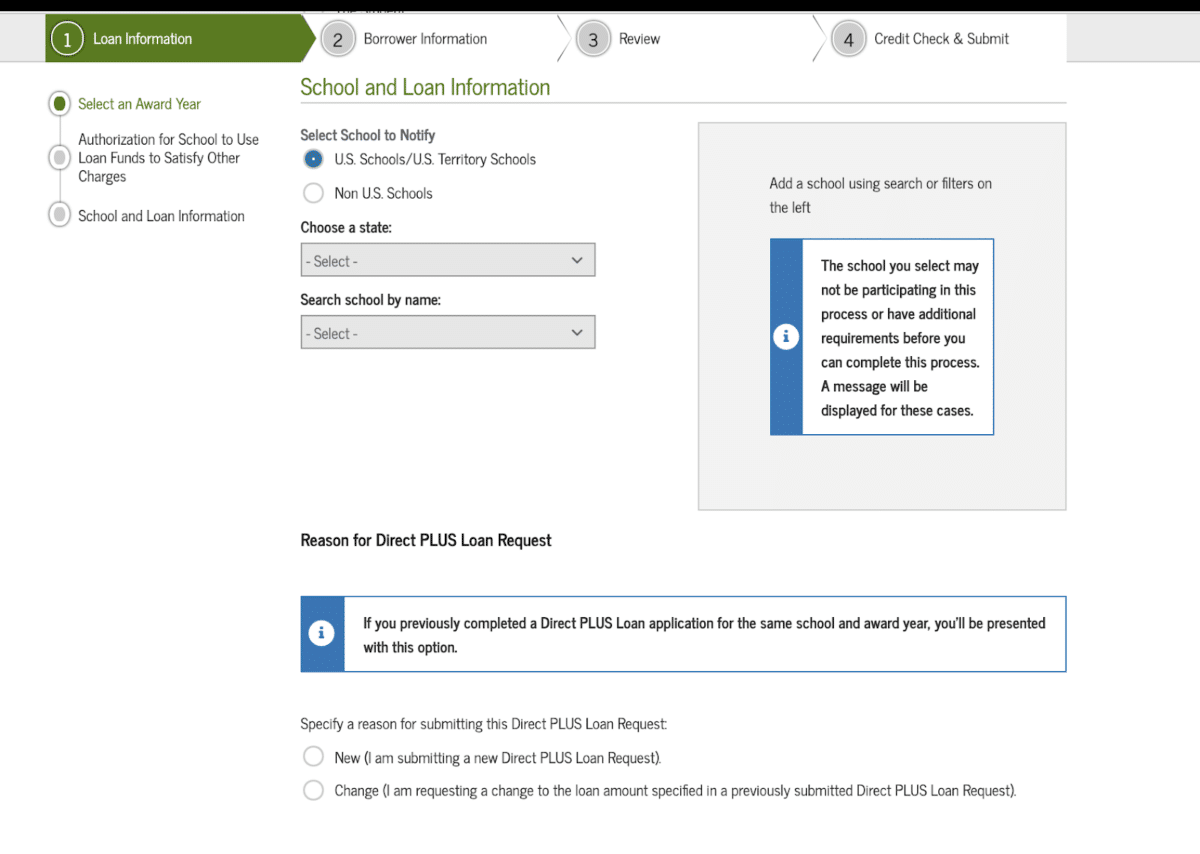

7. Select which school to notify

You must designate a school to notify when you complete the application. The school is the entity that applies the funds to the student's account.

In this same section, select the reason for the application.

You’ll fill out the same application whether you’re a new borrower or just changing the amount you initially asked for. Any requests for changing the amount must be completed before the loan is disbursed.

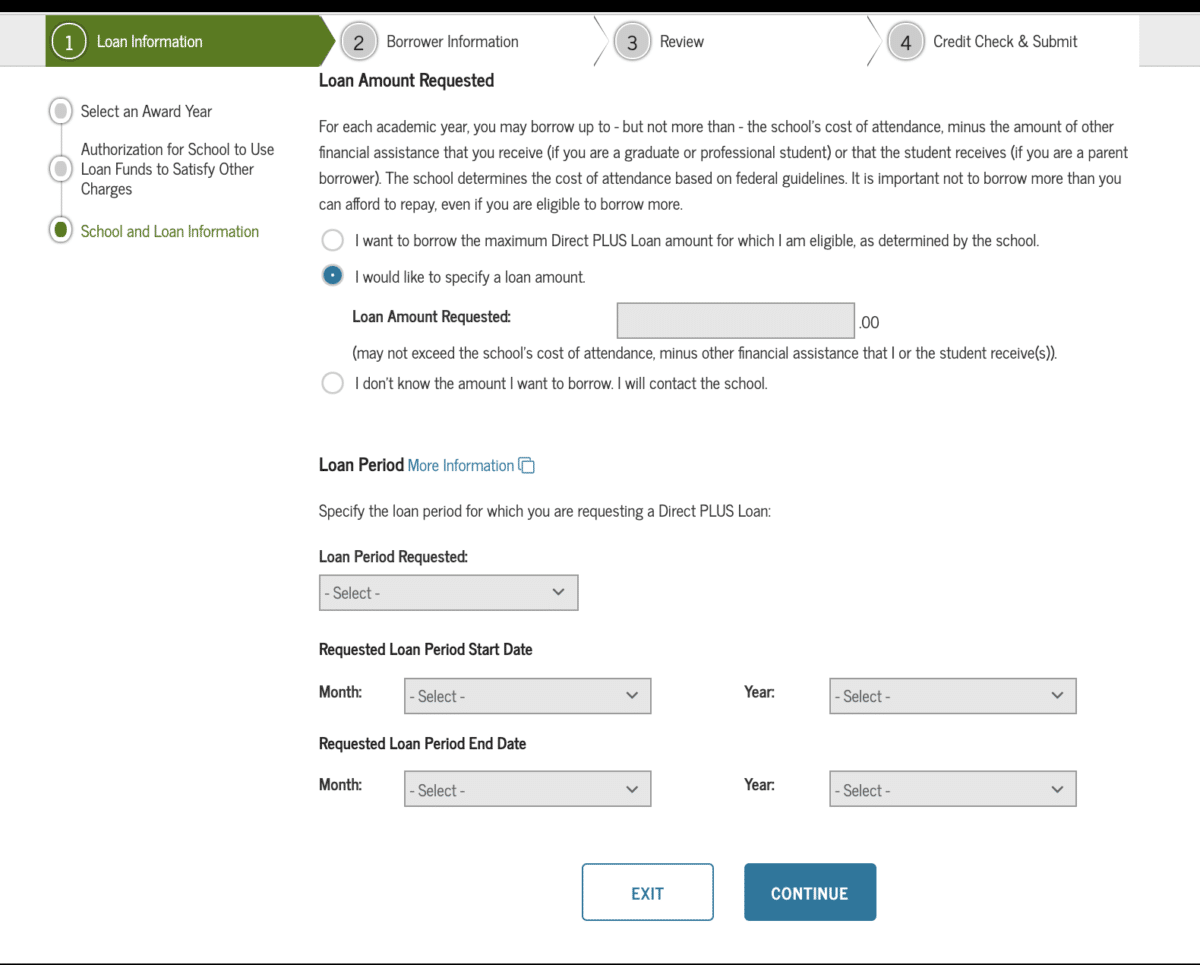

8. Enter the loan amount and loan period

You can select to take the maximum allowed for the cost of attendance, minus financial assistance. However, you can also ask for a specific amount. If you know how much your child is short, it’s a better idea to request a specific amount rather than maxing the loan out.

You’ll select the loan period as your very last step on page one of the application. This is typically the same one that the school uses. If you don’t know the loan period dates, contact the school's financial aid office.

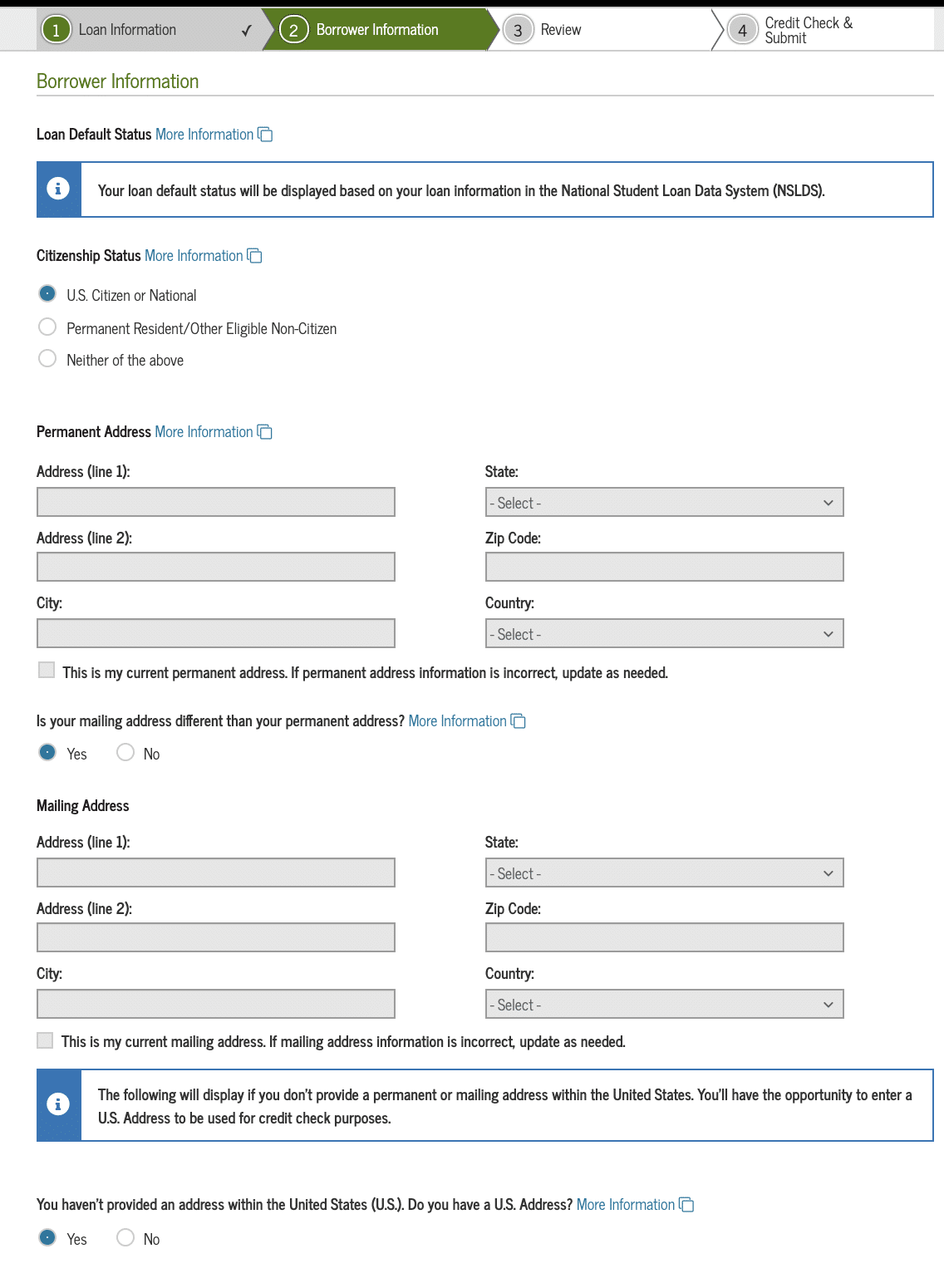

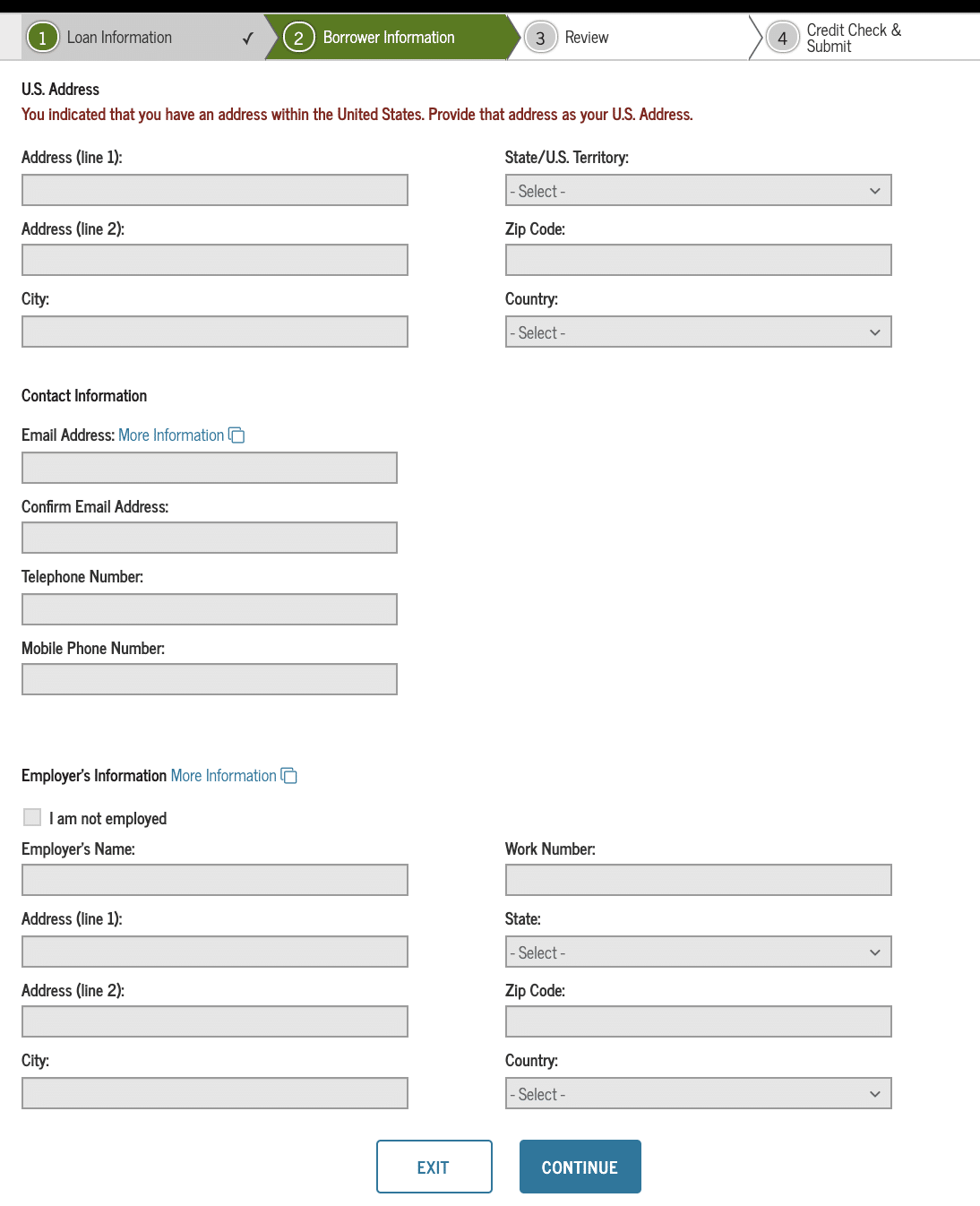

9. Provide your personal information

You’ll also input your own personal information for the loan. This includes your:

- Citizenship status

- Permanent address

- Mailing address

- Contact information

- Employer’s information

After this step, click “continue” and move on to the review.

10. Review all the information provided

Look over all the information you’ve given and verify that it’s correct.

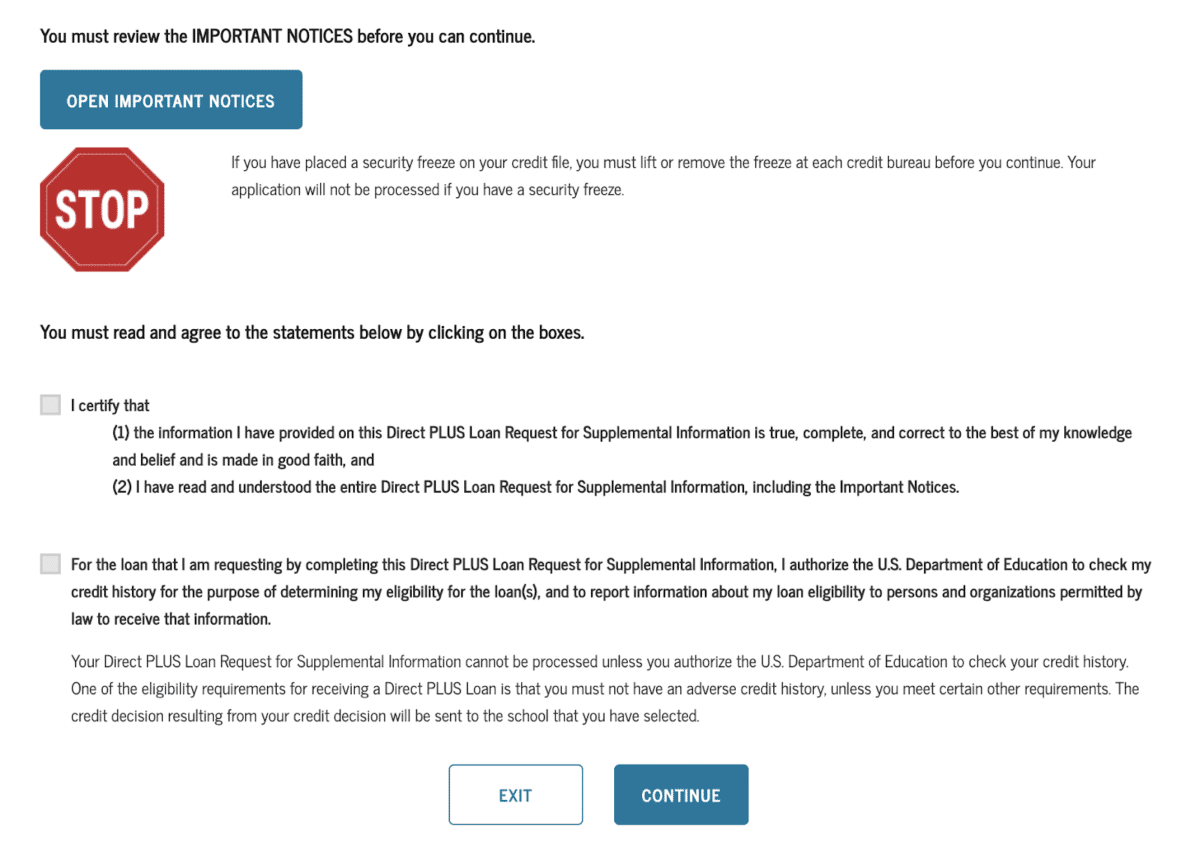

11. Certify your information, agree to a credit check and submit

The very last step asks you to certify that all the information you provided is correct. You’ll agree to a credit check — make sure you don’t have a freeze on your credit history — and then press submit.

Afterwards, there are still a few things you need to take care of if your application is accepted.

What happens next?

After submitting the application, it will be accepted or denied.

If your application is accepted, sign the Master Promissory Note (MPN). This means you agree to all the terms of the loan. Contact the financial aid office at your child's school for details about the process for this. Please note that if you’re taking out Parent PLUS Loans for more than one child, you’ll need to sign separate MPNs for each loan.

If your application is denied, review your other options to help your child with their education (more on this in a bit). There’s also the possibility of receiving a pending notice, depending on the information you submitted on the application.

Is the Parent PLUS Loan a good idea?

Parent PLUS Loans are an accessible way to pay for your child's schooling. This doesn’t mean they’re the best choice for you. Taking out a Parent PLUS Loan is a big financial responsibility that shouldn’t be taken lightly. Sit down and take time to consider the pros and cons of Parent PLUS Loans for your future.

Evaluate your financial health

Taking out a loan to help your kid get through school is very generous of you. However, it’s important to first look at your own finances before taking on student loan debt for your child. Ask yourself:

- Are you saving enough for retirement?

- Do you have an emergency fund?

- Can you afford the payments?

- What other forms of debt do you already have?

- Do you have good credit?

Take a hard look at your own finances before reaching out to help others. Not only do you need to meet eligibility requirements, but the health of your finances needs to be examined.

Calculate how much money your child needs

You can borrow as much as needed to cover the cost of attendance. This is helpful, but it also means you need to have a solid plan in place to repay it. Thankfully, you have several repayment plan options with Parent PLUS Loans. These loans are eligible for:

- A Standard 10-year Repayment Plan

- A Graduated Repayment Plan, which slowly increases the amount you pay over 10 years

- An Extended Repayment Plan where you can choose fixed or graduated payments for up to 25 years

You may also be eligible for the Income-Contingent Repayment (ICR) plan. You’d need to consolidate your Parent PLUS Loans into a Direct Consolidation Loan in order to be eligible for ICR. Under this plan, the monthly payment amount is adjusted annually based on your income.

You can calculate repayment amounts using a tool like our Parent PLUS Loan calculator.

Parent PLUS Loan interest rate and fees

Whenever you consider the repayment plans you’re eligible for, you should also look at the interest rate and origination fees of the loan.

The Parent PLUS Loan interest rate is currently **7.08%. Interest rates on Parent PLUS Loans are fixed, meaning they don’t change during the life of the loan. That said, this rate is on the higher end for student loans.

Parent PLUS Loans also come with an origination fee, which is a percentage of the loan amount. Loans disbursed after Oct. 1, 2019 will carry a fee of 4.236%. The amount is taken from the loan itself before disbursement.

Repayment starts immediately

There isn’t a grace period for Parent PLUS Loans. That said, when you complete the application, you can request deferment of payments while the student is in school. You can also ask for a six-month deferment period once the student graduates or drops below half-time enrollment.

It’s not guaranteed that deferment will be granted when you take out the loan. Parent PLUS Loans typically begin repayment as soon as they’re disbursed. You should be prepared for this and stay in contact with your loan servicer.

Parent PLUS Loans and forgiveness

Parent PLUS Loans aren’t eligible for student loan forgiveness. But there’s a loophole! The same way you access the ICR plan with a Direct Consolidation Loan, you can also access forgiveness.

Consolidating Parent PLUS Loans into a Direct Consolidation Loan makes you eligible for student loan forgiveness programs, including Public Service Loan Forgiveness. It also means you’ll be making minimum payments and can invest more in retirement.

Transferring Parent PLUS Loans to your child

If you want to be rid of Parent PLUS Loans, you can have them put in your child's name. You can transfer a Parent PLUS Loan by having your child refinance it. Of course, you want to make sure your child is financially able to take on the student loan payments. They’ll also need to have a good credit history.

Student Loan Planner® has a lender we partner with that allows Parent PLUS Loans to be refinanced in your child’s name: Laurel Road.

Other options besides Parent PLUS Loans

Parent PLUS Loans can be an option to help pay for your child's education. However, you have other choices.

Look into a cosigned private student loan

If your student has exhausted all forms of federal student aid, you and your student can investigate private student loans. These loans will be taken out in their name, but if you cosign, you’re also responsible if they miss a payment. Keep in mind that your child’s missed payment can negatively affect your credit.

Try to find private student loans for parents

Parent PLUS Loans carry a high interest rate. If you’re stable financially and don’t need to count on flexible repayment plans, investigate private student loans for parents.

While it’s more common for lenders to offer private loans to students and have their parents cosign, some lenders offer parent-only private student loans. You’ll have to shop around and compare your options.

When looking at private student loans, your payments also begin right away. Be sure this is feasible for you and your student.

Still unsure if Parent PLUS Loans are right for you?

Don’t forget that you can always help your student find alternative ways to pay for school. There are numerous outside scholarships and grant opportunities that can supplement their financial aid package.

If you decide to take out any kind of loan for your child, have a financial plan. Don’t let it destroy your own finances or your future retirement.

If you’re still unsure of which way to help your child in college, reach out to the team at Student Loan Planner®. We can offer you and your student a pre-debt consultation to look at all of your choices.

Refinance student loans, get a bonus in 2024

| Lender Name | Lender | Offer | Learn more |

|---|---|---|---|

|

$500 Bonus

*Includes optional 0.25% Auto Pay discount. For 100k or more.

|

Fixed 5.24 - 9.99% APR*

Variable 6.24 - 9.99% APR*

|

|

|

$1,000 Bonus

For 100k or more. $300 for 50k to $99,999

|

Fixed 5.19 - 10.24% APPR

Variable 5.28 - 10.24% APR

|

|

|

$1,000 Bonus

For 100k or more. $200 for 50k to $99,999

|

Fixed 5.19 - 9.74% APR

Variable 5.99 - 9.74% APR

|

|

|

$1,050 Bonus

For 100k+, $300 for 50k to 99k.

|

Fixed 5.44 - 9.75% APR

Variable 5.49 - 9.95% APR

|

|

|

$1,275 Bonus

For 150k+, $300 to $575 for 50k to 149k.

|

Fixed 5.48 - 8.69% APR

Variable 5.28 - 8.99% APR

|

|

|

$1,250 Bonus

For 100k+, $350 for 50k to 100k. $100 for 5k to 50k

|

Fixed 5.48 - 10.98% APR

Variable 5.28 - 12.41% AR

|

Not sure what to do with your student loans?

Take our 11 question quiz to get a personalized recommendation for 2024 on whether you should pursue PSLF, Biden’s New IDR plan, or refinancing (including the one lender we think could give you the best rate).

[…] not going to suggest Parent PLUS loans either. You know when the airline attendant says to always put on your own mask first before helping […]