Loyola University is a private Jesuit university located in Chicago. The school currently enrolls just over 17,000 students and has 150,000 alumni, with 85,000 of those graduates still living in the Chicago area.

It made national news when its NCAA basketball team made an incredible March Madness run all the way to the Final Four from the 11th seed. But the university is most proud that it’s student athletes have boasted a 99% graduation rate for three consecutive years. Loyola’s student body also focuses heavily on community outreach, logging over 92,000 volunteer hours in Chicago.

It’s easy to see why the school would be an attractive option for many soon-to-be college students. But the school’s cost also needs to be considered. Recent data shows that the average family will end up with nearly $80,000 of Loyola student loans and parent loans by the time an undergraduate reaches graduation.

Below, we list a few key Loyola debt statistics that you need to know. And if you already have a Loyola Parent PLUS Loan or student loan, we lay out some of your best repayment options.

Loyola student loans: Key statistics

Each year, the Department of Education’s College Scorecard releases a variety of school-level data regarding things like average tuition, debt, and employment after graduation. According to the tool’s newest stats, here are a few of Loyola’s important student loan numbers:

- Median student debt (all students): $19,500

- Median student debt (Pell Grant recipients): $21,415

- Percentage of students that received student loans: 63%

- Typical monthly payment: $131 to $258 per month

The numbers above apply only to undergraduate, federal student debt. If you were a graduate student or took out private student loans during your time at Loyola, your total student loan debt load could be higher. And it should be noted that your specific degree path will significantly affect how much Loyola student loans you graduate with.

Students who graduated with certificates or diplomas in Legal Support Services had the lowest median debt at $13,700. In contrast, those who graduated with bachelor’s degrees in Security Science and Technology had the highest median debt of $27,000.

Finally, notice that Pell Grant recipients actually ended up with slightly higher median student debt at Loyola than their fellow students who came from higher-income family backgrounds. This isn’t too surprising as students with less family financial support are likely to rely more on student debt.

But while students who don’t qualify for need-based grants tend to get more financial support from their parents, it’s not necessarily through cash savings. Instead, as we’ll see below, many of these parents are simply taking on high levels of Parent PLUS Loans.

Loyola Parent PLUS Loans: key statistics

For several years, the College Scorecard only provided statistics on student debt. But, in December 2020, it began including data on Parent PLUS Loans as well. Here were some of the key parent debt numbers reported for Loyola University of Chicago.

- Median Parent PLUS Loan debt (all parents): $59,718

- Median Parent PLUS Loan debt (parents of Pell Grant recipients): $39,574

- Percentage of parents who took out loans: 15% to 20%

- Typical monthly payment: $642

These numbers are surprising in two particular ways:

First, they show that Loyola’s median parent debt is over three times higher than its median student debt! Many think of education debt as primarily being a student problem. But these new statistics show that parents actually often become more indebted during their child’s higher education.

Second, there’s a much wider gap between the median debt of all Loyola parents ($59,718) and those of Pell Grant recipients ($39,754) than exists between the students themselves. Parents, on average, take on nearly $20,000 more of Loyola Parent PLUS Loan debt when their children don’t qualify for Loyola financial aid.

Best ways to pay off Loyola student and parent loans

When parent and student debt is combined, you’ll find the median federal debt for the families of Loyola undergraduates to be $79,218. It would seem that student loans in Chicago are about as ubiquitous as the wind.

What are the best ways to pay off these loans? The answer for you will depend on several factors such as your employment, income, and credit history.

Below, we cover three different repayment strategies for a Loyola student loan or Loyola Parent PLUS Loan. We also explain which type of borrower would be the best fit for each option.

1. Income-driven repayment: Best if you have a high debt-to-income ratio

All federal Direct student loans can become eligible to be paid on one of the four available income-driven repayment (IDR) plans. On these plans, monthly payments are based on 10% to 20% of discretionary income and any remaining balance is forgiven after 20 to 25 years.

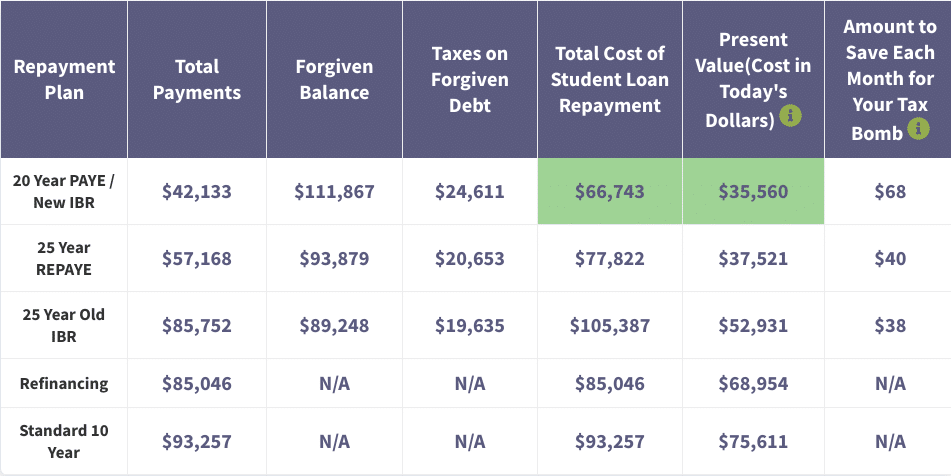

Low-income borrowers aren’t the only ones who can benefit from IDR plans. Anyone with a high debt-to-income (DTI) ratio might find that IDR might result in paying less today (by lowering monthly payments) while also saving money overall (through loan forgiveness at the end of the repayment plan).

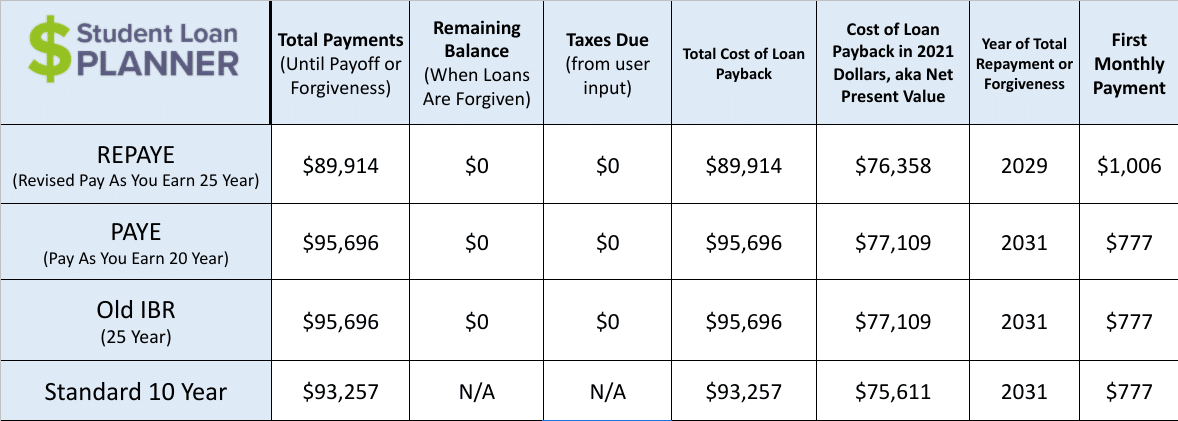

For example, let’s say you have $70,000 of Loyola Parent PLUS Loans and an annual income of $35,000 (DTI of 2:1). Plugging these numbers in the Student Loan Planner® calculator, we see that choosing PAYE or IBR instead of the 10-Year Standard Repayment plan could save you over $51,000!

But what if your income was $140,000 (DTI of 1:2)? In this case, the PAYE and IBR plans would actually cost you a little more than the 10-Year plan. You would save a few thousand dollars with REPAYE, but your monthly payments would also start out $229 higher.

If your DTI is high or you’re worried about your job security, IDR can be a smart choice. But if you have a low DTI and an upward career trajectory, you’ll likely want to choose a different repayment strategy.

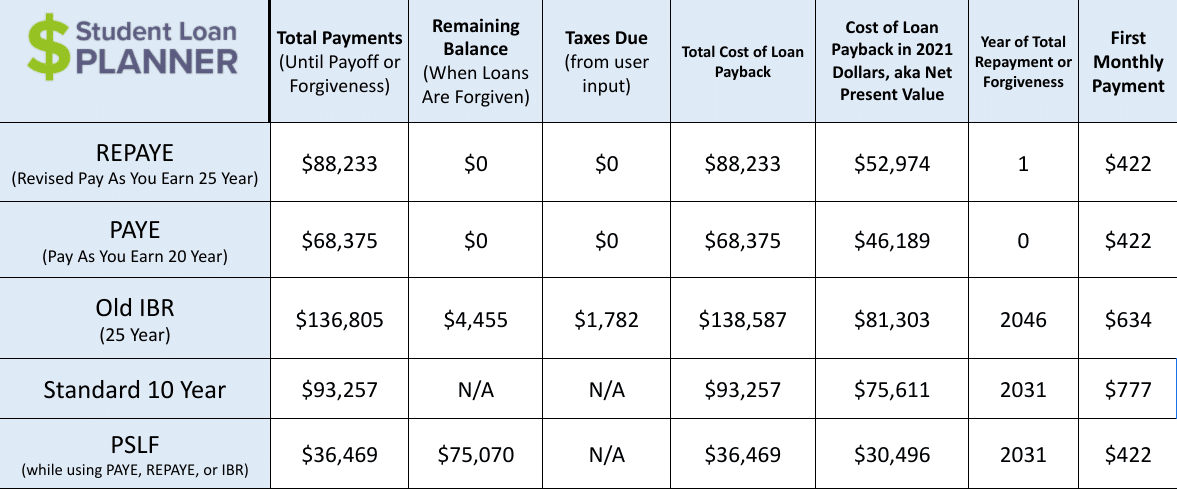

2. PSLF: Best if you work in the public sector

Of the various federal forgiveness programs available, Public Service Loan Forgiveness (PSLF) is one of the most valuable and popular. If you qualify for the program, you can earn tax-free forgiveness in as little as 10 years.

To earn forgiveness with PSLF, you have to make 120 payments while working for a qualifying non-profit or public service employer. Unlike the Teacher Loan Forgiveness program, the payments do not have to be consecutive.

If you work for a government agency or non-profit organization, pursuing PSLF could save you tens of thousands of dollars in student loan interest. For example, with $70,000 in loans and a $70,000 annual income (DTI of 1:1), PSLF could save you more than $56,000 over the 10-Year plan.

These astounding numbers show just how valuable PSLF can be. However, there are two caveats to note for Parent PLUS borrowers.

First, you’ll need to make sure that it’s you who works for a qualifying employer rather than the child who benefited from the loans. Second, you’ll need to be making payments on an IDR plan in order to earn any forgiveness from PSLF. Unfortunately, Parent PLUS Loans aren’t eligible to join any of the IDR plans.

The good news is that Parent PLUS Loans can become eligible for the Income-Contingent Repayment (ICR) plan after they’ve been consolidated into a Direct Consolidation Loan. And through a double consolidation loophole, some Parent PLUS borrowers may be able to qualify for REPAYE, PAYE, and IBR as well.

3. Private refinancing: Best if you have a strong credit score and income

We’ve already established that IDR plans benefit you less and less as your income rises. We’ve also seen that even borrowers with a relatively high income can still earn a lot of forgiveness with PSLF.

But what if you have a strong income and don’t qualify for PSLF? Well, if you also happen to have a good credit score, it may make sense to apply for refinancing with a private lender.

By refinancing, you’ll lose eligibility to join IDR plans or federal forgiveness programs. But that may not be a big deal to you if you’re already unable to take advantage of these benefits.

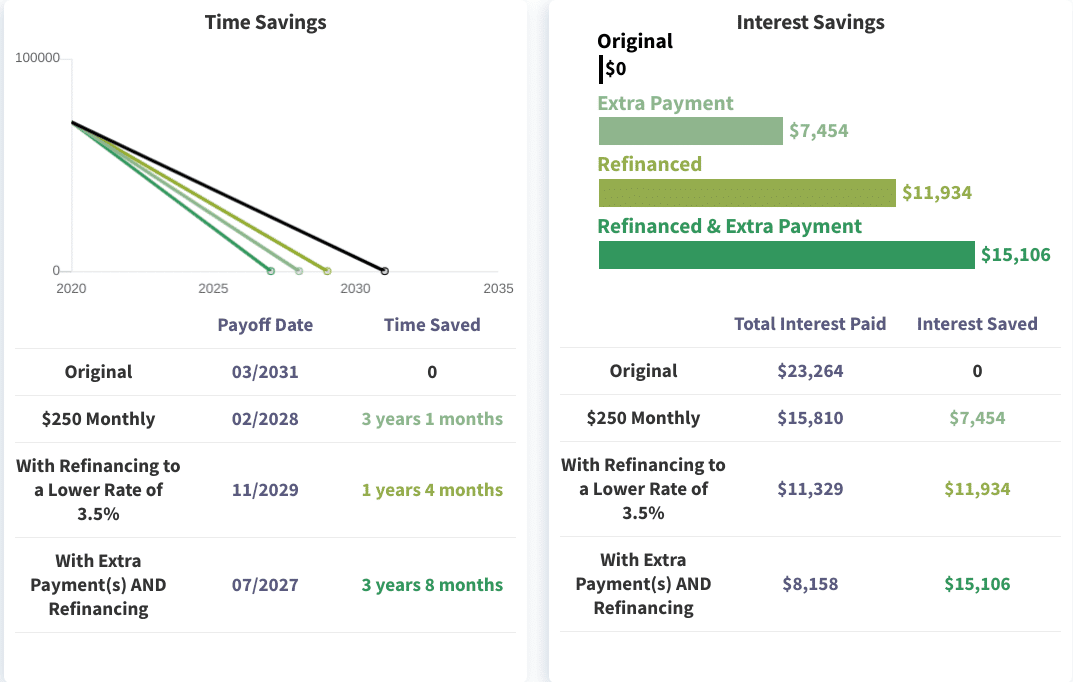

Let’s see how much you could save by refinancing $70,000 of Parent PLUS Loans. We’ll assume that your average interest rate is 6.00% and you’re able to refinance at 3.50%. We’ll also consider how much extra you could save by making an additional payment towards principal of $250 per month.

We see that by refinancing and simply paying your new loan as agreed, you’d save nearly $12,000 in interest. You’d also become completely debt-free 16 months sooner.

And what if you decided to combine your lower interest rate with extra monthly payments of $250? In that case, you’d save over $15,000 and would bump your payoff date up by over 3.5 years.

If you think that refinancing is right for you, you’ll want to shop around for the best rate and terms. To compare your options, check out our list of the top refinancing lenders and their current cash bonus offers.

Not sure what to do with your student loans?

Take our 11 question quiz to get a personalized recommendation for 2024 on whether you should pursue PSLF, Biden’s New IDR plan, or refinancing (including the one lender we think could give you the best rate).