Whether you have a few thousand dollars in student debt from your undergraduate degree or a six-figure loan balance, there are many emotional and financial benefits to paying off your student loans early.

For private student loans, repayment terms typically range from five to 20 years. For federal loans, repayment options range from a 10-year repayment plan up to 20 or 25 years on an income-driven repayment plan. In some cases, borrowers can make payments for up to 30 years under a Graduated Repayment Plan.

But that’s a long time to carry around the burden of student debt.

Many borrowers choose to aggressively pay off their student loans within a short time. Here’s how to pay off student loans in five years.

How to pay off student loans in 5 years

Paying off your student loan in five years can save you thousands of dollars in interest. But it can also reduce negative mental health effects and free up funds that can be used for other financial goals, such as saving up to buy a house or planning for retirement.

Here are a handful of strategies to help you pay off your student loan in five years.

1. Get motivated by using a student loan payoff calculator

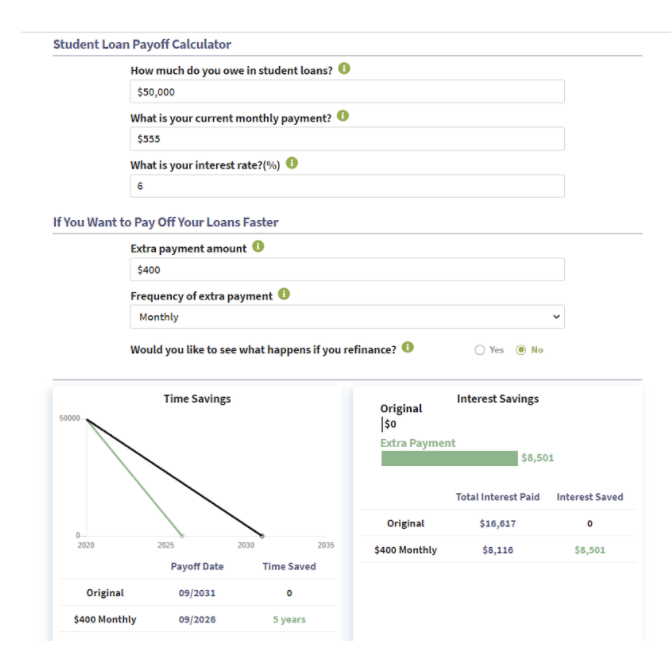

If you want to pay off your student loans as quickly as possible, you need a clear picture of your current repayment plan and how extra payments will affect it. Visually seeing how much interest you can save can be extremely motivating and set the tone for your payoff journey.

Let’s say you owe $50,000 with an average interest rate of 6% on a 10-year repayment term. Your current monthly payment is roughly $555.

Using our Student Loan Payoff Calculator, you can see that by making an extra payment of $400 per month, you can pay off your total balance within five years. You’ll save about $8,500 in interest over the life of your loan and rid yourself of student debt forever.

2. Use the student loan refinancing ladder

If you’re motivated to pay off your student loans aggressively, consider refinancing. A student loan refinance is a great way to reduce interest and score a cash-back bonus that can help pay down your loans even faster.

Many borrowers only refinance one time throughout the life of their loans. But you could be missing out on big student loan interest savings and cash-back bonuses by limiting yourself to only one refinance.

There’s a refinancing strategy that’s often overlooked by student loan borrowers and it can help you pay off your student loan in five years. It’s called the student loan refinancing ladder.

Here’s an overview of how the refinancing ladder works:

- Start by refinancing to a long-term loan. This might seem counter-intuitive considering you want to pay off your student loans in five years. However, refinancing to a long-term loan (e.g. a 20-year term) allows you to get a better interest rate than your current loan, while also giving you the flexibility to pay less toward your student loans if needed. Paying off your loans in five years is a great plan, but life can get in the way. The long-term loan provides a safety net.

- Make big prepayments to cut your balance. Even though you have low minimum payments, make as large of a payment as you can. This will aggressively pay down your loan principal balance.

- Then, refinance again to a lower interest rate. Once you’ve knocked out a big portion of your loans, refinance to a shorter repayment term (e.g. 7-, 10- or 15-year term) with a new lender. Your monthly payment shouldn’t change too much since your total balance is significantly lower from making large prepayments during your first refinance.

- Continue making those big prepayments. Keep chipping away at your balance by making large additional payments.

- Refinance a third time to a five-year term. Once your loan is one-third or less than your original loan balance, refinance to a five-year, fixed- or variable-rate loan with a different lender.

It’s important to refinance with a new private lender each time you use this approach. If you use one of our partner lenders, you might be eligible for huge cash-back bonuses that can be used to reduce your loan balance.

3. Make sure you’re receiving student loan discounts

This is a simple way to ensure more of your payment is going to principal, rather than interest. Most lenders offer an autopay discount (e.g. 0.25% interest rate reduction) just for signing up for automatic payments.

Your lender might offer other discounts, such as a loyalty discount for using multiple financial products. Be sure to check directly with your lender or loan servicer to determine if you’re eligible for any student loan discounts that can save you money.

4. Look for ways to save within your budget

One of the key components of paying your student loan in five years is making large extra payments. But where does that extra money come from?

Start by examining your current budget to look for ways to lower your expenses. Dedicate any savings you find to your student loans.

Many expenses can be reduced without any major lifestyle changes. For example, there are often promotions or updated costs for service providers (e.g. cell phone and internet) that you likely won’t know about unless you do your own research and request an adjustment directly.

Additionally, weigh whether you can cut some expenses altogether for the next several years. Common budget items that can be reduced or eliminated entirely might include landscaping costs, subscription products, gym memberships and salon services.

Other ways to lower your expenses might include:

- Adjusting budgeting categories like food, transportation and entertainment.

- Getting a roommate to share housing costs, like rent and utilities.

- Trading your expensive car payments for a used car that is paid off or one with much lower monthly payments. If you live in an area with good public transportation options, consider ditching your vehicle for the next few years while you pay down your student loans.

Every dollar counts when you’re making sacrifices to pay off your student loan balance in five years. Rework your budget to a level you’re comfortable with and then look for other ways to bring in money.

5. Boost your income (and your student loan payment) with a side hustle

If you’ve trimmed your budget as much as possible, consider ways to increase your income. You might be able to negotiate a raise or pick up extra shifts with your current employer. Alternatively, you can pay off your student loans with a side hustle.

We have a whole series focused on side hustles for high-debt professions, like occupational therapists, dentists and teachers.

You can choose a strategic side hustle that uses your existing skills and credentials or pick one that provides a creative outlet or new learning opportunity. Consider picking up some smaller side hustles that don’t require a ton of time or energy (e.g. dog walking or house sitting).

Then, throw any extra amount you earn toward paying down your student debt balance for the next five years.

Other ways to pay off your student loans early

Depending on your profession, you might be eligible for various student loan repayment assistance programs that can shave off a significant amount of your student debt.

For example, some states offer student loan forgiveness programs for teachers, lawyers and healthcare professionals in vulnerable communities.

Additionally, check with your employer to see if it offers a student loan repayment program for its employees. These types of loan programs are becoming more popular as employers recognize the recruitment and retention value.

Need help deciding if an early payoff of your private or federal student loans is in your best interest? Our team of student debt experts can analyze your unique situation and provide you with a variety of student loan repayment strategies to optimize your overall finances.

Not sure what to do with your student loans?

Take our 11 question quiz to get a personalized recommendation for 2024 on whether you should pursue PSLF, Biden’s New IDR plan, or refinancing (including the one lender we think could give you the best rate).