According to the American Veterinary Medical Association (AVMA), the average student debt among 2016 veterinary school graduates was $143,757.82. And that average includes vet grads who have no debt whatsoever. If you only consider indebted veterinary graduates, the average debt jumps up to $167,534.89!

And remember that this is just the average. The AVMA points out that many veterinarians have even higher student debt totals. It says over 20% of vet school graduates have at least $200,000 in debt. Student Loan Planner® has worked with over 200 veterinarians with an average debt of $265,000.

Related: Veterinarians Are Treated Horribly Under Student Loan Rules

With eye-popping student loan totals like these, veterinarians need a smart repayment strategy. One money-saving option is to refinance veterinary school loans. Let’s take a look at when it would be a good idea to refinance vet school loans.

How student loan refinancing works

Student loan refinancing is all about saving money on interest. For instance, let’s say you have $140,000 of vet school debt at an average interest rate of 6.5%. Let’s also say you’re starting salary is $90,000 a year, and you’ll receive an annual 3% pay raise.

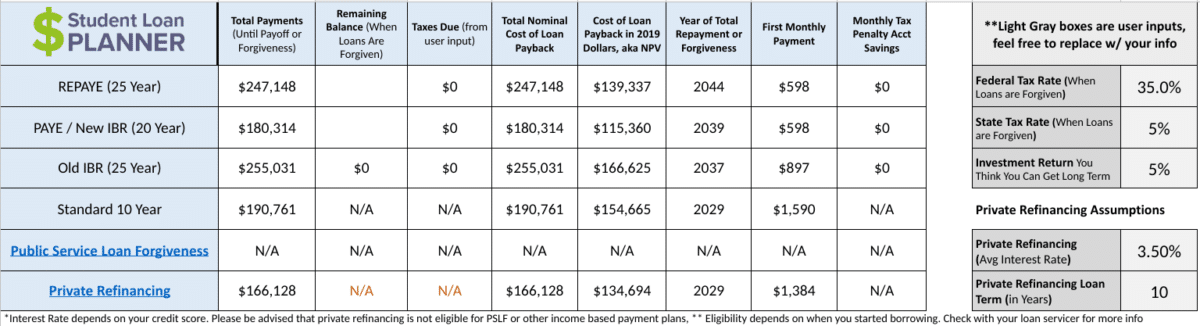

Using the Student Loan Planner® calculator, let’s see how much you could save by refinancing at 3.5%:

By refinancing, you could save over $24,000 versus the 10-year Standard Repayment Plan. And you’d save over $14,000 compared to the Pay As You Earn income-driven repayment plan. That’s a big deal. But not everyone qualifies for the lowest rates when they refinance veterinary school loans. Here are two questions you’ll want to consider.

1. What does your credit score look like?

To get the best rates on a refinance, you’re going to need a high credit score. You’ll usually need a score over 700 to get good rates. Once you’ve hit 750, increasing your score shouldn’t make much of a difference in the rates you’re offered. At that point, it’s really all about your debt-to-income ratio.

Vet grads who have a lower credit score may want to wait before trying to refinance vet school loans. Continue to follow good credit habits, and your score will improve. And once it does, you’ll have a better chance of qualifying for prime rates.

2. What does your debt-to-income ratio look like?

Lenders are all about limiting risk. And one of the ways they do this is by considering the debt-to-income (DTI) ratio of applicants. The higher the number, the higher the risk of default a borrower is believed to be. For this reason, you’ll need a reasonable DTI ratio in order to qualify for the best rates.

A good rule of thumb is that refinancing may be a good move if you owe less than less than 1.5 times your income. For example, let’s say you make $120,000 a year and have $120,000 of student loan debt. In that case, you’d have a 1-to-1 ratio and may qualify for a prime interest rate. However, if you owed over $180,000 in total debt, you’d have a harder time finding a lender that will offer you a great rate.

Another thing you’ll want to look at is your payment-to-income ratio. Generally, you’ll want your cumulative monthly payment obligations from all of your debt (credit cards, mortgage, car loan, student loans, etc.) to be below 40% of your monthly income.

If your credit score and DTI ratio are both good, should you refinance veterinary school loans? Maybe. But you’ll also want to consider the benefits you may give up.

What benefits do you give up by refinancing?

If you have private student loans, refinancing to a lower interest rate is almost always a slam-dunk decision. However, if you have federal student loans, you’ll want to tread more carefully. There are several benefits you’ll give up by refinancing your federal student loans.

Income-driven repayment plans

With an income-driven repayment (IDR) plan, your monthly payment will be based on your income.

Are your federal loans are in your own name? Then you have three IDR options: Revised Pay As You Earn (REPAYE), Pay As You Earn (PAYE) and Income-Based Repayment (IBR). With each of these plans, your payment will generally be 10% of your discretionary income.

If your parents took out Parent Plus Loans to help pay for your veterinary school, they can consolidate them via a Direct Loan Consolidation and choose the Income-Contingent Repayment (ICR) plan. On the ICR plan, payments are typically 20% of discretionary income.

The great part about IDR plans is that your payment scales up and down with your income. But if you have a high student loan balance, your IDR payments may not even cover your interest cost. And that would essentially keep you in a student loan debt trap for 20 years.

Student loan forgiveness

Federal student loan forgiveness is another benefit you’ll give up by refinancing. If you took out your loans after 2014 and are on the PAYE or IBR plan, you’ll be eligible for forgiveness on your remaining balance after 20 years. With REPAYE, undergraduate loans can be forgiven after 20 years, but graduate loans take 25 years. And the ICR plan grants forgiveness after 25 years for all loan types.

It’s important to keep in mind, though, that you’ll owe income tax on the forgiven balance. And for vets with large forgiven amounts, this could create a serious “tax bomb.” For instance, $100,000 of student loan forgiveness could generate a $20,000 to $35,000 tax bill, depending on your tax bracket.

Public Service Loan Forgiveness

The Public Service Loan Forgiveness (PSLF) program is designed to encourage workers to choose jobs in public service. With PSLF, you’ll be eligible for tax-free forgiveness after only 10 years of on-time payments on an IDR plan.

PSLF can be a great choice for medical professionals, teachers, lawyers, social workers and several other groups. But can veterinarians qualify for PSLF? The short answer is yes. But there’s a major caveat: PSLF jobs may not be very fulfilling.

For instance, many PSLF-qualifying jobs are food inspection positions with the U.S. Food and Drug Administration. Many veterinarians simply don’t find these kinds of jobs appealing. Working at a nonprofit shelter would also qualify for PSLF, but overworked staff and less-than-ideal living conditions for the animals can be discouraging.

For these reasons, it can be difficult for vets to stick with PSLF-qualifying jobs. Many of the veterinarians that Student Loan Planner® have worked with end up walking away well before the 10 years.

However, if you are pursuing veterinary PSLF and think you’ll stick it out with your qualifying job, you should definitely not refinance. You’ll immediately lose eligibility for the program.

Should veterinarians refinance?

If your credit and DTI ratio are good and you don’t plan to pursue PSLF, you could be an ideal candidate to refinance vet school loans.

However, you’ll want to make sure you don’t qualify for any other forgiveness options. For instance, the Veterinary Medicine Loan Repayment Program will pay up $25,000 a year if you agree to serve in a designated shortage area for three years. The Army offers up to $120,000 of student loan repayment through the Active Duty Health Professions Loan Repayment Program. And finally, your state may have its own vet student loan forgiveness programs.

If you plan to take advantage of any forgiveness programs, you might as well stay on a federal IDR repayment plan. But if you don’t qualify for any of them, refinancing could save you a ton of money.

Choosing your lender

You’ll want to be careful when selecting a lender to refinance your student loans. To begin your search, take a look at Student Loan Planner®’s list of the best banks to refinance student loans.

When you’re comparing lenders, the interest rate you’re offered is obviously very important. But there are a few more questions you’ll want to ask before making a decision:

- Is the APR I’m being quoted for a variable- or fixed-rate loan?

- What are the repayment terms (how many years until the loan will be fully repaid)?

- What are the eligibility requirements for this lender?

- Does this lender offer financial hardship forbearance or deferment if I choose to go back to school?

- Does this lender offer death or disability forgiveness?

We’ve quickly covered the basic pros and cons to consider before you refinance vet school loans. But you may run into more questions along the way. If so, one of Student Loan Planner®’s consultants would love to help. Schedule a student loan consultation today.

Refinance student loans, get a bonus in 2024

| Lender Name | Lender | Offer | Learn more |

|---|---|---|---|

|

$500 Bonus

*Includes optional 0.25% Auto Pay discount. For 100k or more.

|

Fixed 5.24 - 9.99% APR*

Variable 6.24 - 9.99% APR*

|

|

|

$1,000 Bonus

For 100k or more. $300 for 50k to $99,999

|

Fixed 5.19 - 10.24% APPR

Variable 5.28 - 10.24% APR

|

|

|

$1,000 Bonus

For 100k or more. $200 for 50k to $99,999

|

Fixed 5.19 - 9.74% APR

Variable 5.99 - 9.74% APR

|

|

|

$1,050 Bonus

For 100k+, $300 for 50k to 99k.

|

Fixed 5.44 - 9.75% APR

Variable 5.49 - 9.95% APR

|

|

|

$1,275 Bonus

For 150k+, $300 to $575 for 50k to 149k.

|

Fixed 5.48 - 8.69% APR

Variable 5.28 - 8.99% APR

|

|

|

$1,250 Bonus

For 100k+, $350 for 50k to 100k. $100 for 5k to 50k

|

Fixed 5.48 - 10.98% APR

Variable 5.28 - 12.41% AR

|