The Public Service Loan Forgiveness (PSLF) program is a great repayment option to pursue IF your career takes you in this direction. PSLF is a student loan forgiveness opportunity for borrowers working full-time in public service.

To be eligible for PSLF you need to:

- Have Direct Loans

- Be on an income-driven repayment (IDR) plan

- Work full-time for a qualified employer

- Make 120 qualifying payments

After 120 qualifying payments are made on your loans, whatever balance is left is forgiven, tax-free. 120 payments work out to be about a 10-year commitment if paid straight through — as in, if you don’t miss a payment or time in service.

Some common misconceptions about PSLF

A common misconception that turns people off from PSLF is the belief that you have to be with the same employer for those 120 payments.

This is false. As long as each entity you work for is considered a qualifying employer, which you can certify with the Employment Certification Form (ECF), you’re good.

A Qualifying employer includes the U.S. government, a nonprofit organization that’s tax-exempt under IRS Section 501(c)(3), or a private not-for-profit organization that provides certain public services. Serving in an AmeriCorps or Peace Corps position is also qualifying employment.

Another misconception is if you miss a payment, your payment count starts all over again. This is again, false — and thank goodness!

If you leave public service temporarily but come back, or you go into forbearance (other than the CARES Act forbearance), payments will pick up where you left off when all of the same qualifications are met:

- Have Direct Loans

- Be on an IDR plan

- Work full-time for a qualified employer

- Make 120 qualifying payments

One other maybe lesser-known fact is if you work part-time for two, separate public service entities, and those hours combined are 30 or more on average per week, that satisfies the full-time requirement.

The ECF form defines full-time as working for one or more qualifying employers for the greater of: (1) An annual average of at least 30 hours per week or, for a contractual or employment period of at least eight months, an average of 30 hours per week; or (2) Unless the qualifying employment is with two or more employers, the number of hours the employer considers full time.

Related: 5 Myths About the New SAVE Plan, Demystified

When you’re unsure about PSLF long-term

What if you don’t know if you’ll stay working in public service long-term? This is sometimes hard to predict.

To optimize the forgiveness route, your goal is to pay as little as possible to maximize how much is forgiven. But if you don’t see the PSLF route through to the end, this could cost you more in the long-run since you’d switch from a passive to an aggressive pay-down strategy.

Without PSLF, should you take a passive pay-down approach?

First, assess if you’d be a good candidate for taxable IDR forgiveness if PSLF doesn’t work out. As a rule of thumb to see whether you should still take a passive loan repayment strategy, see if your balance is 1.25-1.5x or more your annual income.

Each of the income-driven repayment plans have a maximum repayment period where, after making payments for 20 or 25 years, the balance that’s left over is forgiven. It’s similar to PSLF, but there are no employer or work status requirements.

Longer-term forgiveness can be more than double the time it takes for PSLF. However, it could still be an optimal plan for those with a balance much greater than their income.

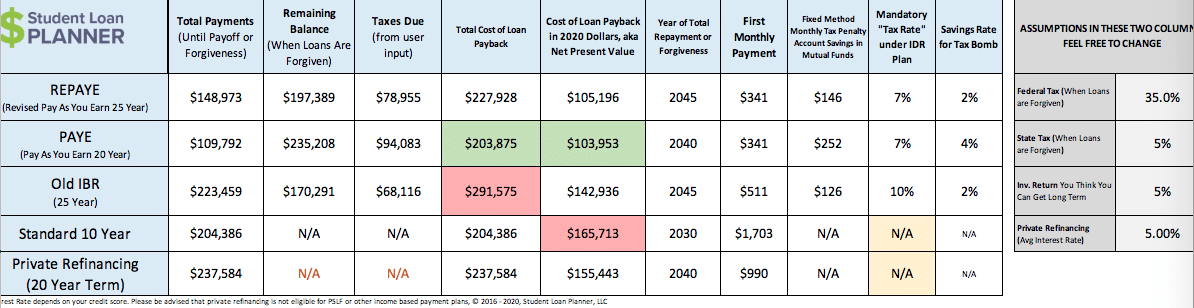

Take this case as an example: A single borrower with $150,000 of federal student loans at a 6.5% interest rate, earns $60,000 per year with 3% pay raises each year.

PAYE’s longer-term forgiveness route is more optimal from a total cost & NPV perspective even with the need to save for the potential tax bomb.

When the passive approach works in either scenario — PSLF or not — you wouldn’t need to change repayment plans if you forego PSLF. You could stop filing your annual ECF but would want to continue recertifying your income every year. To be conservative, you could save for the potential tax implication if you’re still not sure if PSLF is your long-term strategy.

Aggressive pay-down strategy without PSLF

There’s a push-and-pull relationship if you’re not a good candidate for a passive non-PSLF pay-down approach, but want to pursue PSLF for now until you’re clearer about your career path.

You essentially want skin in the game for PSLF in case that path comes to fruition. But you also don’t want to stay along the PSLF route too long, if you should’ve taken an aggressive pay-down approach from the start.

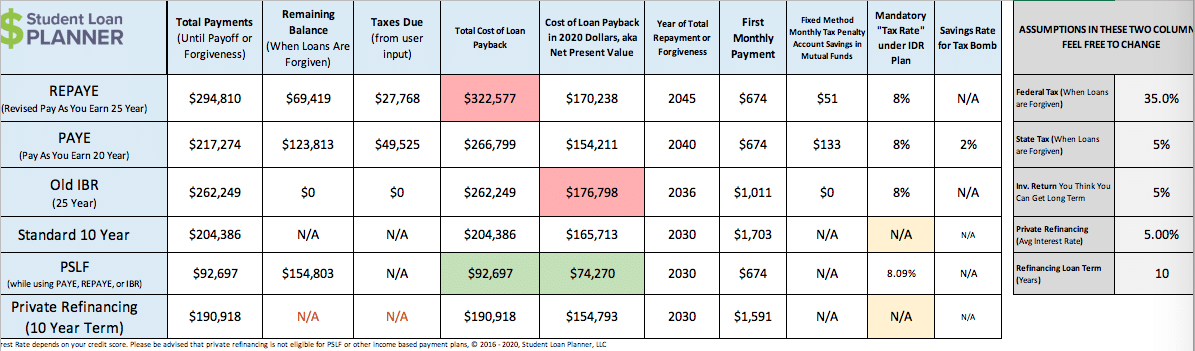

Let’s take a similar example as before: A single borrower with $150,000 of federal student loans at a 6.5% interest rate, earns $100,000 per year with 3% pay raises each year.

From a total-cost perspective, refinancing student loans would be a more cost efficient repayment plan if PSLF wasn’t an option. But to keep skin in the game for PSLF until we know for sure that it’s not an option, what do we do?

Go on REPAYE or IDR and save aggressively

REPAYE is an income-driven plan that has interest subsidies (i.e. discounts on accrued interest).

When you’re in negative amortization (when your payment doesn’t satisfy the monthly interest charge), the government pays ½ of the unpaid interest on your unsubsidized loans for you over the life of the loan, and 100% of unpaid interest on subsidized loans for the first three years. This keeps your balance from ballooning.

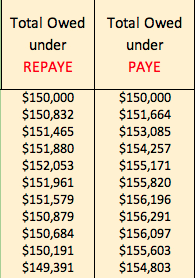

Using these same case facts, you can see the slight difference between the balance growth for repaying on REPAYE vs. PAYE. Both have the same payment (10% of discretionary income) but REPAYE keeps the balance lower for longer.

REPAYE can be extremely valuable when a borrower’s income is really low in the early years of repayment, then increases rapidly much like a post-grad in residency or fellowship. It keeps the payment proportionate off of the low income and reduces the interest growth on the loans.

The downside to REPAYE is that the payment calculation factors in spousal income, if applicable, even if you file taxes separately. The other IDR plans could work well, too, they just might not be as great as REPAYE from an interest subsidy standpoint. BUT you need to be on an IDR plan to pursue PSLF, so PAYE or IBR will work. Plus, spousal income can be excluded if filing taxes separately on PAYE and IBR.

Hedging your bets by saving aggressively

When pursuing PSLF, you want to pay as little as possible toward the loans to maximize forgiveness after 120 payments. But if you’re unsure about PSLF being your long-term strategy, you can hedge your bets by saving aggressively while making monthly payments toward your loans.

The timeline is likely unknown for when you’d know if PSLF is the path or not. Saving in a higher-yield savings account or very conservative brokerage account could be appropriate to stockpile money. You can even earn interest on your savings, making your dollars work for you.

If you know PSLF isn’t the route you want, you can apply those savings toward your loans and look into refinancing to continue with your aggressive pay-down strategy. This might not be as efficient as going the aggressive route from the beginning, but it keeps your options open, and is better than having your balance grow higher without money set aside.

If PSLF ends up being your chosen route — congrats! You’re on track for PSLF and you have that bucket of savings available to throw toward your next financial goal.

Why wouldn’t you just pay more toward your loans?

Paying more toward your loans versus toward savings commits you to paying more into the federal system. If PSLF is indeed your path, you paid more than you needed to (and you can’t get that extra money back). You can also jeopardize future payments counting toward PSLF by getting yourself into paid-ahead status.

Be confident about your repayment strategy

Will your career path stay in public service long-term or not? That we can’t answer for you, BUT we CAN help you navigate through Plan A and Plan B, and prepare you for how to pivot as life changes.

If you need additional guidance with your specific student loan situation, schedule a consultation with us. Our team has helped hundreds of people handle their student loan debt.

Not sure what to do with your student loans?

Take our 11 question quiz to get a personalized recommendation for 2024 on whether you should pursue PSLF, Biden’s New IDR plan, or refinancing (including the one lender we think could give you the best rate).

I have loans that I plan on paying off on an IDR plan. My income is significantly lower than my husband’s, so we’re going to be married filing separately this year. However, I’m going to be receiving $30,000 from a will. Is this taxable income and will it change the amount that I’ll pay per month?

Inheritance laws can vary by state so it’s best to check with a tax expert on how it will affect your taxable income. If it’s counted as income, yes, it will likely increase your monthly payment amount.