Student debt is growing at a fast pace, but there is one age range that is growing at the fastest pace by far: older Americans.

The direct federal student loan debt burden among seniors (borrowers ages 62 and older) has grown by 85% in just three years, according to StudentAid.gov.

This is a real problem because older adults in this age range might feel like their retirement plans are compromised. Thanks to private and federal loans, they wonder if they can afford their ideal lifestyles in retirement even after putting in decades of hard work.

If they end up defaulting on their student loans, the federal government will garnish their Social Security benefits which put student loan borrowers in grave financial peril.

The good news is that seniors can get a solid student loan plan that might even fit within their retirement savings plans. But before we get to that, let’s examine the problem.

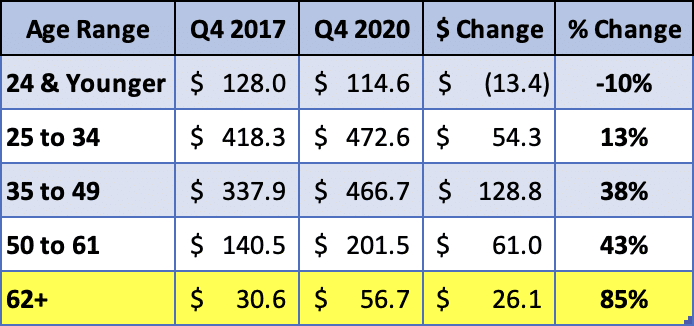

Student loan growth by age

Let’s take a look at Student Aid’s direct federal student loan data by age range. We’ll show you the amount of debt by age and the number of borrowers by age and how it has changed over the last three years.

The majority of student loans are owed by those between the ages of 25 and 49. However, as the trends show, the amount of student loan growth by percentage is greatest in the 50+ range.

*Debt amount in billions

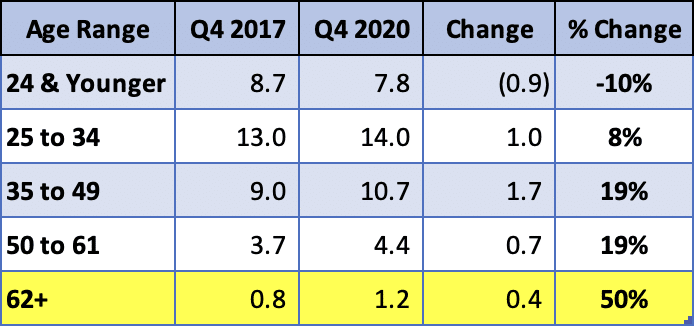

It’s the same for the number of people who owe student loans. It’s growing fastest for seniors, too.

*People in millions

Another important thing to note is that the amount of student debt is growing at a faster rate than the number of actual student loan borrowers. What that means is that the amount of debt owed per borrower is also growing.

Not only are more people accumulating federal and private student loans, but the average debt load per borrower is growing, too.

Six-figure student debt for seniors can feel incredibly daunting and it’s not a small number. Using the same data, there are 670,000 people, in their 50s to age 61, who owe six-figure student debt and another 220,000 in the 62+ age range.

Why student debt is growing at a fast pace for seniors

Why would Baby Boomers and older Gen Xers have the fastest pace of student loan growth?

Many parents take out loans for their children because there’s a cap on how much federal student aid can be borrowed for undergraduate degrees. Combine that with growing college expenses and — voila!

Another factor is that Parent PLUS Loans (loans taken out by parents) have some of the highest interest rates and worst repayment options out there (as far as federal student loans go). That puts seniors in tough financial circumstances.

They might not be able to afford payments so these high-interest loans go into forbearance and grow at a compounded rate over time. Worse yet, they might default on their loans leading to wage Social Security benefits garnishment. What a mess!

These two things happen precisely for senior retirees. Their income typically drops at this age, too, leading to an even greater predicament.

This all sounds pretty dire, but seniors have a slew of solid student loan repayment options to choose from to avoid forbearance or default. Their payments might actually be manageable, too.

Student loan repayment strategies for seniors

There are plenty of affordable repayment options for seniors with student loans that can fit around plans for retirement. Here are some of our favorites.

Related: Seniors & Student Loans: What You Need to Know About Medicare

Double Consolidation for Parent PLUS Loans

For those with Parent PLUS loans, the options for income-driven repayment (IDR) are limited to the most expensive IDR plans. It’s called Income-Contingent Repayment (ICR) and you pay 20% of “discretionary income”. That rate is twice the 10% rate of Pay As You Earn (PAYE) or Revised Pay As You Earn (REPAYE).

But there’s a way to turn Parent PLUS Loans into a federal Direct Consolidation Loan that’s eligible for PAYE or REPAYE. We call this process the “double consolidation loophole”.

The bottom line is that with some extra steps and paperwork, this strategy can essentially cut the monthly payment on an IDR plan in half compared to ICR. That opens up a world of financial possibilities for seniors as it relates to retirement savings.

Consolidation wipes away any built-up credit toward student loan forgiveness programs, so keep this in mind when considering this strategy.

Public Service Loan Forgiveness for seniors

Many seniors often launch into retirement by ramping down their prior careers and starting another one. If you’re thinking about working for a nonprofit to do some good during this stage of life, then Public Service Loan Forgiveness (PSLF) might be an option.

Eligibility requirements include having direct federal student loans and enrolling in an IDR plan. Then, you can either work full-time at a qualifying employer or work two part-time jobs that equal 30+ hours per week.

After 120 months of qualifying payments, whatever loans are remaining are forgiven, tax-free.

IDR for seniors collecting Social Security benefits

If a senior citizen plans will rely exclusively on Social Security benefits for living expenses, chances are their student loan payment while on an IDR plan could be next to nothing.

Even though the taxes on Social Security income can be a little confusing, just know that you can earn a decent amount from it and have minimal student loan payments while in retirement.

That’s because payments aren’t based on how much you owe — they’re based on how much you make. Loan payments are essentially an income tax that you pay each month. It’s a change in mindset to think of federal student loans as a tax instead of a debt when on an IDR plan but it holds up.

After paying for either 20 or 25 years depending on the plan, the loans are forgiven. As of now, that loan forgiveness is taxable, but future legislation appears to be moving toward tax-free loan forgiveness even without PSLF.

What happens to federal student loans when I die?

No one wants to think about this, but it’s important to know that federal student loans are discharged upon death.

This isn’t always a strategy that is front of mind, but for seniors who start on an IDR plan in their late-60s or early-70s, they might not reach the 20 to 25 years on IDR plan before passing. If death happens before loan forgiveness, the loans would be discharged tax-free.

For those who don’t want student loans to interfere with their finances in old age, dying with student loan debt might be OK. The burden won’t be passed on to surviving family members.

Refinance and pay off the loans before retiring

Paying off the student debt the old-fashioned way might make sense for those with low, five-figure debt. I might also be a fit for those who are planning to earn a nice six-figure salary for the next 10 years.

The goal here is to refinance your student loans to get a lower interest rate, pay the loans off aggressively, and become student debt-free before retirement.

The reason someone might do this is when they have a low debt to income, pre-retirement, and will maintain that during retirement. In this scenario, payments on an IDR plan might be so high that the loans end up getting paid off before forgiveness kicks in.

Without refinancing in these scenarios, the cost of paying back student loans within the federal program can be greater due to the higher interest rates. Remember, though, that once federal student loans are refinanced to a private lender, all forgiveness options are off the table.

Help for seniors with student loans

There are so many different options for seniors with student loans to pay them back without interfering with their golden years. No matter how much you owe and what you plan to do during this life stage, chances are that there is a solid student loan plan that fits the life you want to live.

Here at Student Loan Planner, we provide help for seniors with student loans as well as many others with six-figure student debt. We can set you up with a solid student loan repayment strategy that aligns with your retirement goals. Schedule a consultation with our team.

You don’t have to feel the burden that other seniors paying student loans might feel. Get the clarity you’re looking for so you can jump into retirement confidently knowing that you have the optimal student loan plan.

Not sure what to do with your student loans?

Take our 11 question quiz to get a personalized recommendation for 2024 on whether you should pursue PSLF, Biden’s New IDR plan, or refinancing (including the one lender we think could give you the best rate).