As a counselor, you play a pivotal role in helping others. Whether you work as a mental health counselor or a school counselor, your work makes a world of difference in the lives of others. Unfortunately, becoming a counselor comes at a cost as the profession typically requires advanced education.

Getting a master’s degree to pursue a counseling career can be costly. Paying back your student loans on a counselor’s salary can be tough, too, especially when the loan interest is high and accrues daily. One option to consider is student loan refinancing.

But is refinancing worth it if you’re a counselor, or should you pursue student loan forgiveness? Read on to learn more in our guide to student loan refinancing for counselors.

Average debt and salary for counselors

Counselors require an education that can add a hefty amount of debt to your life. According to the American Psychological Association, “The median anticipated final graduate debt load for current psychology students — excluding undergraduate debt — is $110,000.”

That’s over six figures and doesn’t include any student debt accrued in undergrad school. In other words, it’s safe to say that many counselors graduate with over six figures in debt but their annual salaries don’t match that.

Data from the Bureau of Labor Statistics states that the average salary for counselors is $47,740. More specifically, the median salary for mental health counselors is $44,630, while the median salary for school and career counselors is $56,310. Having your debt load be nearly twice your salary or more can make paying back your student loan debt tough, which can make student loan refinancing for counselors look attractive.

Related: Psychologist Salary: Is it Worth the Huge Student Debt?

Refinancing for counselors

As a counselor, you want to review the pros and cons of student loan refinancing carefully. You could save a lot of money, but at the expense of federal loan benefits that can provide some security and assistance. Weigh the cost savings versus the lost benefits.

Pros of refinancing

Student loan refinancing offers borrowers the opportunity to slash their interest rates. If you have good credit and stable employment, you could get approved for a refinancing loan with a private student loan refinancing company at a lower rate.

This new rate could save you thousands of dollars over the life of the loans. Working with a company like Earnest could provide you with more flexible repayment options and terms. Counselors could save money by obtaining a lower interest rate, but there are other important factors to consider as well.

Cons of refinancing

When you refinance your federal student loans, those loans are paid off. Once that happens, you pay off the refinancing loan at a lower rate. Because your original loans are paid off, you end up giving up access to federal student loan benefits.

Many counselors would benefit from an income-driven repayment (IDR) plan or student loan forgiveness given the low salary and high debt-to-income ratio common in the field. Both of these benefits are part of having federal student loans.

Getting student loan refinancing for mental health counselors or loan refinancing for school counselors means working with a private lender and taking out a private refinancing loan. For counselors, refinancing typically isn’t the best idea because of the relatively low salary and high debt that comes along with the profession.

Why student loan forgiveness might be a better option

If you’re a counselor who is stressed about your federal loans and added interest, pursuing student loan forgiveness might be a better option than student loan refinancing. IDR and Public Service Loan Forgiveness (PSLF) are two options available to counselors with federal student loans.

IDR allows borrowers to:

- Pay 10% to 20% of discretionary income toward the loans each month

- Forgives any remaining balance after 20 to 25 years of payments

It’s not all good news though. You’ll have to pay taxes on that amount because the IRS considers the forgiven debt taxable income. This option might be good if you work in the private sector.

PSLF offers:

- Forgiveness after 10 years of qualified employment and 120 monthly payments

- No tax on the forgiven amount

If you work in the public sector or at a school, you could qualify for PSLF.

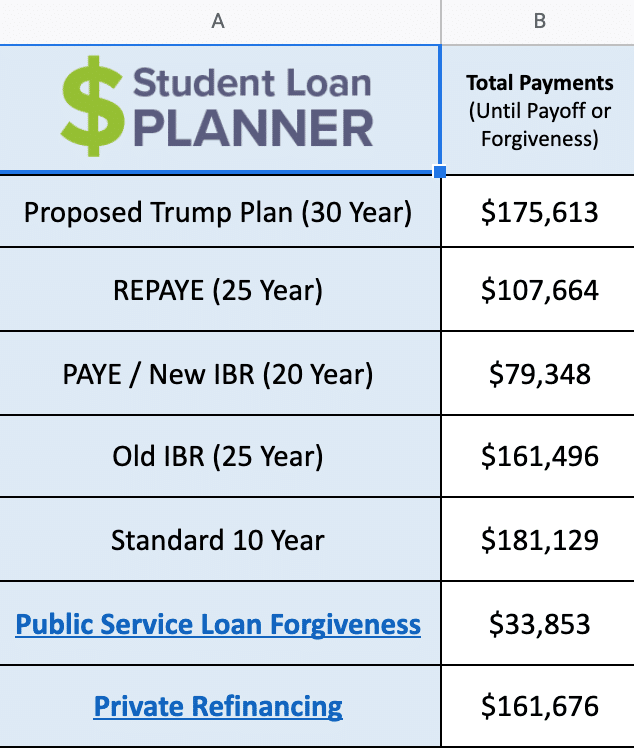

Let’s assume you have accumulated $130,000 in student loan debt for undergrad and grad school to become a counselor. Your average interest rate is 7%. Using the average salary of $47,740, and assuming 3% growth each year, here is what your total amount paid looks like under these various student loan debt options:

In this scenario, refinancing can save you about $20,000 from the Standard Repayment Plan. But the PAYE or the New IBR plan can cut your total amount in half compared to refinancing. PSLF could also be a good option if you want to get your loans forgiven without any tax consequences. In that instance, you’d only pay $33,853, which is the lowest amount of all the plans, plus no taxes. If you are interested in working in the public sector, this could be the best option for you.

What to consider before refinancing

In many cases, student loan forgiveness is a preferable option for counselors. But in some niche cases, student loan refinancing could be a good option. If you have your own practice, for example, the cost savings could be worth it to you. Be mindful that you’ll likely need two years of tax returns to qualify.

If you do end up refinancing, be sure you:

- Won’t need student loan forgiveness or IDR

- Have a plan to pay off your debt with the refinancing loan

- Research lenders’ repayment terms, deferment or forbearance options, and interest rates (in many cases, you can check your rate without affecting your credit)

Counselors interested in refinancing may need a cosigner as well. A cosigner is someone who you add to the loan as a co-applicant. This person is also responsible for the loan if you miss your payments.

To start researching lenders, you can check out our refinancing partners that may have eligible cash-back bonuses, depending on how much you refinance.

If you need help determining the best way to tackle your student loan debt, get in touch with us for a customized plan for your situation.

Refinance student loans, get a bonus in 2024

| Lender Name | Lender | Offer | Learn more |

|---|---|---|---|

|

$500 Bonus

*Includes optional 0.25% Auto Pay discount. For 100k or more.

|

Fixed 5.24 - 9.99% APR*

Variable 6.24 - 9.99% APR*

|

|

|

$1,000 Bonus

For 100k or more. $300 for 50k to $99,999

|

Fixed 5.19 - 10.24% APPR

Variable 5.28 - 10.24% APR

|

|

|

$1,000 Bonus

For 100k or more. $200 for 50k to $99,999

|

Fixed 5.19 - 9.74% APR

Variable 5.99 - 9.74% APR

|

|

|

$1,050 Bonus

For 100k+, $300 for 50k to 99k.

|

Fixed 5.44 - 9.75% APR

Variable 5.49 - 9.95% APR

|

|

|

$1,275 Bonus

For 150k+, $300 to $575 for 50k to 149k.

|

Fixed 5.48 - 8.69% APR

Variable 5.28 - 8.99% APR

|

|

|

$1,250 Bonus

For 100k+, $350 for 50k to 100k. $100 for 5k to 50k

|

Fixed 5.48 - 10.98% APR

Variable 5.28 - 12.41% AR

|

Ms. Lockert, I would love to speak with you about getting national attention to some of these loan forgiveness programs. I am a school counselor and have found in my research that NYC teachers are offered more in student loan forgiveness if they work in special districts or concentrations like a Title I school or a Special Education teacher. The issue is, counselors work directly with the SpED population That’s where our funding comes from, so I am wondering why we are not offered the same forgiveness opportunity. This is different from the public service loan forgiveness program. What is the best way to communicate with you ?

I can jump in and just say we almost always see PSLF as the best forgiveness opportunity for counselors Valerie.