Student loan refinancing for naturopathic doctors (NDs) and naturopathic medical doctors (NMDs) is only one of the options out there for tackling the six-figure debt most ND graduates face. Although refinancing can be a good idea for a few naturopaths, you really want to consider loan forgiveness or consolidation options before refinancing.

The frustrating truth about naturopathic student loan debt

To become a naturopathic doctor you need both a four-year bachelor’s degree and four years of medical school. This isn’t news to you. But the lack of transparency about potential income versus student loan debt can be frustrating and can greatly impact a person’s awareness of their future need for debt payoff or naturopathy student loan refinancing.

The Association of Accredited Naturopathic Medical Colleges (AANMC) boasts about an increase in pay for ND grads. Its survey reports that, “Naturopathic medical professionals practicing full-time earn about $90,000 annually on average in the U.S., compared to about $39,000 before entering school,” and that, “Graduates who use their naturopathic medical degree in a full-time position have seen their annual pay more than double since prior to enrolling in school.”

In the fine print, however, it reported that 34% of participants were unemployed at the time they entered grad school, making the statement claiming a “doubled” salary seem misrepresented. Not mentioning debt here is also unhelpful for ND grads.

Payscale reports that the average salary for an ND is $72,009 and that starting salaries can be as low as $49,132.

AANMC’s most recent published report on student loan debt for naturopathic doctors shows an average of $167,156 in student loan debt. That was in 2015, and it’s certain tuition inflation and cost of living have gone up. The 2014 edition of the study said that 50% of grads lefts with $200,000 of student loan debt.

The reality is that naturopathic doctors will be making about $72,000 a few years into their career, and have six figures of student loan debt. This is when loan forgiveness is going to make the most financial sense.

Related: The Cost of Becoming a Naturopath with Katelyn Bailey

Pros and cons of naturopathy student loan refinancing

When you refinance your student loans, the lender pays off your old loans and gives you a new one. This process has some general pros:

- Your loans are consolidated into a new loan with one easy-to-manage payment.

- It can lower your monthly payment, but be cautious as that also could mean longer loan terms. To save the most money with a lower interest rate, your payments will probably be larger.

- You could get a new loan servicer with better service and possible perks.

For naturopathic doctors, the cons may outweigh the pros. Cons for naturopathic student loan refinancing include:

- You lose eligibility for student loan forgiveness available for ND’s.

- You won’t have income-driven repayment plan options, which is especially important when considering the average ND salary and six-figure student loan debt.

- You must have a good credit history to get the lowest loan rates (you might not have a long credit history yet).

- You lose federal borrower protections, such as deferment, forbearance and grace periods.

- Two years of tax returns are required to refinance if you are self-employed at a private practice.

In most cases, student loan refinancing for naturopathic doctors isn’t cost-effective when compared to student loan forgiveness programs.

General student loan refinancing for naturopathic doctors

Student loan refinancing can save you money by getting you a lower interest rate. After you leave school and increase your income and credit score, you can become eligible for lower student loan interest rates.

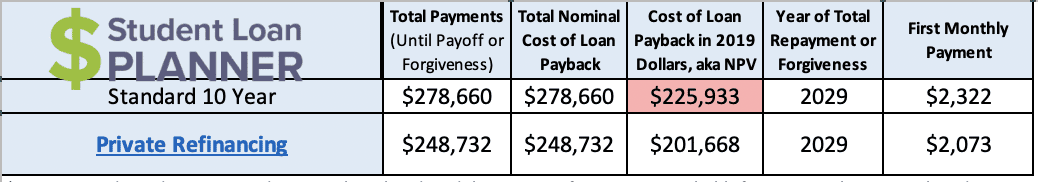

For example, if you owe $200,000 of student loan debt and make the average ND salary of $72,009 (according to PayScale), a low interest rate can greatly impact how much you pay over time. Here is the difference between an average federal interest rate of 7% and a lower rate of 4.05% offered by private refinancing companies:

You can save $29,928 in total payments. The payment term for both is 10 years, and the monthly payments are similar, but by lowering your interest rate, you’re putting money back in your pocket.

Note that in order to get the best rates, you’ll need to have a good debt-to-income ratio. We never recommend you refinance your student loans unless you owe less than 1.5 times your income.

When naturopathy student loan refinancing is the best fit

Paying back your student loans with naturopathy student loan refinancing offers an aggressive debt payoff strategy. You throw everything at your loans to pay them off in 10 years or less. This plan only makes sense if:

- You don’t qualify for Public Service Loan Forgiveness (PSLF).

- Your debt is less than 1.5 times your income.

- You are comfortable leaving all federal borrower protections.

- You can afford a higher monthly payment.

If all these are true, then you can check out our refinancing options and start shopping for a lender.

You need to decide if you can afford such a large payment every month for 10 years, however. You also need to think about ways you can invest your cash flow over the years so you are able to retire and plan for the future.

Options for naturopathy student loan forgiveness

When it comes to loan forgiveness for naturopathic doctors, there are several plans you may qualify for.

1. PSLF

PSLF should be your first choice as a naturopathic doctor because it’s tax-free forgiveness and will keep the most money in your pocket. To qualify you must:

- Work full time for a not-for-profit or government agency

- Have direct loans (or consolidate to one direct loan)

- Use an income-driven repayment (IDR) plan

- Make 120 qualifying payments

After completing all 120 payments (which takes about 10 years if you don’t take a break from work) your loans are forgiven.

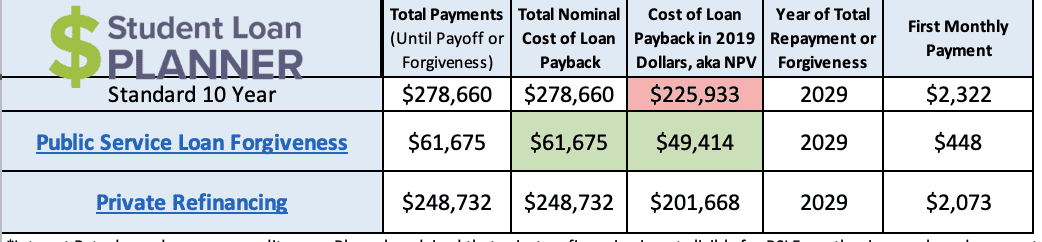

Using the same numbers as we did above to look at student loan refinancing, you can see that PSLF is the cheapest option for repaying your student loans if your employment qualifies:

2. IDR plan forgiveness

The IDR forgiveness option requires payments for 20 to 25 years. Then, the remaining student loan balance will be forgiven. This is a great option for naturopathic doctors who:

- Work in private practice

- Don’t qualify for PSLF

- Owe more than 1.5 times their income

Unfortunately, it’s not tax-free forgiveness, so you’ll need to be saving for taxes while making payments.

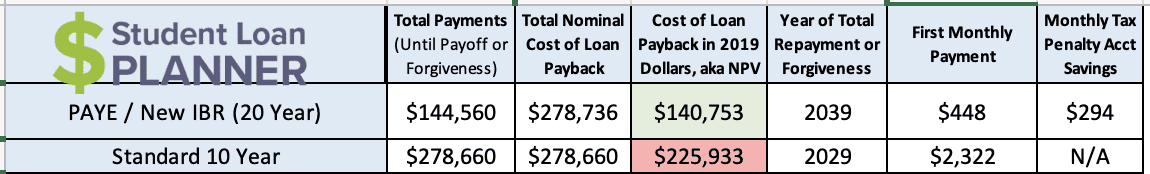

Using the same numbers again, it’s a cheaper option compared to the 10-year plan, but you’ll need to put away $294 a month for taxes:

Related: The Guide to Student Loan Forgiveness for Naturopathic Doctors

Need help with your student loan debt?

Feel free to use our free student loan calculator to run your own numbers. Compare refinancing to your forgiveness options to make sure it’s the right choice for you. You’ll be able to benefit the most if you can qualify for forgiveness rather than refinancing. But you should always check your refinancing options for your own situation.

If you’re still unsure of how to deal with your six-figure debt, then reach out to SLP. The team has helped thousands of people with serious debt figure out a way to pay it back and move forward in life.

Refinance student loans, get a bonus in 2024

| Lender Name | Lender | Offer | Learn more |

|---|---|---|---|

|

$500 Bonus

*Includes optional 0.25% Auto Pay discount. For 100k or more.

|

Fixed 5.24 - 9.99% APR*

Variable 6.24 - 9.99% APR*

|

|

|

$1,000 Bonus

For 100k or more. $300 for 50k to $99,999

|

Fixed 5.19 - 10.24% APPR

Variable 5.28 - 10.24% APR

|

|

|

$1,000 Bonus

For 100k or more. $200 for 50k to $99,999

|

Fixed 5.19 - 9.74% APR

Variable 5.99 - 9.74% APR

|

|

|

$1,050 Bonus

For 100k+, $300 for 50k to 99k.

|

Fixed 5.44 - 9.75% APR

Variable 5.49 - 9.95% APR

|

|

|

$1,275 Bonus

For 150k+, $300 to $575 for 50k to 149k.

|

Fixed 5.48 - 8.69% APR

Variable 5.28 - 8.99% APR

|

|

|

$1,250 Bonus

For 100k+, $350 for 50k to 100k. $100 for 5k to 50k

|

Fixed 5.48 - 10.98% APR

Variable 5.28 - 12.41% AR

|