The path to becoming an osteopathic physician is not only challenging but downright expensive. The high cost of osteopathic medical school can leave graduates with a heavy debt burden that can have lasting effects on both their personal financial success and future career goals.

You can make your student debt more affordable, however, by refinancing your medical loans at any time. But just because you can doesn’t necessarily mean you should.

Here’s what you need to know about student loan refinancing for osteopathic physicians.

The cost of becoming an osteopathic physician

Osteopathic physicians typically spend well over a decade of time and a significant amount of money on gaining their medical expertise. Their medical education timeline typically looks something like this:

- Four years of undergrad study

- Four years of medical school to earn their doctor of osteopathic medicine (DO)

- Three to seven years of internship or residency

- An additional one to three years of specialty fellowship

This extensive education and training can easily leave physicians with student debt in the six-figure range. The osteopathic field is still gaining in popularity and acceptance compared to its allopathic counterpart. Most of the osteopathy schools, by comparison, are newer, private institutions with higher tuition and fewer billionaire donors to help shoulder students’ costs.

A study from the American Association of Colleges of Osteopathic Medicine found that the average osteopathic graduate started their career with $240,000 of student debt. But that study was conducted based on graduating seniors in the 2015-16 academic year, so costs have gone up since.

The average osteopathic Student Loan Planner® client carries a debt load between $300,000 to $350,000. And some carry even more because they deferred undergraduate loans or did not get on an efficient repayment path for many years.

Although there may be a high cost associated with becoming an osteopathic physician, there’s also a high salary in this field compared with what the average college graduate earns.

According to the Bureau of Labor Statistics, the median salary of an osteopathic physician is $208,000. But MDs and DOs are lumped together in the BLS data for reporting purposes, so we can’t be certain of the accuracy of this data point specific to DOs. However, ZipRecruiter marks the nationwide average salary of an osteopathic physician at $157,942.

The high earning potential of an osteopathic physician can balance out the high cost of education. Even if your income ends up being less than expected, you can still strategically choose a repayment plan that maximizes your finances.

Student loan refinancing for osteopathic physicians

DOs who are interested in aggressively paying off their student debt within 10 years should consider refinancing. Refinancing can lower your interest rate, reduce your monthly payment, add or release a cosigner, and streamline your repayment into one loan.

As a general guideline, if you owe 1.5 times your income or less, then refinancing is probably your best bet.

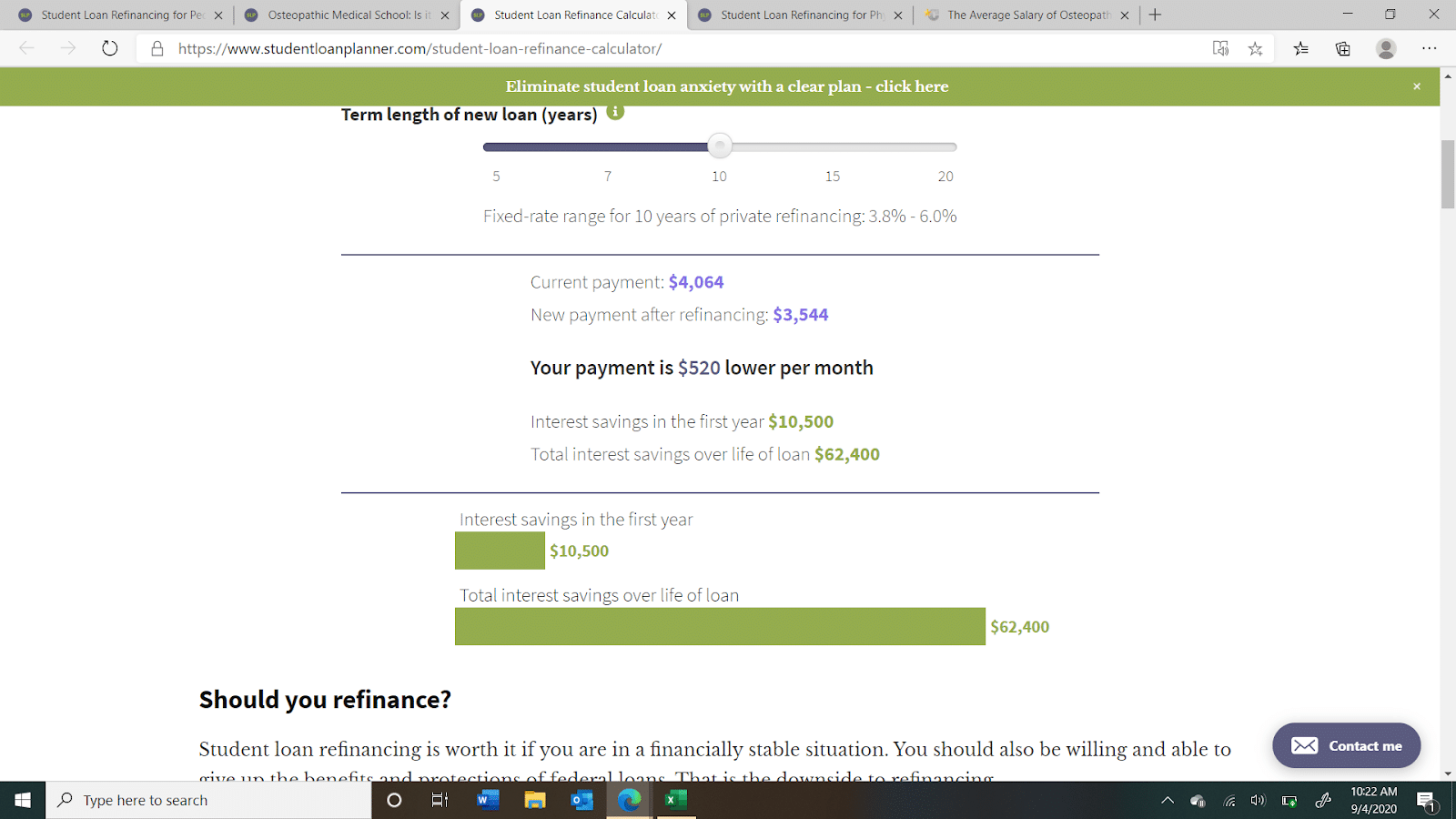

Let’s say you’re a DO with $350,000 in student loans at 7% and you earn $225,000 annually. Using our Student Loan Refinance Calculator, here’s how osteopathic physician student loan refinancing could help you pay your debt faster and save you thousands of dollars:

By refinancing your medical school loans down to a 4% interest rate, you would reduce your monthly payment by $520 and save over $10,000 in the first year alone. And you’d save a total of $62,400 in interest over the life of the loan.

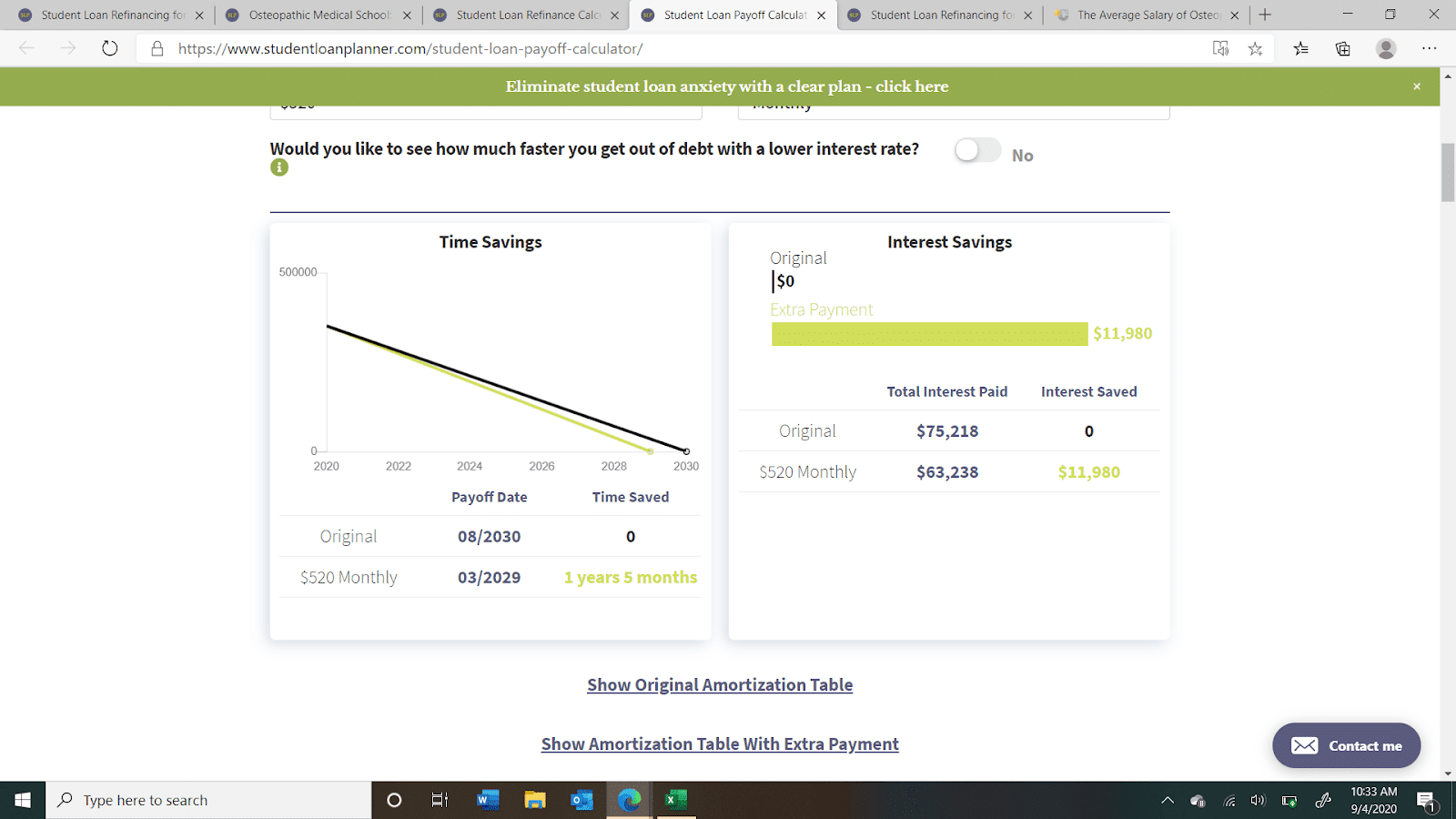

But what if you were to refinance and continue making the exact same payment as before? Remember, one of the primary goals with refinancing is to get rid of your debt as fast as possible by throwing every extra dollar at it that you can.

If you continued making the extra $520 payment after refinancing, you could pay your loans off almost 1.5 years earlier and save an additional $11,980 in interest.

Use our Student Loan Payoff Calculator to see how making extra payments can pay off your student loans faster.

Refinancing comes with some pitfalls

If you have private student loans, you should shop around for new refinancing rates at least once a year. But if you have federal student loans, you’ll need to consider the following before refinancing with a private lender:

- You’ll lose access to federal student loan protections such as options for forbearance or deferment if you were to lose your job.

- You’ll have limited repayment plans that don’t factor in your income.

- You may run into issues with finding a lender who will accept your debt-to-income ratio if you had to rely on student loans to finance your medical education.

Additionally, you’ll miss out on any federal loan forgiveness programs that could save you from paying back the full amount of your student loans.

But if you don’t need the federal benefits or protections and just want to pay off your loans as quickly as possible, then refinancing is the way to go.

When you should pursue student loan forgiveness instead of refinancing

Although some osteopathic physicians choose to pursue higher-paying specialties, many serve in primary care fields that have lower earning potential.

Because of this, most DOs can benefit from exploring loan forgiveness and repayment programs that can make their student debt more affordable, such as:

- Public Service Loan Forgiveness (PSLF). Physicians who work for nonprofit or public organizations are eligible for tax-free loan forgiveness after 10 years of qualifying payments.

- Income-driven repayment (IDR) forgiveness. Physicians who make 20-25 years of qualifying payments under an IDR plan are eligible for taxable loan forgiveness.

- National Health Service Corps Loan Repayment Program. Borrowers may be eligible for partial loan forgiveness in exchange for working in a medically underserved area.

Programs like PSLF and IDR forgiveness can significantly lower your monthly payments and eliminate the need to pay back your loans in full. And many osteopathic professionals are taking notice and making career decisions based on these programs.

A recent study published in the Journal of the American Osteopathic Association determined that osteopathic graduates who intended to use loan forgiveness or repayment programs were more likely to choose primary care fields instead of a higher-paying specialty.

Even if you aren’t aiming for full loan forgiveness, you may benefit from using a combination of repayment strategies to maximize your savings.

For example, some physicians choose to remain on an IDR plan during residency to keep their monthly payments low and then refinance the remainder of their loans once they reach their full earning potential.

Is refinancing right for you?

An osteopathic physician student loan refinancing strategy could save you thousands of dollars, but there may be more efficient paths to repaying your student loans.

If refinancing might be in your future, check out these top refinancing lenders that may offer cash-back bonuses or special rates for osteopathic physicians. For example, Laurel Road offers special pricing for physicians and other medical professionals.

If you’d like help figuring out which repayment strategy is best for you, schedule a consultation with one of our student debt experts.

Refinance student loans, get a bonus in 2024

| Lender Name | Lender | Offer | Learn more |

|---|---|---|---|

|

$500 Bonus

*Includes optional 0.25% Auto Pay discount. For 100k or more.

|

Fixed 5.24 - 9.99% APR*

Variable 6.24 - 9.99% APR*

|

|

|

$1,000 Bonus

For 100k or more. $300 for 50k to $99,999

|

Fixed 5.19 - 10.24% APPR

Variable 5.28 - 10.24% APR

|

|

|

$1,000 Bonus

For 100k or more. $200 for 50k to $99,999

|

Fixed 5.19 - 9.74% APR

Variable 5.99 - 9.74% APR

|

|

|

$1,050 Bonus

For 100k+, $300 for 50k to 99k.

|

Fixed 5.44 - 9.75% APR

Variable 5.49 - 9.95% APR

|

|

|

$1,275 Bonus

For 150k+, $300 to $575 for 50k to 149k.

|

Fixed 5.48 - 8.69% APR

Variable 5.28 - 8.99% APR

|

|

|

$1,250 Bonus

For 100k+, $350 for 50k to 100k. $100 for 5k to 50k

|

Fixed 5.48 - 10.98% APR

Variable 5.28 - 12.41% AR

|

Not sure what to do with your student loans?

Take our 11 question quiz to get a personalized recommendation for 2024 on whether you should pursue PSLF, Biden’s New IDR plan, or refinancing (including the one lender we think could give you the best rate).