How often does the income tax coming out of your paycheck keep you up at night? Ok, now how often do you feel stressed about your six-figure student debt?

Chances are your student debt is creating a lot more stress in your life than your taxes. In fact, paying more taxes can sometimes “feel good” because it means you’re making more money.

What if you thought about your student loans that way, too? What if your mindset was that the student loans opened up the opportunity to get a better education, earn more income, and pursue a career that you’re passionate about?

It might be a leap in thinking at first, but we can get there.

To start, you’ll need to unravel student debt from other kinds of debt. Federal student loan rules and repayment plans are different than other types of debt.

Credit card debt, a car loan, a personal loan, and your mortgage must be paid off in full no matter what. Their payments are also based on how much you owe.

But federal student loan debt has different rules of engagement. Not only can your education lead to greater earnings, but income-driven repayment plans can make loan repayment operate more like a tax than a debt.

Let’s examine this idea further starting with how to calculate student loan payments.

Would you move to a different state just to save on taxes?

Most of us don’t choose where we live because of the tax rate in the state. We’re more likely to live in a state that provides the lifestyle, job and family life we want to have.

Whatever the state income tax happens to be, it is what it is. We just deal with it. Often we don’t even think about it.

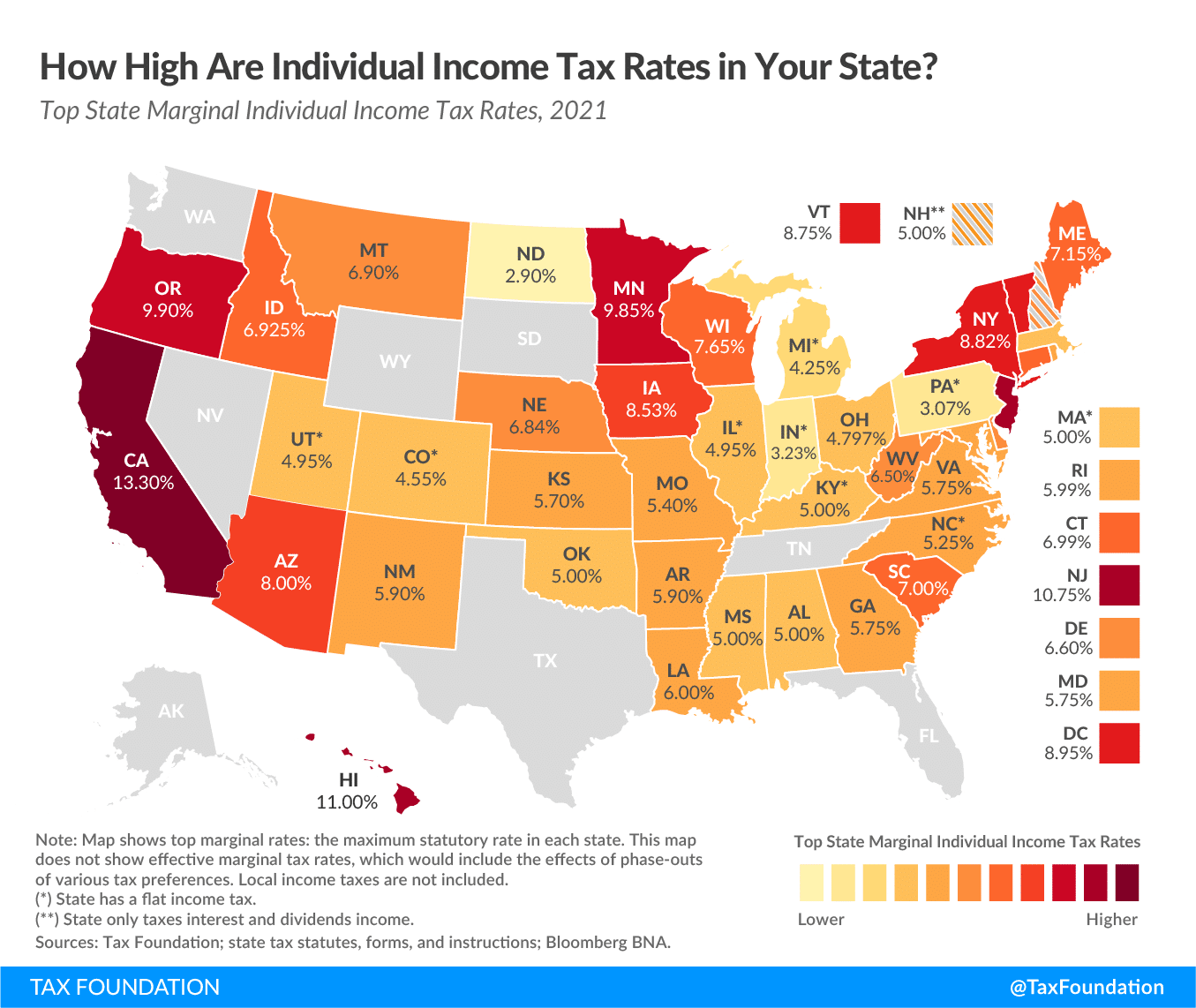

If we did choose where we lived based upon the state’s tax rate, no one would live in the states with the highest state income tax — namely, California, New York, Oregon, New Jersey, Arizona, Hawaii, Minnesota, Vermont or Iowa.

We’d all live in the eight states with no income tax, like Washington, Nevada, Texas, Florida, Tennessee, South Dakota, Wyoming or Alaska.

Despite its high taxes, some people move to California for the great weather. Some move to New York for the hustle, bustle and culture of a big city. People choose to live there despite the taxes.

The same can be true of getting a graduate degree.

Whether you went to school to be a doctor, dentist, pharmacist, veterinarian, chiropractor, lawyer, psychologist, social worker, or other graduate-level professional, you’ll probably choose it because it’s a rewarding career path for you.

Student loans are a byproduct of that decision to have a fulfilling career path.

When you can think of your student loans as a tax instead of a debt, your mindset can shift to:

“I love my job and am making more money because of it, too. It’s worth it to pay an extra tax in the form of student loan payments to live the life I want.”

Let’s start by understanding how to calculate your student loan payments, then go through why they can be thought of as a tax.

How student loan payments are calculated

If you have federal student loans, you can pay them back with one of two strategies:

- Pay based on how much you owe: Standard Plan, Extended Plan, and Graduated Plans

- Pay based on how much you make: Income-driven repayment plans, like Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE) and Income-Based Repayment (IBR)

The payments based on how much student debt you owe are calculated just like any other debt. The more you owe, the higher your payments.

But income-driven repayment is different. Your discretionary income determines your payments and works as an education tax of sorts.

If you’re on PAYE or REPAYE, your payments are 10% of your discretionary income. If you select IBR, then your payments will be 15% of discretionary income.

Discretionary income

Discretionary income is the calculation used to determine your income-driven repayment plan payment. This is important because that number is multiplied by 10% or 15% to come up with your income-driven payment amount, just like an income tax.

Discretionary income starts with your adjusted gross income (AGI) from your tax return. AGI is calculated by starting with your income from all sources (including investment or rental income) and then subtracting certain deductions.

The major ones for most people are pre-tax retirement plan contributions and health savings account (HSA) contributions.

Note: The standard deduction or other itemized deductions (mortgage interest, personal charitable contributions) come after AGI and don’t affect your student loan payments.

Keeping it simple, let’s say that someone earning $100,000 in salary contributes $10,000 to their pre-tax retirement account through work. Their AGI would be $90,000.

Then, take your AGI and subtract 1.5x the federal poverty level (FPL). Think of the FPL deduction as a standard deduction to lower your income and student loan payment.

For 2021, the FPL for a single person is $12,880. That’s a $19,320 deduction against AGI.

So the discretionary income for a single person making $100,000 and contributing $10,000 to a pre-tax retirement plan would be $70,680. That’s the number used to calculate student loan payments.

The FPL goes up $4,540 per family member (spouse, kids). That means the discretionary income deduction would go up by $6,810 per family member. If that same person was in a family of four, their discretionary income would be $50,250.

Think of the FPL deduction as your standard deduction or itemized deductions to get to your calculated income tax rate.

Example of student loans as an income tax

Emily’s a veterinarian making $100,000 and has $200,000 in vet school debt at 6.8%. She’s passionate about veterinary medicine, but her student debt is really weighing on her and making her question if she made the right choice.

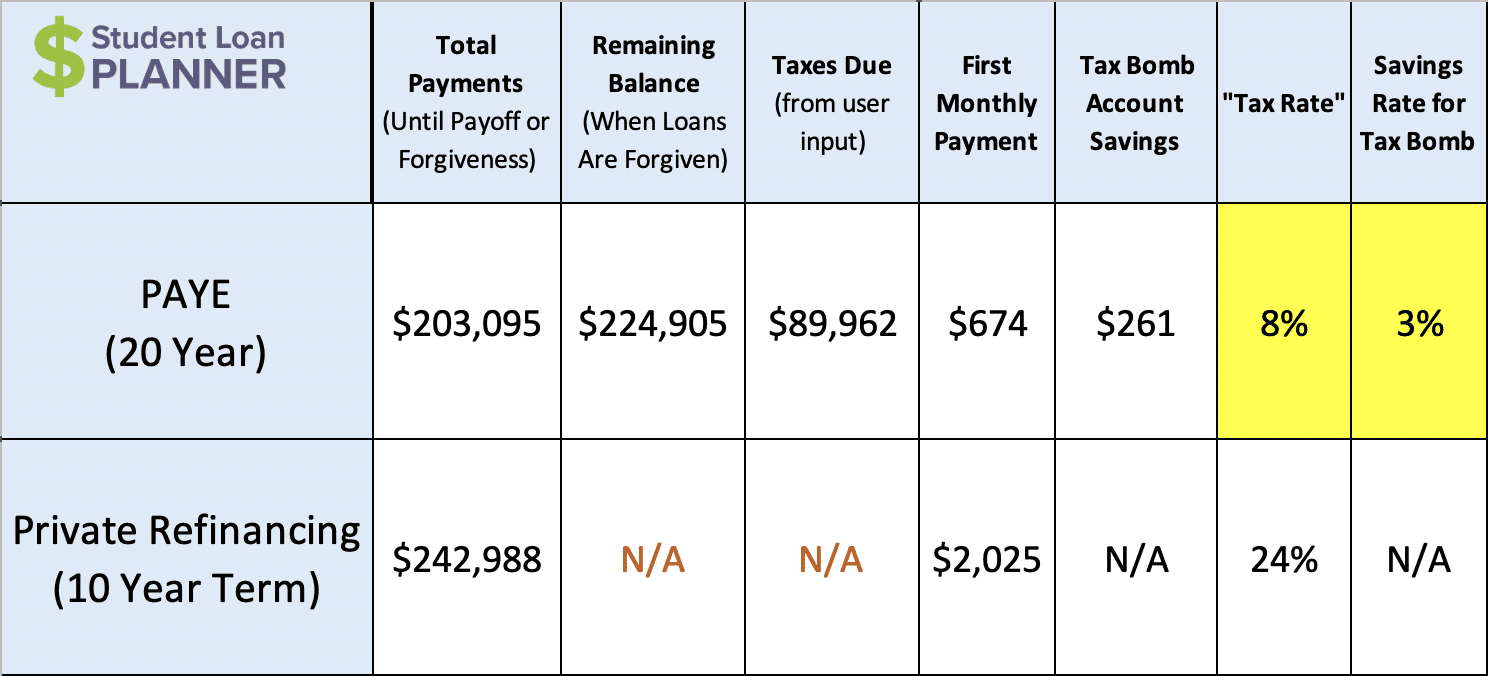

She’s trying to figure out whether she should pay back her loans in full by paying $2,000 per month or go on PAYE where her payments are based on her income.

If we just look at this as a debt on PAYE, Emily will make $203,095 in payments over 20 years and then have a $89,962 tax bomb in 20 years. These are big numbers and add to her stress level because it seems like an enormous mountain to climb.

But if we break it down and say that her PAYE payments are like an 8% tax for 20 years of payments on PAYE and 3% for the tax bomb savings, that’s different. Essentially her student loans go from a $200,000 debt to an 11% education tax that she’d pay for 20 years.

I could ask Emily, “Would you pay 11% more in taxes to make $100,000 doing what you love?” That’s less than what someone living in New York City pays between state and local taxes (12%+)!

She can just set her payments and automate her tax bomb savings and think of it like monthly taxes she has to pay. That’s much better than having the burden of paying $2,000 per month for 10 years where she’d be locked into a certain job to make sure she can make the payments.

She can really choose the job she likes the most whether it pays more or less than what she’s making, and her student loan tax will adjust up or down with her income.

If she earns $75,000 or $125,000, her payments would go up and down with her income just like a tax. However, her “tax rate” stays about the same at 11%.

If she decides to take a few months off to explore options, she can adjust her payments to $0 per month. No income, no student loan payment “tax”. She can even take a break from the tax bomb savings and ramp back up after.

Student loan tax for high debt-to-income borrowers

Having a super high debt-to-income ratio can feel mentally debilitating. Watching those loans continue to grow can be disheartening. But it doesn’t have to be that way. Even a high student debt-to-income can be thought of as a tax, too.

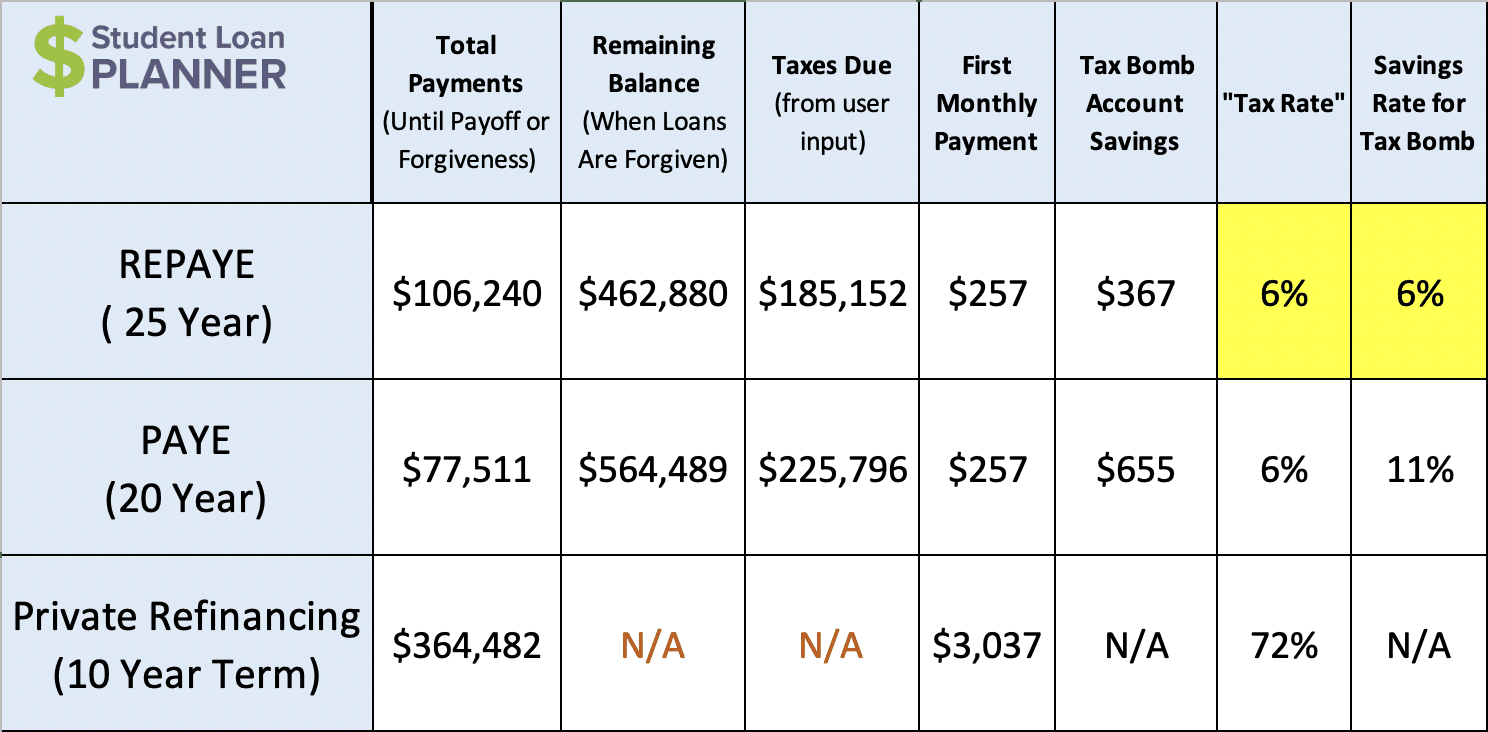

Let’s say that Tina has $300,000 of debt and is making $50,000 as a chiropractor. That’s a 6:1 debt-to-income ratio.

Paying off her loans in full would be a giant hurdle because the payments would be about $3,000 per month for a 10-year term and around $1,900 for a 20-year term. Either option would eat up most of her take-home pay.

The loans are causing Tina great stress, because she’s not sure how to manage them. But if she looks at income-driven repayment as a tax, then she has affordable repayment options to feel better.

Rather than trying to figure out how to make a large monthly payment from $2,000 to $3,000, she can go on REPAYE and earmark $624 per month to go toward her loans, $257 for the payment, and $367 for the tax bomb savings.

That equates to a student loan “tax” of 12% (6% for the payment, 6% for the tax bomb savings) which is less than living in California or New York City.

If she automates her student loan payment and also her tax bomb savings, it’ll leave right after it hits her bank account similar to a tax withholding. She won’t even miss it.

Tina can sleep better at night after shifting her mindset from the student loans being this heavy debt burden to an affordable tax.

Are her loans fun to look at now? Of course not. Does it cause a great deal of stress relief to shift her mindset? Absolutely.

You don’t have to feel stuck in a job because of student debt

What if chiropractic medicine isn’t working out for Tina and she decides to take another career path?

Well, when she thinks of the student loans as a tax, she can have the freedom to pursue whatever she wants. Maybe she finds another job that pays $75,000. She can take it. What about a career change to something like data analytics? She can make that switch, too.

As she makes more or less money, her payments will adjust accordingly until she reaches loan forgiveness. The repayment strategy and tax can be built around whatever career or life decisions she chooses.

Should you make less money to pay less student loan tax?

Heck no!

I often get this question during a student loan consult. Never take a lower-paying job just to get lower student loan payments.

Yes, your payments will go up as you make more money, but wouldn’t you be willing to pay $2,000 as a result of earning an extra $20,000? I know I would because my take-home pay after student loan payments would still have a really nice increase.

Besides, if you’re worried about making more and paying more on your income-driven payments, then just put more money away into your pre-tax retirement account or HSA. That will lower your AGI → discretionary income→ student loan payment while helping you build an awesome nest egg.

Student loans don’t have to be a burden

If you’re struggling with anxiety due to your debt or you’re not sure what to make of this whole “student loans as a tax” thing, feel free to reach out.

We can examine your student loan situation and show you the clear path forward, a path that empowers you to put your career and life goals first and fit a student loan repayment strategy around that. Student loans don’t have to control your life.

Let’s get you back in the driver’s seat. Learn more about how our consult process works — we’re here to help.

Not sure what to do with your student loans?

Take our 11 question quiz to get a personalized recommendation for 2024 on whether you should pursue PSLF, Biden’s New IDR plan, or refinancing (including the one lender we think could give you the best rate).