Well, sort of. At the start of each year, there’s a lot of excitement about resolutions. It’s also the start of a dreaded annual event: tax time.

Taxes are a necessary burden. We download TurboTax, walk into H&R Block, or hesitantly call our CPA, hating every minute of it.

The lucky ones get a bright and shiny refund, but some of us have to write a check. There’s nothing worse than writing a check to the IRS in April, but we do it because we have to. What if you thought of your student loans in the same way?

How our student loan calculator works

For those unfamiliar with spreadsheets (or finance in general), our student loan calculator can feel a little overwhelming. Still, it’s a valuable tool once you understand how it works.

We start with inputs. The inputs you should know before using the calculator include:

- Your student loan balance(s).

- The weighted average interest rate of your loans.

- The year you first borrowed.

- How long you’ve been paying off your loans.

- Your family size now and in the future.

- Your adjusted gross income (AGI).

How is AGI calculated?

You likely know how much money you make from the tax forms you receive early each year.

Adjusted gross income (AGI) is a significant number for student loans. AGI is the income number the Department of Education uses to calculate monthly payments under income-driven repayment plans like PAYE or REPAYE.

Student Loan Planner’s calculator typically calculates AGI as your gross (or total) income minus any pre-tax savings like retirement and health savings accounts (HSA).

Student loan repayment plans: which is best?

Once you’ve input the initial numbers into the calculator, you’ll see the monthly payment options. Start by looking at the Standard 10-year repayment plan. This is the repayment plan the Department of Education automatically places you on unless you choose otherwise.

If you owe a substantial amount, this can be a terrifyingly high number, but use it as a reference point. Often the biggest goal during a consultation is to beat this number.

Next, you’ll compare the monthly payments under private refinancing and income-driven repayment plans. It can be tempting to choose the lowest payment, especially if you’ve just started your career or your job isn’t very steady.

Student loan calculator results

Low payments don’t usually translate into high savings when paying off debt, but with student loans, they can.

If you’re interested in Public Service Loan Forgiveness or long-term forgiveness under repayment plans like PAYE or REPAYE, strategically pay the least amount possible every month.

Our calculator highlights the best results for you by color-coding them. Green is good, red is bad. The goal of this page is to provide you with the most savings possible. The results usually fit into one of two categories:

- Pay the loans off as quickly as possible by paying the standard payment or refinancing.

- Pay the least amount possible and pursue forgiveness.

How to optimize your student loan repayment strategy

Let’s say you’re a new lawyer with $395,000 of student loans. Your average interest rate is 6.2%, but you haven’t started paying your loans because of COVID forbearance.

Your starting salary as an associate is $120,000, and you expect your salary to grow at about 5% as you pursue the path to partner.

You plan to marry in the next couple of years and have at least two children, all in the next five to 10 years. You don’t really know much about taxes, so you haven’t considered incorporating tax planning into your student loans.

Student loan monthly payment options

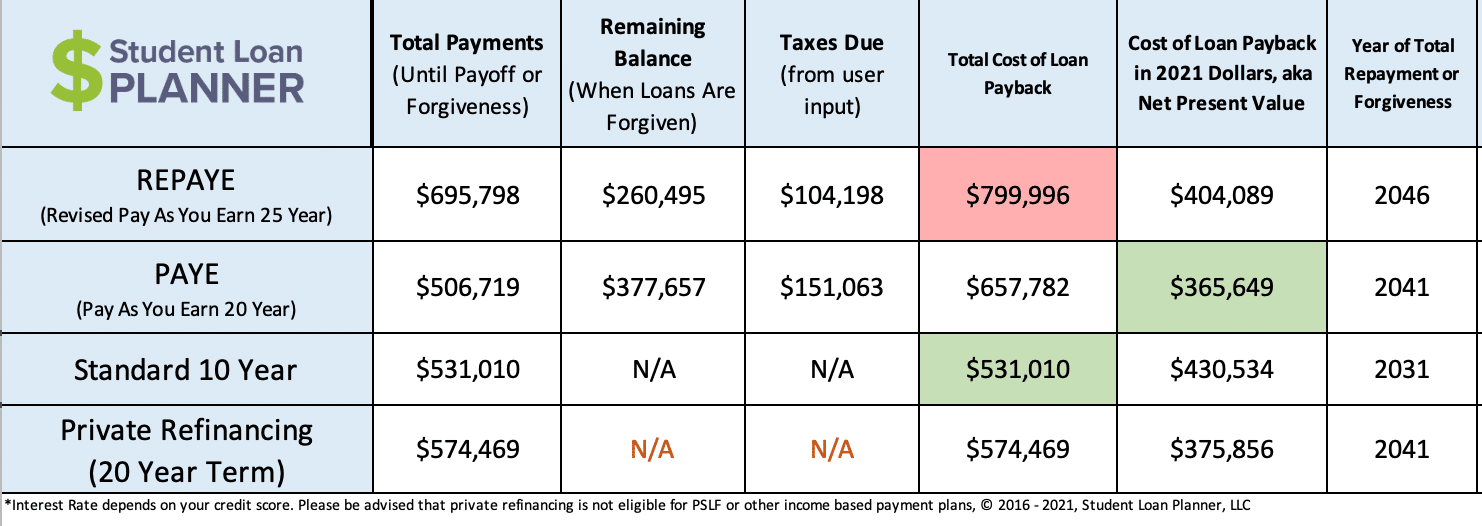

Here’s what the calculator says about your repayment options in this initial scenario:

| Year | REPAYE monthly payment | PAYE monthly payment | Old IBR monthly payment | Private refinancing monthly payment | Standard 10 year PAYE/IBR cap |

|---|---|---|---|---|---|

| 2021 | $839 | 839 | $1,259 | $2,394 | $4,425 |

| 2022 | $884 | $884 | $1,326 | $2,394 | $4,425 |

| 2023 | $1,705 | $1,705 | 2,557 | $2,394 | $4,425 |

| 2024 | $,1778 | $,1778 | $2,667 | $2,394 | $4,425 |

Take a look at the Standard 10-year payment on the far right: $4,425 per month. Ouch! It’s best to acknowledge this number and move on quickly.

Moving from right to left, you’ll see private refinancing next. Private refinancing can significantly decrease your payment, but $2,394 per month doesn’t feel great either.

As you examine the income-driven repayment options, REPAYE or PAYE’s monthly payments look the best. $839 per month is much more palatable than over $4,000 per month.

Student loan forgiveness or student loan repayment

After reviewing your monthly payment options, you can move on to your results:

Remember, you want to look for the green boxes. Green is good. In terms of the total cost of your loan payback, the Standard 10-year takes the win, but the monthly payment isn’t ideal.

If we look at the total cost of the loans in today’s dollars, PAYE is the winner.

PAYE will cost $506,719 in total payments (less than the Standard 10-year plan), with a potential tax bomb of $151,063. Lastly, remember the initial monthly payments start at $839 per month.

Why students loans are like an income tax

If you’ve decided to invest in yourself and pursue a professional career, you might be looking at these numbers wondering if it’s worth it.

Maybe you were making $50,000 to $75,000 as a paralegal before you decided to go to law school. Is this ridiculous loan balance worth the sleepless nights and multiple years of stress?

We’ve all asked ourselves this question, but what if you take a step out of your shame spiral and think of your student loan repayment as an income tax on your gross earnings each year?

Remember taxes? Those things we have to pay every year, paycheck by paycheck? Student loans can be paid piece by piece as well.

Income-driven repayment plans are like income taxes

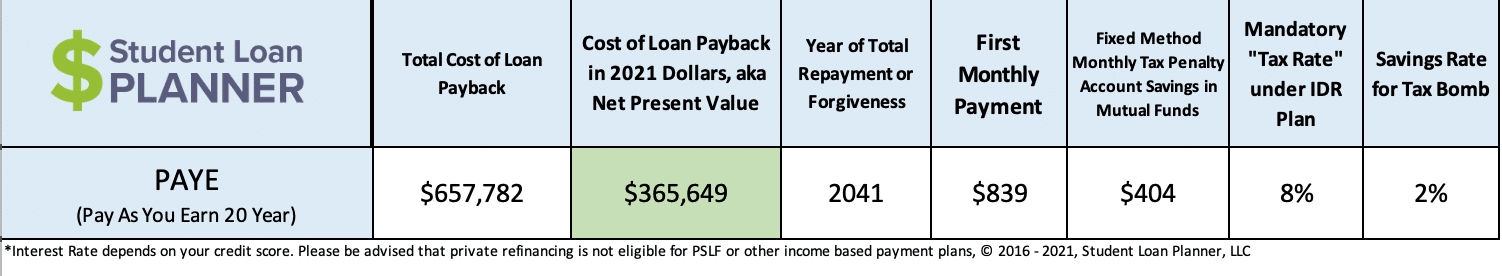

If we look at the scenario above and consider the Pay As You Earn plan, here’s how this “income tax” scenario works:

Paying $839 per month and increasing that amount correspondingly with your income each year is like paying an 8% tax each year over 20 years.

Tax bomb for student loans

To save for that potential $150,000 tax bomb 20 years from now, you’ll need to save a little over $400 per month into a taxable brokerage account and aim for a return of 5% or higher.

That’s like an additional 2% tax on your income.

In total, paying your student loans under an income-driven plan has created a 10% tax on your income over the next twenty years.

Still not sure if law school was a good idea?

Is graduate school worth it?

You’re looking down the barrel of an additional 10% “income tax” because of law school, which sucks, but let’s look at how your salary has changed.

As a paralegal, if you made $75,000 per year and as a lawyer, you start at $120,000 per year, that’s an annual increase of $45,000.

A 10% income tax on your $120,000 salary is $12,000, so even if we subtract $12,000 from your $45,000 salary increase, you still come out ahead by $33,000 per year or more.

Confusing math, but in short, yes — grad school is worth it.

How to improve your student loan repayment results

Student loans are really complicated. The scenario we reviewed above is typically our starting point. Doing things like filing our taxes jointly and using our “gross” or total salary in the student loan calculator keeps life simple.

Here’s what you can do to maximize your student loan savings:

1. Maximize your retirement savings

Saving in pre-tax retirement accounts or HSA accounts reduces your AGI, which reduces your student loan payments.

2. Consider filing your taxes separately

Filing your taxes separately calculates your monthly payment based on your income alone and ignores your spouse's income. Lower income translates to lower monthly payments.

This might mean higher savings for the tax bomb, but both the Trump and Biden administrations have paid close attention to the idea of eliminating the tax bomb. Politicians are aware of the burden of the tax bomb, which is good news for student loan borrowers.

3. Choose the right investment strategy

I spoke with a consult recently who was saving monthly for her tax bomb in a money market account. Another student loan consulting company told her to do so.

Here’s the problem with that — have you looked at the interest rate your bank account generates recently? It’s measly.

It’s incredibly important to generate a return on your tax bomb savings. We have an entire investing course related to choosing the right investments.

The bottom line

If this post slapped you in the face like a cold fish in a Seattle fish market, we get it. Student loans can be stupidly overwhelming.

For example, sometimes the simplest solution is to refinance your student loans. If you choose a fixed rate in a time when interest rates are low, you’ll have a steady monthly payment you can plan for.

This is especially true for those with earnings on the higher end of the spectrum. If you make $500,000 per year, an additional “income tax” of 5% to 10% using income driven repayment is usually worse than refinancing.

But if you’re still unsure, Student Loan Planner exists to help you answer these questions. Schedule a call with us when you are ready!

Not sure what to do with your student loans?

Take our 11 question quiz to get a personalized recommendation for 2024 on whether you should pursue PSLF, Biden’s New IDR plan, or refinancing (including the one lender we think could give you the best rate).

Hello,

I have done consultation with SLP in the past and decided doing PAYE and pursuing forgiveness would be the best course of action for me. I wanted to understand if it would make any difference between filing single versus getting married and filing separately. When using the discretionary income calculator on SLP, the discretionary income was higher when I put married filing separately versus when filing single, which is confusing since I thought it should be the same. I would love to understand the pros and cons since I am debating between getting married legally or not. Thank you so much!

Hi J, have you read our blog: “Married, Filing Separately”: Impact on Student Loans and Health Insurance Marketplace Eligibility? If this doesn’t address your question feel free to respond back or email us at help@studentloanplanner.com.