When you borrow Stafford or PLUS loans, you have an additional interest charge added which is called a student loan origination fee. Most borrowers don’t even know this exists, and many schools don’t even disclose it in their cost of attendance.

Knowing how much your student loan origination fee is will tell you the full cost of student loans. It might also push you to use alternative sources of financing depending if you’re using PLUS loans and do not plan to go for forgiveness.

How does an origination fee affect your debt?

Until October 2019, the origination fee or “loan fee” will be 1.062% for Stafford Subsidized and Unsubsidized loans and 4.248% for Grad PLUS and Parent PLUS.

| Direct loan type | Origination fee |

|---|---|

| Stafford Subsidized | 1.06% |

| Stafford Unsubsidized | 1.06% |

| Grad PLUS | 4.25% |

| Parent PLUS | 4.25% |

A loan fee or origination fee for student loans comes out of your disbursement before you see it.

For example, if you borrow $10,000 of Stafford loans, you’ll receive $9,893.80 since $106.20 would go to the government as an upfront student loan fee.

If you borrowed the same amount but through the PLUS program, you’d have a $424.80 origination fee and you’d get a disbursement for $9,575.20.

Calculating what you should request in loans including the loan fee

If you want to figure out what you’d need to request in loans to receive a specific amount, here’s a rule to use.

Take the amount you need and divide by the quantity 1 minus the origination fee percentage. That will give you the amount you’d need to request from financial aid.

Quantity Requested = Quantity Needed / (1 – Origination Fee as %)

Do grad school programs disclose origination fees to students?

Most programs that give a detailed cost of attendance estimate will put a number on there for loan fees. However, I’ve found those numbers to be frequently wrong, incomplete, or totally missing. To show you what I mean, let’s look at three cost of attendance estimates from Midwestern, NYU, and UPenn dental schools. By comparing across the same degree program, we’ll help control for variance in disclosure requirements.

Midwestern University Dental School disclosing origination fees

In the 2016-2017 cost of attendance estimate, Midwestern shows that the average student loan origination fees it expects are $3,073 per year. That is a hybrid of Stafford and Grad PLUS origination fee levels.

The total cost of education there is astronomical. You might be able to say that the school could do a better job warning students of the cost in presentations and in person. However, if the student knows about the cost of attendance, at least it’s on there.

Also, in small letters at the bottom, Midwestern states that tuition has historically gone up 4% to 7% per year. I usually don’t see that amount of warning that you’re going to be pummeled with tuition increases.

New York University Dental School vastly understating them

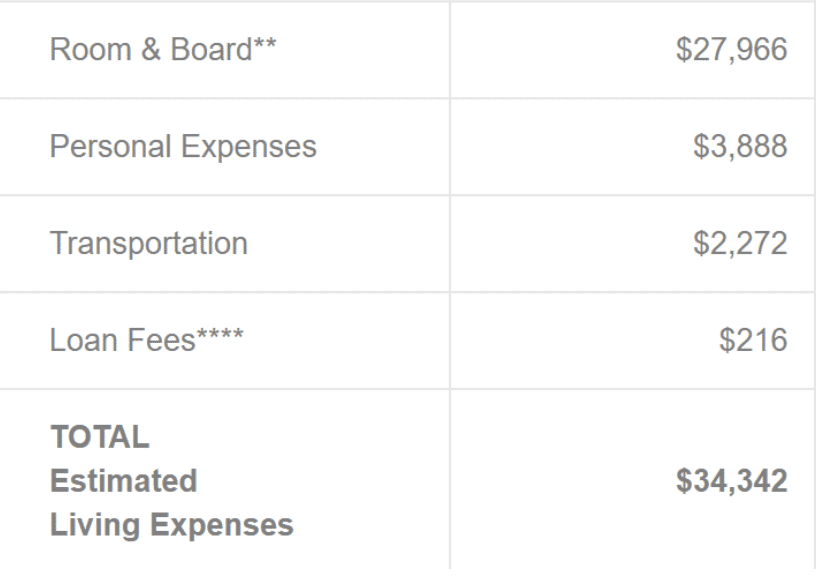

One of my favorite targets, NYU Dental school, decided to remove living expenses from its site when I wrote this.

Before they did, thanks to the Wayback Machine organization, we can see their estimates of loan fees in the 2017 school year.

I have no idea how they came up with $216 per year for loan fees. The loan fee estimate should’ve been at least $1,000 if they were using Stafford loan origination fees instead of the correct mix of Stafford and Grad PLUS.

That said, I do have to give them credit for at least listing them on the site at all.

University of Pennsylvania Dental School vastly understating them

The cost of attendance estimate at UPenn’s dental school makes no mention of loan fees at all.

To their credit, they do list 12 separate line items you will be billed for as a student, which is more disclosure than NYU even though UPenn omitted student loan origination fee disclosure.

These three cases are just within a single degree program across different institutions. I’ve seen this kind of variance across other programs as well.

It’s common for admissions departments to do less disclosure on origination fees than a sketchy used car lot.

How much do origination fees add to your loan balance?

To run this math, we must make some assumptions.

Assume you borrow $100,000 for your graduate school program. Let’s assume it’s a medical profession since you’d get a higher Stafford loan limit of $40,500 per year instead of the normal $20,500 annually.

Hence, for the $40,500, you’d get a 1.062% origination fee and you’d have $430.11 deducted.

For the remaining $59,500, you’d need to use the Grad PLUS program to finance the cost. That means you’d have an origination fee of 4.248%, or $2,527.56.

I think many financial aid departments misrepresent loan fees by only displaying the approximate figure for Stafford Loans instead of both loan types.

The total loan fee would be $2,957.67.

This origination fee would go slightly up or down depending on Department of Education rules each year, but it would not change much under the current Higher Education Act.

How much does this fee cost in total approximately?

Loan fee for a medical student going to high-cost osteopathic school

Med students can borrow $40,500 of annual Stafford loans instead of $20,500. To keep the math familiar let’s assume our med student, let’s car her Avita, borrows $100,000 per year.

Her origination fee each year is $2,957.67. I’ll round it to $2,958 to keep it readable.

Here’s how the cost would look like over four years.

Assume tuition goes up by 4% each year and the interest rate is 7% on her loans.

Total fee = $2,958 * (1+4*0.07) + $2,958 * (1+3(0.07))*(1.04) + $2,958 * (1+2(0.07))*(1.04^2) + $2,958 * (1.07)*(1.04^3) = $14,716

Even that figure might be understating the total, since any marginal borrowing would come from the more expensive Grad PLUS program instead of the blended fee.

Ask the admissions office to disclose your full origination fees

Knowing what loan fees will cost you can be complicated, but if you leave school with a typical professional degree balance, you probably will get charged a new car’s worth. Very few institutions warn you adequately about this.

If you have taken out debt already, we’d love to help you figure out how to manage it.

In rare cases, it can make sense to take out private loans instead of Grad PLUS. Private loans usually have lower student loan origination fees and lower interest rates than PLUS loans. However, you should never borrow anything but federal loans even at higher rates if your plan is to utilize income-driven repayment.

Private loans often have upfront loan fees too. Always ask if your loan has them and read the fine print.

What did you know about student loan origination fees before attending grad school? Have any questions about how these fees work? Comment below!

Refinance student loans, get a bonus in 2024

| Lender Name | Lender | Offer | Learn more |

|---|---|---|---|

|

$500 Bonus

*Includes optional 0.25% Auto Pay discount. For 100k or more.

|

Fixed 5.24 - 9.99% APR*

Variable 6.24 - 9.99% APR*

|

|

|

$1,000 Bonus

For 100k or more. $300 for 50k to $99,999

|

Fixed 5.19 - 10.24% APPR

Variable 5.28 - 10.24% APR

|

|

|

$1,000 Bonus

For 100k or more. $200 for 50k to $99,999

|

Fixed 5.19 - 9.74% APR

Variable 5.99 - 9.74% APR

|

|

|

$1,050 Bonus

For 100k+, $300 for 50k to 99k.

|

Fixed 5.44 - 9.75% APR

Variable 5.49 - 9.95% APR

|

|

|

$1,275 Bonus

For 150k+, $300 to $575 for 50k to 149k.

|

Fixed 5.48 - 8.69% APR

Variable 5.28 - 8.99% APR

|

|

|

$1,250 Bonus

For 100k+, $350 for 50k to 100k. $100 for 5k to 50k

|

Fixed 5.48 - 10.98% APR

Variable 5.28 - 12.41% AR

|

Not sure what to do with your student loans?

Take our 11 question quiz to get a personalized recommendation for 2024 on whether you should pursue PSLF, Biden’s New IDR plan, or refinancing (including the one lender we think could give you the best rate).