The COVID-19 federal student loan payment and interest freeze will expire on August 29, 2023. Most federal borrowers have benefited from almost two years of $0 payments and 0% APR. But as payments resume, you might be wondering, “Should I refinance my student loans?”

When payments begin, federal student loan interest rates for existing loans will return to their pre-pandemic level. If your interest rate was 6.8% before the administrative forbearance, it’ll bump back up to the same 6.8% starting in August 2023.

With student loan refinancing rates still at historic lows (plus huge cash-back refinancing incentives and temporary 0% offers), now’s a great time to evaluate whether refinancing is right for you.

Student loan refinancing 101

Refinancing student loans can lower your interest rate or reduce your monthly payment — or potentially both — without fees. With refinancing, a private lender pays off your existing loans (federal and private loans) by providing you with one loan that has all new loan terms.

For the purpose of this article, we’ll focus on refinancing federal student loans. However, it’s worth mentioning that if you have private student loans, you should check interest rates at least once a year or if your financial situation changes (e.g., your credit score improved).

You can also refinance as many times as you want to get a lower interest rate. However, if you have federal student loans, know that you’ll lose all federal loan benefits.

When NOT to refinance your federal student loans

When you refinance your federal student loans, you’ll forfeit access to federal perks, like loan forgiveness programs and income-driven repayment (IDR) plans. Losing these benefits is why refinancing isn’t the right choice for everyone.

As a general rule of thumb, we don’t recommend refinancing your federal student loans if:

- You work in the public or nonprofit sector, including government, tribal or 501(c)(3) organizations.

- You don’t have a stable income or employment.

- You’ll owe federal debt that’s 1.5 times more than your annual income (e.g., you owe more than $150,000 of student debt and make less than $100,000 per year).

In these instances, you might benefit more from keeping your federal loans intact. You’ll have the option to pursue federal loan forgiveness programs (e.g., Public Service Loan Forgiveness and IDR forgiveness) while maintaining a low minimum payment based on your income.

When to refinance student loans after the payment freeze

Some federal borrowers will benefit significantly from refinancing their student loans after the payment pause is lifted in 2023.

Consider refinancing your federal loans if:

- You work for a private employer.

- You’ll owe federal debt less than 1.25 to 1.5 times your income.

- You’re willing to forfeit federal benefits, such as deferment and forbearance options, loan forgiveness programs, and IDR plans.

- You qualify for a 0% introductory interest rate (or a lower rate that likely won’t be available in several months).

- You’ve built a solid emergency fund.

These general guidelines serve as a starting point to decide if refinancing is a realistic option for you.

Let’s look at a couple of scenarios where it makes sense to refinance your federal student loans.

Scenario 1: You qualify for a 0% introductory interest rate

Student loan borrowers had the upper hand in terms of refinancing during the pandemic. To compete, lenders offered super low rates and huge cash-back bonuses throughout the administrative forbearance period.

But some of the best online lenders offering refinancing have taken it a step further with a 0% introductory interest rate that will extend past the federal interest freeze.

However, these types of promotions will end soon. If you’re planning to refinance in the near future, take advantage of these introductory rates while they’re still available. You can squeeze out several more months of 0% interest, even after the payment freeze has expired for other borrowers.

If you don’t meet the criteria for a 0% introductory rate, you might still qualify for a low rate that likely won’t be available later down the road.

Scenario 2: You want to get rid of student debt as fast as possible

Federal loan forgiveness programs and IDR plans help borrowers who carry high debt loads and are struggling to make monthly payments. But not everyone needs federal loan benefits.

If you want to completely eliminate your student debt with the least amount of interest, then refinancing is the way to go.

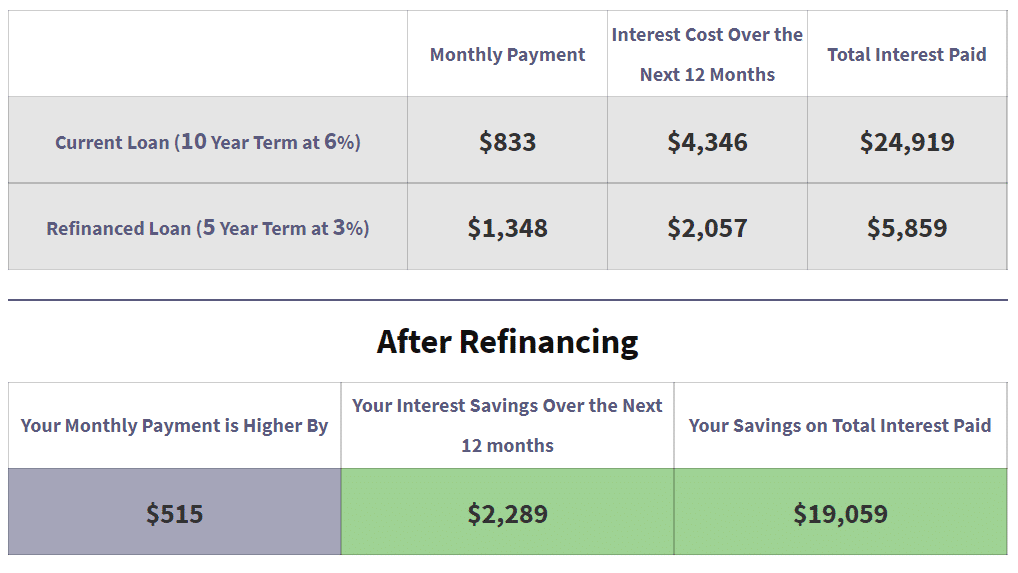

Let’s say you have $75,000 of federal student loans with a weighted average interest rate of 6%. Your current monthly payment is $833. However, your finances are in order, so you can safely afford to aggressively tackle your student debt over the next five years by increasing your payment.

Using our Student Loan Refinancing Calculator, you can see that by refinancing to a five-year repayment term at 3%, you’ll increase your monthly payment by roughly $500. But you’ll save over $19,000 in interest over the life of your loans.

But remember, your primary goal in this scenario is to get rid of your student debt as fast as possible if it means you can have peace of mind. So, you’ll want to throw every extra dollar you can to paying off the new refinanced loan early, saving you even more interest.

Alternative strategies to save you money

Refinancing might not be a viable option if you want or need to keep your federal student loans.

Consider exploring these strategies to make your federal student loan payment more affordable:

- Enroll in an income-driven repayment plan. There are four federal repayment options that are based on your annual income, ranging from 10% to 20% of your discretionary income. Each IDR plan has its own eligibility and loan forgiveness criteria, but each plan is designed to limit your monthly payment.

- Strategically lower your adjusted gross income (AGI). If you’re already on an IDR plan, your monthly payment is based on your discretionary income, which is generally determined by your AGI and family size. Fortunately, there are legal ways to lower your AGI, such as increasing your pre-tax retirement contributions. A lower AGI equals a lower student loan payment.

- Ask your employer if they offer student loan repayment assistance. Many employers are adding student loan repayment assistance as part of their benefits package.

- Adjust your personal budget. Student loans are only one piece of your financial puzzle. Take a look at your budget and determine ways to cut your expenses and earn additional income. This can alleviate some of the pressure you might be feeling from your student loan debt.

Need help determining if refinancing your federal student loans is the right move? Schedule a one-hour consult with our team of student debt experts!

Refinance student loans, get a bonus in 2024

| Lender Name | Lender | Offer | Learn more |

|---|---|---|---|

|

$500 Bonus

*Includes optional 0.25% Auto Pay discount. For 100k or more.

|

Fixed 5.24 - 9.99% APR*

Variable 6.24 - 9.99% APR*

|

|

|

$1,000 Bonus

For 100k or more. $300 for 50k to $99,999

|

Fixed 5.19 - 10.24% APPR

Variable 5.28 - 10.24% APR

|

|

|

$1,000 Bonus

For 100k or more. $200 for 50k to $99,999

|

Fixed 5.19 - 9.74% APR

Variable 5.99 - 9.74% APR

|

|

|

$1,050 Bonus

For 100k+, $300 for 50k to 99k.

|

Fixed 5.44 - 9.75% APR

Variable 5.49 - 9.95% APR

|

|

|

$1,275 Bonus

For 150k+, $300 to $575 for 50k to 149k.

|

Fixed 5.48 - 8.69% APR

Variable 5.28 - 8.99% APR

|

|

|

$1,250 Bonus

For 100k+, $350 for 50k to 100k. $100 for 5k to 50k

|

Fixed 5.48 - 10.98% APR

Variable 5.28 - 12.41% AR

|

Not sure what to do with your student loans?

Take our 11 question quiz to get a personalized recommendation for 2024 on whether you should pursue PSLF, Biden’s New IDR plan, or refinancing (including the one lender we think could give you the best rate).