Anesthesiologists rank in the top 10 for highest compensated physicians. But like all physicians, they also can rack up hundreds of thousands of dollars in student debt during medical school. Is taking on six-figure student debt worth it to become an anesthesiologist?

We also want to explore what an anesthesiologist’s income looks like when working for a hospital versus going into private practice. And how do these different types of income affect student loan repayment options?

Let’s compare this field’s average salary, debt and other factors to answer these questions.

The first thing to understand is that student loans operate by different rules than any other type of debt. It can be a challenge to understand the best ways to pay back such a large amount of debt. Your loan repayment strategy can also be a factor in deciding whether to pursue a career as an anesthesiologist.

Income & Student Debt by Profession

How you compare to other

accountants stats*

| Average student debt | |

| Average income | |

| Average Debt-to-Income Ratio |

Statistics represent the population of Student Loan Planner clients in the respective profession referenced in the chart from 2017-2023. Sample excludes those in school or in training.*

Requirements to become an anesthesiologist

It’s a long road for most physicians to get through due to having to gruel through undergrad and a med school curriculum, followed by residency. To become an anesthesiologist, the road is even longer, due to the extra knowledge required to specialize.

Anesthesiologists need to make sure that any anesthesia used is as safe and effective as possible. They’re also present throughout the surgery to make sure that everything is running smoothly in terms of the patient’s vitals and comfort. Then they check on the patient’s recovery and pain management after surgery.

Anesthesiologists work alongside other physicians as partners in the procedures, whether it’s a major surgery, less invasive procedure, or even labor and delivery,

To get the extensive training needed to be there during critical moments, anesthesiologists go through a four-year anesthesiology residency after graduating from medical school compared to three years of residency for primary care physicians. They can then choose an additional fellowship year or two to specialize further. More anesthesiologists have been exploring this extra training to continue to differentiate themselves.

It’s a long road but it can be rewarding both financially and professionally. Many anesthesiologists say they’d choose this career path again.

When anesthesiologists are done with their training, many end up working for a hospital, but they also can choose to go into private practice. Both tracks could require different approaches to managing their student loan debt.

Anesthesiologist student loan debt

Undergraduates can take many steps to keep their student debt low, but med school students have fewer options. They aren’t able to work during medical school, for example, and the high cost of medical school is hard to save up for in advance. For these reasons, many anesthesiologists graduate with student debt in the multiple six-figures.

Some sources say the typical medical school debt amount is $200,000 for MDs or $300,000 for DOs. But those numbers may underestimate the actual amount of student loans that a physician could graduate with. The Student Loan Planner® team has worked individually with more than 600 physicians. These clients had an average of $331,000 in student debt.

Worse, pursuing the wrong repayment strategy can make paying the debt back even more expensive by tens or hundreds of thousands of dollars.

The best loan repayment strategy for an anesthesiologist

In our experience advising with nearly 4,000 clients on over $1 billion in student loans, we’ve found that anesthesiologists have three solid options to pay back their loans:

1. Pay off their loans aggressively with a goal of being debt free in 10 years or less. This approach could involve refinancing student loans if it would lower their interest rate and they could afford the payment. This plan could work for anesthesiologists in private practice with a low debt-to-income ratio.

2. Work for a nonprofit hospital, government employer or academic institution and go for Public Service Loan Forgiveness (PSLF).

3. Sign up for an income-driven repayment plan like PAYE or REPAYE, make payments based upon income for 20-25 years, then pay taxes on the forgiven balance. This could be another solid option for an anesthesiologist in private practice with a high debt-to-income ratio or for single physician-owned practices, but this option is the least used path for anesthesiologists.

With the first option, an anesthesiologist should throw every extra dollar they can find toward getting debt free. The remaining options are the exact opposite, pick an income-driven repayment plan that will keep payments as low as possible and maximize student loan forgiveness.

Pursuing a strategy somewhere in between or switching back and forth between repayment plans could be a needless waste of thousands of dollars. We’d rather anesthesiologists have a solid and clear plan so they can keep as much extra money in their pockets as possible.

To figure out which one of these options would be best for an anesthesiologist depends on their specific situation.

Private practice anesthesiologist income vs. hospital anesthesiologist income

It’s close to a 50/50 split between anesthesiologists who work for a private practice versus hospital and academic anesthesiologist positions. The pay is different too

The Medscape’s 2019 survey of 17,000 physicians found that those who work for an employer earned $369,000 on average while self-employed anesthesiologists earned $424,000, a $55,000 (15%) difference. Those numbers appear pretty accurate from what we’ve seen and heard here.

That increase in salary could really be meaningful in terms of lifestyle and loan repayment. But the private practice landscape is changing, according to Justin Harvey, founder of APM Wealth, an RIA focused on helping anesthesiologists.

Physician-owned private practice jobs can still be very good opportunities for anesthesiologists and they come with many of the benefits (and drawbacks) of business ownership. However, more and more physician-owned practices are being purchased by national corporate groups, sometimes resulting in a cut in pay and less autonomy for the anesthesiologists who work there.

When looking at physician-owned private practice jobs, it's important to factor in the financial solvency, business efficiency, and goodwill that the practice has with any hospitals or other sites of service. New anesthesiologists on a partner track often receive no upside if their group sells to another party — even if they've received a reduced salary for years as sweat equity for a buy-in — while equity-holding physicians will be compensated for their stake.

All that is to say, physician-owned private practice jobs can still be an excellent opportunity, but they come with additional risks that need to be considered.

Owning a practice can put an anesthesiologist in the driver’s seat in many ways. They can have autonomy, earn more money for the same patient load and build wealth within their practice.

Let’s explore some case studies on how anesthesiologists could pay back their loans when working for a private practice or for a PSLF-qualifying employer.

Case study: Private employer vs. nonprofit hospital

Let’s say, hypothetically, that Mina is an anesthesiologist who owes $350,000 in student loans with a 6.8% interest rate and she has two job opportunities. One is a nonprofit hospital with a salary of $360,000 and the other is with a private practice at $400,000. She’s been on REPAYE for her 4 years of residency.

Right now, she would be fine to work for either place. She likes the idea of PSLF but is also considering moving to the extended repayment plan to keep her payments low if she works for the private practice. She fears that if she stays on REPAYE, her payments will jump up due to her attending physician salary. She’s thinking about staying on REPAYE for PSLF with the nonprofit hospital though.

Let’s compare the numbers to see what that decision looks like from a purely financial perspective.

The extended repayment plan is expensive

First, we’ll take a look at her repayment options with a private job.

With the nearly 4,000 consults we’ve done, the extended plan is one of the worst options over 99% of the time. First of all, in our example with Mina, she’d pay a very high-interest loan back over 25 years. That lower monthly payment is affordable now but may prove to be very costly in the long run.

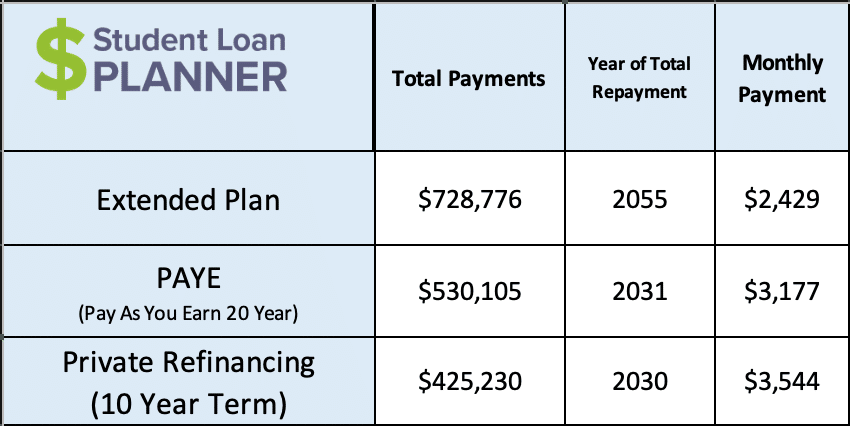

Let’s compare refinancing to a 10-year term with a 4% interest rate to the extended repayment plan, where she’d pay back a 6.8% loan over 25 years. Let’s also throw in the PAYE plan to make sure we’re covering all of our bases:

Refinancing is hands down the best option for Mina if she goes into private practice. Sometimes it’s challenging to see the big picture when fixated on the monthly payment. The monthly payment after refinancing is about $1,115 a month more than the extended plan, which can be somewhat intimidating on the surface. But let’s reframe the numbers here.

Refinancing would save Mina $303,546 as she’s paying back her loans. Instead of paying $2,429 per month for 25 whole years, she could pay $3,544 per month for 10 years and then have no more student loan payments.

PAYE isn’t much better either. Remember that the goal with this is to keep payments as low as possible and maximize forgiveness. The problem is that Mina’s income would be high compared to her debt. Because of that, her PAYE payments would be large enough that she’d actually end up paying off her loan in full in 11 more years. That would cost her $104,875 more than refinancing with marginally lower payments that would increase as her income grows each year.

Mina should budget an extra $1,115 per month to put toward student loans so she can refinance instead of going on the extended repayment plan. After seeing how much she’d save on her loan repayment, combined with the drastically higher income on the way, she is committed to using a portion of that high income to throw at her loans and committing to refinancing.

Anesthesiologist Public Service Loan Forgiveness

Now that we’ve narrowed down the repayment strategy to refinancing if our hypothetical Mina takes the private practice job, we can take a closer look at the job offers. Mina can now focus on comparing the job for which she’d refinance and the other where we’d explore PSLF vs refinancing.

Because Mina was making payments on REPAYE during residency, those four years of payments could count toward her 10 years of PSLF assuming she had direct loans and worked full time at a qualifying employer the entire time. In other words, she’d only have six more years of qualifying payments to get the balance of her student loans forgiven with PSLF.

PSLF and refinancing are very different approaches to loan repayment. Think of refinancing a 10-year term is just like a 10-year mortgage. You make the same payment each month, and the payments are based on paying off the entire loan with interest over that period of time. The payment is based upon how much debt is owed.

When we talk about PSLF, it’s the opposite. Because we have to select an income-driven repayment plan, the payment is not based upon the amount of debt. It is based solely upon income. Payments would go up or down with income.

Let’s focus on PAYE as the income-driven repayment plan we’d want to look at for Mina as she goes for PSLF. Payments are based upon 10% of discretionary income, as is REPAYE. But PAYE has other features and flexibility that could make it more appealing as she’s going for PSLF, including a cap on payments and also the ability to exclude a future spouse’s income from her payments.

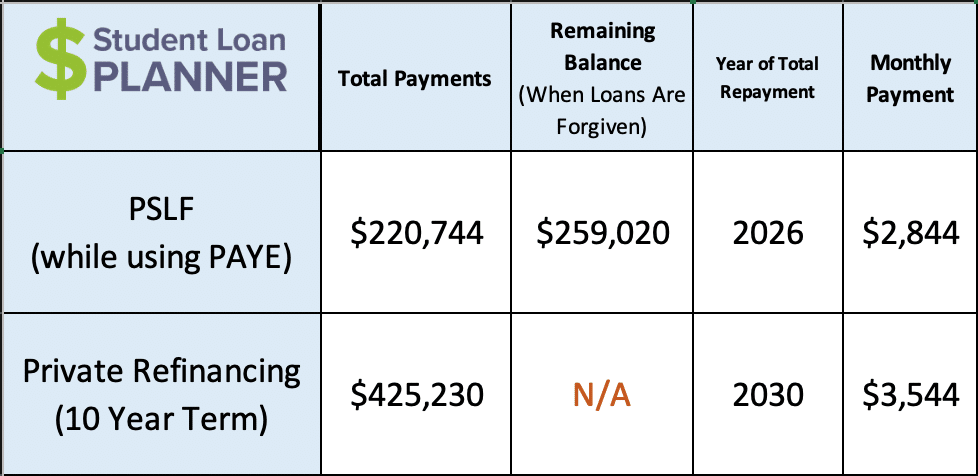

Let’s compare the numbers between PSLF using PAYE with the hospital job versus refinancing:

You can see by the chart that PSLF would end up saving her $204,486 and four years of paying back her loans versus refinancing with the private practice job. That’s a huge number. On the surface, it appears to be a no-brainer to go for PSLF, but that’s not the whole picture.

The difference in pay matters too. It’s an important calculation to compare the true benefit of PSLF with a lower-paying job versus refinancing if you have a higher-paying job.

Generally, the types of jobs that qualify for PSLF pay less. But if the PSLF job pays too much less, taking the job for PSLF purposes could end up being more costly in the long run. We have to break it down to see what amount of salary is worth it to give up the benefit.

Here’s how to choose between private practice and hospitals based on potential income

In our hypothetical example, PSLF would save Mina $204,486 over six years paying back her loans versus refinancing at 4%. That works out to an average savings of $34,081 a year for six years.

In other words, if she were to take the private job, she’d have to make an extra $34,081 in take-home pay so that she could cover the higher refinancing payments. That number would be her take-home pay (aka after-tax dollars), so she’d probably have to make around $50,000 more in salary to take home $34,000 after taxes.

The private job is offering her $40,000 more in salary ($400,000 vs. $360,000), which means that the PSLF-qualifying job is financially better after factoring in the benefit of PSLF in reducing how much it costs to pay back her loan. PSLF is like a $50,000 gross pay benefit on top of her $360,000 salary, which is greater than making $400,000 without PSLF.

The numbers are fairly close in the scheme of things, so Mina could go either way. And, even if she were to choose staying in a hospital job to complete the PSLF process, she could go into private practice afterward.

Anesthesiologists can get a solid student loan plan

This hypothetical example shows how to approach loan repayment and employment options, but every situation is unique. Spousal income, spousal student loans (or lack thereof), cost of living, private versus federal student loans, how far along into your career you are, and what repayment looked like so far all can come into play to design the ideal path to pay back student loans.

An anesthesiologist’s salary is pretty good, but is the student loan debt you accumulate to get there worth it? I would say so, but you have to be comfortable with it and know how to optimize loan repayment and make it a priority.

Whether you work for a private practice, a PSLF-qualifying hospital or another employment situation, the team at Student Loan Planner® can help you figure out the optimal path in just one hour. Plus, we include email support after the consultation to continue to answer your questions and help you implement the plan.

Our team can help anyone though, so feel free to choose the right consultant for you based on your individual circumstances. Here is more information about our process and how to sign up for a consultation.

Income & Student Debt by Profession

How you compare to other

accountants stats*

| Average student debt | |

| Average income | |

| Average Debt-to-Income Ratio |

Statistics represent the population of Student Loan Planner clients in the respective profession referenced in the chart from 2017-2023. Sample excludes those in school or in training.*

It should be clarified that a CRNA and anesthesiologist are two different jobs and the training varies significantly between the two. You refer to the theoretical anesthesiologist/CRNA going through residency and medical school, but they are not interchangeable professionally and in terms of student loan burden and income.

Hi Matt- great catch! Thanks for pointing this out. Updating the article now.