Looking to pay off your student loans faster? With our Student Loan Payoff Calculator, you can see how quickly you can be student debt-free!

This calculator also serves as a student loan extra-payment calculator, so you can see how long it will take to pay off your student loans by adding extra payments, refinancing your student loans, or doing both!

Student Loan Payoff Calculator

How much do you owe in student loans? Enter the total balance of all your student loans.

What is your current monthly payment? Enter your total combined monthly payment that you make now.

What is your interest rate?(%) Enter the weighted average interest rate of all of your current federal student loans.

If You Want to Pay Off Your Loans Faster

Extra payment amount Enter any extra payments in addition to your currently monthly payment. If you're not paying any extra, put "0".

Frequency of extra payment Enter how often you intend to make this extra payment.

Would you like to see what happens if you refinance? Select "Yes" if you’d like to consider refinancing your student loans at a lower interest rate. If not, select "No."

Interest rate you'd like to get by refinancing (%) Enter your desired interest rate if you're able to refinance your student loans. Note that this does not guarantee a rate. For currently available interest rates from lenders, see the table below.

Note: If the calculator displays “Your monthly payment is too small,” the current monthly payment value you've entered is too small and insufficient to fully repay the loan. Please try increasing the monthly payment amount.

Perks of paying off your student loans faster

Paying off your student loan debt as soon as possible can result in many benefits. Borrowers can save thousands of dollars in interest and free up funds to put toward your savings and retirement plan, for example.

Plus, you’ll lower your debt-to-income ratio, which can be important if you’re trying to buy a home or take out a business loan, not to mention the peace of mind you’ll get from not carrying around a massive amount of debt.

One way to get out of debt sooner, as you can see above, is student loan refinancing.

You can check to see if you could get a lower interest rate in minutes at a lender, like Earnest, below. Plus, you can get bonuses of hundreds of dollars for applying through Student Loan Planner®.

Savings in action

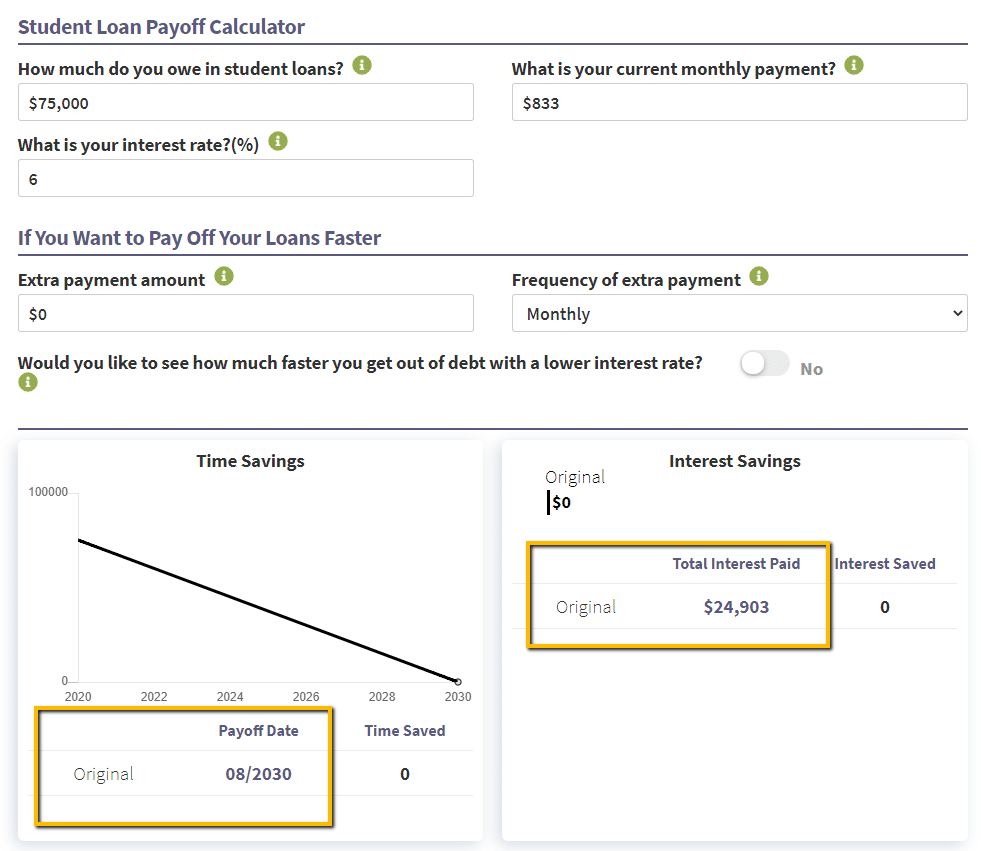

Let’s look at how paying your student loans off early can save you money. Pretend it's September 2020, you owe $75,000 (federal loans and/or private loans) at 6% with a 10-year standard repayment plan, and your required monthly student loan payment is $833.

Using the Student Loan Payoff Calculator, you can see it would take until August 2030 – a full 10 years – to pay off your student debt and result in an additional $24,903 in interest over the loan term.

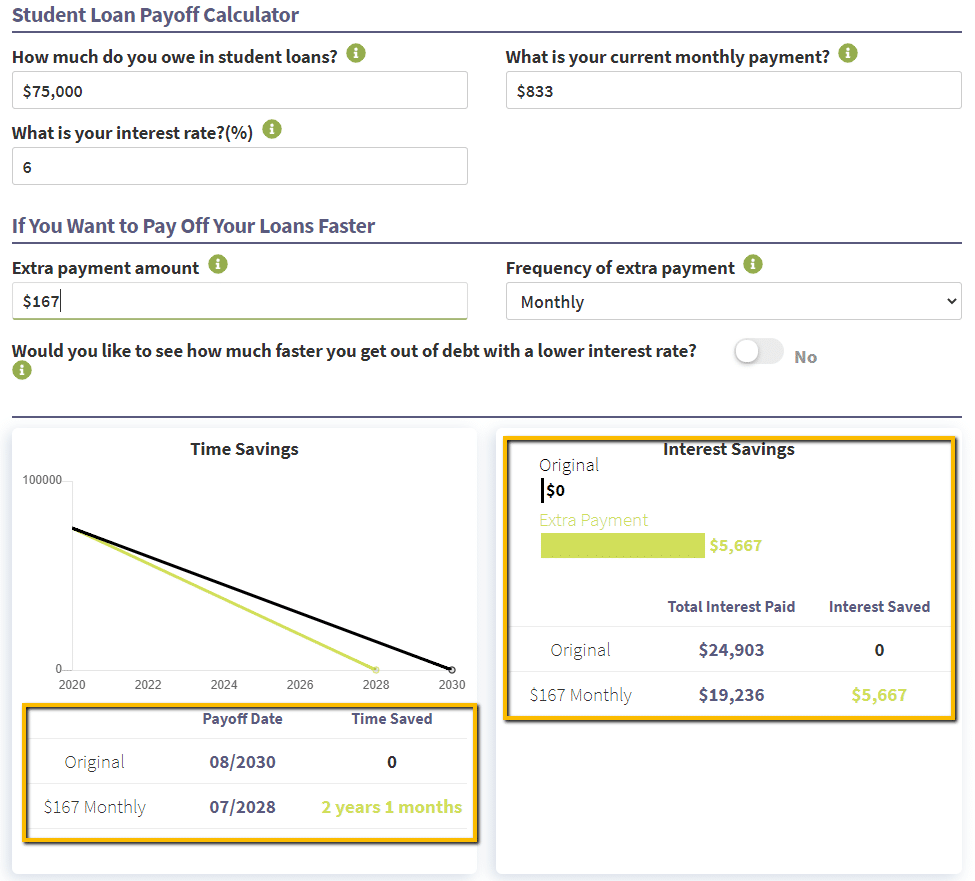

Now, let’s say you can afford to put an additional $167 toward your student loans to give you an even $1,000 payment each month. You’d pay off your debt two years early (in a total of 94 monthly student loan payments) and save about $5,677 in interest over the entire repayment term just by paying a little extra each month.

Refinancing can save you money

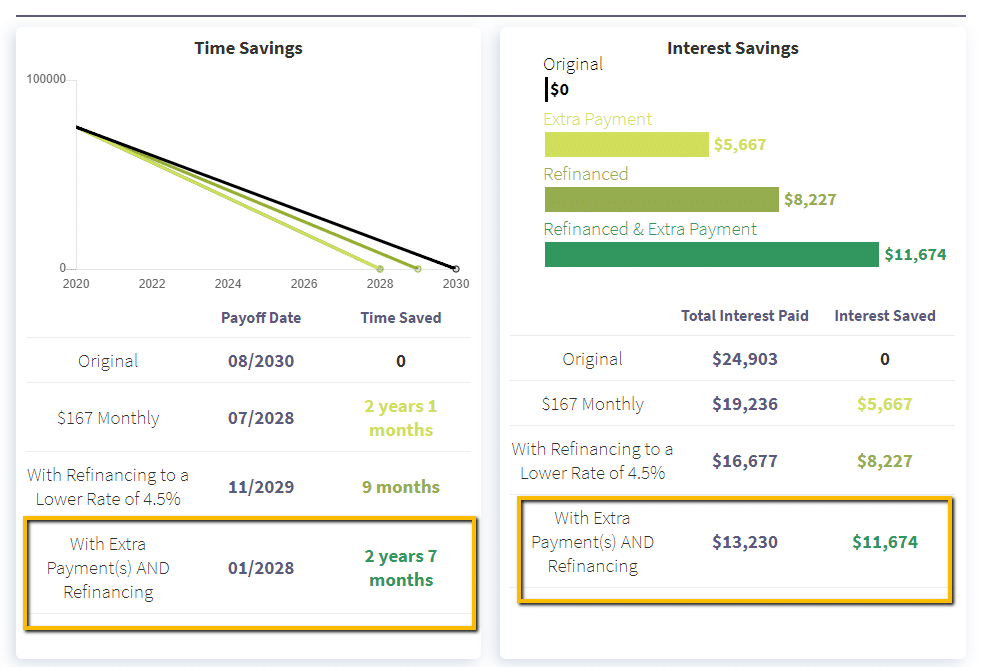

You could save even more by using this student loan calculator to estimate your savings from refinancing your student loans.

Using the same scenario, let’s say you’re able to refinance your $75,000 debt down to a new 4.5% interest rate and continue paying $1,000 each month.

You’d pay off your total debt within 88 months (or about seven years) and only pay a total amount of interest of $13,229. In that scenario, you’d yield a savings of $11,674 in interest over the life of the loan alone due to a lower refinancing rate and higher monthly loan payment.

Plug in your own student loan numbers and see how much you can save in different scenarios.

Using the Student Loan Payoff Calculator

The Student Loan Payoff Calculator makes a few assumptions, including:

- You’ve entered the correct data for your current amount owed, monthly minimum payment and interest rates.

- All of your student loans (federal and/or private student loans) are included in your choice to refinance.

- Any extra payment amount is applied equally across all of your loans.

- You make the same extra payment each month.

- You’re able to refinance at the rate you’ve entered.

- You’re using a weighted average interest rate for your student loans. A weighted average takes the principal balance of each loan into account, in addition to the interest rate. Here’s an example calculation:

1. Multiple each loan amount by its interest rate to get the “per-loan weight factor.”

Loan 1: $15,000 x 4% = 600

Loan 2: $20,000 x 7% = 1400

2. Add all per-loan weight factors.

600 + 1400 = 2000

3. Add all loan amounts together.

$15,000 + $20,000 = $35,000

4. Divide the total per-loan weight factor by the total loan amount. Then multiply by 100 to get the weighted average.

(2000 / 35,000) × 100 = 5.71428571%

5. Round to the nearest highest one-eighth of 1%.

Round up to 5.75%

This calculator is for informational purposes only. It should be used to estimate how much you may be able to save given different scenarios. It doesn’t guarantee any rates, repayment options, savings or other information.

Student loan payoff FAQs

When you’re exploring various ways to manage your debt payments and budget, it’s normal to have a lot of questions. Take one what-if or how-to question at a time and get the information you need to make an educated decision. Here are the answers to several frequently asked questions about paying off student loans.

If you've entered your actual monthly payment and you keep receiving this message, this is because your monthly payment is too small to repay the loan. When the monthly payment doesn't cover the accrued interest, your loan balance increases rather than decreases. This is called negative amortization.

To use this calculator in this situation, try increasing your monthly payment amount until the error clears. You may then test different extra payment amounts and see the total payment required by adding the monthly payment amount and extra payment values together.

Paying your student loans off early can save you money, but it may not be the best option for everyone. As a general rule, consider making extra payments if your debt-to-income (DTI) ratio is below 1.5 to 1.0 and you make at least $50,000 annually. If you owe more than 1.5 times your salary, you may benefit more by taking advantage of income-driven repayment plans (IDR) that offer loan forgiveness.

Yes. There is no prepayment penalty for federal or private student loans. But you could run into issues with being put into paid-ahead status if you’re on a federal student loan IDR plan.

Paid-ahead status can affect which payments are counted as qualified payments toward loan forgiveness. If you’re planning on making extra payments, contact your loan servicer directly to ensure your qualifying payments are applied correctly to your tally for your loan forgiveness application.

You can use many strategies to pay down your student loans faster. You can refinance your loans to a lower interest rate or make biweekly payments so that you’re making the equivalent of 13 monthly student loan payments in a year. Or you can pay as much extra money as you can each month by taking on a side hustle or cutting back on your expenses.

Related: 107 Ways to Pay Off Your Student Loans Faster.

The number of payments required to qualify for student loan forgiveness depends on your student loan repayment plan. If you’re pursuing Public Service Loan Forgiveness (PSLF), your remaining loan balance is forgiven tax-free after 120 qualifying monthly payments; whereas, IDR plans provide forgiveness after 20 to 25 years of qualifying payments.

If you want a private copy of our most powerful student loan calculator, enter your name and email below and we'll send it over to you so you can see how much money you could save.