The Biden Administration’s new student debt relief plan has unique benefits for registered nurses with undergraduate degrees. Many of these nurses didn’t derive much benefit from student loan forgiveness in the past. This is because their monthly payments on income-driven repayment plans (IDR) didn’t leave much of their balances left for forgiveness when they became eligible.

However, Biden’s new IDR plan lowers monthly payments for undergraduate borrowers. When combined with the Public Service Loan Forgiveness (PSLF) program available to most nurses, this new student loan repayment plan offers expanded access to loan forgiveness that was previously out of reach.

Read on to find out how to take advantage of this opportunity for yourself.

Biden’s new IDR plan

One aspect of the Biden Administration’s sweeping student loan relief package is a new IDR plan for federal student loans. In early January 2023, the Biden Administration announced the details of this new plan. It’s a modification of the existing REPAYE repayment plan, making it much more generous than all other IDR plans.

Under the New REPAYE plan, undergrad borrowers’ student loan payments are lowered from 10% of their discretionary income to 5%. Discretionary income was previously defined as taxable income above 150% of the poverty line, but now it’s taxable income above 225% of the poverty line.

Public Service Loan Forgiveness

Established in 2007, the PSLF program lets Direct Loan borrowers qualify for loan forgiveness after making 120 payments while working full-time for a qualifying nonprofit institution. Those payments must be made while on an IDR plan.

Although most nurses are employed by nonprofit hospitals, it was previously difficult for nurses with bachelor’s degrees to benefit from PSLF. After 10 years of repayment, IDR plans often leave little to nothing left to forgive. Nurses with graduate degrees have larger balances, so it has historically been easier for them to benefit from PSLF.

But now that payments are much lower on the New REPAYE plan, nurses with bachelor’s degrees can pay very little over ten years before getting their remaining balances forgiven.

Old REPAYE case study

Let’s use an example to illustrate why PSLF previously offered limited benefits to nurses with bachelor’s degrees.

Let’s say Paula has recently graduated with her BSN and has started a job at a nonprofit hospital making the average $56,000 starting salary for nurses with BSNs. Let’s assume she was a dependent student who earned her degree right after high school. That means she could borrow up to the aggregate federal student loan maximum for dependent undergraduate students, which is $31,000.

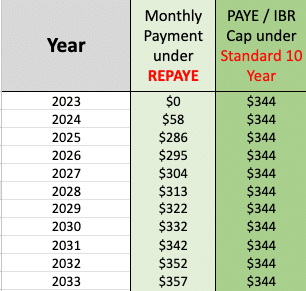

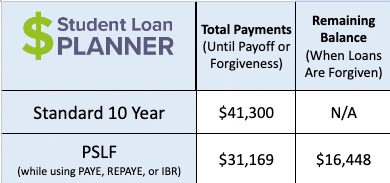

If she enrolls in the old REPAYE plan, her monthly payment would be based on her 2022 tax return. She was a full-time student and didn’t earn much income, so her payment would be $0 for the first year and would count toward the 120 required PSLF payments. This is why it’s important to file a tax return for the year before you graduate, even if you aren’t required to.

Her payment would eventually catch up to her income, and she’d owe about $300 a month. The payment would increase a little each year as she gets raises. After 10 years of working and making payments, she’ll have paid a total of $31,000 in monthly payments, and her remaining balance would be forgiven.

If she, instead, paid off her balance in 10 years, it would’ve required $344 a month from the very beginning, and her total out-of-pocket cost would have been $41,000.

PSLF would end up saving her $10,000 over 10 years, which is nice, but it might not be anything to write home about. If she got married before her loans were forgiven, her spouse’s income would cause her payment to increase, which would limit the benefits of PSLF even more.

New REPAYE case study

Now let’s see how things improve for Paula on Biden’s New REPAYE plan.

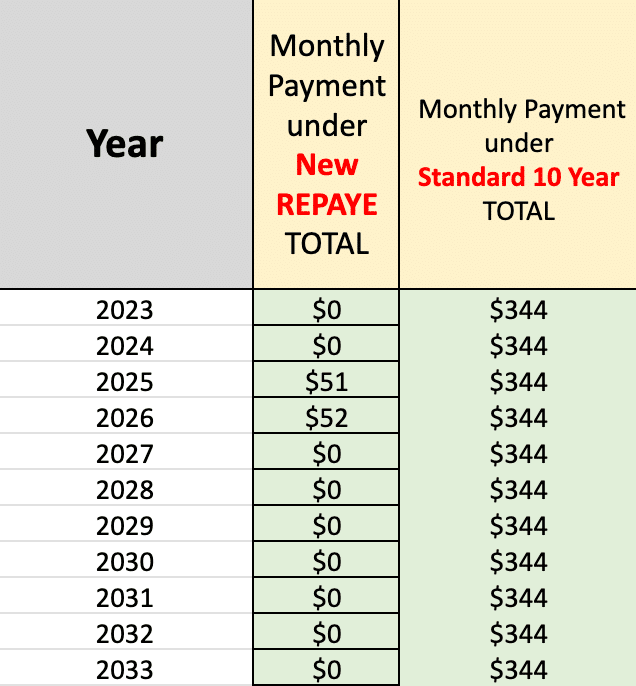

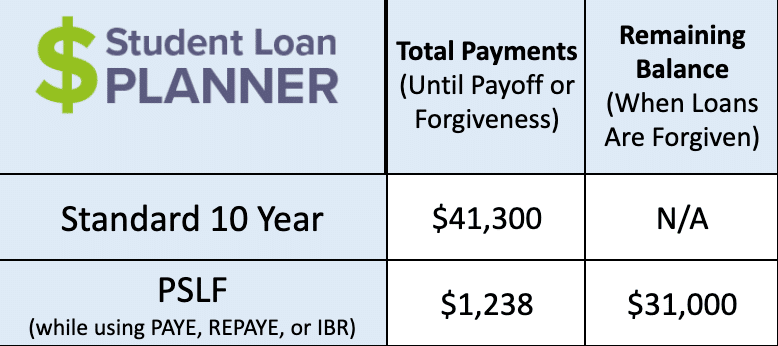

Just like Old REPAYE, her payments would start out at $0 a month. But once her payments catch up to her income, her payment would be only $90 a month, less than half of her $300 old REPAYE payment.

This is because of the larger poverty line deduction and the fact that she owes 5% of her discretionary income instead of 10%. She’d pay a total of $9,000 over 10 years before earning PSLF, saving her $32,000 compared to paying off her loans over 10 years.

Married while under new REPAYE

Let’s say she gets married in 2025 and has a child in 2027. She can file taxes as “married, filing separately” to exclude her spouse’s income, another added benefit of the New REPAYE plan.

If she contributes just $9,000 a year, 16% of her income, to her 403(b) at the hospital, her payment will drop to $0 in 2027. This coincides with her increased family size. That means she’d pay a total of $1,000, before her loans are forgiven.

For borrowers who make a lot more than they owe, the benefits of PSLF and other loan forgiveness programs have always been limited. Even though Paula earns $56,000 a year, compared to only $31,000 in student loan debt, she can pay very little to nothing back with the New REPAYE plan.

This is a real game-changer.

What if she decides to become a travel nurse to earn more per hour and have a more flexible work schedule? She would no longer qualify for PSLF, but she could still keep her $0 payments and earn IDR forgiveness after 20 years of payments.

In this case, her total monthly payments would still total $1,000, but IDR forgiveness allows her to work anywhere she wants to as long as she stays on REPAYE for 20 years.

Additional Benefits for Independent Students

If you meet at least one of the requirements to be considered an independent student, you can borrow more for your undergraduate program — up to $57,500. A lot of BSN students are independent students who are going back to school. This offers independent students a greater benefit under the New REPAYE plan and student loan forgiveness.

Borrowing Limits for Federal Student Loans

| Year | Dependent students | Independent students |

|---|---|---|

| First year undergrad | $5,500 | $9,500 |

| Second year undergrad | $6,500 | $10,500 |

| Third year+ undergrad | $7,500 | $12,500 |

| Aggregate loan limit | $31,000 | $57,500 |

Independent student case study

Let’s say Michelle is an LPN who wants to get her BSN part-time and become an RN to make more money and take on more responsibilities. If she’s smart about limiting the cost of her degree, she might be able to cover the entire cost of a degree with federal student loans.

For instance, she can choose a local public university —with a combination of online courses and in-person lessons — to minimize transportation costs. Let’s say she graduates with a balance of $57,500.

Michelle’s already married with one child, and she chooses to file taxes as married, filing separately, to exclude her husband’s income. Let’s assume she gets a raise from $40,000, a typical salary for an LPN, to $56,000 after moving into her new RN role. Let’s also assume that she contributes $9,000 of her $16,000 raise to her 403(b). She’s now saving a lot more money than she used to while also having more money to spend.

Her payment would be $0 on the New REPAYE plan. That’s right, after 10 years of PSLF qualifying payments, her loans would be forgiven after paying nothing toward them.

She basically earned a free nursing degree and all the benefits that come with it, courtesy of Uncle Sam and the Department of Education. On the flip side, if she paid off her loan balance over 10 years, she’d have paid a total of $77,000, including interest.

As a bonus, if we assume a 5% average annual return in her 403(b), she’d save over $100,000 by the time her loans are forgiven.

New REPAYE plan for nurses with undergraduate degrees

Student loan borrowers with higher debt-to-income ratios have historically benefitted from IDR plans and student loan forgiveness programs like PSLF. The new REPAYE calculation is more generous toward nursing undergrad borrowers with smaller debt balances.

With some savvy planning, you can reduce your payment to $0, pay nothing toward your loans, and get forgiveness after 10 years at a PSLF-qualifying hospital or 20 years working for any employer.

Subscribe to our email list for access to our specialized spreadsheet to run the numbers and see how this strategy might work for you. If you need help or have specific questions about the new REPAYE plan, schedule a meeting with a Student Loan Planner consultant.

Not sure what to do with your student loans?

Take our 11 question quiz to get a personalized recommendation for 2024 on whether you should pursue PSLF, Biden’s New IDR plan, or refinancing (including the one lender we think could give you the best rate).