Congratulations! You made it. You worked your tail off, crushed it in your summer internships, and graduated from law school near the top of your class.

After graduation, you got that highly coveted offer from a “big law” firm and are about to make an awesome income. Sure, you have a grueling work schedule ahead of you, but you’re being compensated nicely for it with tremendous upside on your income during your career.

Oh, I forgot to mention: You were expected to pay sky-high tuition rates for your law school program and you took out six figures of student loans to make it happen. For many law school graduates who will be paying off law school debt on a “big law” salary, this could be totally worth it.

But how do former law students take that awesome income to pay back their student loans while also practicing self-care and dealing with the long workweeks? Let’s look at this from a higher level first and examine the best ways we’ve found to attack student loans. This comes from our one-on-one work with hundreds of lawyers with student loan debt.

Average student debt and salary for “big law” attorneys

According to the most recent data from the National Center for Education Statistics (NCES), the average law school debt is $145,500. And a 2021 survey by the American Bar Association found that 9 out of 10 young lawyers had $130,000 or more in student loans.

That's the bad news. But the good news is that lawyers also typically earn solid incomes. The Bureau of Labor Statistics says that the median pay for all attorneys in 2022 was $135,740. But “big law” attorneys could earn far more. Here's a look at what lawyers earn at most firms in the major U.S. cities:

| Salary | Bonus | Total salary | |

|---|---|---|---|

| 1st | $215,000 | $20,000 | $235,000 |

| 2nd | $225,000 | $30,000 | $255,000 |

| 3rd | $250,000 | $57,500 | $307,500 |

| 4th | $295,000 | $75,000 | $370,000 |

| 5th | $345,000 | $90,000 | $435,000 |

| 6th | $370,000 | $105,000 | $475,000 |

| 7th | $400,000 | $115,000 | $515,000 |

| 8th | $415,000 | $115,000 | $530,000 |

That’s an amazing income trajectory for first-year associates! But it's also why an income-driven loan repayment program won’t typically work on a “big law” salary scale (more on that later).

Income & Student Debt by Profession

How you compare to other

accountants stats*

| Average student debt | |

| Average income | |

| Average Debt-to-Income Ratio |

Statistics represent the population of Student Loan Planner clients in the respective profession referenced in the chart from 2017-2023. Sample excludes those in school or in training.*

Best strategies for paying off law school debt on a “big law” salary

Working for a private sector “big law” company automatically disqualifies lawyers from pursuing Public Service Loan Forgiveness. And their high salaries will make it difficult to qualify for other federal loan forgiveness programs or loan repayment assistance programs.

With that in mind, there are essentially two ways to attack student loans as a young lawyer. We briefly explain both strategies below.

1. Taxable loan forgiveness using an income-driven repayment plan for federal loans

This could be a viable option for new lawyers who owe more than two times their income in student loans (e.g., owing $200,000 and earning $100,000 or less). In this situation, selecting an income-driven repayment (IDR) plan — like Pay As You Earn (PAYE) or Revised Pay As You Earn (REPAYE) — could be the best option.

In the end, the remaining loan balance is forgiven, though taxes will be owed on the forgiven amount. The idea is to keep student loan monthly payments as low as possible, save up for the potential tax bomb and work toward other financial goals along the way.

2. Aggressive repayment with refinancing to get a lower interest rate

This usually applies to lawyers in “big law”. If a lawyer owes 1.5 times their income in student loans or less (e.g., owes $225,000 and makes $150,000 or more), their best bet could be to pay off the debt as quickly as they can.

The goal is to pay as little interest as possible and to eliminate the debt in 10 years or less — hopefully much less so you can move on with your life without student loans. This may also include applying for student loan refinancing to get a lower interest rate.

Note that borrowers with low credit scores may not be able to qualify for a better rate. Also, refinancing federal student loans with a private lender will cause you to lose out on a variety of benefits such as the ability to join income-driven repayment plans. But, as we explain next, that might not be as big of a deal for “big law” attorneys as it can be for other student loan borrowers.

Why most “big law” attorneys won’t benefit from income-driven repayment

Let me show you why attorneys often end up spending a ton more in the long run if they choose income-driven repayment for paying off their law school debt on a “big law” salary.

First, let’s assume that an attorney is compensated according to The BigLaw Investor’s salary scale shown above. Here’s why it's hard to save with income-driven repayment when you're on a rapidly-accelerating income path.

The goal of using these income driven plans — which include PAYE, REPAYE, Income-Based Repayment (IBR) and Income-Contingent Repayment (ICR) — is to keep payments low for 20 to 25 years, have a bunch forgiven and then pay taxes on the forgiven balance.

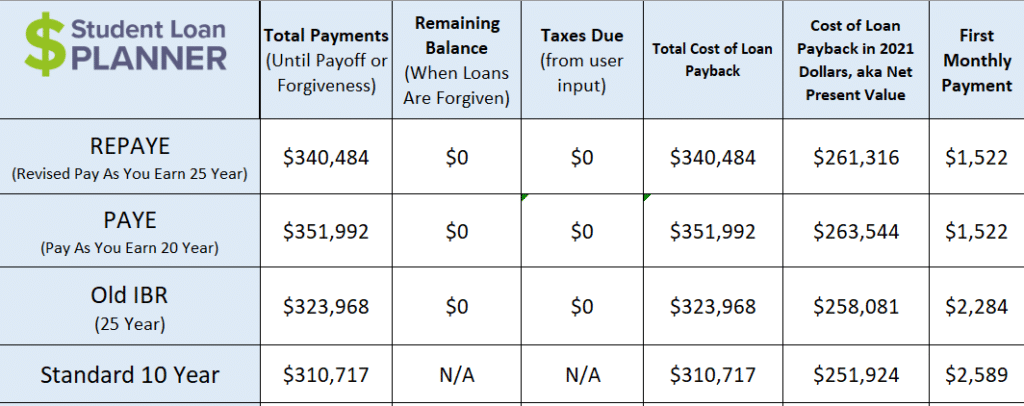

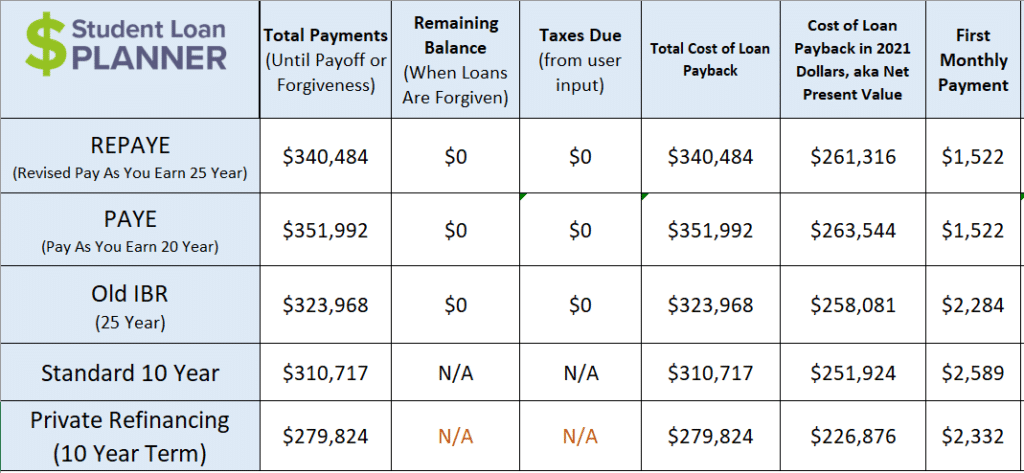

For example, let’s say Monique has $225,000 in student loans at 6.8% interest. She was just hired as a first-year associate by a “big law” firm and is projected to make the “big law” salary shown above.

Let’s see how the IDR plans — IBR, REPAYE and PAYE — would work for her:

As you can see from the table, Monique’s income would be so high compared to the loan balance that she would end up paying off her loans in full well before any taxable loan forgiveness would be reached — within 12 to 15 years. This would be highly inefficient because she’d end up paying a 6.8% loan (high interest rate) over too long a time (more than 10 years).

Monique would be best served with aggressive repayment in combination with refinancing to get her interest rate down from 6.8%. What would repayment look like if she refinanced the loan to 4.5% and paid off the loan in 10 years?

Wow! She’d save $30,000 to $70,000! That savings is entirely made up of interest. Wouldn’t you rather keep that money than pay it in interest?

How to save on law school student loan repayment

Refinancing might be the best long-term strategy for paying off law school debt on a Big Law salary. But how can you do it if you haven’t started working and don’t have the income history to refinance without needing a cosigner?

Let’s talk about REPAYE for a moment. This payment plan could help bridge the gap and save some money.

REPAYE is an IDR plan with payments of up to 10% of your discretionary income. These payments would go for up to 25 years. Whatever loans are remaining after 25 years would be forgiven, and the person with the student loans would pay taxes on the forgiven balance.

How the REPAYE interest subsidy works

So why am I talking about REPAYE? The sizable benefit to a Big Law attorney is that REPAYE provides an interest subsidy. Let’s go back to Monique to see how it works.

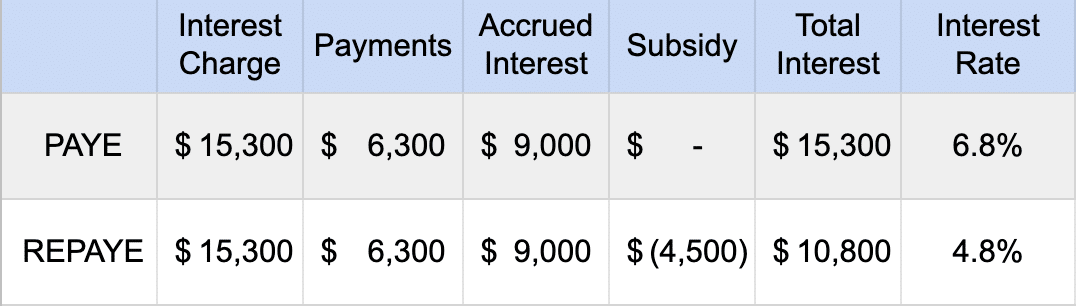

She has a job lined up that will pay her $190,000, but she doesn’t start work for another month. If you remember, she has $225,000 in loans at 6.8%. That means that $15,300 in interest will be charged on her loan each year: $225,000 x 6.8% = $15,300

The REPAYE interest subsidy will wipe away half of any interest not covered by Monique’s payments. Let’s say her payments for the year are $6,300. If she were on PAYE, the interest that would accrue would be $15,300 – $6,300 = $9,000.

The REPAYE subsidy cuts that in half. So, if $9,000 were to accrue on the loan with PAYE, then the government would wipe away $4,500 of that on REPAYE. That makes the interest on her loan go down from $15,300 to $10,800.

Sounds good right?

Getting a $0 payment on REPAYE

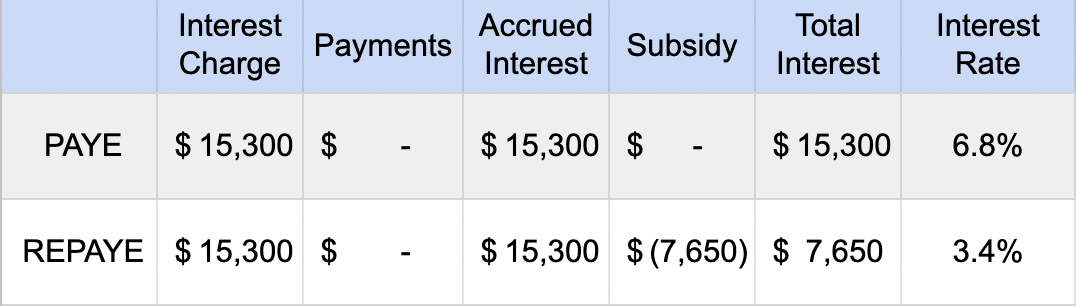

OK, here’s an advanced REPAYE trick: Monique hasn’t started working yet, and her loans are in the grace period. If she consolidates her loans in order to waive the grace period and start on REPAYE before working, her payments would be $0 because her income is $0.

Since there are no payments to offset interest, the interest subsidy would be half of the entire $15,300 (or $7,650). That effectively cuts her interest rate for the year down from 6.8% to 3.4%.

This would defeat the purpose of refinancing for this first year. However, Monique would still want to be aggressive in paying down her loans.

Let’s say she pays $3,000 per month toward her loans, even though her required payment is $0. That’s $36,000 in payments for the year.

The benefit is that those extra payments won’t affect the interest subsidy. Using the interest subsidy, she’d pay down $28,350 of principal. Without the REPAYE subsidy, she’d only pay down $20,700 in principal — a huge difference.

This will only work for one year, though. That’s because when she recertifies her income, her payments could be high enough that the interest subsidy virtually goes away since her recalculated income-driven payments would be high enough to cover the interest and pay down some principal.

So, after that first year, refinancing could make a lot of sense. She’d have less than $200,000 in student debt and a full year on $190,000 salary. The chances of refinancing to get a great rate are even better.

Paying off law school debt on a “big law” salary scale after year one

Let’s say Monique was able to refinance $200,000 of student loans from 6.8% down to 4.5% after her first year. She’ll save more money the faster she pays off these loans. If she sticks with the $3,000 per month, it will take her another five years to pay off the loans in addition to the first year.

But she could do even better by taking advantage of her raises and bonuses. Provided that she's not counting on this money to help cover required expenses, a large portion of it can go towards reaching financial goals. But how much of her bonuses and raises should Monique allocate towards making extra principal-only student loan payments?

I personally use a 50-50 rule. This helps split any increase in income between increased spending and setting aside more money to reach financial goals. So Monique would take at least half of any increase in salary and bonuses and throw it at her loans in addition to her current payment. And she can live it up with whatever is left over.

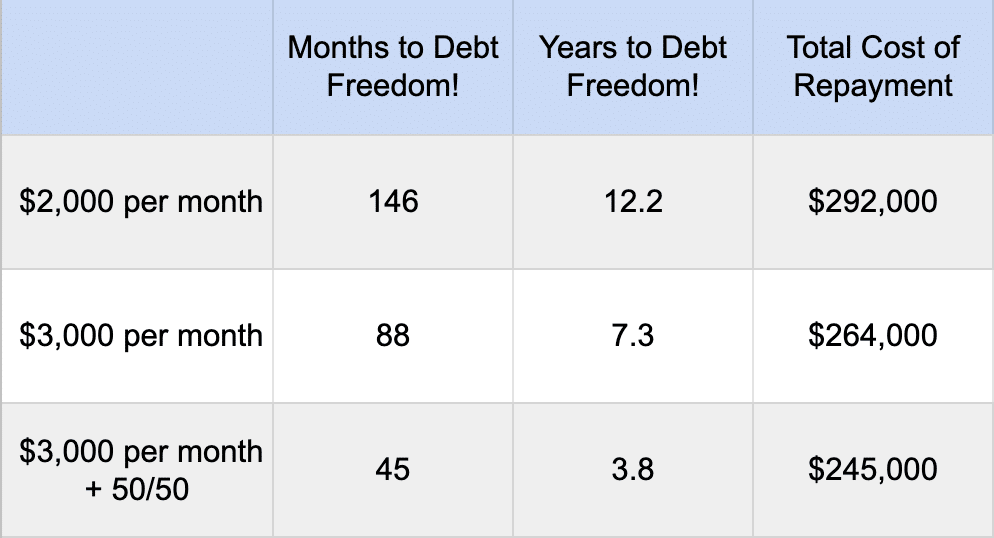

Let’s compare three strategies: 1) paying $2,000 per month, 2) paying $3,000 per month and 3) paying $3,000 while using the 50-50 rule.

As you can see, “big law” attorneys would be best served to take care of the debt as quickly as possible. They can use their annual salary increases and bonus structures to make it happen.

The goal should be student-debt freedom in five years or less. The 50-50 rule will allow you have the money to decompress after the grueling workweeks while ridding yourself of the student loan burden in the most efficient and fastest way possible.

Next steps for “big law” attorneys with law school loans

We’ve worked individually with more than 5,000 student loan borrowers with over $1 billion in combined debt.

Some are married while some are single. And some are planning to stay in “big law” while others are thinking of exiting at some point. The student loan plan would be different depending on your personal circumstances.

If you’d like to have a plan for your specific situation, learn more about getting a customized plan for your student loans. And if you know you want to refinance and attack these loans, see if you can lower your interest rate and get a cash-back bonus on our refi page.

Income & Student Debt by Profession

How you compare to other

accountants stats*

| Average student debt | |

| Average income | |

| Average Debt-to-Income Ratio |

Statistics represent the population of Student Loan Planner clients in the respective profession referenced in the chart from 2017-2023. Sample excludes those in school or in training.*