Unless you’re Thor, you’re probably going to need medical care at some point. In the next 13 years, the United States will see a physician shortage of nearly 122,000, according to the Association of American Medical Colleges (AAMC) annual report. The projected doctor shortage should be concerning for both patients and physicians.

Do people not want to become doctors anymore? The AAMC says it’s not that. In fact, enrollment and applications to medical school have increased. The predictions of a doctor shortage have everything to do with the United State’s changing demographics.

What’s the deal with the doctor shortage?

The nation's population is growing and aging all at the same time. With Americans expected to live even longer, the demand for health-care professionals is all too real.

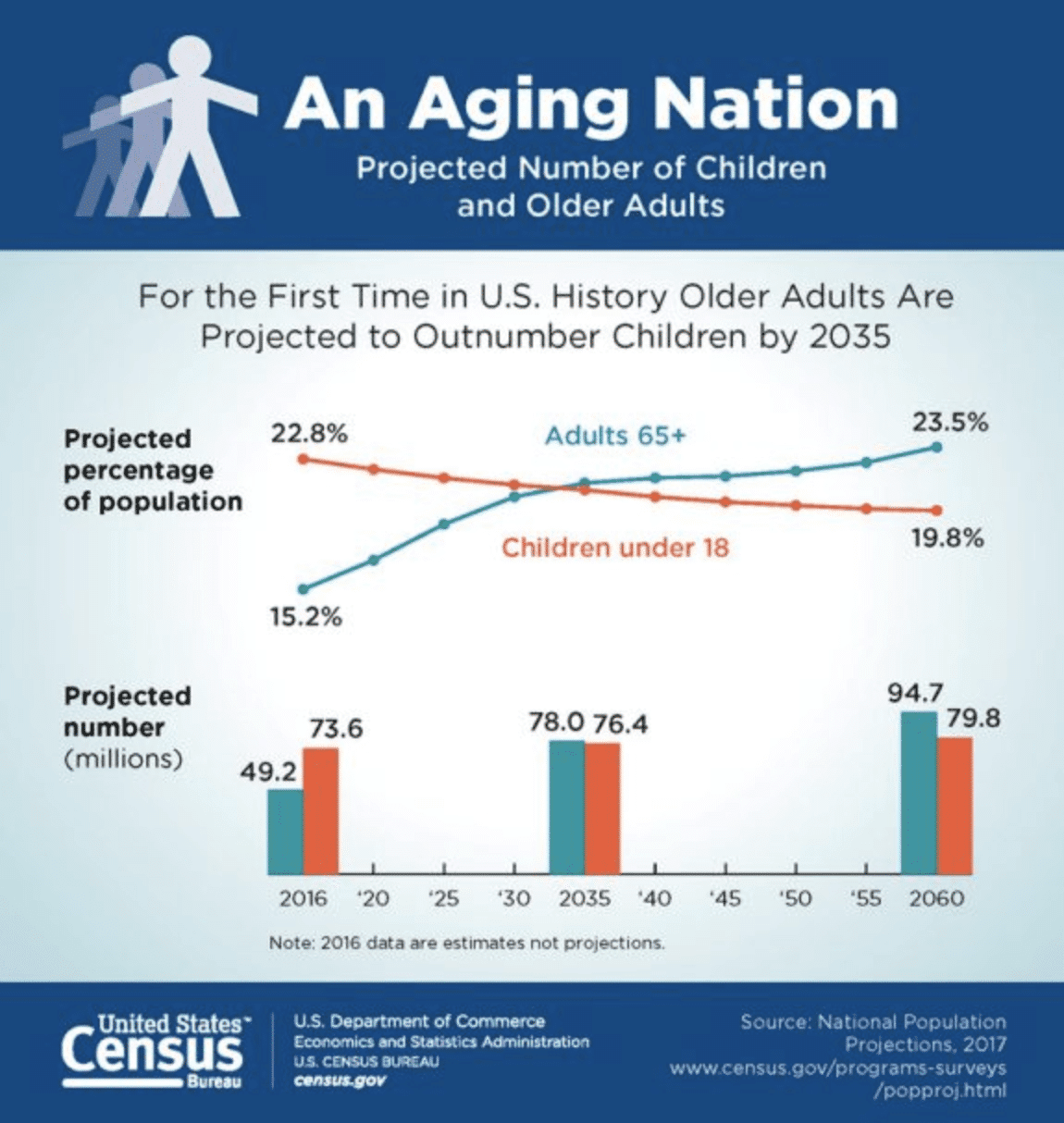

The U.S. Census Bureau projects that the nation’s population will grow by 1.8 million every year between 2017 and 2060. This isn’t shocking news. What’s changing for the U.S. is an aging population that outnumbers the younger generation. By 2060, nearly one in four Americans will be 65 or older, and the number of 85-plus-year-old individuals will triple. An aging population like this means there will be a high demand for doctors over the next several years.

Source: U.S. Census Bureau

Not only will doctors be needed, but they’re also aging out, causing a gap in available physicians. The AACM states, “… the aging population will affect physician supply since one-third of all currently active doctors will be older than 65 in the next decade. When these physicians decide to retire could have the greatest impact on supply.”

Specialists also face doctor shortage

There’s an especially large gap for primary care physicians. The AAMC projects the shortage will be between 21,100 and 55,200 primary care physicians by 2032. But this isn't the only need for medical professionals. There’s also a predicted shortage among medical specialists and surgical specialists, too.

Rural communities will feel this the most, but over time, the shortage will be felt everywhere. The U.S. will be in serious need of doctors. Unfortunately, there are funding roadblocks in the way of increasing the output of doctors.

The doctor shortage is in part due to funding

There’s a barrier when it comes to training more doctors and filling the demand: The Medicare funding cap placed on hospitals limits how many doctors they can train.

Many post-graduate programs are sponsored by Medicare, Medicaid, the Department of Veterans Affairs, the Department of Defense, and sundry other governmental agencies. The Balanced Budget Act (BBA) of 1997 and 1999 is what limited the funding. Hospitals aren’t able to put out as many doctors in the region as needed for adequate care. Congress will need to change this.

Because this all feels so far away, it seems like Congress still has time to act. This is true, but they need to act now. The doctor shortage can be addressed in one way — by training a few thousand more doctors every year. The only problem is that it takes years for doctors to be ready to treat patients and fill the need. Medical school takes at least seven years to get through. Some specialties need even more training, adding on the years.

Medicaid funding isn’t the only roadblock to the doctor shortage. It’s going to be a serious problem if it’s not addressed from multiple angles. Thankfully, we’re seeing programs popping up everywhere. One of them includes ways to reduce or eliminate student loan debt for doctors.

Tackling the doctor shortage by looking at student debt

One major area of focus is student loan debt. It’s known that health-care professionals are slammed with high tuition costs. A primary care physician easily walk out of school with six figures of student loan debt. As you can imagine, this can be a major turn-off to those pursuing a career.

Loan forgiveness options that can impact the doctor shortage

Student loan debt can deter students from going to medical school. To help relieve this burden, there are loan forgiveness programs accessible to doctors.

Rural student loan forgiveness programs for doctors are available to address the primary care physician shortage. The Health Resources and Services Administration (HRSA) houses a program called the National Health Service Corps (NHSC), which identifies areas of need. If you agree to work in these areas, you can be eligible for various loan repayment programs.

Many physicians are also counting on the Public Service Loan Forgiveness (PSLF) program. If you work for a nonprofit or government employer, you could be eligible for PSLF. This program erases your entire remaining student loan balance after 120 qualifying payments. The forgiveness and affordable payments come as a huge relief for primary care physicians, whose starting salary in residency can be between $50,000 and $60,000.

Specific states also have loan forgiveness programs available to doctors. Most recently, California made the news for enacting a budget that would help pay off student loans for doctors and dentists. Applicants must agree to have 30% of their caseload be Medi-Cal patients.

The Los Angeles Times reports, “California will spend $340 million paying off doctors’ debts using Proposition 56 tobacco tax revenue. This month, the state offered its first awards — 40 dentists received $10.5 million in debt relief while 247 physicians received $58.6 million.”

Loan forgiveness is only effective for those doctors already out there working. There are some universities that are working on addressing student loan debt before it becomes as issue.

Free medical school tuition to bring in more doctors

To encourage more individuals to pursue medical school, certain universities are removing one major barrier: the cost. The following universities offer free medical school tuition:

- New York University School of Medicine: All new and current medical students starting in 2018 will have their yearly tuition costs covered by a scholarship of $55,018. The NYU School of Medicine launched this effort in hopes that it would address the issues of crushing medical student loan debt and open up the doors to a more diverse group of doctors.

- Washington University School of Medicine in St. Louis: The class of 2019-2020 will have the opportunity to attend tuition-free. The school committed $100 million over the next decade to provide scholarships for future medical students; an estimated half of them will be able to attend tuition-free.

- University of Houston College of Medicine: The school was given an anonymous $3 million dollars to fund medical school for 30 students, tuition-free. The UH College of Medicine aims to have at least 50% of every graduating class specialize in primary care.

Even private medical schools are working on reducing student loan debt for students. Kaiser Permanente is opening a new accredited medical school in the summer of 2020. It’s offering free tuition for the first five graduating classes.

There are a surprising number of scholarships available for doctors outside of schools as well. The funding for students is out there, but whether it will be enough to get doctors into the workforce is hard to tell.

Will this be enough to curb the doctor shortage?

It’s difficult to say if all these efforts will really help with the doctor shortage since the demand will be so high. One thing is for sure: Increased funding is needed for hospitals and universities.

A bill called the Resident Physician Shortage Reduction Act of 2019 was introduced this year to address the physician shortage. It asks for increased Medicare support for an additional 3,000 new residency positions each year over the next five years. The AAMC is backing this bill and urging Congress to remove the freeze on residency funding.

You can be sure that wherever you’re at with your medical career, you’ll be in high demand over the next several years. Know that there are ways to pay for medical school so you’re not strapped with six figures of student loan debt.

If you want to talk to a professional about paying for medical school or paying off student loan debt, the team at Student Loan Planner® is here to help. Schedule a consultation today.

Comments are closed.