When boarding a plane, you sometimes get a glimpse of the crisp uniforms worn by the captain and co-pilot of your flight. Inside the cockpit, there are what appear to be hundreds of buttons and knobs with no recognizable pattern to the common passenger.

Occasionally, due to weather conditions, you might experience turbulence mid-air. When windy conditions cause a bumpy landing, you sometimes find yourself (along with everyone else on board) expressing your gratitude for arriving safely with a soft clap for the captain. Inwardly, you are probably glad that it’s not your job to ensure 400+ passengers arrive at their destination, on-schedule.

But what if it were your job? What does it take to become a pilot?

If you want to achieve a Bachelor’s degree, the path to get into and pay for college is helped along by high school counselors, education consultants, and your college’s financial aid office.

The path to becoming an airline pilot, however, isn’t widely discussed. Flight training also doesn’t cost any less than traditional higher education. According to The College Board, the average four-year private university cost of attendance is just over $38,000 a year. Compare that to the almost $88,000 cost of flight school and 1500 hours of flight training and hands-on experience to become an airline pilot.

Typical wages for airline pilots

According to the Bureau of Labor Statistics, median wage for airline pilots in 2020 was $93,300. Of course, there’s a range of incomes for airline pilots, from $28,000 into the few hundred thousands. It depends on:

- Aircraft flown,

- Regional vs. major airlines, and

- Experience level.

Paying for flight school: Finding funds for airline pilot training

Not all flight school students have the savings to pay for enrollment in full upfront. Before enrolling in an aviation program or flight school, it’s important to fully understand your flight training financing options.

Federal student loans and Pell Grants are available if you’re pursuing a Bachelor’s degree in Aviation through an accredited university or accredited flight school (such as the Aviator College of Aeronautical Science and Technology or the National Aviation Academy). Here are some types of federal student loan options you could receive for flight school:

- Direct Subsidized Loan. A need-based loan where the Department of Education pays the interest accrual while you’re in school and during your six-month grace period immediately following graduation.

- Direct Unsubsidized Loan. A non need-based loan where you’re responsible for paying all of the interest, and the interest accrues while you’re in school.

- Direct Parent PLUS Loan. Parents and students can help cover the cost of a pilot training program through this non need-based loan. It can cover up to the cost of attendance.

However, the most common way to finance flight school is through a private lender or through tuition reimbursement programs offered through commercial airlines.

Airline Transport Professionals (ATP) and Phoenix East Aviation are industry leading flight schools and have developed close relationships with a variety of private lenders, including Sallie Mae, SunTrust, and Meritize to provide loans for students enrolled in their flight programs.

Many airlines also offer reimbursement programs — as affiliates and partners of flight schools — for pilots who complete their training and sign-on to work with them. Below are a few airlines that offer flight school reimbursement through their flight school affiliations:

- Delta Airlines

- Alaska Airlines

- American Airlines

- United Airlines

United Airlines, in 2020, took a unique step for airlines and purchased a flight school (branded the United Aviate Academy) to have more direction over recruitment, development, and training.

Get Started With Our New IDR Calculator

Repayment options for borrowers with flight school debt

Depending on the loan types you chose to fund your flight school training, your repayment options and terms can vary.

Private Loans

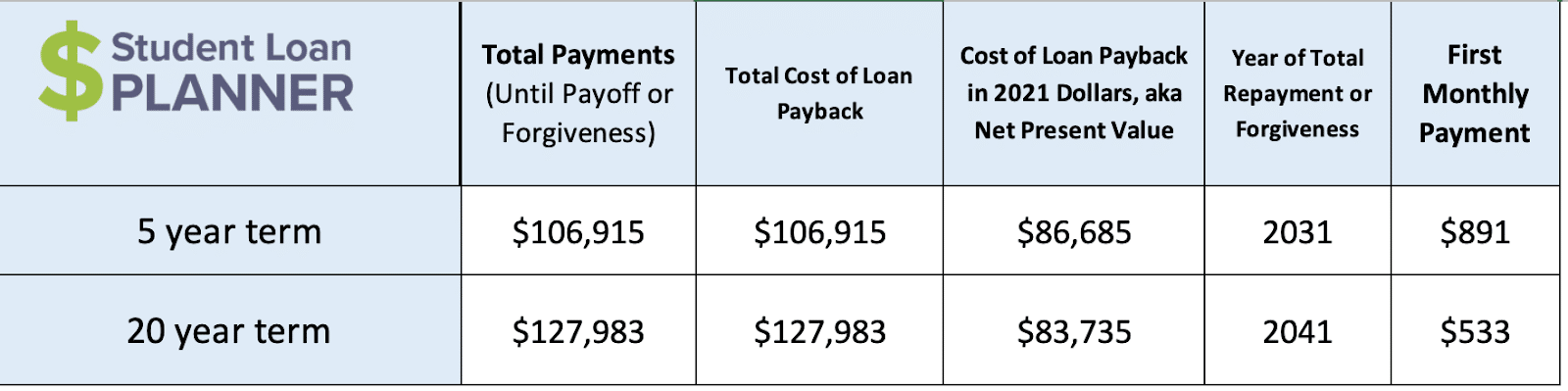

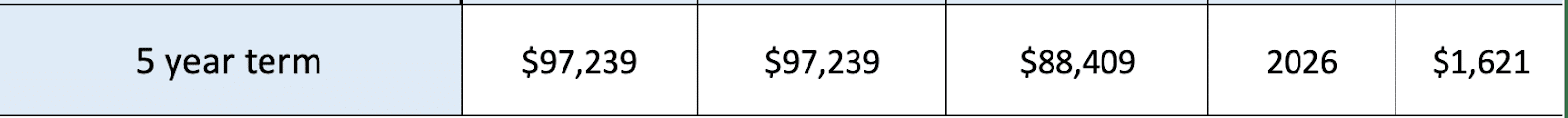

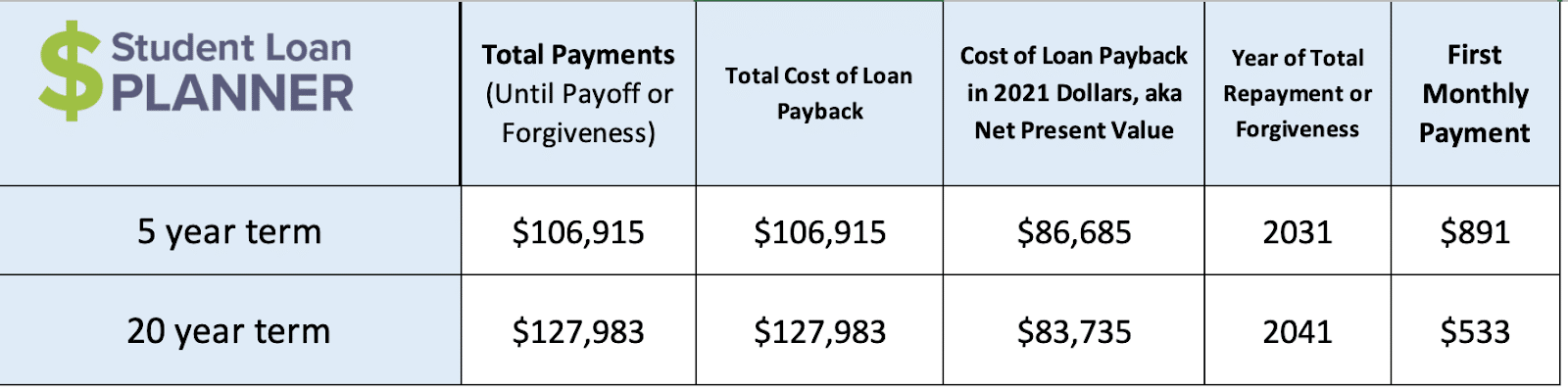

If you have $88,000 in private student loans to figure out on a $93,000 salary, then you have two options on the periphery to consider.

- Option 1: Pay as little as you can and save aggressively instead.

- Option 2: Aggressive payback.

Let’s take a look at the experience of paying back the owed amount of $88,000 using a fixed 4% interest rate over two repayment periods — five years to represent Option 1 and 20 years to represent Option 2.

When you pay a loan to zero, you’ll always pay back what you owe, plus interest. When comparing the five-year loan to the 20-year loan, the amount of interest paid is about $21,000 less for the shorter term. On top of that, you’ll avoid an additional 15 years of agonizing payments.

With a 20-year term, your monthly payment would seem much more palatable. And if you took the difference between the two monthly payments ($1,088) and invested it in a brokerage account for the 20 years it takes to pay the loan off, you’d have just over $449,000.

For fairness, let’s assume that after paying down the five-year loan, you devoted $1,621 per month to a brokerage account — this time, for 15 years. In that account, you’d have just over $435,000.

Left to interpretation, it would seem that the longer loan wins, provided that the assumptions of continued savings and same average return are dually experienced. Unfortunately, it’s not that simple.

The example illustrates two paths that end up at relatively the same point in the future. It’s up to you to decide which path is right for you.

You might find it helpful to frame the decision through a comparison of how you feel about:

- The certainty of loss (through the fixed interest rate of the student loan) and the chance to outearn the loss in a brokerage account, and

- The experience of having student debt obligations for five years versus 20 years.

Scholarships

Scholarships can also be a great way to get a head start on paying for part (or all) of your flight school expenses. Check out the following resources for funding opportunities:

- Flightscholaship.info

- Federal Aviation Administration Scholarships

- AOPA Foundation Scholarship Program

- The Amelia Earhart Memorial Scholarships

- Boeing Scholarships

The past, present, and future of airline pilots

In 2011, there were 142,511 airline pilots, according to the Federal Aviation Administration. The number of airline pilots in the industry has grown steadily and today, the number of airline pilots has reached 164,193.

Still, there’s a shortage in airline pilots, due to large numbers of tenured pilots retiring amid the COVID-19 pandemic and a surge in travel demand, recently.

And Boeing expects that over the next 20 years, an additional 2.1 million personnel will be required (612,000 airline pilots among them) to fly and maintain the global commercial fleet.

Airline Pilots have student debt like many other professions

Don’t let the high price tag of aviation school deter you from pursuing a career in the clouds. And if you have a seemingly insurmountable pile of student loans from flight school, we can help you plan a manageable strategy in a short amount of time. Find your optimal repayment path in just one hour with a consultation.

Look for opportunities to help you put your best financial foot forward!

Not sure what to do with your student loans?

Take our 11 question quiz to get a personalized recommendation for 2024 on whether you should pursue PSLF, Biden’s New IDR plan, or refinancing (including the one lender we think could give you the best rate).