An income-driven repayment (IDR) plan is one of the benefits of federal student loans. These repayment plans can make it affordable to begin the process of paying off your student loans. They can also keep you eligible for student loan forgiveness programs.

IDR repayment plans set your monthly payment based on a percentage of your income. For this reason, you’re required to recertify your income information every year.

Your repayment options under the IDR plan

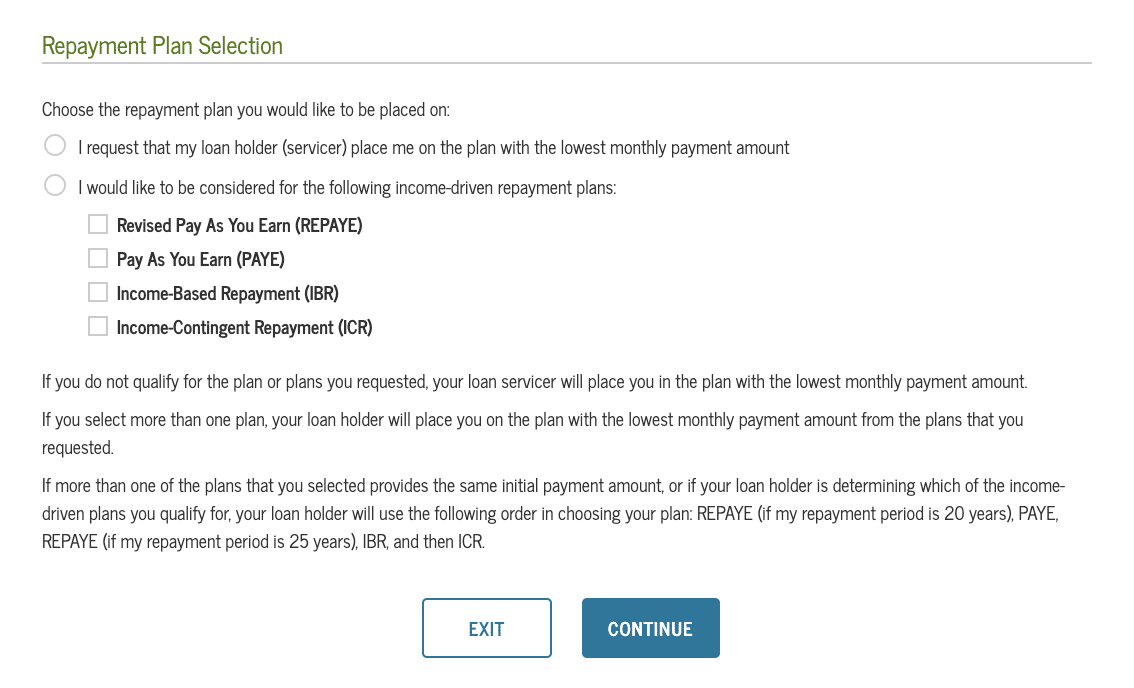

If you’re certifying under the IDR plan for the first time, you’ll want to be clear on your repayment plan options. IDR is an umbrella term that houses four types of repayment plan options. There are eligibility requirements for each.

The four student loan repayment options are:

- Income-Based Repayment (IBR)

- Income-Contingent Repayment (ICR)

- Pay As You Earn (PAYE)

- Revised Pay As You Earn (REPAYE)

There’s an option on the form to select “I want the IDR plan with the lowest payment.” While this is fine to select, it’s a good idea to use a repayment calculator and run your own numbers first. Look into our complete guide to the IDR plans to compare your options.

How to complete the IDR certification (and recertification) form

The form is the same for both initial certification and recertification on the IDR plan.

You can complete this form online or on paper. Take note that if you file the IDR certification form on paper and have multiple student loan servicers, you’ll need to fill out a separate form for each loan servicer. Some loan servicers require the paper application, so call them first to find out.

It will take approximately 10 minutes to complete the IDR form online.

Step 1: Log into the IDR certification application

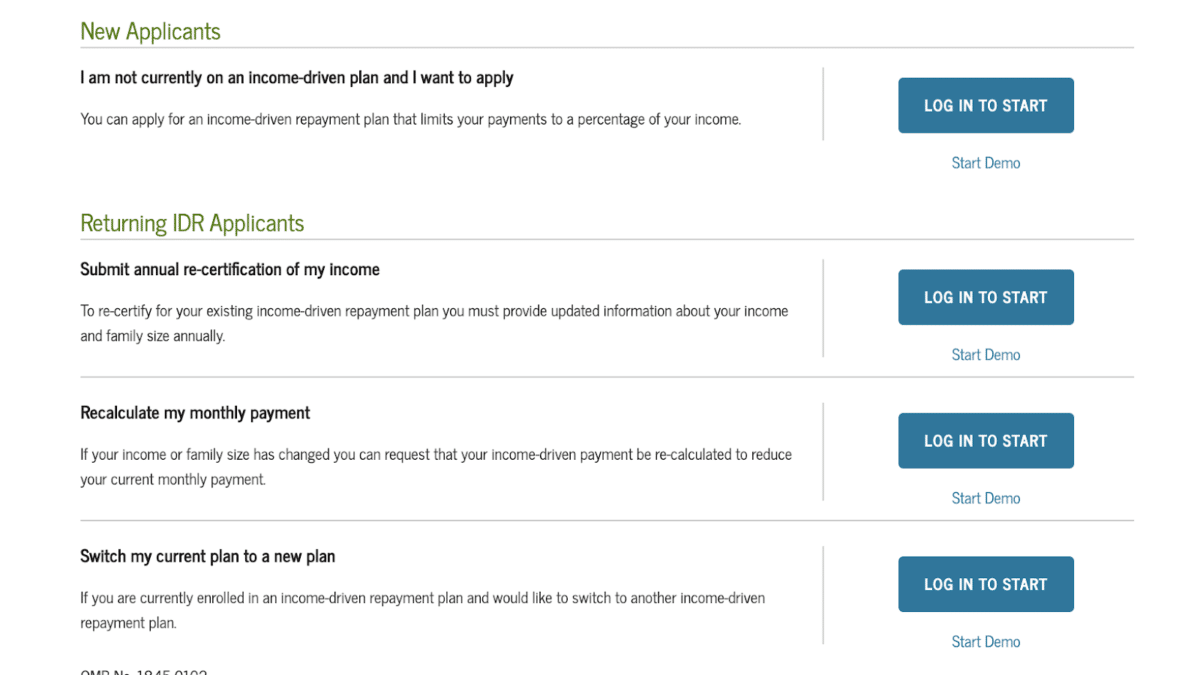

Find the application for IDR certification on StudentLoans.gov. You’ll choose New Applicant or Returning IDR Applicant. Log in with your Federal Student Aid (FSA) ID and password to get to the form.

You’ll notice you can also use the FSA calculator or switch your current IDR plan from this same page. These aren’t what you use to complete certification or recertification but may be helpful for you. You can calculate your payment for each type of plan offered; this way, you can choose the one that’s the most affordable for you.

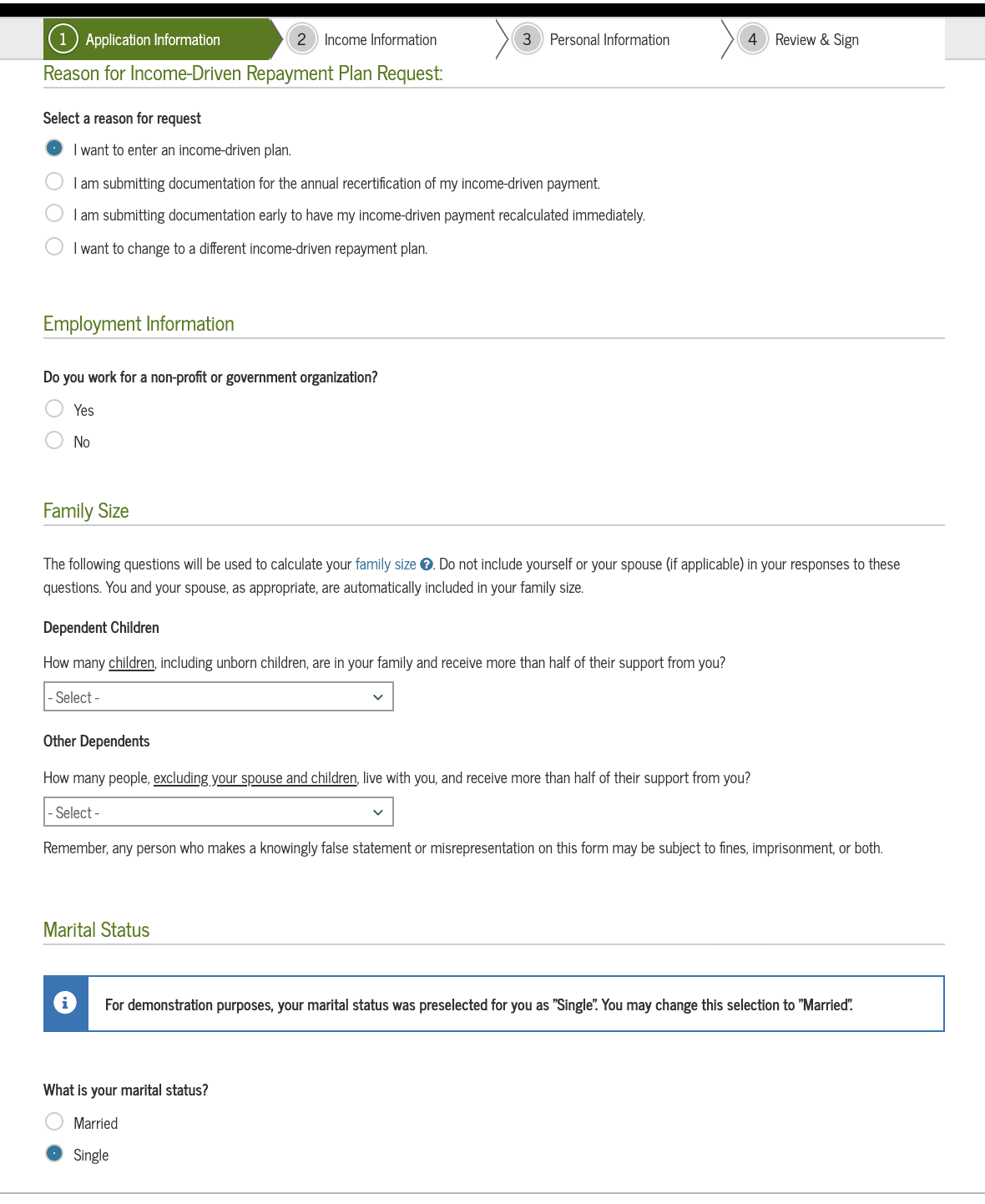

Step 2: Provide your general household information

The first portion of the application asks the reason for your IDR request, whether your employer is a nonprofit or government organization, family size, and marital status.

The reason the form asks about your employer is for student loan forgiveness purposes. Filling out this form alone won’t start you on a student loan forgiveness program; however, an IDR repayment plan is required to qualify for federal student loan forgiveness programs.

If you’re married, you’ll need to answer some more questions about your spouse in the income information part of the application.

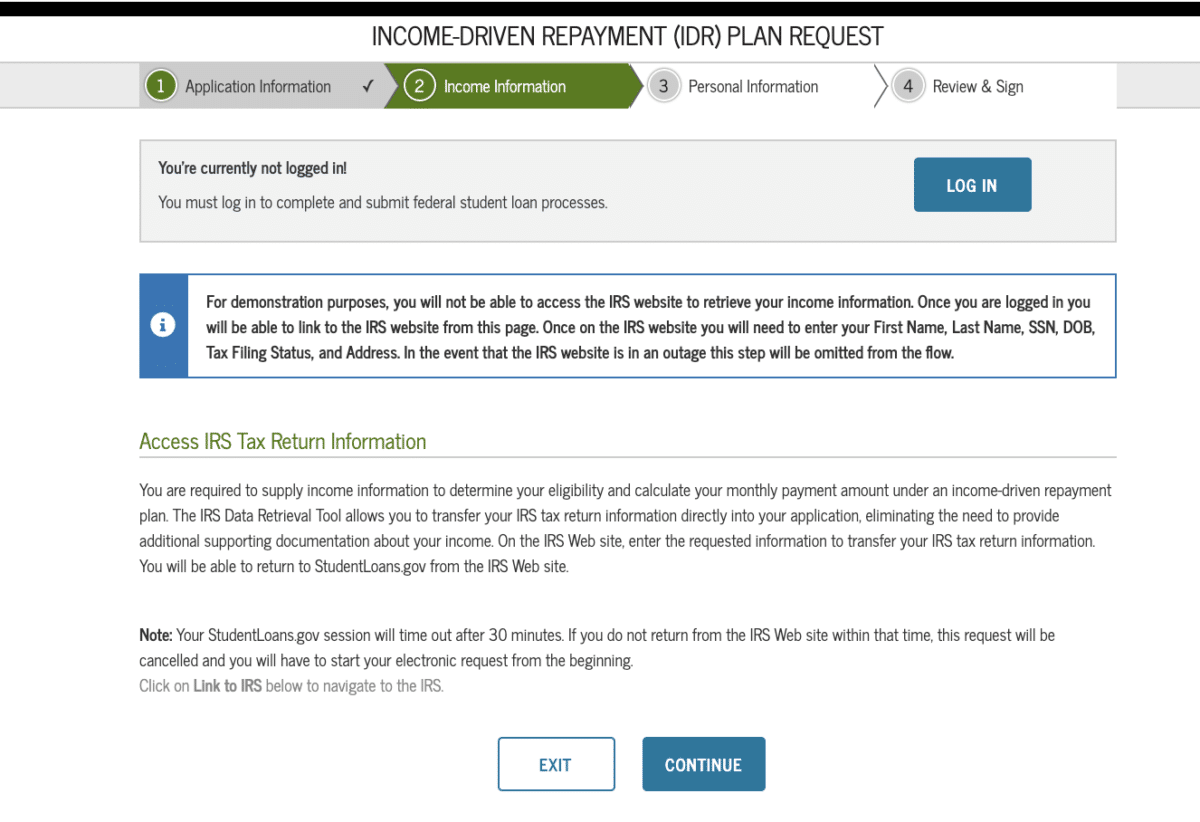

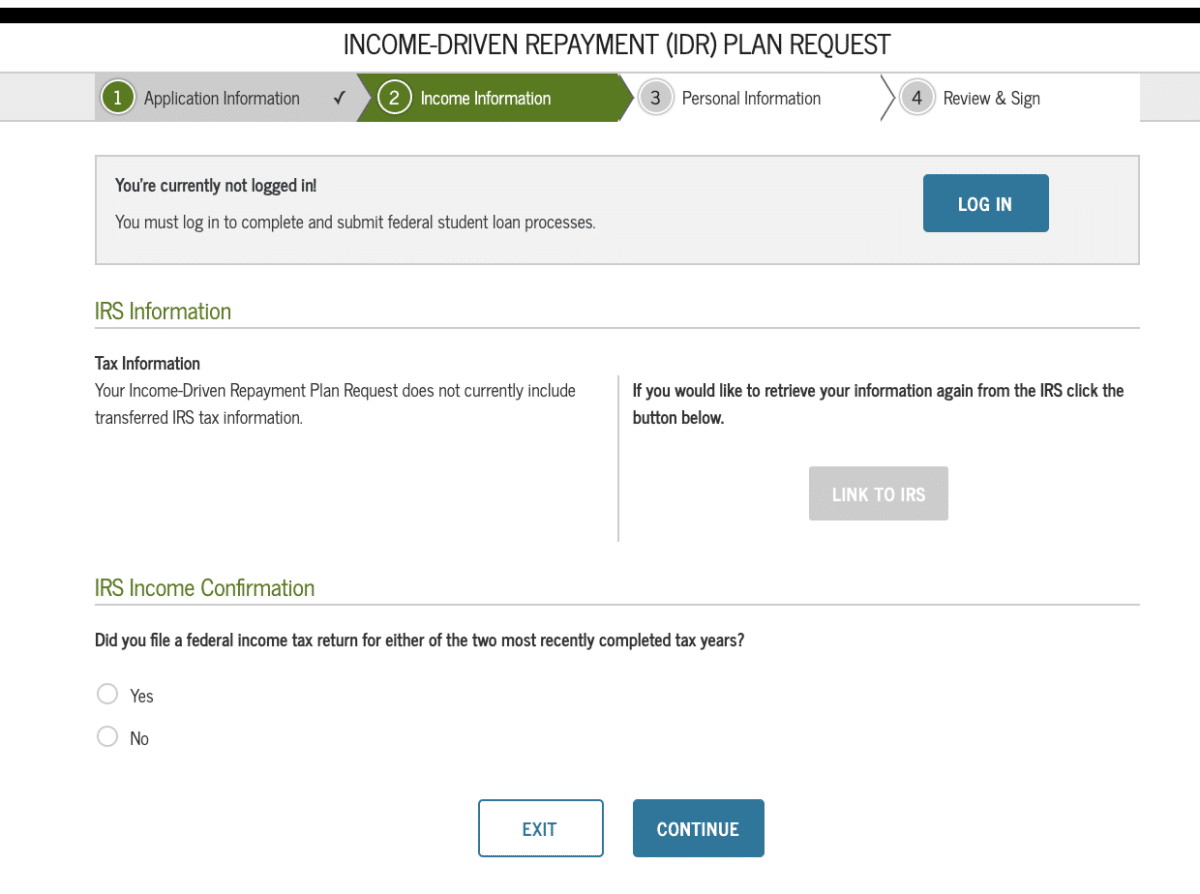

Step 3: Verify your income

The online application makes it fairly painless to provide your income information. You can use the IRS tax retrieval tool to link your information directly to the application.

Accept the waiver, then link your accounts. When you complete this step, you’ll be taken away from the studentloan.gov website temporarily and then returned.

If any further information is needed about your income, you’ll be contacted.

If you don’t want to use your previous income because it has changed, you can submit proof of income manually. This documentation will usually include:

- A pay stub or letter from your employer listing your gross pay. You’ll write on this how often you receive this income — for example, “every other week.”

- If you have multiple income streams, you must provide documentation for each one.

- If documentation isn’t available or you want to explain your income, attach a signed statement explaining every source of income and giving the name and the address for each of them.

The date on any supporting documentation you provide must be no farther back than 90 days from the date you submit the form.

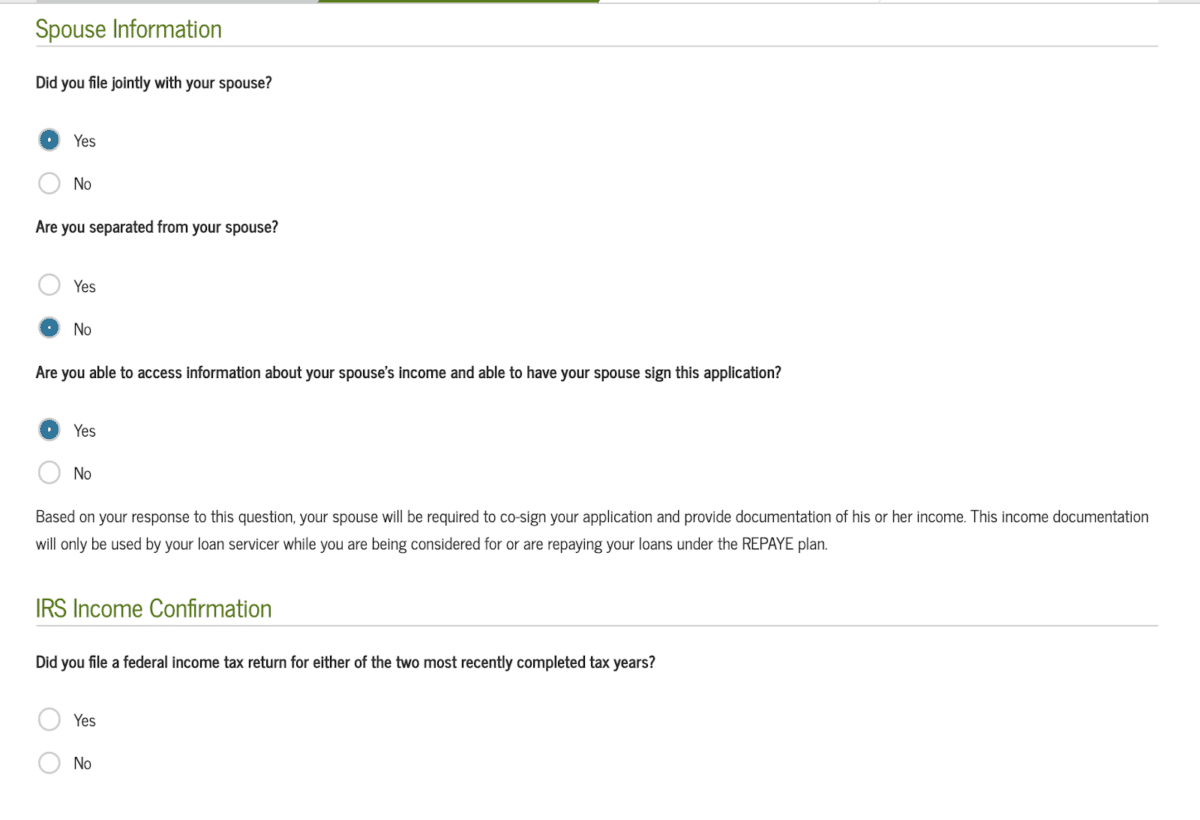

The income information page will have an extra section if you’re married. You’ll need to specify if you file your taxes jointly or separately from your spouse and if you can provide your spouse's income information.

Step 4: Select your IDR plan if it’s your first time certifying

On the same part of the application where you verified your income, you’ll choose your IDR plan. This is only an option if you’re entering IDR for the first time. If you’re recertifying and want to change your IDR plan, you’ll have to complete a separate form to switch your payments outside of recertification.

FSA has an option to estimate your payments under each plan within the application, but you’ll want to do your research on these ahead of time.

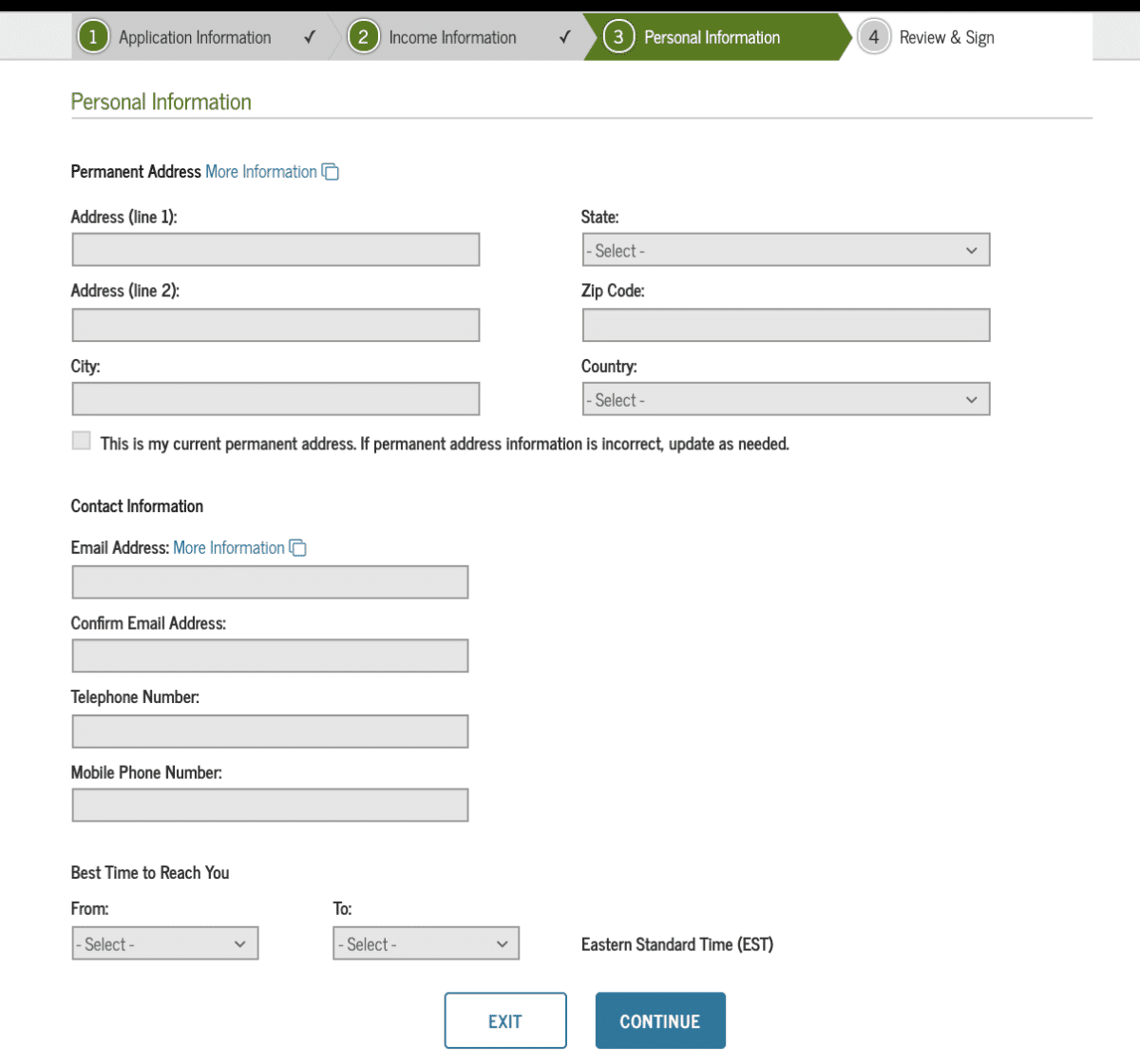

Step 5: Input your personal information

You’ll need to submit your personal information, including your address, email, phone number and the best time to reach you.

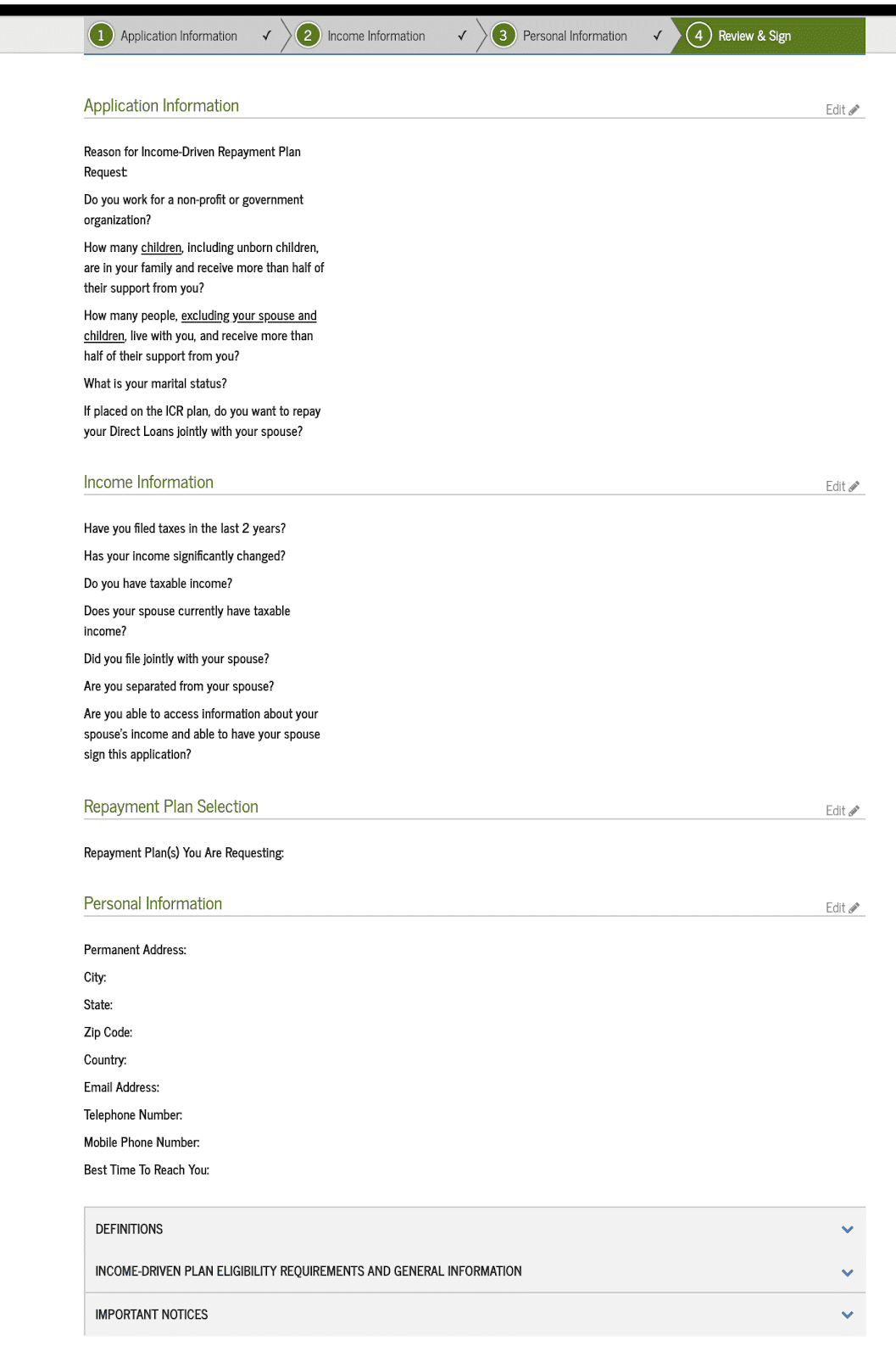

Step 6: Review your application

Look over your application and verify that all your information is correct. You can click the appropriate edit button on the right-hand side of this page if you need to change anything.

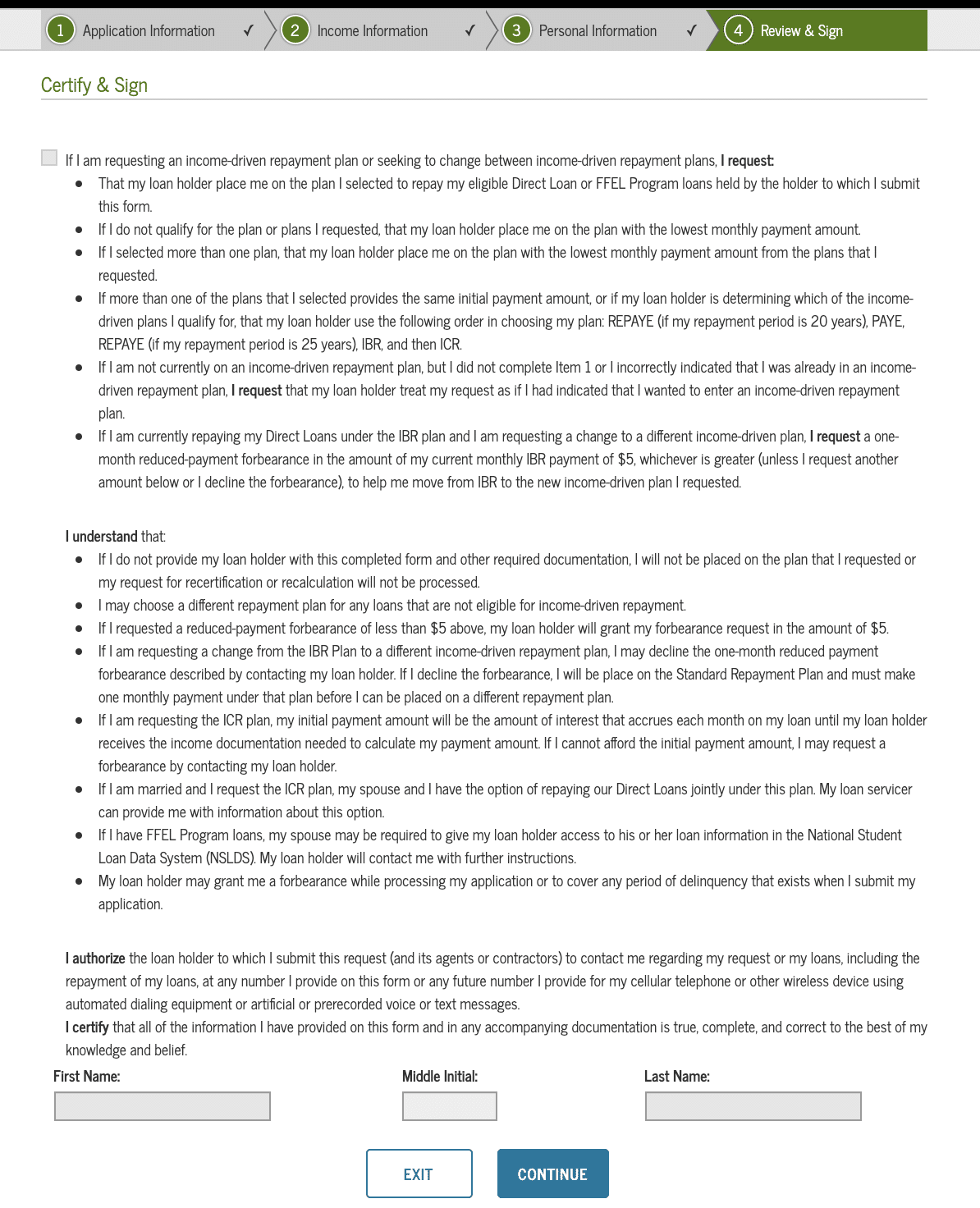

Step 7: Certify and sign the IDR form

Authorize and certify the form. Then press submit.

After you complete the application, continue making your regular payments. You’ll be contacted by your loan servicer if any further information is needed. If your request is accepted, you’ll be notified. And if you’re switching to IDR for the first time, you’ll receive your new payment schedule as well.

Top mistakes to avoid on your IDR recertification form

When you initially sign up for IDR, some things can change over time. This can include getting married and increases in your income. As you continue to recertify, be sure to avoid these mistakes:

1. Not recertifying annually

You must recertify your IDR plan every single year. Your loan servicer will contact you ahead of time with the deadline, but it’s your responsibility to recertify. If you don’t, your payments will jump back up to the amount required on the Standard Repayment Plan.

2. Missing the deadline

If you complete your annual recertification but fail to do so by the deadline, your consequences could be more than a larger payment. If you’re taken off the IDR plan and returned to the Standard Repayment Plan, your eligibility for student loan forgiveness also goes away.

Even more concerning than this is the capitalization of interest. Once you’re removed from the IDR plan, your unpaid interest will be added to the principal balance of your student loan.

3. Reporting your income too soon

If you complete the online application and use the tax-return retrieval tool, you should stay on track with your income. However, if your student loan servicer requires the paper form, you should be careful about reporting a rise in income too soon. This is because an increase in income means a recalculation of your payment. If you make more, your payment will go up.

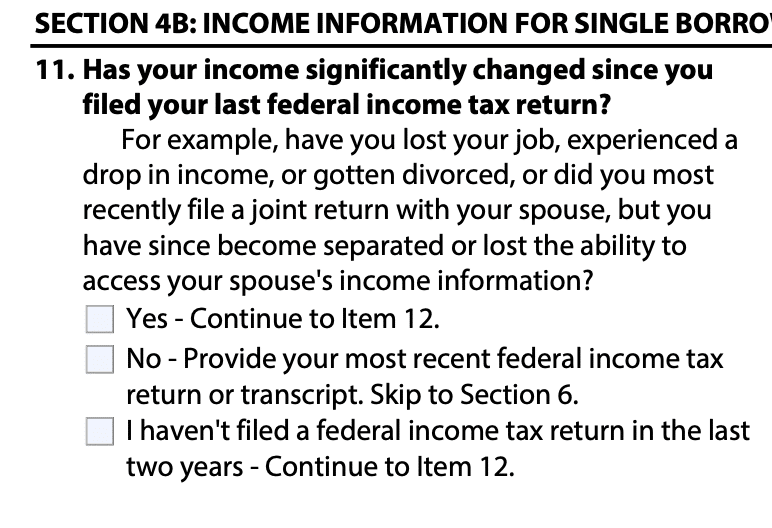

The paper form asks if your income has significantly changed since you filed your tax return. You can select “Yes,” but you should use your most recent tax return whenever you complete the application. This keeps you from being penalized by having a higher payment sooner than you need to.

4. Filing your taxes jointly with your spouse

Deciding to file your taxes separately or jointly is an important question when you’re on an IDR plan. The vast majority of couples file a joint tax return, but you should look into filing separately if you’re on either PAYE or IBR, as your payment amount will take into account your spouse’s income. If you file separately, you could save more money on your payment this way, which is important when taking advantage of student loan forgiveness programs.

Most importantly, recertify on time every year. Don’t make the mistake of missing this crucial deadline. As long as you recertify according to schedule, you’re off to a good start with your student loan management.

Stay on top of your student loans

Make sure you keep yourself organized when it comes to your student loans. Set a reminder on your phone a few weeks ahead of time for the due date. Set aside time to certify (or recertify) so you don’t mess up your repayment process.

You can treat it just like Tax Day, but instead, it’s a student loan certification day. If you’re going for PSLF or income-based loan forgiveness, putting aside time for recertification also ensures that you’ll stay on track with these programs.

If you’re unsure of the best IDR plan for you and your family, the team at Student Loan Planner® would love to help you decide. We’ll look over all your student loans to help you create the best plan for paying them off or having them forgiven. It will be a plan that works with your life, right where you are now.

Not sure what to do with your student loans?

Take our 11 question quiz to get a personalized recommendation for 2024 on whether you should pursue PSLF, Biden’s New IDR plan, or refinancing (including the one lender we think could give you the best rate).