For married student loan borrowers, your tax filing status — “married filing jointly” versus “married filing separately” — affects how much you pay in taxes. It also impacts how much you pay on your monthly student loan payment if you’re using an income-driven repayment (IDR) plan, such as PAYE, IBR or the new RAP plan.

However, the decision to file separately or jointly can also impact your eligibility for various tax credits and benefits. For example, it might affect your access to the dependent childcare credit and healthcare premium subsidies on the Health Insurance Marketplace.

Borrowers need to decide if the savings of filing separately for student loans is larger than the extra tax costs of filing separately.

Below, we discuss when it makes sense to choose a filing status of “married filing separately” with student loans and when it doesn’t. If you still feel confused, you can get an expert plan.

More borrowers than ever are choosing to file taxes separately

The vast majority of American households file a joint tax return. However, more student loan borrowers are filing their taxes separately as they factor potential student loan savings into the equation.

You can amend from separate to joint if necessary

You can't amend from joint to separate, but you can amend from separate to joint. Unfortunately, many borrowers unintentionally leave thousands on the table simply because they don’t realize this flexibility exists. And that flexibility becomes especially valuable given the current IDR upheaval following the One Big Beautiful Bill Act (OBBBA).

For many borrowers, income tax filing status will be relevant for the first time in years. Thanks to extended IDR recertification dates (pushed into 2026 and, in some cases, 2027 for many borrowers), your most recent tax return may or may not be used for payment calculations. However, whether these dates will be honored remains to be seen. So, it's important to stay on top of your recertification date and think strategically about how you file.

If it turns out that your recent taxes are irrelevant for IDR payments because your recertification extension gets pushed out even further, you can simply amend your taxes to joint later using IRS Form 1040-X.

Even individuals with modest debt who previously filed jointly may need to reconsider their filing status, given that you can amend it if it turns out you made an unnecessary mistake by choosing separate.

How filing taxes separately saves money on loan payments

First, let’s look at how student loans and married filing separately are correlated.

When a federal student loan borrower is on an income-driven repayment plan (IDR) with the U.S. Department of Education, their payments are based on discretionary income. This calculation factors in adjusted gross income (AGI) and a poverty line deduction according to family size. The higher the income, the higher the student loan payments. The lower the income, the lower the payments. However, when the new Repayment Assistance Plan (RAP) becomes available, it will use a formula based on AGI and a $50 dependent deduction instead of discretionary income.

The income used for the student loan payment calculation is generally taken from the borrower’s latest tax return. If the borrower is married to someone who earns an income and they file their taxes jointly, the loan servicer uses their combined household income to calculate the payment.

Pay As You Earn (PAYE) and Income-Based Repayment (IBR) allow borrowers to file their taxes separately, as will RAP when it’s available.

With each of these payment plans, the income-driven payment is based only on the borrower’s earnings and not their spouse’s income when taxes are filed separately. However, borrowers living in community property states must split income equally when filing taxes separately — which can still be advantageous depending on each spouse’s student debt (more on that later).

Now, you might be thinking, “Why wouldn’t all borrowers just file separately to keep their payments low?”

Well, the student loan payment is only one component of the decision. The amount of taxes paid by the household as a whole is affected by how a couple files taxes, too.

Calculating your extra tax costs when married filing separately

The biggest impact of married filing separately is that it tends to place the higher-earning spouse into a higher tax bracket.

However, other scenarios can skyrocket your tax bill if they happen to apply to you.

Situations that often result in a very high married filing separate penalty include:

- Additional Medicare tax

- Adoption expenses

- Dependent care credits for young children in daycare

- Higher Medicare premiums

- Loss of ACA health insurance subsidies

- Loss of certain business tax deductions

- Loss of higher education credits for adult children in college

To get an idea of how much you might pay versus save with the MFS strategy, use our married filing separate tax calculator below:

Your Income Last Year

Your Spouse’s Income Last Year

Number of children under age 13

How much do you spend on daycare annually?

Dependent Care FSA Contribution Usually $0 to $5,000. List what you’d normally contribute if you weren’t filing separately

Number of dependent children enrolled in college

Who in your family owns a small business?

How many children did you adopt this year?

Is anyone in your family currently on Medicare?

Do you receive federal health insurance subsidies? Specifically, do you purchase a subsidized health plan on the ACA marketplace

Have you contributed directly to a Roth IRA this year?

Do you live in AZ, CA, ID, LA, NM, NV, TX, WA, or WI?

| Estimated Extra Annual Cost of Filing Taxes Separately That is, the additional taxes you’ll pay under the married filing separate status compared with filing your taxes as married filing joint. Note that this estimate does not include the potential cost savings of a lower IDR payment when filing separate. |

Components of married filling separate cost

(Remember, this is just an estimate and shouldn’t be relied on as your true taxes. Consult a tax professional to get the numbers for your exact situation.)

You can also download a more complete spreadsheet version of the calculator by visiting the button below to model more complex scenarios.

Tax differences between filing separately versus jointly

Couples typically owe more in taxes as a household when they file separately. This is primarily because each spouse’s income hits the tax brackets as individual filers.

Plus, some tax deductions and credits go away or are harder to get when filing separately, especially for couples with kids. Let’s take a look at the difference in estimated taxes paid in two different scenarios.

Note these are general scenarios with rough estimates. You’ll need to consult a tax professional to address your specific financial situation.

Scenario 1: Spousal incomes are vastly different

Let’s say a dentist is married to a social worker. The dentist earns $300,000, and the social worker earns $50,000. They have a joint adjusted gross income (AGI) of $350,000.

Let's illustrate their tax hit using 2025 federal tax brackets. If this couple files jointly, they'd pay around $62,494 in federal income taxes. However, if they each file a separate federal income tax return, the dentist will owe about $69,297 on their tax return. The social worker will owe about $3,962. Together, this totals $73,259.

Filing separately could cost them over $10,765 in federal taxes as a household versus married, filing jointly. In this case, there are tax benefits for using joint income.

Scenario 2: Spouses have the same income

Let’s say a pharmacist and a nurse practitioner are married and making $110,000 each.

They could pay about $31,628 as a household if they file their taxes jointly. They’d each owe roughly $15,814 if they filed separately. So, their federal tax liability, or tax bill, would be the same, no matter how they file their taxes.

Related: Student Loans and Taxes: Everything You Need to Know

Other important side effects of filing taxes separately

Tax brackets aren’t the only part of the equation when determining whether a couple should file separately or jointly.

Couples can lose out on some other tax deductions and credits. They can also miss out on subsidy opportunities with the Health Insurance Marketplace by filing separately.

Married filing separately disqualifies you from receiving a premium tax credit for healthcare

Subsidized healthcare coverage is available to people with incomes below certain levels via the Health Insurance Marketplace.

For example, your household income must be between 100% and 400% of the federal poverty level (FPL) to qualify for a premium tax credit, which lowers your insurance costs. Eligibility was temporarily expanded for household incomes above 400% FPL. However, Congress hasn’t extended these enhanced premium tax credits, so they expire at the end of 2025.

The state you live in and your household size also affect premiums and eligibility for subsidized programs, such as Medicaid or the Children’s Health Insurance Program (CHIP).

According to Healthcare.gov, married couples who file separately can enroll in a Marketplace healthcare plan together. But by filing taxes separately, you’ll forfeit eligibility for a premium tax credit or other savings that would reduce your monthly insurance payment.

Note that there are exceptions if you plan to file as head of household and meet other criteria (e.g., living separately) or if you’re a victim of domestic abuse, domestic violence or spousal abandonment.

This penalty for filing separately should be seriously considered for low- and moderate-income households who would otherwise qualify for health insurance subsidies.

According to KFF data, more than 21.8 million marketplace enrollees receive advanced premium tax credits. The average monthly APTC for 2025 is $550, but this number varies widely by state. That’s an average annual benefit of roughly over $6,600.

Considering the cost of healthcare in the U.S., you might miss out on significant savings that might benefit your family in more ways than one.

Tax deductions and credits affected by married filing separately

The most relevant credit is the child dependent care tax credit (CDCTC) — which is not the same as the child tax credit (CTC). Additionally, the student loan interest deduction goes away when filing separately.

Those two items might add up to an extra $2,000 to $3,000 in taxes a couple could pay if they file separately.

Filing taxes separately also drastically reduces the ability to deduct a Traditional IRA contribution, as well as eligibility for Roth IRA contributions. So, the lower income-driven student loan payments might be offset by higher taxes and the subtraction of other benefits.

Tax laws change, so consult the IRS website or a tax professional (like our SLP Wealth team) to learn about the differences in taxes filing separately versus filing jointly.

Which filing status will save you the most money paying back student loans?

Filing separately if both spouses have federal student loan debt eligible for IDR usually doesn’t make much sense for married borrowers. This is typically a decision for married couples where only one has student loans.

The equation we use is a holistic one based on what’s best for the household, not one spouse.

We need to look at the entire household taxes and student loan payments to see which method would be better.

Generally speaking, we know student loan payments will be lower if couples file separately, but they’ll most likely pay more taxes as a household.

Here’s the equation:

Student loan payment savings married filing separately (MFS) – increase in taxes by MFS = total savings (or loss) from filing separately

If the result is a positive number, then married filing separately will give the most household savings net of taxes. If it’s negative, then filing jointly will save the household the most money.

Keep in mind that there’s an extra layer of decision-making for households who qualify for subsidized coverage with the Health Insurance Marketplace. The key here is to take a holistic approach to evaluate what will benefit your household the most.

Related: Is a student loan consult right for you?

The best IDR plans to keep payments low when filing separately

The One Big Beautiful Bill Act (OBBBA) has reshaped income-driven repayment for both existing and future borrowers. New borrowers entering repayment in the coming years will only have access to the new Repayment Assistance Plan (RAP) or the updated tiered Standard Plan, which is based on loan balance. But existing borrowers have a limited “grandfathering” window through June 30, 2028, allowing them to remain in their current plan temporarily (including PAYE and ICR). However, anyone who fails to switch to the IBR plan by that date will be automatically moved into RAP.

Because of this, IBR and RAP are the only long-term IDR plans that existing borrowers can proactively plan for.

How filing taxes separately plays into IDR payments

Both IBR and the new RAP plan allow married borrowers to file taxes separately so that payments are based on the borrower’s income alone. PAYE also offers this option for borrowers who remain on it during the transition period. However, the plans differ significantly in how payments are determined:

- Payment calculation. IBR sets payments at 10% of discretionary income for “new borrowers” whose first federal loan was on or after July 1, 2014, and 15% for borrowers with earlier loans. PAYE also uses 10% of discretionary income, but borrowers who took out their first loan before October 1, 2007, generally aren’t eligible. RAP works differently, using a sliding scale from 1% to 10% of AGI for borrowers with AGIs above $10,000.

- Capped payments. IBR and PAYE are both capped at the 10-year standard amount, meaning your monthly payment will never exceed what it would take to pay the loan off in 10 years. However, the new RAP plan doesn’t include a payment cap. Therefore, as income rises, so will RAP payments.

- Forgiveness timeline. New IBR forgives remaining balances after 20 years of qualifying payments. Whereas, old IBR stretches to 25 years and RAP requires 30 years of repayment before reaching forgiveness. Note that borrowers eligible for Public Service Loan Forgiveness (PSLF) receive tax-free forgiveness after 10 years of qualifying payments, regardless of which IDR plan they’re enrolled in.

- Tax bomb. All IDR plans include a potential “tax bomb” when the remaining balance is forgiven. The forgiven amount is reported on a 1099 tax form and added as taxable income for that year, which can create a significant tax bill. This tax treatment is temporarily suspended until December 31, 2025, but no extension is currently planned, so borrowers should keep this in mind when creating their repayment strategy.

Understanding these differences is key to choosing the plan that best minimizes payments and aligns with your long-term repayment strategy. Here’s a quick table for comparison:

| Feature | IBR | PAYE | RAP |

|---|---|---|---|

| Can file MFS to exclude spouse’s income? | Yes | Yes (for borrowers who remain on PAYE during transition) | Yes |

| Payment calculation | 10% of discretionary income for “new borrowers” (first loan on or after July 1, 2014); 15% for earlier borrowers | 10% of discretionary income; must have first loan on or after Oct. 1, 2007 to be eligible | Sliding scale from 1% to 10% of AGI (applies once AGI > $10,000) |

| Payment cap | Yes, capped at the 10-year standard payment | Yes, capped at the 10-year standard payment | No, payments keep rising as income rises |

| Forgiveness timeline | 20 years (new IBR); 25 years (old IBR) | 20 years | 30 years |

| PSLF eligibility | Yes, forgiveness after 10 years | Yes, forgiveness after 10 years | Yes, forgiveness after 10 years |

| Tax bomb on forgiven balance | Yes | Yes | Yes |

Will filing taxes separately or jointly save you the most money?

Let's walk through two examples in the sections below:

- One spouse is the breadwinner and owes the student loan debt.

- One where the breadwinner isn’t the spouse with the student loan debt.

When filing jointly could make sense

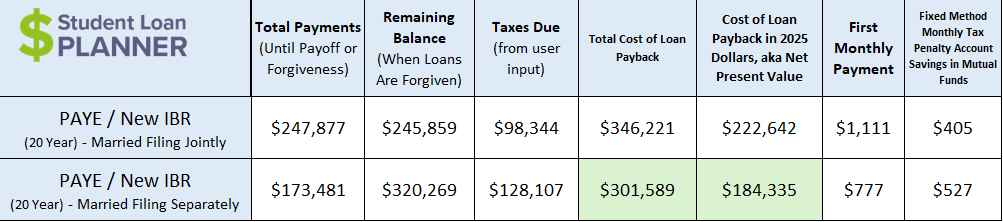

Jamie and Adam got married this year. Jamie is a psychologist with $250,000 in student loan debt at a 6.5% interest rate. She earns $125,000 from her private practice and has been on IBR for five years. Adam is a teacher making $40,000 with no student loan debt. Both anticipate their incomes growing at 3% annually.

*Assumptions: Tax bomb savings growth rate is 5% per year. Tax rate at time of loan forgiveness is 40%.

If Jamie and Adam continue filing jointly under IBR, her total estimated repayment cost (including the future tax bomb) is $346,221. But by filing taxes separately for the next 15 years, the projected total cost drops by $44,632, which is about $2,975 of annual student loan savings on average.

However, looking at just this year, filing jointly will cost $1,516 per month ($1,111 student loan payment + $405 tax bomb savings). Filing separately will cost Jamie $1,304 per month ($777 student loan payment + $527 tax bomb savings). That’s a $2,544 annual benefit this year for filing separately.

However, they must also factor in how filing separately will impact their taxes. Using our Married Filing Separate Tax Calculator, they’re projected to owe $3,031 more in taxes if they file separately.

Using the equation:

($2,544 student loan payment savings MFS) – ($3,031 more in taxes MFS) = -$487

In other words, filing separately could cost them more overall this year. Therefore, Jamie and Adam should file their taxes jointly to save the most money this year. They can make a fresh decision each year on their tax filing status based on income, taxes and repayment plan changes.

When filing separately could make sense

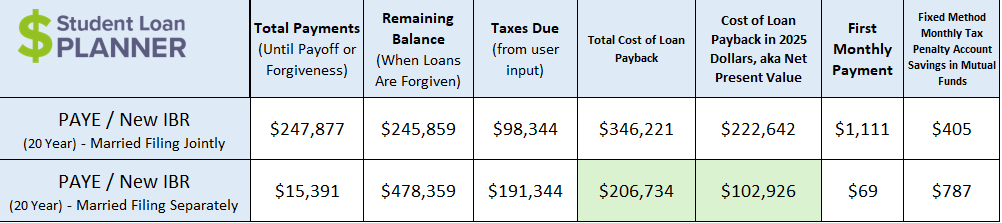

Now let’s look at a different scenario. Let’s say Amber is a chiropractor with $250,000 in student loan debt and is making $40,000 working part-time. She’s been on IBR for five years as well. Her husband, George, works in IT, making $125,000.

*Assumptions: Tax bomb savings growth rate is 5% per year. Tax rate at time of loan forgiveness is 40%.

Notice that filing jointly on IBR is the exact same as with Jamie and Adam. But the filing separately scenario is completely different since the breadwinner isn’t the one with the student loans.

Now we’re looking at a difference of $139,487 in projected savings to pay back her student loans if they were to file separately. That works out to be about $9,300 per year over 15 years. Just like Jamie and Adam, Amber and George would pay $3,031 more in taxes by filing separately.

Using the same equation:

($9,300 student loan payment savings MFS) – ($3,031 more in taxes MFS) = $6,269

Amber and George should file their taxes separately to save the most money net of taxes as a household.

As income changes from year to year, so can the result of this equation. The good news is that they can compare their taxes to student loan payments and decide how to file their taxes each year if they’re on IBR. They can and should make a fresh tax filing status decision each year.

Overall, there appears to be a greater benefit to filing separately if the spouse with student loans makes less money. The couple has the same tax penalty, regardless of who has the loans, but the cost to pay back the loans goes way down.

Other ideas to save money paying back your student loans when filing separately

A married couple will not pay as much taxes when filing separately if their income is fairly close. The wider the income gap, the more the household will generally owe in taxes if they file separately.

If the person with student loans has a higher income, then any and all deductions to adjusted gross income (AGI) could change their side of the income equation.

For example, let’s say Doug earns $100,000 and owes $200,000 in debt, while Julie earns $70,000 and has no student loans. They are both contributing 6% of their income to get their maximum employer matching contribution to their retirement plan. They still have another $1,000 per month that they could put into retirement. Doug is on New IBR, and they’re filing their taxes separately.

Rather than splitting up the $1,000 evenly, Doug could put the $12,000 per year into his retirement only. That would reduce his AGI from $100,000 to $88,000. Julie’s would stay at $70,000.

Now, Doug can also put $7,000 into his Health Savings Account (HSA), which lowers his AGI to $81,000. By reducing Doug’s AGI by $19,000, their individual incomes are only $11,000 apart rather than $30,000. So, the extra taxes from filing separately should go down.

Doug would also benefit from lower student loan payments the following year. Remember that New IBR is based on 10% of discretionary income. So, lowering Doug’s income by $19,000 will reduce his student loan payment by $1,900 for the year. It’s a win-win…win! Less taxes, lower student loan payments and awesome additional nest egg savings!

“Married, filing separately” with student loans in a community property state

Someone with student loans who lives in a community property state might also be able to save even more money paying back student loans if they file taxes separately.

Nine states are community property states and have different laws around whose income is whose. These are Arizona, California, Idaho, Louisiana, New Mexico, Nevada, Texas, Washington and Wisconsin.

The gist of it is any salary, wages or other pay received for services performed by either or both spouses while married basically belongs to both spouses equally. There are other nuances that I’ll spare you, but feel free to read this from the IRS website.

The benefit to couples living in a community property state is that this community income is equally distributed between the spouses if they file separately.

In other words, if a doctor made $300,000 in income and her psychologist spouse made $100,000, they would each claim $200,000 on their income if they were to file separately, rather than their individually earned income, if it’s considered community income.

This typically means that a couple would pay less in taxes by filing separately than they otherwise might in a common law state.

Where this is really attractive is if the doctor I mentioned had student loans and was pursuing Public Service Loan Forgiveness (PSLF). But their PsyD spouse didn’t have loans. This “breadwinner loophole” would lower the doctor’s income dramatically. And that would significantly lower their overall cost while pursuing the PSLF program.

If you’re interested to learn more, check out Student Loan Planner® Podcast Episode 6, where we talk about the “breadwinner loophole” in detail.

Should you file taxes separately if you both have student loans?

This is a fairly common question because it’s hard to find the right answer on how this works.

When both spouses have student loan debt and are on an IDR plan, filing taxes separately gives very little reduction in student loans. It usually ends up costing the couple more in taxes than it saves them in loan repayment.

Let’s say that both are on New IBR and that they file their taxes jointly. One spouse makes $150,000, and the other makes $50,000 — 75% of household income and 25% of household income.

The loan servicer will calculate the household payment based on the household income of $200,000. Of that monthly payment, 75% will go toward the loans of the $150,000 earner. The other 25% will go to the loans of the $50,000 earner.

If this couple were to file taxes separately and certify their income using their individual tax returns, they might have significantly lower payments due to an extra deduction from their discretionary income.

How to save the most money paying back student loans

There’s a ton of money at stake when we’re talking about paying back five or six-figure student loan debt. It makes sense for an expert to review your specific situation while taking family size, career path, household income, repayment amount, forgiveness programs and financial goals into consideration.

This holistic approach will ensure that you’re saving the most money but also weighing additional factors, like qualifying for Health Insurance Marketplace savings and other tax benefits.

Our team has consulted on over $4.9 billion in student debt and found $1.7 billion in projected savings by creating winning repayment and refinancing strategies to take on their student debt. We’d love to help you finally feel confident about how you’re handling your student loans and save as much money as possible.

After a consultation with us, you’ll understand the path that will save you the most money when paying back your loans. You’ll also gain the clarity you need to feel in control.

Not sure what to do with your student loans?

Take our 11-question quiz to get a personalized recommendation for 2026 on whether you should pursue PSLF, IDR, or refinancing (including the one lender we think could give you the best rate).

Comments are closed.