Nurse practitioners (NPs) are extremely valuable to the medical community and patients. They can specialize in many different areas of medicine, such as women's health, psychiatric mental health, oncology, adult-gerontology, and more. But the most common is probably pediatrics. NPs who work with kids typically have the Family Nurse Practitioner (FNP) designation.

While NPs aren't primary care physicians, they know their stuff and provide high-quality care. The education requirements to become a nurse practitioner (a.k.a. Advanced Practice Registered Nurse) have gotten even more robust. That means nurse practitioners are even more skilled than before and can handle more complex medical cases.

But with more training comes more student debt. The good news is that NPs are in high demand and can finish their education at a relatively low cost compared to the average nurse practitioner salary. Plus, many of them are eligible for favorable loan repayment like Public Service Loan Forgiveness (PSLF).

So is becoming a nurse practitioner worth it? Let's take a deeper dive into the education, salaries, and average student debt to help you decide if pursuing a nursing career as an NP is worth the time and effort.

Education requirements for nurse practitioners

According to the American Association of Nurse Practitioners (AANP), the path to becoming an NP begins with earning your Bachelor of Science in Nursing (BSN) and having passed the National Council Licensure Examination (NCLEX-RN). You'll then need to take an NP-focused graduate master’s or doctoral nursing program (DNP).

DNP programs have risen in popularity over the past 15+ years since the American Association of Colleges of Nursing (AACN) recommending that advanced practice nurses earn doctorates. Today, there are over 350 DNP programs scattered through every U.S. state and the District of Columbia.

Finally, prospective nurse practitioners must site for and pass a national board certification exam in order to become licensed. The three most popular certification boards for NPs are the American Academy of Nurse Practitioners Certification Board (AANPCB), the Pediatric Nursing Certification Board, and the American Nurses Credentialing Center (ANCC).

Related: How to Become a Nurse Practitioner: Salary, Debt, And What to Expect

Nurse practitioners graduate with more student loans than anticipated

Not too long ago, NPs could get a Master of Science Degree in Nursing (MSN) after two years, costing them between $20,000 and $40,000. They could then start earning close to $100,000.

Now employers are often seeking NPs with their Doctor of Nursing Practice (D.N.P.) degree. This four-year program doubles the years of school and more than doubles the cost of becoming an NP. As I said before though, everyone benefits from more-skilled NPs.

The average NP we’ve worked with here at Student Loan Planner® has about $149,000 in student loans. This is on the rise due to the tuition hikes. So is becoming a nurse practitioner worth it? Let's take a look the average NP salary to get a better gauge.

Income & Student Debt by Profession

How you compare to other

accountants stats*

| Average student debt | |

| Average income | |

| Average Debt-to-Income Ratio |

Statistics represent the population of Student Loan Planner clients in the respective profession referenced in the chart from 2017-2023. Sample excludes those in school or in training.*

Nurse practitioner salary comparison

According to the Bureau of Labor and Statistics (BLS), the median nurse practitioner salary is around $124,680 per year. That's actually about $3,000 more than the median pay for all advanced practice registered nurses (APRNs). But it's about $36,000 more than nurses that graduated from an associate degree program (ADN) or BSN program.

The salary can vary by state too. There are currently the top-paying state for nurse practitioners by mean wages:

- California: $158,130

- New Jersey: $143,250

- Massachusetts: $138,700

- Oregon: $136,250

- Nevada: $136,230

The median wage for a college graduate is currently about $84,240 according to the BLS. So becoming a nurse practitioner leads to an extra $40,000 in earnings per year by the averages.

Let’s assume that $40,000 in extra income sustains throughout the entire 40-year career of a NP. That works out to an extra $1,600,000 in lifetime earnings for an NP compared to someone with a bachelor’s degree. That’s a huge number!

Taking out $149,000 in loans to make nearly an extra $1.6 million seems to make great financial sense on the surface. But, remember, those extra earnings will be taxed. We also have to factor in the cost to repay the student loans.

If we assume a combined 40% tax rate for federal and state, then we can reduce that $1.6 million in earnings down to about $960,000 in extra take home pay. So now we’re talking about NPs having an extra $960,000 to pay off the $149,000 of student loan debt.

Seems good on the surface. But we should dig deeper. Let’s explore the cost of paying back the student loans to see if it makes sense.

Nurse practitioner student loan repayment options

We’ve done over 5,500 consults and advised on over $1.2 billion of student debt here at Student Loan Planner®. Our experience shows there are two optimal ways for NPs to pay off their student loans:

- Aggressive Pay Back: For people who owe 1.5 times their income or less (e.g. a nurse practitioner who makes $100,000 with loans at $150,000 or less), their best bet could be to throw every dollar they can find into paying back their loans as fast as possible, in 10 years or less. NPs should be sure to look at their PSLF options before refinancing. Often this includes refinancing student loans to get a better interest rate.

- Pay the least amount possible: For nurse practitioners who owe more than twice their income (e.g., $100,000 salary and $200,000 or more in student loans), the goal is to get on an income-driven repayment plan that will keep payments low and maximize loan forgiveness, whether it’s through PSLF or taxable loan forgiveness.

The nurse practitioner employer (nonprofit or private practice) could be the biggest factor in choosing between either option.

PSLF vs. refinancing for nurse practitioners

Let’s say Melissa has $150,000 in student loans at 6.8% interest. She’s been a nurse practitioner in Texas for three years and was paying on the graduated plan to keep her payments low.

Right now, she’s making $100,000 at an employer that would qualify for Public Service Loan Forgiveness (PSLF) with projected 3% salary increases for the foreseeable future. She’s not married.

In almost all circumstances, the graduated plan is going to end up costing a nurse practitioner more money than they’d otherwise have to spend when paying back their loans.

The graduated plan is neither option 1 nor option 2 listed above and is much more costly. Melissa will end up paying off a 6.8% loan in full over 30 years with increasing payments every 2 years.

It sounds like a good idea to help with monthly cash flow. But 99 out of 100 times, it’s one of the worst repayment options. Choosing PSLF or refinancing to a 10-year fixed rate will both cost less than that.

Remember the graduated plan is not a repayment program that qualifies for PSLF. So let’s compare starting on the PSLF path now versus refinancing to a 10-year fixed rate.

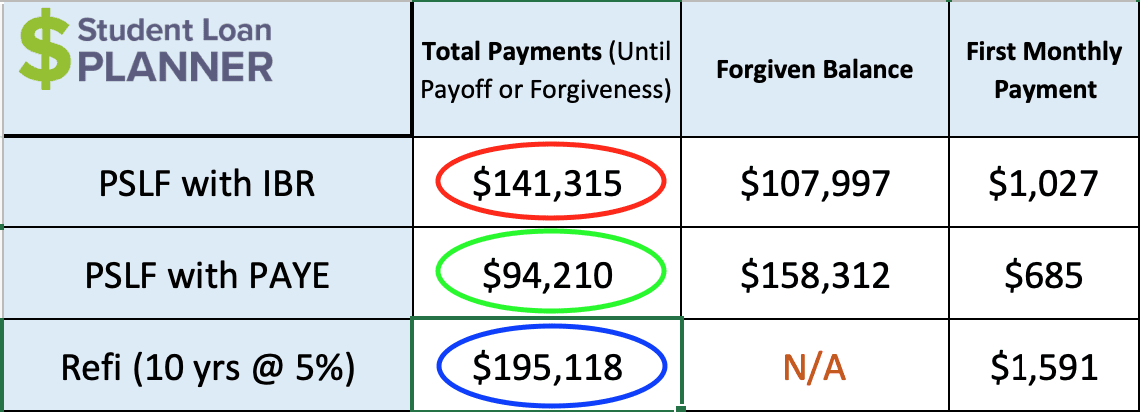

It’s important to see the difference in going for PSLF on Pay As You Earn (PAYE) versus Income-Based Repayment (IBR). You can see being on IBR would cost Melissa about 50% more to pay back her loans compared to PAYE. Nurse practitioners with student debt who are eligible for PAYE should almost never be on IBR.

As for PSLF with PAYE versus refinancing, PSLF is the clear winner. It’s projected to cost about $100,000 less then refinancing — $94,210 versus $195,118.

But should Melissa be beholden to a nonprofit employer just to get PSLF?

When is it ok for a nurse practitioner to forgo PSLF?

Melissa likes her job working for the nonprofit hospital. But she got an offer for a private practice job where she’d earn $125,000. That’s an above-average nurse practitioner salary in Texas.

Would it make more sense financially to stay where she is and get PSLF? Or should she take the new job, give up PSLF and make more money to pay off her loans in full?

The job move could mean her student loan repayment could cost $100,000 more over 10 years. That works out to paying $10,000 per year.

In other words, her take-home pay would have to increase by more than $10,000 for the year. All of that extra money would have to go toward paying back the refinanced loan to break even with PSLF.

But Melissa is going to make an additional $25,000 in private practice and take home $15,000 more per year. If she pays an extra $10,000 toward her loan each year, she’d still have an additional $5,000 in take-home pay. Now that makes financial sense!

If Melissa and I were having a discussion about this, I’d let her know that refinancing means giving up PSLF for good. So we might talk about taking the job but keeping her loans in the federal program until she’s certain she wants to stay in the private arena. When she’s 100% certain, she’d want to refinance her loans to drop the interest rate down from 6.8% into the 5% range.

Is becoming a nurse practitioner worth it?

The pure financial answer is yes. The projected lifetime earnings of a nurse practitioner versus the average college grad is $960,000 after taxes. This is compared to the $195,000 estimated cost of paying back student loans with the more costly path.

Either way, most nurse practitioners should have a goal to be student debt free in 10 years or less. That could be through refinancing and paying it off in full or going for PSLF and saving aggressively on the side.

Just like any profession, NP candidates should only pursue this path if they’re all in and student loans won’t make them regret their decision.

Having a clear understanding of how loan repayment works and how to mitigate both the financial and psychological aspects of carrying that amount of debt are a must before entering school.

Nurse practitioners need a plan for student loan repayment

Nurse practitioners can find a clear path to pay back their student loans. A path that could not only save them significant money but help them understand the actions steps to get it done.

Student Loan Planner® has done over 5,500 student loan consults for clients with over $1.3 billion of student loans. Our team can help you figure out the optimal path to pay back your loans in just 1 hour.

You can learn more about our consult process here. Or you can book your consultation now by clicking the button below.

Income & Student Debt by Profession

How you compare to other

accountants stats*

| Average student debt | |

| Average income | |

| Average Debt-to-Income Ratio |

Statistics represent the population of Student Loan Planner clients in the respective profession referenced in the chart from 2017-2023. Sample excludes those in school or in training.*

Comments are closed.