The direct educational cost of NYU dental school is $426,232 for the 2022-2023 school year.

That number ignores accrued interest, loan fees, living expenses, and tuition inflation. If you add these costs, an NYU Dental degree costs far more.

For this high cost, NYU Dean Dr. Charles Bertolami has blamed “real horror stories […] that involve excessive [dental student] living expenses.”

In the analysis below, I'll use our estimate of the true cost of NYU Dental for the class of 2024, which we calculate as $705,997.

The only horror story is the price NYU sets for its dental school degree, which we will break down in detail for you.

NYU Dental School cost explained

| NYU Dental School Cost by Year | Education Expense | Living Expense | Loan Fees | Accrued Interest at Graduation | Expected Tuition Inflation |

|---|---|---|---|---|---|

| 2020-2021 | $99,562 | $40,000 | $4,187 | $34,500 | – |

| 2021-2022 | $98,677 | $41,200 | $4,196 | $28,597 | $4,934 |

| 2022-2023 | $98,577 | $42,436 | $4,230 | $21,070 | $10,114 |

| 2023-2024 | $98,577 | $43,709 | $4,269 | $11,592 | $15,549 |

| Total by Category | $395,393 | $167,345 | $16,882 | $95,760 | $30,597 |

Grand Total: $705,977

NYU Dental School removed its cost of living estimate off their website around 2018, presumably because the total amount looked appalingly high. If you check internet archives, you can see NYU estimated about $38,000 per year before that estimate was removed.

We assume above a 6% accrued interest rate, a blended 3% upfront origination fee (from 25% Stafford loans and 75% PLUS loans, and 5% yearly tuition inflation, which has happened virtually every year at NYU.

The total cost of NYU Dental for the class of 2024 without financial help is $705,977, if you borrowed the full amount.

NYU associate dentist salaries are not high enough to pay for the degree without Income Based Repayment

The average associate dentist makes around $120,000 to $140,000 (about $80,000 to $100,000 after taxes). The average NYU dental grad that I’ve worked with owes about $600,000.

Keep in mind you cannot go back in time and borrow at yesterday's tuition prices. Therefore, take any mention of the student debt of the graduating class with a grain of salt.

Even if you could refinance that debt to 5%, you’d have to pay about $5,800 a month, or roughly $70,000 a year just to make a meaningful dent in the principal.

When prospects and students ask about how they’ll pay back their loans, how can NYU’s dental school say anything but “Our graduates from working-class and middle-class families are almost exclusively at the mercy of federal income-based repayment and forgiveness programs for their financial survival.”

Yet, students have told me that financial aid and administrators do not tell them that. They even suggest that they’ll “pay it back in no time.” That assertion seems to be at odds with basic math.

Practice Loan Quote Form

NYU dental student claims of misleading statements by admissions office

I have had numerous clients and readers who told me that when they applied to NYU, someone in the administration claimed that the average repayment period for dental student loans was only seven years.

Is this possible? Perhaps if you include students from wealthy backgrounds who borrow nothing, or maybe it’s just blatantly false.

Much of the national discussion has been about regulating the banks, insurance companies, or investment firms. Who’s watching the universities who are taking our Millennial and Gen Z generations to the poor house?

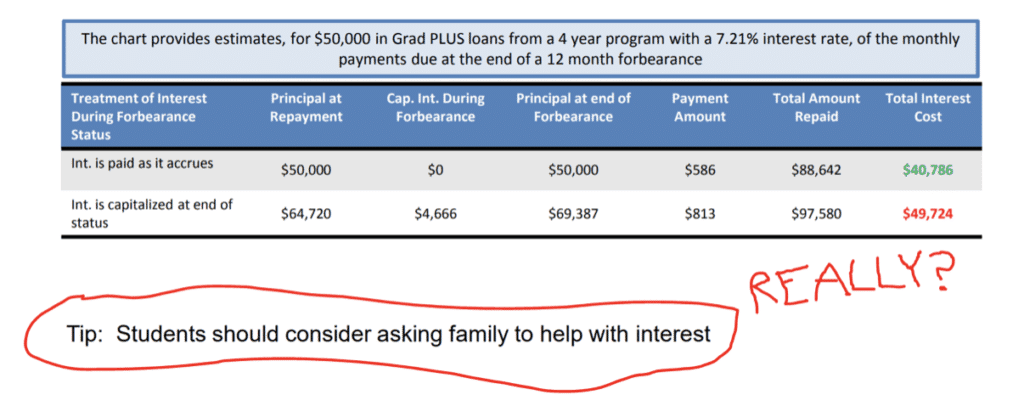

Look at this presentation to the class of 2016 on NYU College of Dentistry's financial aid website. They suggest trying to make payments on the accruing interest while still in school to make paying back the loans easier.

That is TERRIBLE advice. If someone can barely afford to pay down the interest, they will struggle ever paying back the loan in the first place and should use an income-driven strategy like PAYE or SAVE, formerly called REPAYE.

*Source: NYU presentation listed on website

After listening to NYU’s financial aid department, you’ll only have to deal with $500,000 of student debt instead of $550,000. How helpful!

Excuses about the cost of NYU Dental School

One of the most common excuses I’ve heard from administrations everywhere at dental programs for rising tuition is that “The cost to educate a dentist has soared and that’s why tuition had to go up.”

Another one of my favorite excuses is “Federal and state support for higher education has declined enormously, so we had to make up the difference in revenue with higher tuition.”

Yes, inflation happens over time. I understand that faculty want raises and that health insurance costs for staff continue to increase rapidly.

However, at least in NYU’s case, the university owns some of the most valuable real estate in the world, which has only gone up in value.

It established locations in Shanghai and Abu Dhabi. Are they unrelated to the finances of the dental school? Perhaps.

That said, the school is not hurting for money.

Professional schools are a profit center for universities

I’d argue that dental school is a big profit center. The tuition increases have little to do with rising costs of equipment or insurance. It’s mostly about an institution that seems to act like a for-profit business.

In my view, the main reason tuition at schools like NYU has soared is simply because they have been able to get away with it. Students don’t say, “You know what, I’d rather not be a dentist because of that sticker price.” Why is this?

- Income-based programs keep students from feeling the full weight of their debt load.

- Schools like NYU still have many more applicants than seats.

- Publications routinely tout the high incomes and job stability of the dental fields without mentioning the debt.

One dentist told me a story about being forced to buy an equipment box at the cost of hundreds of dollars. Meanwhile, a bait and tackle box that basically performs the same purpose can be had for $30 on Amazon.

Others have shared stories about software programs that run in the thousands, textbooks so expensive that you might as well carry around gold instead, and other equipment that seems unneeded or at least wildly more expensive than it should be.

The average NYU dental school debt vs the NYU loan balance I’ve seen

According to the most recently available College Scorecard data, the NYU dental school average debt for students in 2016 and 2017 was $357,882. The median was $387,660. That big difference between the median and mean suggests that there are a lot of smaller debt burdens from students, with family assistance hiding the true cost for students without financial help.

Keep in mind that the estimated cost of attendance I’m showing you is supposed to be for entering 1st-year students in the fall of 2020. However, I mentioned that the debt loads of the class of 2015-2020 that I’ve seen have been about $600,000 for NYU dental students.

That means that when they went to school, the published cost of attendance was significantly less than what’s on the NYU website today.

Dentists have told me that their tuition increased while they were in school. If you look at NYU’s four-year cost of attendance estimate, you’ll only see the published prices at today’s rates. That gives an inaccurate picture for a student interested in their final loan balance at graduation.

Accrued Interest Growth Has a Big Impact on the Cost of NYU Dental

The worst impact though comes from the accrued interest growth while you’re in school. Unlike undergraduates, professional students receive few subsidies. The accrued interest balance once you finish can often be over $80,000 for dental students. At NYU Dental I project that new students will add just under $100,000 of interest on the balance borrowed during school alone.

This interest goes directly into your principal balance at graduation (called capitalization).

Hence, there are three ways that the school’s cost of attendance estimate is flawed:

- Future tuition increases are not accounted for.

- Accrued Interest isn’t mentioned.

- Loan Fees are not accurate.

High cost of living in New York City adds to NYU Dental School cost

Let me focus on one aspect of the NYU student loan balances that is not the fault of the school: location.

New York City is extremely expensive. You’re virtually guaranteed to need the super high-cost Grad PLUS loans to pay for living expenses there. In New York (or any expensive city for that matter), your rent could easily exceed $2,000, or even $3,000, a month.

Motivated students might try to live with roommates or avoid expensive food and entertainment options, but that only goes so far when your required tuition and fees cost $100,000 each year.

If you have other options, I always suggest to prospective applicants to choose a low-cost location for their graduate study. You’ll be working and studying most of the time anyway, so you might as well save $100,000 or more in living expenses that will result in a much lower debt burden.

Is NYU Dental School the worst offender?

There are plenty of offenders out there in the high balance student loan world.

I have already written about St. George’s med and vet schools, so this is not the first time I’ve called out a university before.

There are certainly other extremely expensive dental schools I could mention. I've chosen NYU Dental to analyze because I consistently hear so many horrifying stories coming from my clients and readers. It's also one of the biggest dental schools by class size.

A cynical person might say I'm attacking NYU because I have a student loan consulting business. If I was smart, I'd keep my mouth shut and send a thank you note to NYU administration for producing so many new clients in need of our services. I'd rather folks have options when they graduate dental school that include not being at the mercy of government repayment plans.

In my view, the school seems to pair lots of poor information with a massive debt load. They are a virtual factory churning out dentists at a huge rate.

At other high-cost schools including USC, I have heard more stories of financial aid departments going out of their way to tell people about how they will likely need to use income-based repayment programs when they graduate.

Another example is Midwestern University. They list on their cost of attendance estimate that students should expect tuition increases of between 4% and 7% annually.

In contrast, I have heard SO many stories of NYU employees claiming fast repayment periods for half-million-dollar loan balances that I felt compelled to write this article.

What if you already have NYU Dental School debt?

While you might be able to put 50% of your take-home pay to your student loans, the first question I’d ask is if that’s a smart approach? If a loan forgiveness strategy shows a cost in today’s dollars of 60% of what you owe, then that would be the better path.

However, if your current family income today and in the future would warrant refinancing, you can get a plan for how and when to do that based on your career and family plans.

Maybe you want to start a family first, or buy a house, or purchase a private practice. Whatever your goals are, the student loans you have should bend to that objective.

NYU Dental School loans are a tax or a debt, whichever one is better for you

If your loans are federal, then you can choose to pay a percent of your income on your loans after school. That percentage is calculated based on your AGI, or Adjusted Gross Income. That means things like owning a dental practice and saving for retirement can reduce that payment.

You can also put about $500 to $1,500 a month into index mutual funds, to prepare for the taxes on forgiven student loan debt after 20 years of repayment.

The total percentage usually comes out to 10% to 20% of your income.

That often ends up being a good trade if you enjoy dentistry more than you would enjoy a different career. It also ends up being a good financial decision if what you're earning as a dentist minus 20% to your loan forgiveness strategy nets you more than what you'd earn without that degree.

I don't think NYU dental school understands this, but they do understand your income-driven payment is the same at $200,000 as it is at $600,000. That is why I think they've chosen to raise tuition so much.

Get a custom plan if you have high anxiety about your dental school debt

We specialize in making student loans plans for dentists, and our average dentist client owes somewhere around $380,000. Some have even owed over $1 million. Many have been NYU graduates. You can learn more about that service if you’re curious.

Eventually, the demand for seats at super expensive schools must go down. While I think we are 10 years or more away from the bubble bursting for dentists, the current model is not sustainable. You cannot charge a half million for a degree to students whose main goal is to help patients.

For now, the solution I have for folks interested in pursuing a dental school education at the ‘nonprofit’ NYU is simple: “May the buyer beware.”

Private student loan options for 2025

| Lender Name | Lender | Offer | Learn more |

|---|---|---|---|

| Sallie Mae |

Competitive interest rates.

|

Fixed 3.19 - 16.99% APR

Variable 4.37 - 16.15% APR

|

|

| Earnest |

Check eligibility in two minutes.

|

Fixed 3.24 - 16.49% APR

Variable 4.99 - 16.85% APR

|

|

| Ascent |

Large autopay discounts.

|

Fixed 3.09 - 15.61% APR

Variable 4.31 - 15.22% APR

|

|

| College Ave |

Flexible repayment options.

|

Fixed 3.19 - 17.99% APR (1)

Variable 4.24 - 17.99% APR (1)

|

Comments are closed.