Otolaryngologists — also called, “ear, nose, and throat doctors,” or ENTs — are trained to perform both medical and surgical treatment of head and neck issues. Some of the many illnesses and disorders they treat include hearing loss, allergies, voice and swallowing disorders, and face and neck tumors or cosmetic deformities.

According to a 2022 Medscape survey, ENTs seem to have a high degree of work satisfaction: 90% said that if they had it to do over again, they would pick the exact same medical specialty. Also, 66% of ENTs felt their otolaryngology salary was fair. But does crunching the numbers show that the otolaryngology salary is worth the student debt that an ENT will accumulate along the way?

In short — yes. The potential financial upside of becoming an otolaryngologist is even higher for ENTs who carefully think through their student loan repayment strategy.

Otolaryngology education and training requirements

To become an ENT, you’ll first need a medical license. Most physicians who pursue a specialty in otolaryngology will have already spent four years earning a bachelor’s degree and another four years in medical school.

Once medical school is completed and you’ve passed the United States Medical Licensing Exam or Comprehensive Osteopathic Medical Licensing Examination (for DOs), you can begin fulfilling the ENT residency requirements.

At a minimum, you must spend five years in residency to earn your primary certification. But additional time in residency is required if you want to earn certification in the subspecialties of neurotology, complex pediatric otolaryngology, plastic surgery within the head and neck, or sleep medicine.

After completing the residency requirements listed above, you’re then eligible to sit for the qualifying exam from the American Board of Otolaryngology. Doctors who receive a passing score on the qualifying exam may then take the oral certification exam.

Finally, after completing the requirements listed above and earning your license, you can then become board certified as an otolaryngologist.

At a minimum, the process of becoming an ENT will require 13 years of education and training.

Income & Student Debt by Profession

How you compare to other

accountants stats*

| Average student debt | |

| Average income | |

| Average Debt-to-Income Ratio |

Statistics represent the population of Student Loan Planner clients in the respective profession referenced in the chart from 2017-2023. Sample excludes those in school or in training.*

Average otolaryngology salary

According to Medscape’s 2022 Physician Compensation Report, the average ENT salary is $469,000. That ranked third-highest of all specialties included in the survey. In fact, the average otolaryngology salary is nearly double that of pediatric doctors, who earn an average of $232,000 per year.

Otolaryngologists had the second-highest annual incentive bonuses of all medical specialties in Medscape’s survey at $91,000 (only behind orthopedic surgeons). And 71% of ENT doctors earn at least three-quarters of their incentive bonus.

Although board-certified ENTs make a healthy salary, resident otolaryngologists make far less. According to Medscape’s most recent data, the average otolaryngology salary during residency is $61,100. Residents make the least during the first year of residency ($55,200 per year) but earn an average salary of $65,200 by their fifth year.

Prior Medscape Otolaryngology Compensation Surveys also found a significant income discrepancy of over $64,000 between self-employed and employed otolaryngologists. Private practice ENTs earned an average of $495,000 per year, while the employed average ENT doctor salary was $431,000.

Otolaryngologist student debt

Student loan totals for otolaryngologists should track closely with the average student debt of physicians as a whole. In fact, in one of the only studies to examine student debt by specialty, the median ENT student debt was exactly the same as the median debt for all physicians.

The Association of American Medical Colleges’ (AAMC) latest statement on the physician student loan situation said that the median debt for all medical school graduates was $200,000.

It can take longer for otolaryngologists to repay their student debt than other physicians, however. Medscape’s 2020 Physician Debt and Net Worth Report 2020 found that 29% of ENTs were still paying off student loans. That put them in a tie with OB/GYNs and surgery general doctors for sixth-highest out of nearly 30 medical specialties.

This seems somewhat surprising when you consider the fact that the ENT surgeon salary is higher than the average physician salary. But the answer likely lies in the fact that ENTs also spend a longer time in residency than other doctors.

Best student loan repayment strategies for otolaryngologists

According to the AAMC, the average medical school graduate will pay $365,000 to $440,000 in total student loan payments. With the right strategy, however, you can dramatically reduce how much you pay.

How to pay back ENT student loans while working in private practice

The potential for an extra $64,000 in annual income could make private practice ownership an attractive option for many otolaryngologists. However, it’s important to understand that if you go this route, you won’t qualify for Public Service Loan Forgiveness. Your best option would probably be to pay down your student loans as fast as you can.

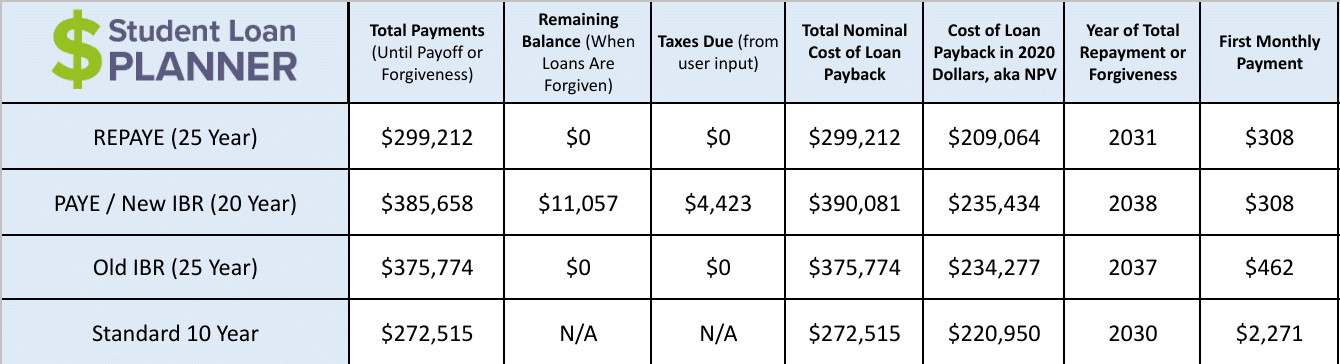

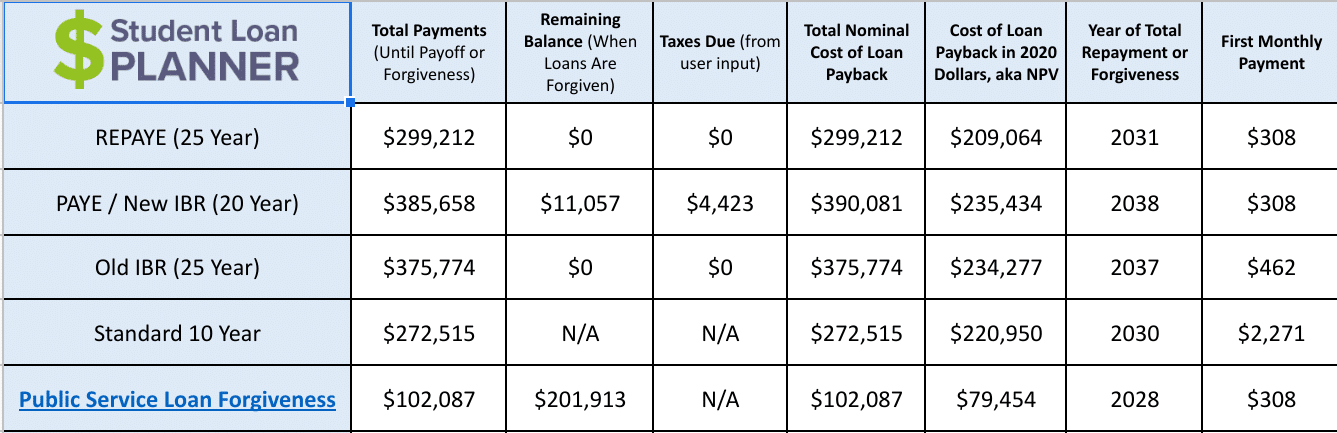

You could extend your payments out 20 to 25 years with an income-driven repayment (IDR) plan, which would lower your monthly payments, but, using the Student Loan Planner® calculator, you can see that the average ENT with $200,000 of student debt will pay an extra $20,000 to $117,000 by choosing IDR over the Standard 10-Year plan.

You might be thinking that $20,000 isn’t that big of a difference considering that your monthly payments would be so much lower. But remember, once your income jumps up after residency, your payments on any of the IDR plans will increase (and be even higher on the REPAYE plan).

What you really need to consider is how much you can save in interest by making extra payments above your plan requirements.

Let’s say, for example, that you joined and paid according to the REPAYE plan during residency. In this case, your balance will have grown to just over $222,000 by the time you begin earning your normal attending salary.

At a minimum, you’d be required to make payments of over $2,500 per month.

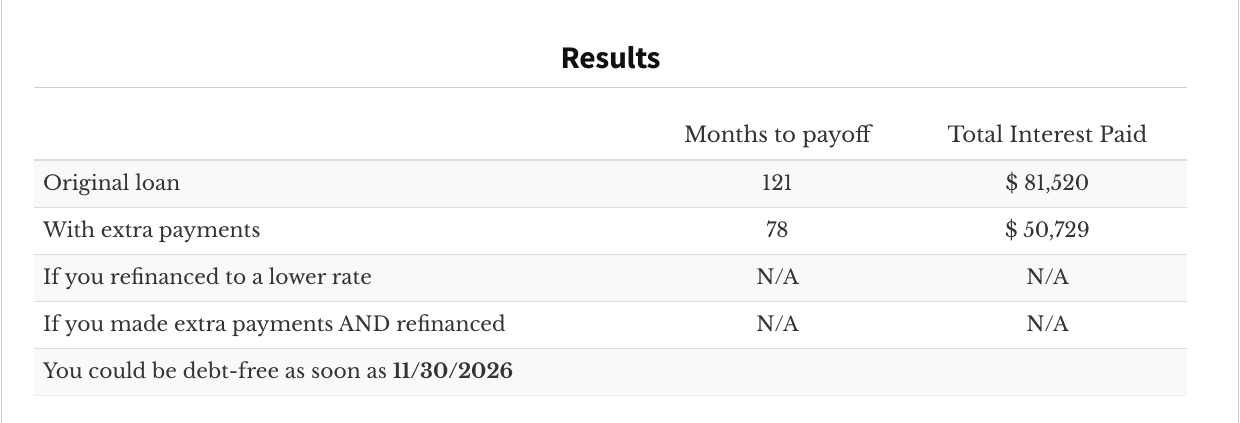

What if you chose to make extra payments of $1,000 per month? Well, you’d save yourself over $30,000 in interest.

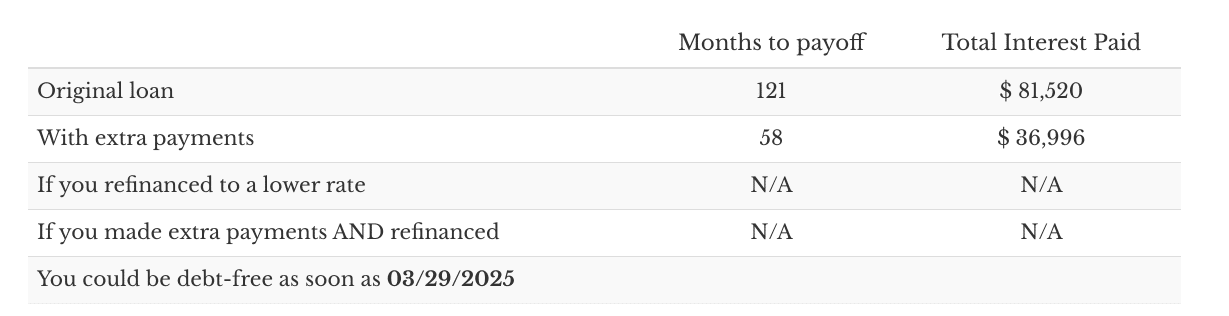

But what if you chose to pay $2,000 more per month? In that case, you’d increase your interest savings to just over $44,000.

Before you assume that you can’t afford that kind of a monthly payment, consider the fact that the monthly income of someone earning $455,000 is nearly $38,000. So even with a $4,500 payment, you’re only allocating about 12% of your monthly income to student debt repayment.

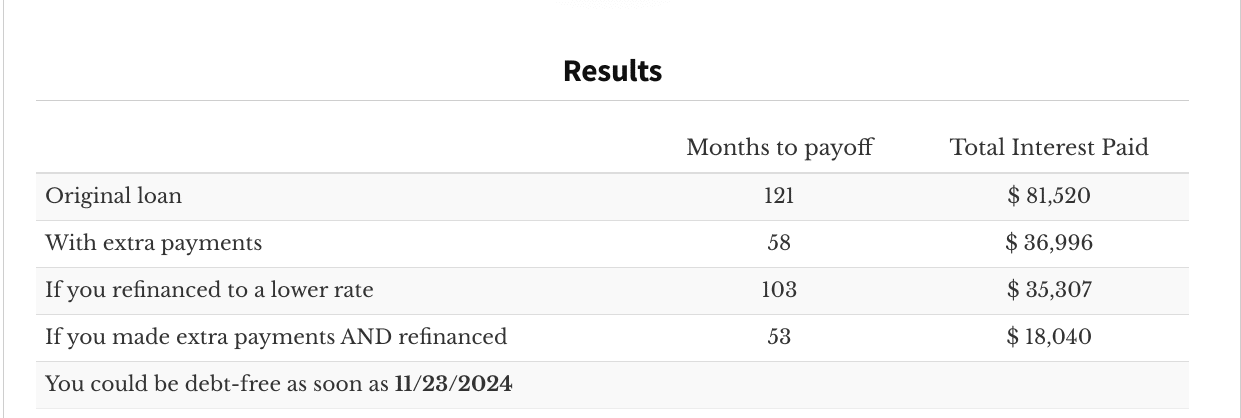

But what if you also refinanced your student loans at a 3.5% interest rate and combined that lower rate with the power of making extra monthly payments of $2,000? In that case, you’d reduce your total interest payments to $18,000, and your total savings would exceed $63,000.

How to pay back ENT student loans while working for a nonprofit

If you don’t think that private practice ownership is right for you, your next best option would be to work for a nonprofit hospital or clinic. This route lets you qualify for the PSLF program.

With PSLF, you could earn full tax-free forgiveness after just 10 years (120 qualifying payments). Plus, you’ll be in a better cash-flow situation during those 10 years because you’ll be making payments on an IDR plan.

These benefits make PSLF the clear winner for nonprofit otolaryngologists. When compared to the 10-Year Standard repayment plan and all IDR plans, PSLF comes out ahead by $170,000 to $273,000.

Is otolaryngology private practice ownership possible?

It is possible for you to own your private otolaryngology practice. Despite the advantages of PSLF, private practice ownership is not only possible for ENTs but may still be the best financial choice.

Remember, the average self-employed ENT makes an extra $64,000 per year. When you consider that you’d need to spend five years in nonprofit employment after residency to earn PSLF, you could be sacrificing up to $320,000 of additional income.

If you already know that you want to do nonprofit work, then, by all means, join the PSLF program as soon as you can. But the pure dollars-and-cents math shows that you’ll come out ahead by launching your otolaryngology private practice as soon as possible.

Get a solid repayment plan for your otolaryngologist student loans

Are you wondering whether pursuing private practice ownership or nonprofit employment would be your best financial decision? Or are you waffling between adopting an aggressive repayment strategy or trying to maximize federal forgiveness?

Our Student Loan Planner® consultants can help you answer those questions and more. Our advisors have helped over 4,000 borrowers save an average of $50,000 in projected savings over the life of their loans. And they’d love to help you build a comprehensive repayment plan for your ENT student loans too.

Income & Student Debt by Profession

How you compare to other

accountants stats*

| Average student debt | |

| Average income | |

| Average Debt-to-Income Ratio |

Statistics represent the population of Student Loan Planner clients in the respective profession referenced in the chart from 2017-2023. Sample excludes those in school or in training.*

A very important note on PSLF is that most Residency and Fellowship programs are qualifying employers as either Gov’t institutions or non-profits. So this takes the total payment amount down drastically and the forgiven amount up drastically as compared to your chart above. When my wife finishes her General Surgery training she will have 9 years out of 10 already completed for PSLF. This has an effect of her only making payments with her ‘normal’ doctor salary for 1 year. With this calculation – it is very important for Doctors to take into account their residency programs status for PSLF. If you only have to work at a non-profit for 1 year post training to get PSLF then is makes zero financial sense to go straight into private practice. Waiting 1 year is a much smarter financial decision.