Editor's note: The final version of President Biden's New IDR rules was announced on June 30, 2023, and phase out the double consolidation loophole by July 1, 2025. Anyone who completes the process of consolidating twice before that date can access the Saving on a Valuable Education (SAVE) plan. If you miss that date, you're stuck paying 20% of your income on Income Contingent Repayment (ICR) with a very low deduction (100% of the poverty line).

Why is that a big deal? Take a borrower earning $50,000 yearly with $100,000 of Parent PLUS loans. The ICR monthly payment would be $590, while the SAVE plan would be only $143. The SAVE plan offers huge interest subsidies, too. The stakes have never been higher for Parent PLUS borrowers seeking a more affordable repayment plan. If you're struggling to complete this process yourself with the article below, our team of student loan experts can help. We have more than 3,000 five-star reviews and have been helping borrowers navigate these complex repayment options since 2016.

Borrowers who have Parent PLUS Loans deal with somewhat of a different beast than when a student borrows federal student loans. Parent PLUS Loans stay in the name of the parent who pulled them out if kept in the federal system. They generally have much higher interest rates than Direct Loans and don't offer student loan forgiveness opportunities.

Parent PLUS Loans also have far fewer repayment options available (e.g., amortized standard fixed and graduated repayment plans). But there's a loophole you probably haven't heard about before: the Parent PLUS double consolidation.

The Parent PLUS double consolidation loophole is a game changer. This strategy could drop your payment from 20% to 10% of your income.

Refinancing Parent PLUS Loans to private student loans

A few past options we’ve written about have included private refinancing and consolidation. With Parent PLUS Loan refinancing, you take federal loans from the federal system and get a new loan from a private lender. The goal is to get a lower interest rate and snag more favorable terms.

Student loan refinancing works great for folks in a couple of different situations, assuming their credit is in a good place, such as:

- When the student loan debt balance is lower than their annual income, and they feel confident in committing to that payment and term

- When there’s a need or desire to transfer ownership of the loan to the student/child, and their credit and financial situation allow them to commit to that payment and term

If refinancing doesn’t seem to be the right fit (because of poor credit or the loan balance is much higher than income), the repayment terms are more difficult to commit to. In that case, consolidating within the federal system is a way to open the door to income-driven repayment (IDR), but Parent PLUS Loans can access just one plan: Income Contingent Repayment (ICR). More on that below.

Calculate Your Parent PLUS Loan Payments and Forgiveness Path

Parent PLUS Loan CalculatorParent PLUS double consolidation loophole

Parent PLUS loan borrowers can consolidate into a Direct Consolidation Loan, even without another loan, and have access to Income-Contingent Repayment (ICR). This plan is based on 20% of discretionary income and has a maximum student loan repayment period of 25 years. If your employment meets eligibility requirements, it also qualifies for loan forgiveness programs, like the Public Service Loan Forgiveness (PSLF) program.

If refinancing isn’t a viable option and consolidation does not bring relief with the 20% calculation, you can entertain a process called Parent PLUS double consolidation.

How Parent PLUS double consolidation works

Double consolidation is not something your servicer will offer as a strategy for repayment. The federal Direct Consolidation Loan application and process is also very tedious and time-consuming. However, it CAN open the door to Saving on a Valuable Education (SAVE), Pay As You Earn (PAYE), and Income-Based Repayment (IBR).

These lower IDR repayment options were not initially available to Parent PLUS Loans or consolidated Parent PLUS Loans. Let’s get technical:

A consolidation loan that includes two consolidated unsubsidized loans that previously paid off Parent PLUS loans is NOT the same as a consolidation loan that paid off a Parent PLUS Loan directly.

A consolidation loan that paid off a Parent PLUS loan = Access to ICR.

A consolidation loan that consolidated two direct consolidated unsubsidized loans = Access to SAVE, PAYE and IBR.

You get around the rule that says consolidated Parent PLUS loans only have access to ICR by consolidating in this specific way.

This technicality is critical because of how student loans are administered and how the laws were written to identify repayment options for a loan type. This legal “loophole” allows the double-consolidation process to open the door for accessing SAVE, PAYE (if you hadn’t borrowed before October 1, 2007), and IBR.

Could the double consolidation loophole work for you?

First and foremost, let’s review some terminology and how consolidations work:

- Parent PLUS Loans can consolidate themselves into a Direct Consolidation Loan. This means the double-consolidation process could be successful with as little as two Parent PLUS Loans consolidating individually in the first round.

- Unlike Parent PLUS Loans, a Direct Consolidated Unsubsidized Loan needs one other loan to consolidate with.

- Parent PLUS Loans can be consolidated with non-Parent PLUS Loans, but this must be done strategically.

- Suppose you only have one Parent PLUS Loan (and no other federal loans). In that case, your only opportunity is to consolidate that one loan into one Direct Consolidation Loan and have access to ICR or private student loan refinancing.

Will double consolidation be unnecessary with Biden Parent PLUS Reform?

The final version of President Biden's New IDR rules will phase out the double consolidation loophole by July 1, 2025. If you complete the process of consolidating twice before then, you can access the SAVE plan. If you miss that date, you're stuck paying 20% of your income on Income Contingent Repayment (ICR) with a very low deduction (100% of the poverty line).

Parent PLUS double consolidation steps

If it sounds like this double consolidation loophole would work for you, watch the instructional video above, and here are the written next steps and notes:

1. Fill out paper consolidation applications.

You will want to submit paper applications for the first round of consolidations. This includes one application for consolidating one or more loans and the second application for consolidating the other loan(s) left out from the first application.

You will mail to two different servicers to avoid having them added into the same consolidation (which defeats this process’s purpose). Loan account numbers, loan codes, and loan servicer contact information are available on the Federal Student Aid website.

The best way to grab this info is by acting like you’re completing an online consolidation application, which will lay out your specific loan details.

Once logged in, click on the “consolidate my loans” section if it doesn’t take you straight there. Continue through your basic info until you get to your loan details. You should see a long list of your loans and their details.

Here’s another resource for the loan codes, just in case.

*Caution: DON’T submit your application online this way; the first round should be via paper application.

2. Include a Repayment Plan Request form

In the application mailer, include a Repayment Plan Request form. On the form, check the first box for ALL loans, and select the Standard Plan. This is a placeholder until you can do the final consolidation, so you don’t have to submit income documentation. If you don't include this, the consolidation will be denied for no repayment plan elected.

3. Mail your consolidation paperwork.

Use certified mail to ensure delivery to the servicers.

If you’re going for PSLF, don’t send an application to MOHELA first. Consolidations take 30 to 90 days to complete, in which your loans will be put into forbearance or deferment while the process is underway.

Final steps

Wait for confirmation that the different servicers processed both consolidations.. Once the consolidations are settled, you can proceed to the last steps:

4. Do the online consolidation application for the final consolidation.

After confirming that both consolidations were processed, do the online consolidation application. The application should show the two consolidated unsubsidized loans that were just completed. If it still shows the old Parent PLUS loans, close out of the application and return in a week to allow the consolidation process to finalize.

5. Choose your final servicer.

You’ll select this in the online application. If going for PSLF, choose MOHELA. If not, choose a servicer you haven’t sent a consolidation application to yet.

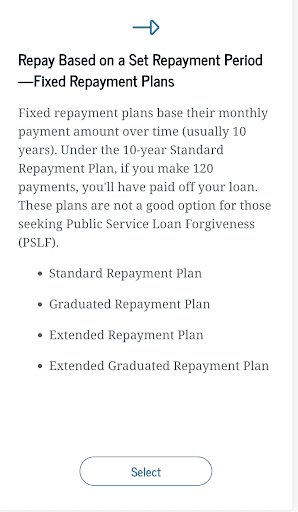

6. Choose a fixed repayment plan.

The online application currently will not allow you to choose SAVE, PAYE or IBR at this stage of your process. So, choose a fixed repayment plan (Standard is fine) again as a placeholder, just like in the initial steps.

7. Submit a paper IDR application.

After the consolidation has been completed, apply for the income-driven repayment plan (SAVE, PAYE, IBR) using this application.

Provide a copy of your income documentation. Upload this completed application and your income documentation to your servicer's online portal (document uploads), or mail it to them.

***Note: If you initially get denied, call the loan servicer and ask to be switched to the income-driven plan. Mention that you did the double consolidation. If that doesn't work, call again and get a different person. You are legally eligible for this IDR plan if you’ve completed the double consolidation process before July 2025. If you still have trouble, submit a complaint with FSA.

8. Make your monthly payments and recertify annually.

To maintain eligibility for income-driven repayment plans, making your monthly payments on time and recertifying your income and family size annually is crucial.

Case study: Parent PLUS double consolidation with PSLF

Sara is a single mom and borrowed loans to send her two sons to college. She works full-time for a 501(c)(3) nonprofit and is interested in pursuing PSLF.

Here's Sarah’s loan list:

| Loan type | Balance | Servicer |

|---|---|---|

| Direct PLUS Parent | $43,000 (Son #1) | Aidvantage |

| Direct PLUS Parent | $35,000 (Son #2) | Aidvantage |

Her current payment on the Standard Extended Fixed Plan is $503 per month for 300 months (25 years). She knows efficiency can be achieved with PSLF, but she needs to consolidate her Parent PLUS loans ) and be on an IDR plan to qualify.

Consolidation process #1

Sara consolidates each Direct PLUS Parent loan individually.

- She mails in a paper consolidation application to Nelnet, consolidating one Direct PLUS Parent Loan. Additionally, she includes a Repayment Plan Request form selecting the Standard plan for all loans and includes this in the mailing packet.

- Sara mails a second paper consolidation application to Aidvantage, consolidating the other Direct PLUS Parent Loan that she didn't include on the first application. She also includes a Repayment Plan Request form selecting Standard for all loans again in the mailing packet.

- She waits. Her Direct PLUS Parent loans are successfully consolidated into a Direct Consolidation Loan at both Nelnet and Aidvantage.

Consolidation process #2

Sara then completes the online consolidation application.

- She now consolidates BOTH loans by logging into studentaid.gov and including them in her online application.

- Sara sends them to MOHELA, since she’s going for PSLF.

- At this stage of her process, the online application doesn't allow her to choose SAVE, PAYE or IBR repayment plans. So Sara chooses a fixed repayment plan (Standard is fine) as a placeholder, just like in the initial steps. When completing the online IDR application, elect SAVE, PAYE or IBR repayment plans.

- After completing the consolidation, she applies for the income-driven repayment plan (SAVE, PAYE, or IBR) using this application and provides a copy of her income documentation. She uploads this completed application and your income documentation to her servicer's online portal.

- She also submits her Employer Certification Form (ECF) for PSLF.

Sara’s adjusted gross income (AGI) is $80,000, so her new payment under SAVE is $393 per month. This payment is slightly lower than the 25-year plan she was on, and now she will achieve PSLF forgiveness after 120 qualifying payments (10 years). Her estimated forgiven balance will be $69,000!

When to get help

The process for the double consolidation can be a double-edged sword if you are unsure of the steps. Throw in a spouse with student loans, or having your own student loans along with Parent PLUS loans, and it makes things extra tricky. With the stakes being high, it's a good idea to speak with a double consolidation expert to set you up with customized instructions to fit your specific situation.

Refinance student loans, get a bonus in 2024

| Lender Name | Lender | Offer | Learn more |

|---|---|---|---|

|

$500 Bonus

*Includes optional 0.25% Auto Pay discount. For 100k or more.

|

Fixed 5.24 - 9.99% APR*

Variable 6.24 - 9.99% APR*

|

|

|

$1,000 Bonus

For 100k or more. $300 for 50k to $99,999

|

Fixed 5.19 - 10.24% APPR

Variable 5.28 - 10.24% APR

|

|

|

$1,000 Bonus

For 100k or more. $200 for 50k to $99,999

|

Fixed 5.19 - 9.74% APR

Variable 5.99 - 9.74% APR

|

|

|

$1,050 Bonus

For 100k+, $300 for 50k to 99k.

|

Fixed 5.44 - 9.75% APR

Variable 5.49 - 9.95% APR

|

|

|

$1,275 Bonus

For 150k+, $300 to $575 for 50k to 149k.

|

Fixed 5.48 - 8.69% APR

Variable 5.28 - 8.99% APR

|

|

|

$1,250 Bonus

For 100k+, $350 for 50k to 100k. $100 for 5k to 50k

|

Fixed 5.48 - 10.98% APR

Variable 5.28 - 12.41% AR

|

Not sure what to do with your student loans?

Take our 11 question quiz to get a personalized recommendation for 2024 on whether you should pursue PSLF, Biden’s New IDR plan, or refinancing (including the one lender we think could give you the best rate).

Comments

Comments are closed.

I mistakenly consolidated two of my daughters plus loans into my direct loans from nursing school (second career). Do I have any options available to pull the plus loans back out? I cannot qualify for the IDR plan to get into the PSLF plan due to the payment being $700 a month. I’m currently on an income contingent plan that has my payments at $350/month.

Nelnet offers me no options except paying the 700 to qualify.

What do you think?

Thanks

This stinks to tell you but unfortunately no it can’t be pulled out once it’s already been included.

Do you have any guidance as to what servicer to file the final consolidation under? Would the original servicer be more likely to recognize the loophole I’m trying to work through and deny me?

Thanks!

We tend to suggest Great Lakes as the ideal servicer to end up with if you’re not pursuing PSLF, and we suggest FedLoan for people pursuing PSLF. The reason you need to use different servicers is that any loans not included with a consolidation get automatically included with a 180 day lookback if you use the same servicer. So you just have to follow the instructions exactly and then it likely works out according to the rules.

Okay gatcha. My initial services was Great Lakes, and I split the first round of the consolidations between Great Lakes and Nelnet. I am pursuing PSLF, so if I do the final consolidation through FedLoan, is the 180 day look-back not applicable? Or should I leave a 180 day window before the final consolidation?

Thanks so much for your quick response.

We suggest using someone besides your current servicer for the 2 consolidations that are used. It might work out ok but I would’ve suggested you use navient and nelnet then do the final consolidation immediately after getting confirmation that both went through and send that internet consolidation of the 2 consolidation loans to fedloan for PSLF.

I was wondering, I have 7 Parent plus loans and no other federal loans. Am I able to take advantage of this strategy? If I consolidate 3 of these loans at one servicer, and 4 at another, and then at a third servicer once those have been confirmed consolidated, submit those two consolidated loans to this third servicer to be consolidated the second time and I am able to apply for REPAYE on this final consolidated loan?

Thanks!

It’s definitely a lengthy process. If you want help walking through it, you can book a consult. All of the student loan planners have experience with it, but Meagan has the most if you want to schedule with her. https://www.studentloanplanner.com/book

I had completed the paperwork and was ready to send everything in to initiate the process of consolidating the 2 sets of loans but then was furloughed at the end of March due to COVID-19. They’re still paying my insurance, though of course my income has been drastically diminished without a paycheck since March. Would it make sense to leave my employer listed, still provide my 2019 tax return, as well as my unemployment application to verify the date of furlough?

Sure you just want to get the loans consolidated then reconsolidated dont worry about the payment you can change that later w updated documentation

Great article but it seems that the outcome of Case Study #2 is a little inflated unless I missed something. Wasn’t the new payment of $288 only for the Parent Plus loans that Sam consolidated? If so, what is the remaining payment for Sam’s Direct loans that were placed into forbearance while he dealt with the Parent Plus loans? If I’m correct, the stated $900 per month cash flow increase will be lower once the remaining loans are accounted for. Thanks for confirming if I missed something or not. Again, great article!

Eventually once you get everything added to the Direct Consolidation loan the payment is then much lower.

I will have 2 Parent Plus Loans. The first has deferred payments until my daughter graduates in 2021. I am deciding whether we should make immediate payments on the second loan, which will be for my son starting college this Fall. Can these consolidation strategies work if we do NOT defer payments on the 2nd loan or must we defer that as well?

It’ll still work, you just might end up paying a little more over the long run.

I have two children. If I have a Parent Plus loan for one child who will graduate in 2023. Can I consolidate that into a Direct Consolidation loan once she graduates with ICR payment? Then, when the second child graduates in 2025, can I consolidate the Parent Plus loan I took for her into a Direct Consolidation loan with ICR, and then immediately consolidate both Direct Consolidation loans into a final consolidation loan with FedLoan as the servicer if I’m going for PSLF? Will this loophole work if I consolidate the first child’s loan two years before the second child’s loan is consolidated? Hope this makes sense. Great article!

It depends. It could work. Although if you consolidate the Parent Plus loans for your child who graduates in 2023 again in 2025, you lose 2 years of potentially qualifying payments toward PSLF because your payment count starts over when you consolidate. When you first child graduates in 2023, I’d suggest booking a consult to walk through your best strategy options.

I have three Parent Plus Loans and I’d like to take the Double Parent Plus Consolidation approah. How can I do this with three Parent Plus Loans?

I suggest you reach out to a consultant to discuss your options and to get a custom repayment plan for your situation.

Is it possible to use this consolidation plan on my own or do I need to pay someone to help me with this? I have Parent Plus loans that I would like to move to PAYEE program by doing the double consolidation.

You shouldn’t ever have to pay someone to use a consolidation plan. It’s possible to do it on your own. Our consult service analyzes your loans and situation to pick the best repayment option but you’re paying for our financial expertise which can streamline your repayment strategy.

I have gone through the first round of consolidation with my parent plus loans. I have received confirmations that both have been approved, but because of the covid cares acts, payments do not start till February, so I have not received a payment schedule yet on both. Would you suggest waiting for the payment schedules before going through the second round of consolidation on Federal Aid’s website? Or would it be ok for me to move forward without the payments schedules?

I appreciate the article!

As long as you have 2 direct consolidation loans showing up on the online consolidation app, you could complete the 2nd round.

If I already have a consolidation loan with Fed Loan that includes a FFEL (my) loan and parent plus, can I consolidate again with my daughters parent plus loans. So basically combining the 3 consolidation loans together with Fedloan to be eligible for the loophole, or will Fedloan know and just combine them all together with them and I would just remain on ICR?

Hi Bobbi – I ran this one by one of our consultants and if they are all 3 separate consolidation loans, you could combine them all and open access to REPAYE/PAYE/IBR. Just make sure to use a different servicer altogether. If you leave the consolidation loan with FedLoan out (with an FFEL loan and a Parent Plus loan) and only consolidated the 2 Parent Plus consolidated loans, that FedLoan consolidation loan would stay only eligible for ICR, while the other 2 would consolidate and have access to PAYE/REPAYE/IBR. If the Parent Plus loans are still in their original form, those need to be consolidated FIRST, then you could consolidate that one with your existing consolidation loan at FedLoan. Hopefully that makes sense – it’s quite a process, as you can see. If that seems confusing, book a consult and one of our consultants can walk you through it.

Thank you Amy, it is not confusing at all. I forgot to mention I am a teacher so that is why I am using Fedloan for PSLF. I listen to the Student Loan Planner podcasts which give great advice as well.

I have told other teachers about your service and info on the web, most of them think they are getting forgiveness but they are not with Fedloan. They do have to be with Fedloan for PSLF, correct?

Thanks Again,

Bobbi

Thank you for the great article!

Do you know whether the same method works if we reconsolidate a single commercially-owned *FFEL* consolidation loan–that repaid Parent PLUS loans–to a Direct Consolidation Loan? The current loan shows up as type J, “Unsubsidized FFEL consolidation loans,” on the Direct Consolidation Loan Application.

By the way, I thought readers might be interested to know the 2017 PROSPER Act (currently dead to my knowledge) had an explicit provision to close this loophole: “A current law loophole allows parent loan borrowers to enter IBR if such borrowers consolidate a consolidation loan. We eliminate this ‘double consolidation’ loophole for all loans.”

If you have not taken a new loan out in the last 180 days (6 months) can you do the process electronically. When talking to the loan servicers, they say that to just pick the loans you want to consolidate when you fill out the online application.

You can, but because you need to send the paperwork to 2 different loan servicers to make the double consolidation loophole work, doing it online isn’t recommended.