Prosthodontics is a dental specialty that focuses on dental prosthetics and teeth replacement. Dentists can refer patients to prosthodontists for tough cases that go beyond the expertise of general dentistry and require specialized teeth or tissue treatment by these types of professionals. This could include prostheses, veneers, dentures for missing teeth, crowns, implants, and more advanced surgery.

Since prosthodontists are specialists, they require extra years of training. But once they complete their training, they earn a nice premium compared to general dentist annual salaries.

To figure out if it’s worth taking out the debt to become a prosthodontist, we’re going to look at income potential and wages, the cost of getting the degree, and other key factors that affect loan repayment plans.

Let’s dive in!

Average prosthodontist salary

Prosthodontists get paid a nice premium compared to general dentists.

According to ZipRecruiter, the average annual salary for a dentist makes $189,403 per year. The same source shows that the national average prosthodontist salary is $330,066. That’s nearly a $150,000 income premium on an already nice general dentist salary.

The number of prosthodontists in the city or town where they practice also impacts income. We’ve found that prosthodontists who practice in more competitive markets tend to make less. Those who are set up in rural areas tend to have the highest salary because they may be the only game in town. Less competition means more business, which leads to a higher income.

Practice ownership also plays a role. Rarely have we worked with a practice-owning Doctor of Dental Surgery (DDS) or Doctor of Medicine in Dentistry (DMD) earning less than $300,000. Profit margins from owning practices are higher than an associate’s payout, so a practice-owning prosthodontist makes more money even if they have the same education as their non-practice owning colleague.

If you want to hear more about what practice ownership entails, listen to this great podcast interview Travis had with Zachary Kingsberg, a practice-owning dentist. Though he’s a general dentist, it gives you a good sense of what the numbers and estimates can look like for prosthodontists.

Related: How to Protect Your Prosthodontist Salary with Disability Insurance

Prosthodontist student loan debt

Dental school is one of the most expensive grad-level programs out there. Dental graduates typically have more debt than most other professions.

A typical dentist will graduate with around $250,000 to $300,000 in student loans and those attending private schools can add about 50% more to that total. That may not even include student debt from a Bachelor's degree. We’ve done 837 consults for dentists with an average debt of $339,615. That’s among the highest average and percentiles we’ve consulted with compared to other professions.

However, dental schools continue to be in high demand because of the high-income potential for dentists and specialists, like prosthodontists. Plus, prosthodontists’ income has a higher potential if they open their own practice.

Income & Student Debt by Profession

How you compare to other

accountants stats*

| Average student debt | |

| Average income | |

| Average Debt-to-Income Ratio |

Statistics represent the population of Student Loan Planner clients in the respective profession referenced in the chart from 2017-2023. Sample excludes those in school or in training.*

Prosthodontist requirements can impact student loan repayment

Prosthodontists go to dental school just like general dentists, but prosthodontists also go through three to four years of additional training studying oral structures after graduating. In contrast, a general dentist can start practicing and performing dental examinations right after graduating from dental school.

Those extra years give prosthodontists the necessary skills to deal with more complicated situations with oral functions and manage patient care.

Obviously, the estimated salary earned during this extra training is a fraction of what’s earned after becoming a full-fledged prosthodontist. Since a good portion of loan repayment is based upon income compared to the loan balance, this variance in income can put a wrinkle in student loan repayment strategies.

Often, the short-term repayment strategy while in training may be different than the optimal long-term strategy for practicing prosthodontists.

2 Best loan repayment strategies for prosthodontists

In our experience, prosthodontists have two solid options that will save the most money paying back their student loans:

- Pay off the loans aggressively with the goal of being debt-free in 10 years or less. This could involve refinancing student loans to lower interest rates, as long as they can afford the payment.

- Sign-up for an income-driven repayment (IDR) plan, like Pay As You Earn (PAYE) or Revised Pay As You Earn (REPAYE), that adjusts payments based on their income for 20 to 25 years. After that, loans are forgiven and taxes are owed on the forgiven balance.

With the first option, a prosthodontist should throw every extra dollar they can find at their debt to become debt-free as quickly as possible.

The second option is the exact opposite — pick an income-driven repayment plan that’ll keep payments as low as possible, max out pre-tax retirement accounts to lower adjusted gross income (AGI), save up for the tax bomb and maximize student loan forgiveness.

Going with an in-between repayment strategy like 1) paying more while on income-driven repayment or 2) going beyond 10 years to pay back the debt after refinancing could be a needless waste of thousands of dollars. We’d rather prosthodontists keep that money in their pockets!

So which option is best? It depends on the specific situation of a prosthodontist. Plus, there could also be a slightly different strategy while in training vs post-training.

I’ll walk you through some scenarios so you can see what I mean.

When prosthodontists should refinance student loans

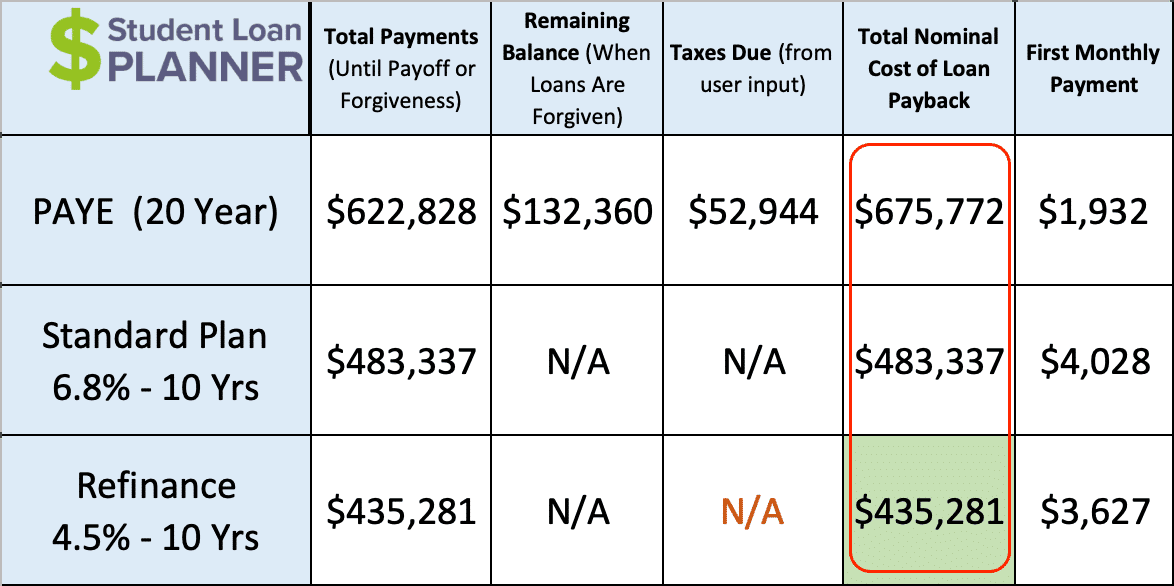

Anita has $350,000 at 6.8% in student debt, with a prosthodontist estimate salary of $250,000. Her income is projected to grow slow and steady at 3% per year. Should she take the aggressive approach or go on income-driven repayment?

Let’s take a look at the numbers comparing PAYE, a standard 10-year plan and refinancing:

This is a clear refinancing case because it will save Anita the most money by far when compared to the other two options.

PAYE would cost about $240,000 more to pay back her student debt and double the amount of time until she’s debt-free (20 years versus 10 years). The refi payments are $1,700 higher per month versus her initial PAYE payment, but she can easily afford that on a $250,000 income. It’s worth it to save money over the long run.

Why refinance with a private lender rather than leave it in the federal system? Anita will save money on interest by doing that.

Let’s look at refinancing over 10 years versus the 10-year standard plan. Both get her debt-free in 10 years, but lowering her interest rate from 6.8% down to 4.5% will reduce the total cost of paying back her debt by nearly $50,000 over 10 years and lower her monthly payment by about $401 per month! All of that savings comes from paying a lower interest rate.

When prosthodontists should look at IDR

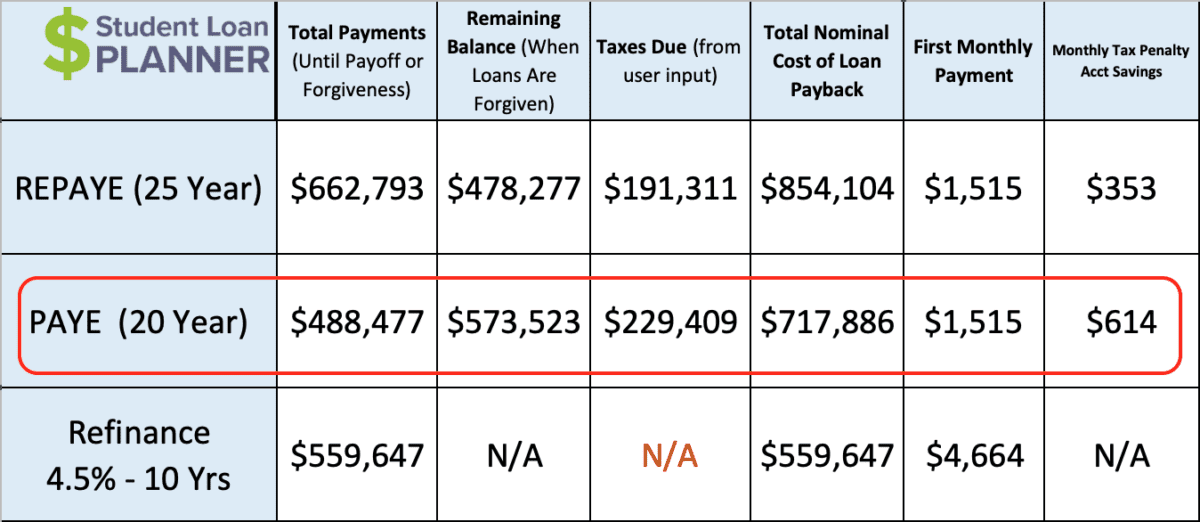

Carlos is a prosthodontist who lives in Southern California who deals with complex oral prostheses and teeth restoration. His prosthodontist income is $200,000, and he owes $450,000 in student debt from undergrad and dental school. He’s not planning to open his own practice so his income should grow at the normal 3% per year.

Although it looks like refinancing costs less out of pocket, it isn’t actually the most affordable or optimal plan. The combination of a high refinance payment and a lower salary doesn’t leave much room to reach other financial goals, like buying a house or saving for retirement.

Let’s say his take-home pay is about $10,000 per month. Nearly half would go toward his refinancing payments over the next 10 years. This leaves him with just over $5,000 for regular monthly outflows while living in expensive Southern California, one of the highest costs of living in America.

On PAYE, his payment would start at $1,515 which would leave him with about $8,500 per month in take-home pay. He could save about $3,000 a month by maxing out his pre-tax retirement plan, saving for the tax bomb ($614/month) by doing a backdoor Roth IRA contribution, and reaching other financial milestones along the way.

Assuming his $3,000 per month would be invested and grow at 5% per year, he’d build up a $465,000 nest egg in 10 years. That would continue growing to $1,004,000 in 20 years, even after paying the tax bomb on the forgiven balance after 20 years of payments on PAYE. That also doesn’t take into consideration that he could also increase the dollar amount going to savings as his income grows.

Now, let’s say he refinanced, throwing all he can toward his loans and holding off on savings for 10 years. He’d be debt-free in 10 years. He could then take the $4,664 payment and invest it for the next 10 years (years 11 to 20) and end up with $724,000. That isn’t bad but it ends up being about $280,000 shy of the PAYE plan which invests the difference in payment.

Carlos would have a 38% higher net worth after 20 years by being on the PAYE plan vs refinancing and paying off the debt in 10 years ($1,004,000 with PAYE versus $724,000 refinancing).

How prosthodontists can save money on student loans in residency

Let’s go back to Anita. Remember that she has $350,000 in student loans at 6.8%. Now, let’s assume that this is what she graduated with before entering a three-year prosthodontic training.

Anita will earn $50,000 for three years during training, then she jumps to $250,000 after those three years.

Refinancing is still the long-term play for her, but a $3,600 per month payment while earning $50,000 is an absolute no-go. That would pretty much be all of her take-home pay, if not more. Putting her loans in forbearance isn’t a good strategy either because the interest will skyrocket over those two years.

Therein lies the rub. But there is a way to keep the loan from growing fast even without making payments that actually cover all the interest.

Enter the REPAYE interest subsidy:

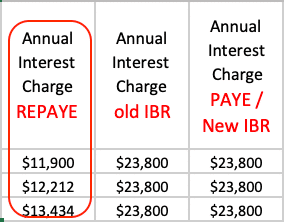

The normal interest charge on Anita’s loans would be $23,800 per year ($350,000 x 6.8%) no matter if she’s on PAYE or IBR. But REPAYE is different because it offers an interest subsidy. The government will wipe away half of the interest that isn’t covered by her monthly payment.

For example, let’s say Anita waives the grace period and starts on REPAYE between graduating from dental school and starting her prosthodontic training. Her payments on REPAYE could actually be $0 per month for the first year of residency which would give her some financial relief.

Along with the $0 payment, she gets an even better kicker with the interest subsidy. This will keep her loan growth low.

Since her $0 payments don’t cover any interest, the REPAYE interest subsidy wipes away half of the $23,800 interest charge. On PAYE, IBR, or if her payment was in forbearance, her loan would accrue $23,800 in interest with $0 monthly payments. But on REPAYE, the accrued interest grows by $11,900, which is half of the amount.

If she were to put her loans in forbearance, she’d actually be missing out on the government paying about $1,000 of interest each month.

She should then use her tax returns to recertify REPAYE while in training. Her tax return for the year she starts her residency will show only $25,000 of income, half a year of residency salary, so her payments would be about $52 per month. From there, she’d get an $11,600 subsidy for the year.

After three years of this strategy, Anita’s payments would be a total of about $1,500 and the government would have paid $35,000 in interest on her behalf! After finishing up residency, her salary would be high enough that she can refinance her dental school loans and pay them back in 10 years or less.

Going on REPAYE would save her more than $35,000 in interest and even more when paying back her refinanced loans. REPAYE first, followed by refi, is a huge savings!

Is going into prosthodontics worth it?

The answer is an emphatic yes! Ideally, minimizing student loans is the way to go, but that’s not always an option.

It’s scary to think about taking out $300,000 to $400,000 of student loans, but there’s an optimal plan to pay it back — whether you’re in Anita’s situation (refinancing) or in Carlos’s situation (using the PAYE plan with aggressive savings on the side).

Either way, it’s really important to either use that nice income to pay back the loans aggressively or keep payments to a minimum and save aggressively instead.

As far as specializing in prosthodontics goes, though finances will be tight during training, the average prosthodontist salary is $150,000 more per year than general dentists. That means it takes less than three years to recoup the salary lost during those three years of training. It’s all gravy after that.

Prosthodontists can have a solid student loan plan

Prosthodontists can find a clear path to pay back their student loans. A path that can not only save them significantly more during repayment but give them actionable steps and a clear way to get it done.

Student Loan Planner® has done over 6,400 student loan consults for clients totaling over $1.5 billion of student loan debt. We can help you figure out the optimal path in just one hour. Plus, we also include email support after the consult where we continue to answer questions and help you implement your plan. Learn more about our consult process.

If you have a clear-cut refinancing case, with no practice ownership in the imminent future (perhaps because the refi payment could get in the way of the practice loan), there’s no need to get a consult. But I’d suggest applying for a refinance loan through our cash-back link. You may be able to cut your interest rate and get the most affordable terms for your situation.

Income & Student Debt by Profession

How you compare to other

accountants stats*

| Average student debt | |

| Average income | |

| Average Debt-to-Income Ratio |

Statistics represent the population of Student Loan Planner clients in the respective profession referenced in the chart from 2017-2023. Sample excludes those in school or in training.*