Public Service Loan Forgiveness (PSLF) is a program that’s gotten a lot of slack in the media for years. Reasons include the alarmingly high rejection rate for forgiveness applicants.

Qualifying requirements can also be difficult to navigate, and loan servicers aren’t very helpful in giving clear and concise information about the program.

Editor's note: Changes to prior PSLF payment eligibility have positively impacted millions of borrowers thanks to the Biden administration’s PSLF order. While it expired in October 2022, many of the same benefits are available through the IDR Waiver. The IDR Waiver, or IDR Adjustment, is a one-time account adjustment to give credit for qualifying payments to borrowers on income-driven repayment plans and under PSLF.

Get Started With Our New IDR Calculator

Qualifying for PSLF

PSLF is designed to provide loan forgiveness to those who dedicate their career to public service work. Qualifying for PSLF comes down to five basic requirements:

- Work for a qualifying employer

- Work full-time for that qualifying employer

- Only Direct loans qualify for PSLF

- Enroll in an income-driven repayment plan (PAYE, IBR, ICR or SAVE / REPAYE)

- Make 120 PSLF qualifying payments

The name of the game while pursuing loan forgiveness is to pay as little as possible, to maximize how much debt you can get forgiven. There’s absolutely no incentive to pay more than you need to when you're on the loan forgiveness track.

120 monthly PSLF payments is no longer literal

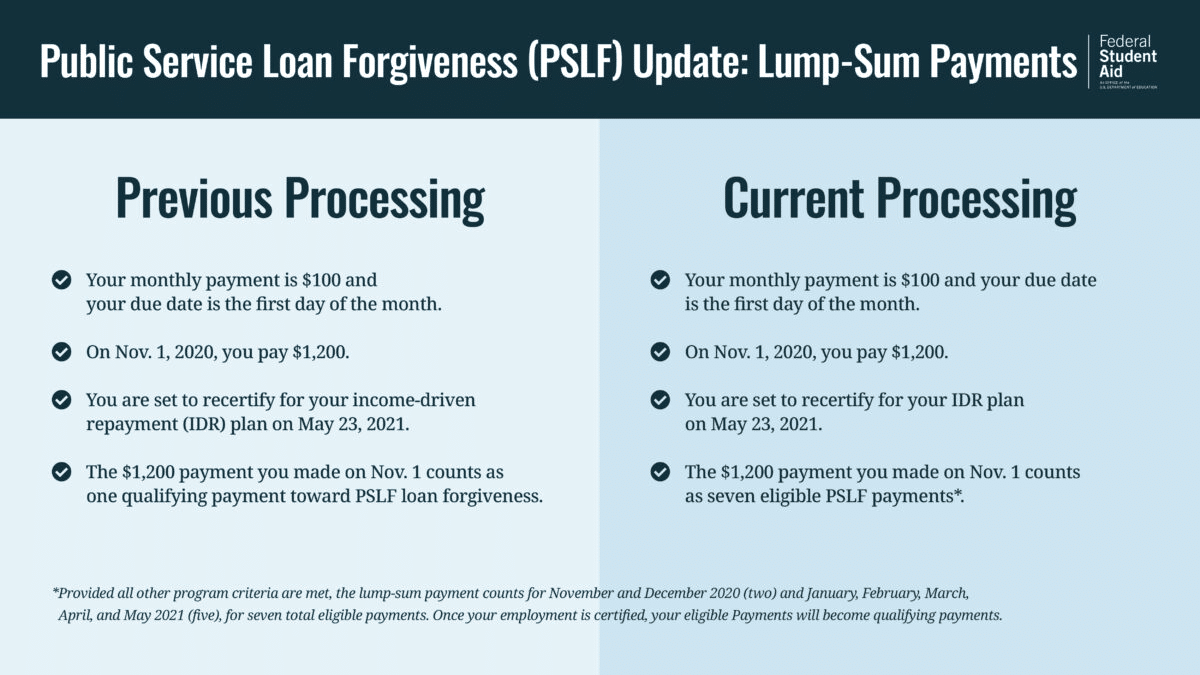

The requirement to make 120 monthly PSLF qualifying payments was updated as of August 2020. Historically, there wasn't a benefit to making lump-sum payments toward PSLF, because it would only count as one PSLF qualifying payment — even if it was 5x the required payment amount.

There was also the danger of your loans getting into paid-ahead status where the payments to follow the PSLF over-payment would not count as a qualifying payment toward the 120 payment requirement.

Not good.

The only exception to this rule was if your lump-sum payment came from The Segal Education Award, a Peace Corps transition payment, or payments made to the U.S. Armed Forces through a U.S. Department of Defense.

As of August 2020, however, there’s been a change to the monthly payment requirement to include lump sums of up to 12 PSLF qualifying payments. This isn’t retroactive, so if you missed out on qualifying payments while under paid-ahead status, previously, this change won’t help you.

Here’s an example of how this works, compliments of the Department of Education:

Are PSLF lump-sum payments a significant improvement to the program? Not really.

It might be helpful for those who prefer not to have monthly payments or prevent unintentional ineligible payments. Also important to note: This payment processing change doesn’t appear to apply to the 20- or 25-year forgiveness paths at the end of an income-driven repayment plan.

Official language

When we first learned that borrowers could now make PSLF lump-sum payments, we didn't trust it. These updated payment processing terms aren't even defined within the new PSLF/TEPSLF Employment Certification Form & Application (used to qualify payments, employment, and apply for forgiveness) which came out after this change was announced.

As it reads in Section 6, under Qualifying Payment Definitions:

Qualifying payments are on-time, full monthly payments made on an eligible loan after October 1, 2007 under a qualifying repayment plan while employed full-time by a qualifying employer.

An on-time payment is a payment made no more than 15 days after the due date for the payment.

BUT the Department of Education's PSLF FAQ page offers a more nuanced explanation. Clarification of what counts as a qualifying monthly payment for PSLF for lump-sum payments is provided under the FAQ: “If I pay more than my scheduled monthly student loan payment amount, can I get PSLF sooner than 10 years?”

“You may prepay, or make lump-sum payments, which first apply to any months during which you missed a payment and then would apply to future months up to your next income-driven repayment (IDR) plan certficication date or 12 months.

For example, if you recertified your IDR and your monthly payment was $100, but you paid $1200 for the first month’s payment, that payment would count as 12 separate payments for that year. You would not need to make another payment until the next 12-month cycle … These payments would count as qualifying payments toward PSLF forgiveness once you certified your eligible employment for the 12-month period.

For the prepayment to qualify for subsequent months, you must

- pay an amount to fully satisfy future billed amounts for each month you wish to prepay within a 12-month period;

- make one or more prepayments that pay your loan ahead (if you are on an IDR plan, you may not prepay past your next annual recertification date— your annual recertification period is the 12-month time period when your payments are based on your income); and

- have qualifying employment that covers the due date for each month you prepay.

Note: Multiple prepayments made within the same year will not afford you more than 12 months of qualifying payments.”

So with that, PSLF lump-sum payments can count toward the forgiveness requirement.

PSLF payment tracking

In late-2020, Fedloan made some upgrades to its online user portal to include PSLF Payment Tracking. This used to be found under the “Payments & Billing” tab.

MOHELA has taken similar efforts to track PSLF payments.

This Tracker lists out each of your loans and reflects your eligible payments toward the 120 payment count. It separates payments that have already qualified via an Employment Certification Form (ECF) and those that need employment certification for both PSLF and TEPSLF.

This tool helps you see your progress toward loan forgiveness more transparently, including the payments you’ve made since your last ECF submission.

If you have any “ineligible payments,” the tracker will help you identify those and list the reason why. If you ever believe there’s a count error for your PSLF qualified payments, after a new ECF is submitted and after reviewing the denial reason provided, here are five steps to fix your PSLF payment count.

This online features from MOHELA are big improvements compared with the past that could help people feel more confident about their timeline toward earning PSLF. Moreover, it will hopefully help borrowers catch discrepancies sooner rather than later.

Hopeful for ongoing PSLF improvements

With the Department of Education’s goal of improving customer service and holding servicers accountable for their performance in managing federal student loans, more improvements are expected.

If you need some additional guidance with your specific student loan situation, schedule a consultation with Student Loan Planner. Our team has helped thousands of people handle their student loan debt.

Not sure what to do with your student loans?

Take our 11 question quiz to get a personalized recommendation for 2024 on whether you should pursue PSLF, Biden’s New IDR plan, or refinancing (including the one lender we think could give you the best rate).

How would the Biden changes to pslf to current borrowers who have been paying for 4 years already?