Teachers face unique challenges while inspiring youth every single day. Many function on a shoestring classroom budget with a low salary and limited ability to pay back student debt. However, their employment can make them eligible for federal loan forgiveness options like Teacher Loan Forgiveness vs. Public Service Loan Forgiveness.

Remember the teacher who had an enormous impact on your life?

The most influential teacher I had was my choir director Brian Kieffer at GlenOak High School in Canton, Ohio. He approached music with unrivaled energy, fun and passion. As I grew vocally in high school, he constantly threw new challenges at me. If I ever felt uncertain whether I could handle it, he was reassuring, which inspired confidence.

He also showed us what we could be by providing the opportunity to hear some of the best music from the genre we were singing. This ranged from seeing one of the premier men’s choruses in the country, the top vocal jazz group, a gold medal-winning barbershop quartet and taking our select group to New York to attend a Broadway show.

My sister, Suzie, is doing incredible work as an elementary school teacher, too. She inspires me everyday with her tireless work and commitment to the kids.

Whether it’s a math teacher, a sports coach or another faculty member, we’re indebted to the educators who helped shape our lives well beyond academics.

Unfortunately, the federal government doesn't necessarily seem to share society’s value of teachers.

Teacher student loans with a Master of Education degree

According to Niche.com, the average teacher starting salary is $38,617, and the overall average teacher salary is $58,950. It’s certainly on the rise but not nearly what it should be.

That average teacher salary is due in part to the Master of Education degree many teachers feel the pressure to get. That pressure can be real — mandated by the state or school district —or implied by the school so a teacher can secure a promotion or attain the next level of pay.

Of course, getting a Master of Education comes at a cost. According to the National Postsecondary Student Aid Survey, the average teacher student loan debt with a masters is $55,200.

The good news is teachers have a couple of options for loan forgiveness and should be debt-free in 10 years. The problem is the program specific to teachers is not the better one, which causes confusion and costs teachers more of their well-earned money than they should otherwise be paying.

The Teacher Loan Forgiveness Program (TLFP): Not great for teachers

You’d think a loan forgiveness program specific to teachers would be the best option available to them, but it’s often not the case.

The TLFP may forgive anywhere between $5,000 to $17,500 of eligible federal student loans after five consecutive, full academic years of service at a low-income school or educational service agency.

But that highest amount of loan forgiveness is only available for certain teachers, specifically “highly qualified” math and science teachers at the secondary school level or special education teachers. Most other teachers may receive a paltry $5,000 after five years of teaching. If either my sister or choir director or your favorite teacher had student loans, this is all they would qualify for under the TLFP.

With all they do for us and our kids, if we have them, why on earth are they treated so poorly with this student loan forgiveness program specific to teachers?

That meager $5,000 of teacher loan forgiveness just won’t cut it unless they have less than $25,000 of student loan debt overall.

This program is also completely inflexible. When I looked at the FAQs about the TLFP, the answer to many of the questions was essentially “no, the TLFP won’t work.” It almost felt like instead of bothering with a FAQ section, the U.S. Department of Education should have said something like, “The answer to your question is probably ‘no, it doesn’t qualify,’ so don’t bother asking.”

Here’s more information about Teacher Loan Forgiveness eligibility requirements.

Public Service Loan Forgiveness (PSLF) program for teachers

This program could be a very powerful one for teachers (and other public servants) with $50,000 of student loans or more, especially when comparing Teacher Loan Forgiveness vs Public Service Loan Forgiveness.

PSLF is a program that will forgive 100% of your remaining loan balance tax-free if the loans are under the Direct Loan program, the borrower has made 120 cumulative (not consecutive like TLFP) qualifying payments on an income-driven repayment (IDR) plan while working full-time at a nonprofit or government qualifying employer (a.k.a. public schools and most private schools).

Here’s more info about PSLF direct from the federal student aid website.

PSLF beats the TLFP

PSLF is so much better than the TLFP. A teacher with a master’s degree and the average amount of student loan debt might be able to pay a lot less toward their loans with PSLF than with the TLFP.

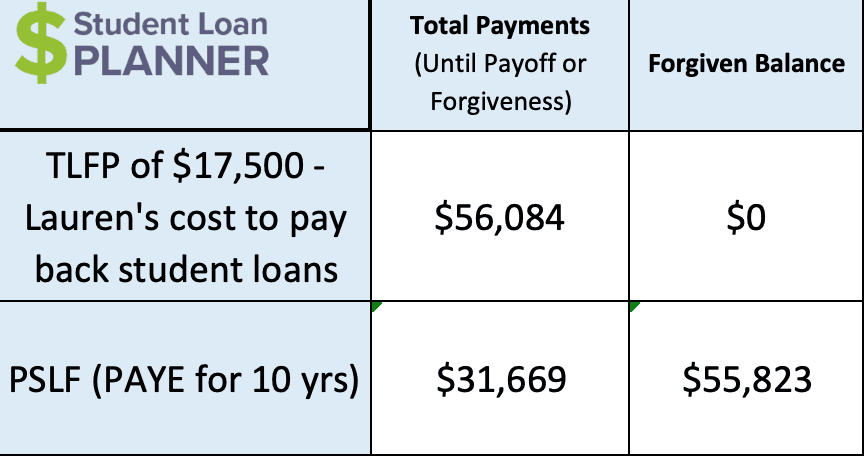

Let’s say Lauren had the average student loans for a teacher with their master’s degree — $55,200 with a 6.5% interest rate.

She’s making $50,000 with 2.5% salary increases each year. She qualifies for the full $17,500 from the TLFP in five years. But she’s also eligible for PSLF as a full-time teacher. Either way, she plans on being debt free in 10 years.

Lauren decides to do a little homework, and here are the calculations:

PSLF is by far the better choice. It would save Lauren almost $25,000 paying back her loans over 10 years compared to paying her loan back in full, even with $17,500 from the TLFP.

Thank goodness Lauren didn’t just rely on the name of the forgiveness program. It’s easy to think the TLFP would be much better for teaching service than PSLF. But that’s not the case.

This is just the starting point for Lauren. There’s a ton more she can do to make sure she can save even more on PSLF. Check out Student Loan Planner®’s Top PSLF Tips to see what else can be done to save money.

The TLFP and PSLF don’t mix

Lauren also asked the question, “Can I combine the TLFP with PSLF?” The answer (just like many of the other FAQs) is a big fat no. The five consecutive years it would take Lauren to qualify for the $17,500 forgiveness can’t also count toward the 10 years of PSLF.

Here’s another way of saying: Lauren would need to make student loan payments for over 15 years to get both Teacher Loan Forgiveness and PSLF — five years for the TLFP, then another 10 for PSLF.

Teachers who are advised incorrectly to go for the TLFP instead of PSLF could end up making payments for five more years than necessary on their student loans.

That’s because someone wouldn’t need to combine Teacher Loan Forgiveness with PSLF anyway. All of Lauren’s loans would be forgiven on PSLF after 10 years. The $17,500 forgiven after five years with the TLFP would be inconsequential since she’ll have that amount forgiven along with the rest of her loans with PSLF in 10 years.

Should teachers with student loans choose PSLF or the TLFP?

The more a teacher has in student loan debt, the greater the power of PSLF versus the TLFP.

Most teachers who owe more than $50,000 in student loans should take a hard look at passing up the TLFP and go right for PSLF. They can keep their monthly payments low on an income-driven repayment plan, max out retirement and other savings goals alongside, and be debt-free in 10 years while keeping the loans in the flexible federal program.

For qualified teachers who owe $30,000 or less, the TLFP might be better.

Either way, teachers should be able to be student debt-free in 10 years and receive some form of loan cancellation.

Teacher Loan Forgiveness vs Public Service Loan Forgiveness: How teachers can save money with student loan repayment

Teachers are near and dear to our hearts here at Student Loan Planner®, and we love helping them save money paying back their student loans. They need a break, and it’s hard to find the right path to pay back their student loans with all of the confusing options and loan forgiveness programs out there.

Just like every teacher is unique in their teaching style and how they impact students, your personal circumstances make student loan repayment unique as well.

We’ve done thousands of consults representing over $1.44 billion of student loan debt and can help make a customized plan based upon your individual circumstance so you can keep more of your hard-earned and well-deserved money in your pocket.

Learn more about our consult process on our help page.

Not sure what to do with your student loans?

Take our 11 question quiz to get a personalized recommendation for 2024 on whether you should pursue PSLF, Biden’s New IDR plan, or refinancing (including the one lender we think could give you the best rate).