I’m noticing a troubling trend where highly educated doctors abandon Public Service Loan Forgiveness (PSLF) for a myriad of reasons. Maybe you’ve heard doctors propose this in the resident or attending lounge.

Humans, on average, make terrible financial decisions because we're extremely emotional creatures. Occasionally, we’ll fight back against our impulses and do something smart like minimize taxes, max student loan forgiveness programs and hold our mutual fund investments for the long-term.

However, the typical result is we panic sell when the stock market declines and we let possessions fill our homes that have little economic worth because of emotional attachment. We also abandon PSLF because of anxiety about the future of loan forgiveness programs.

Let’s discuss who should and shouldn’t stick with Public Service Loan Forgiveness for doctors. I’ll also show you the most popular reasons MDs blow off their right foot with a shotgun financially as it relates to the PSLF program.

Get Started With Our New IDR Calculator

Giving up on Public Service Loan Forgiveness for doctor is becoming an epidemic

I’ve seen doctors refinancing their medical school loans, paying off their federal student loans with home equity or family loans, and throwing over half their take-home pay at their debt just because of the stress they’re facing.

If you qualify for PSLF and are working one of the many public service jobs available to doctors, and don’t plan to take a private practice job for more money or go part-time for lifestyle reasons, then abandoning PSLF is a bad idea for medical school graduates.

Here are some of the major reasons physicians abandon PSLF, even if they have a job that qualifies as public service employment.

Reason 1: Sensational headlines about PSLF scare doctors

Maybe you’ve seen headlines like these in a major media publication.

Public Service Loan Forgiveness Program in Doubt

Trump Proposes Elimination of Loan Forgiveness for Public Servants

This Guy Owes a Gazillion Dollars and the Taxpayer is on the Hook for All of It

Let me let you behind the curtain for a moment. Websites (even this one) respond to what gets them clicks because it makes them more money. If they wrote a post like “PSLF Going to Save You Money in 7 Years” that’s not going to do as well as “Trump Nukes PSLF.”

When the media sensationalizes whatever is happening at the moment, they get paid because they get more advertising dollars. They’re not on the hook financially when you make a poor student loan debt decision because of their reporting.

Reason 2: Referral programs with student loan refinancing companies

This one really pisses me off, to be frank with you. I saw a recent post by a doctor on a Facebook group for PSLF eligible physicians that was encouraging people to use their referral link to refinance with a private lender.

She wrote about how it saved her so much anxiety to know her interest rate was low and that she was finally paying down her medical school debt. Then she encouraged other healthcare professionals to do so, too.

I have no doubt that this borrower thinks she did a smart thing. All she really did was lock in a small chance of $20,000 to $40,000 in interest rate savings if the PSLF gamble doesn’t work out. The 80% to 90% chance that it does work out will end up costing her over $400,000. If you had 50/50 odds at this bet on “Deal or No Deal,” would you immediately settle for the tiny amount?

If you’re going to destroy your own finances by making a stupid decision, fine. Just don’t go encourage thousands of people to join you in jumping off a cliff.

Refinancing companies offer referral bonuses whenever someone uses your link to take out a loan, including me. These referral bonuses and theoretical interest savings if PSLF doesn’t happen are causing physicians to encourage their friends to refinance when it’s not in their best interest. Carefully consider the source before you jump at loan repayment assistance advice.

Reason 3: Political biases causing doctors to make rash judgments about PSLF

Everyone has strong opinions about politics these days. Sometimes these feelings cause physicians to make big mistakes as they don't entirely trust PSLF.

Here’s an example of an anti-PSLF viewpoint tinged with political feelings about the previous administration:

“I don’t trust Trump worth a damn to make good on this promise of loan forgiveness, so I’m doing something about it because there’s no way he’s going to honor this.”

Another opinion I’ve heard from the conservative bent:

“Our government is totally broke. There’s no way they’re going to give loan forgiveness to me because I’m a high-income doctor and the Democrats are going to make sure I don’t get a dime.”

Both of these views seem to be driven more by partisan feeling rather than logic.

Trump inherited the PSLF program, and he certainly could have ended it if he had got the cooperation of the Senate and House. But that didn't happen, and it won't under the current Biden administration which will likely only strengthen the PSLF program.

I’ve only seen one proposal that would affect current borrowers going for PSLF. It was put forward in President Obama’s 2015 budget proposal and it would’ve capped the benefit at $57,500. His own party shot it down, and we haven’t seen a credible proposal since that would limit PSLF for those already working towards it.

Reason 4: Incompetent loan servicers give out wrong information

I recently encountered a systematic problem with borrowers facing down FedLoan’s incompetent help. They’d get a piece of mail that said they no longer qualified for Income-Based Repayment and would call. Then the rep would put them on Revised Pay As You Earn (REPAYE), which can result in payments far higher than the 10-year Standard loan repayment program.

The physician would see how fast she’s paying down her loans and figure it’s not worth it to wait around for PSLF anymore. Then she goes out and refinances her remaining balance to pay the debt down quickly.

Recall you’re allowed to use PAYE or IBR to get your payment capped at the 10-year standard plan no matter how high your discretionary income is. Physicians are believing FedLoan Servicing instead of doing their own research about IDR plans and loan forgiveness. Fortunately, medical professionals can hire someone like us to figure out what their options are.

Don’t dump PSLF just because you think you’re making too much money. Confirm that you can’t benefit any first.

Abandoning Public Service Loan Forgiveness for doctors: Why it reminds me of investors buying high and selling low

Physicians— everyone from primary care physicians to surgeons— have a reputation among financial service professionals for being very poor investors. Even Warren Buffett, perhaps the greatest investor of all time, won’t invest in something unless he deeply understands it.

Physicians will buy a stock based on a tip from a relative, conversation with a medical sales rep at a conference, or because it’s the hot new thing.

Maybe you’re an exception and buy index mutual funds and plan to hold them forever. Hopefully, that’s the case, but many physicians struggle because of not knowing what they don’t know.

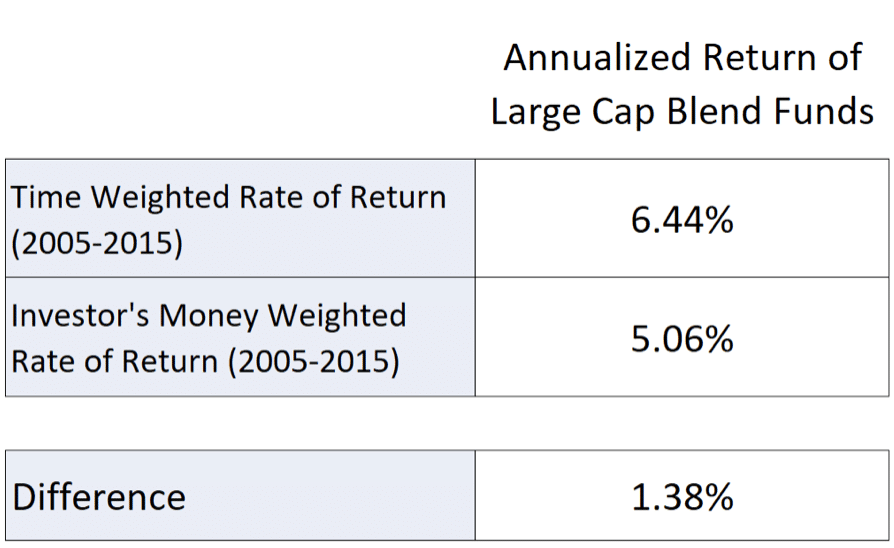

Take a look at this chart sourced from Vanguard and Morningstar that shows the performance gap between what large company mutual funds earned and what their investors made.

Source: Morningstar and Vanguard

What this means is that investors earned 1.38% a year less than the fund they were invested in. If you look across investment styles, different year ranges, and more, the pattern is consistent.

A primary reason is that investors usually buy high and sell low. When you see that an investment is hot and has already performed well, you buy. When the stock market crash comes, you panic and sell to avoid more losses.

Then you repeat this cycle until you’re broke.

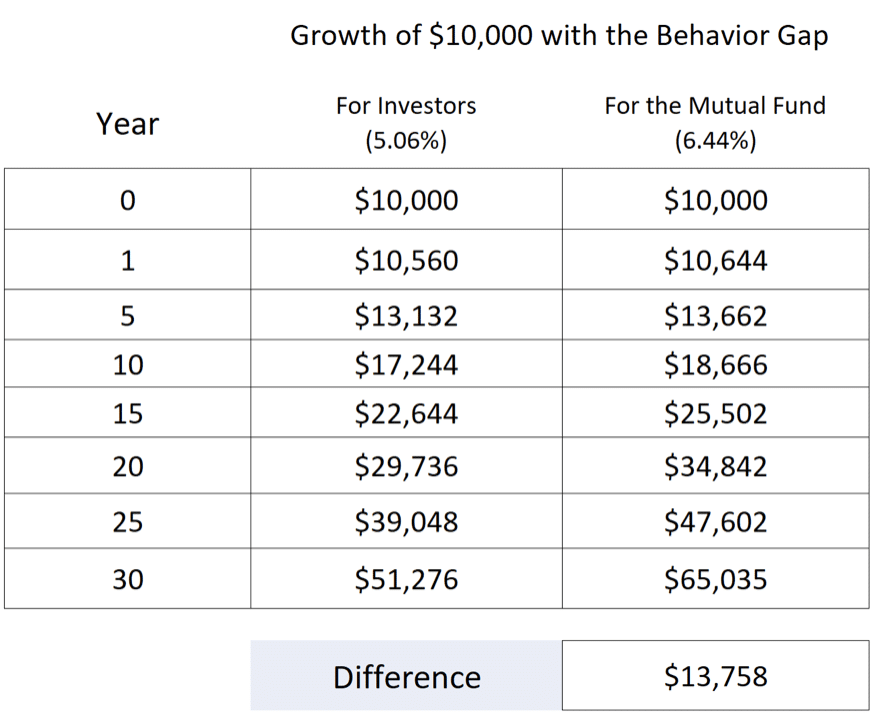

1.38% a year doesn’t sound like much. However, check out the difference in portfolio size with this difference if you start out with $10,000 invested.

The difference after 30 years ends up being more than the original amount invested!

When does it make sense to leave the PSLF program?

I had a case last week when I advised the physician to abandon PSLF. However, it wasn’t because anything was wrong with the program.

Rather, this doctor worked his tail off at a nonprofit hospital for a projected benefit of about $100,000 because of his relatively modest loan balance. He wanted to spend more time with his kids and have money leftover to do other things. His dream was to make work optional in his 40s like my friend Physician on FIRE.

What the physician decided to do is seek out a private practice job with similar hours where he could earn $100,000 more per year over the next six years rather than wait around for PSLF forgiveness of the remaining balance.

In doing so, he’s making a highly rational decision, not an emotional one.

I’ve also had several doctors who decide they want part-time hours because of the demands of raising a family. Keep in mind you need 10 years of cumulative qualifying payments (not consecutive) to get the PSLF program. It can make a lot of sense to continue payments and wait around until you go back to full-time.

That said, if the loans stress you out and stand in the way of you going part-time when that’s your goal, it can make sense in certain situations to opt out of PSLF and refinance and pay the loans off aggressively.

Usually, this is only the case for balances below $200,000.

Unfortunately, most physicians abandon PSLF without carefully considering it as an option and comparing it against other alternatives.

We’ve consulted on hundreds of cases for physicians just like you trying to decide what to do about PSLF. If you’d like a student loan repayment plan customized for your individual situation, click the button below.

If you’ve decided to abandon PSLF or have thought about it, share your thoughts in the comments below!

Not sure what to do with your student loans?

Take our 11 question quiz to get a personalized recommendation for 2024 on whether you should pursue PSLF, Biden’s New IDR plan, or refinancing (including the one lender we think could give you the best rate).

Comments are closed.