What you need to know:

- The Sallie Mae Smart Option Student Loan is available to undergraduates to cover up to 100% of the cost of attendance.

- Applications with a creditworthy cosigner are more likely to be approved.

- Borrowers can choose an in-school repayment option that fits their immediate needs and includes a six-month grace period.

Sallie Mae is one of the largest and most recognizable student loan lenders. It offers many loan products for all levels of higher education. But Sallie Mae’s Smart Option Student Loan is designed to help undergraduates cover up to the full cost of attendance without strict enrollment or program requirements.

Keep reading for our Sallie Mae Smart Option Student Loan review.

Sallie Mae student loans for undergraduates

With the Smart Option Student Loan, undergraduates can borrow up to 100% of their school’s cost of attendance minus any financial aid received. Loan funds are to be used for tuition, fees, housing, books, supplies and other certified school expenses.

Borrowers must be working toward an associate or bachelor’s degree or seeking a certificate with a participating degree-granting school. However, there isn’t a minimum enrollment requirement, which makes this a more accessible student loan option for part-time students.

Sallie Mae offers competitive student loan rates with multiple repayment options. There’s a minimum requested loan amount of $1,000 for each loan application. But you can apply one time for the entire school year instead of applying each academic semester.

Get Started With Our New IDR Calculator

Sallie Mae Smart Option Student Loan review: Pros and cons

Here’s an overview of the pros and cons of the Sallie Mae Smart Option Student Loan.

Pros

- Available to non-U.S. citizen or non-permanent residents. This includes DACA students, residing in and attending school in the U.S. However, they must have a cosigner who is a U.S. citizen or U.S. permanent resident.

- No minimum enrollment requirement. Students enrolled full-time, half-time or less than half-time can qualify.

- A variety of programs qualify. Available for professional certification courses, study abroad programs and for U.S. students enrolled in a school in a foreign country.

- Flexible in-school repayment options. Borrowers can choose to defer payments entirely or make interest-only or fixed $25 monthly loan payments. You might lower your interest rate by choosing in-school repayment.

- Six-month grace period. Principal and interest monthly payments begin six months after you graduate or are no longer enrolled in school.

- Autopay discount. Receive a 0.25% interest rate reduction when you enroll in auto debit payments from your bank account.

- Fewer fees. The lender doesn’t charge application fees, origination fees or prepayment penalties.

- Cosigner release. Apply to release your cosigner after meeting requirements including 12 months of on-time principal and interest payments.

- Options for student loan deferment. If you return to college, attend graduate school, or take an internship, clerkship, fellowship or residency in the future, you might qualify for deferment. Your loans will return to the initial in-school repayment option you chose (e.g. interest-only, fixed or completely deferred).

- Additional perks. Sallie Mae also offers a scholarship search tool and financial literacy training.

Cons

- Requires hard credit check to explore interest rates. Unlike other lenders that offer a pre-approval process, Sallie Mae performs a hard credit pull to see preliminary rate information for comparison.

- Late payment fee. You might be charged a late fee if your payment is more than 15 days after the due date. You might also lose eligibility for borrower benefits or repayment incentives.

Eligibility requirements for Sallie Mae undergraduate loan

Unlike federal student loans for undergraduates, private student loans are credit-based. Therefore, Sallie Mae will check your credit when you submit a loan application.

Your creditworthiness will affect your eligibility and interest rates. This includes meeting minimum credit score requirements and reviewing your borrowing repayment history and other financial indicators.

Because most undergraduates haven’t had a chance to build up their credit enough to qualify for a private student loan on their own, Sallie Mae encourages using a cosigner.

According to Sallie Mae, students are four times as likely to be approved when they add a creditworthy cosigner.

Application process: What to expect

The Sallie Mae Smart Option Student Loan application can be quickly completed online. In fact, most borrowers can apply and receive a credit decision in about 10 minutes.

But before you start the application, make sure you have the following information nearby:

- Permanent address. If you’ve lived at this address for less than a year, you’ll need to provide your previous address, as well.

- Social Security number (SSN). You’ll also need your cosigner’s SSN, if applicable.

- School information. This includes the name of your school and your enrollment status, degree and course of study. You’ll also need to provide the academic period of enrollment and year in school.

- Loan amount. Be prepared to indicate the loan amount you’re requesting and details about other financial aid you expect to receive.

- Employment information. This includes your current company’s name and your gross income.

- Financial information. Gather details about your bank accounts and monthly mortgage or rent payments.

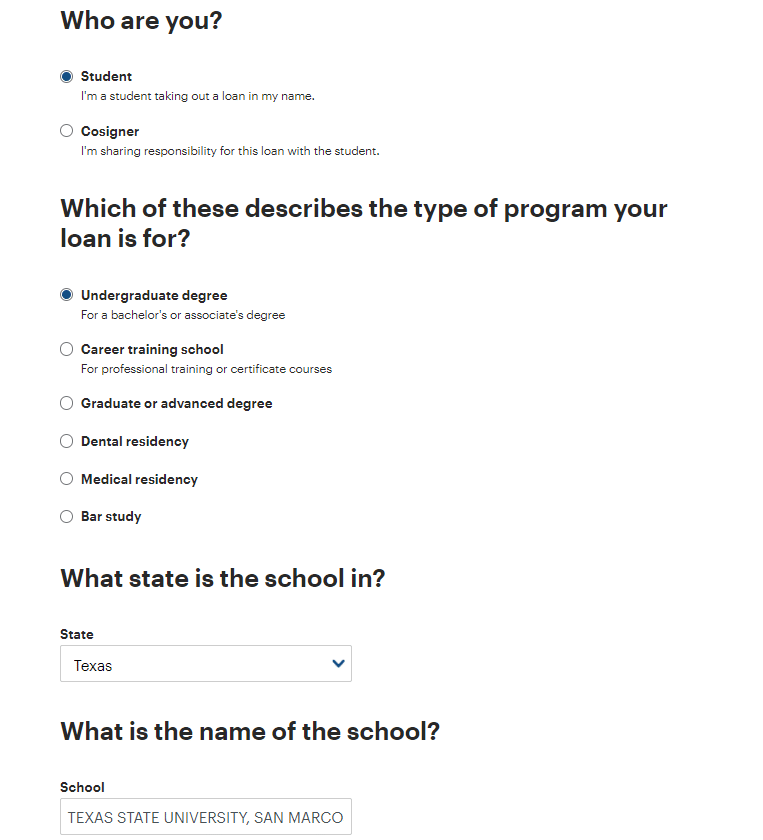

When you’re ready to apply, you’ll need to indicate whether you’re applying as a student or a cosigner. Mark that the loan funds will be used for an undergraduate degree. Then, enter the appropriate state and school information.

From there, provide general information about the student (and cosigner) and complete the remaining application.

If approved, you’ll need to pick an in-school repayment option and interest rate type (e.g. variable versus fixed interest rate) that meets your needs.

Once you sign for the loan, Sallie Mae will work with your school to take care of the rest of the process, including loan disbursement.

The overall application is user-friendly. But if you need assistance, you can use Sallie Mae’s chat feature or call 1-877-279-7175 during business hours.

Is a Sallie Mae loan right for you?

College students should exhaust other funding sources before turning to private student loans. Thoroughly explore opportunities for grants and scholarships, as well as the availability of savings and federal student loan offers. Federal loans have borrower protections and benefits, like income-driven repayment plans and loan forgiveness programs.

But if you need help paying for college or have encountered borrowing hurdles — whether due to your citizen or resident status, or your half-time enrollment status — the Sallie Mae Smart Option Student Loan is a solid option.

If private student loans might be in your future, be sure to shop around for the best private loans and limit your borrowing to only what you need.

| Lender Name | Lender | Offer | Learn more |

|---|---|---|---|

| Sallie Mae |

|

Competitive interest rates.

|

Fixed 4.50 - 15.69%

Variable 6.37 - 16.78%

|

| Earnest |

|

Check eligibility in two minutes.

|

Fixed 4.67 - 16.15%

Variable 5.87 - 18.51%

|

| Ascent |

|

Large autopay discounts.

|

Fixed 4.09 - 14.89%

Variable 6.22 - 15.20%

|

| College Ave |

|

Flexible repayment options.

|

Fixed 4.07 - 15.48%

Variable 5.59 - 16.69%

|