Until now, Income Driven Repayment (IDR) plans have required borrowers to pay 10% of their discretionary income, which is generally defined as all taxable income above 150% of the poverty line. The Biden IDR plan is a game changer for how undergraduate borrowers would approach their student debt.

Based on the recently announced Biden IDR plan parameters, most undergraduate borrowers would not pay back their student debt. Instead, they’d pursue student loan forgiveness on the new IDR plan.

The reason is that the Biden IDR plan both reduces the percent of income a borrower pays and increases the amount of income a borrower can earn before they must pay anything. We’ll look at some examples to show why most borrowers will not want to pay back their student loans in full after this major policy shift.

Biden IDR plan for undergraduate borrowers explained

The Biden IDR plan uses a threshold of 225% of the poverty line before a borrower needs to make a payment, up from 150% in prior IDR plans.

For undergraduate borrowers, the plan only requires paying 5% of discretionary income. It also covers all interest that your required payment does not cover.

To see how this plan reduces payments so drastically, consider a borrower with a family size of 3 earning $70,000 a year (more than the average college graduate salary) who owes $30,000 of student debt (less than the average college debt). If a borrower with higher-than-average earnings and less-than-average debt is a good candidate for forgiveness, you could expect the average undergraduate student loan borrower would pursue forgiveness if this hypothetical borrower was a good candidate.

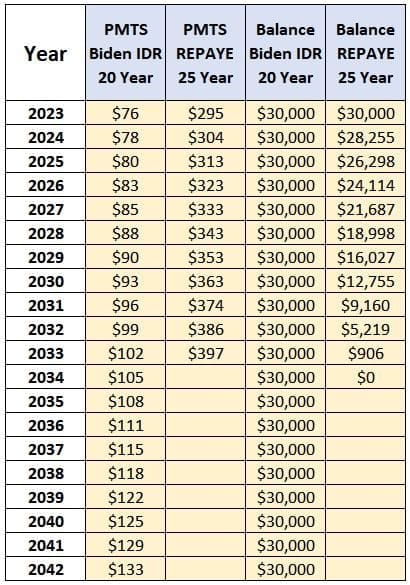

We calculate the payment on the Revised Pay As You Earn plan (REPAYE) as well as the new Biden IDR (or Biden IBR) plan.

Biden IDR plan cost over time for undergraduates: Case study

Using the example of the borrower earning $70,000 per year, with a family size of 3, her discretionary income would be $51,818. She would pay 5% of income on the difference between $70,000 and $51,818, for an annual payment of $909.

Here’s how the cost of monthly payments would look over time compared to one of the more generous IDR plans available in 2022, the REPAYE plan.

Under current rules, an undergraduate borrower receives forgiveness on the REPAYE plan after 20 years of payments. However, with a 150% of poverty line deduction and 10% of income, the typical undergraduate borrower will pay their loans off before getting to forgiveness, so that borrower would be better off paying back her loans as quickly as fits her financial situation, constraints, and goals.

Quick math makes the optimal path under the Biden IDR obvious.

You would pay about $1,000 per year for 20 years, and at the end of the 20 years, the remaining balance of $30,000 would be forgiven.

Current law under the American Rescue Plan allows forgiven debt to be discharged tax-free. That would certainly be the expectation under the Biden IDR plan, although Republicans might view the potential tax bomb as their only source of leverage in a future bipartisan negotiation over student loan rules.

Could the Biden IDR Plan be repealed?

Given this plan was not passed by Congress, a future President could absolutely repeal it, although likely only for borrowers not currently using it. In previous iterations of Republican student loan reform proposals, borrowers could keep their current IDR plans, and new borrowers would have to be forced onto a new and less generous IDR plan or would have to pay back their debt.

The Department of Education has generally held during prior negotiated rulemaking sessions that they believe an executive cannot repeal existing IDR plans without Congress, especially due to borrowers having these payment options listed in their promissory notes.

However, with such a generous payment plan option, we would expect a future Republican President would have an incentive to end this plan for future students.

Importantly, the “New IBR” plan (separate from the Biden IDR plan) allows borrowers to pay 10% of their income for 20 years until loans are forgiven. This program is written into the statute, and any new borrowers as of July 2014 qualify.

With the interest subsidy available under the Biden IDR plan, borrowers would not be much worse off even if the plan were to be repealed.

Other ways to pay less on undergraduate student loans on the Biden IDR Plan

Some policy makers would scoff at the idea that borrowers maximize their financial situation under these IDR plans by engaging in AGI optimization. That’s the entire premise of Student Loan Planner, and it’s how we’ve saved borrowers hundreds of millions of dollars. So, I’m biased to think that borrowers would rationally act in their best interest.

The hypothetical borrower above could eliminate her IDR payment entirely by contributing the maximum to an employer 401k plan.

Since IDR plans base payments on taxable income, by reducing her income from $70,000 to $49,500 (the max contribution is $20,500), our borrower could pay $0 a month on her student loans, accrue 0 interest, and still have the entire balance forgiven in 20 years.

Even a borrower who took out $10,000 of student debt could have it all forgiven under the Biden IDR plan, as a borrower could simply minimize income for the first 10 years after graduation through retirement plan contributions and pay $0 a month.

How many borrowers would sign up for an Income Driven Repayment Plan?

Currently, there are about 9 million borrowers on an income driven repayment plan, according to Department of Education data.

With raising the poverty line deduction 50% and reducing the payment amount a borrower must pay by 50%, one would reasonably expect an increase of 50% to 100% in adoption of IDR plans.

With even high five-figure-income earners best suited to student loan forgiveness, the default payment strategy for student loan borrowers will no longer be paying off your debt and becoming debt free. Borrowers would be smart to borrow the maximum allowed by their school, as worst case the debt would be a near zero interest line of credit, and best case the marginal borrowed dollars would be forgiven.

What’s clear is that many borrowers will want to re-examine their repayment strategies once the Biden IDR plan goes into effect in July 2023. You can get an expert analysis with one of our consultants if you’d like a thorough evaluation of your options.

Not sure what to do with your student loans?

Take our 11 question quiz to get a personalized recommendation for 2024 on whether you should pursue PSLF, Biden’s New IDR plan, or refinancing (including the one lender we think could give you the best rate).

Comments are closed.