Key Takeaways:

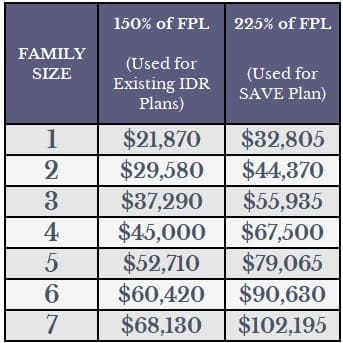

- A poverty line deduction of 225%, rather than 150%.

- Married borrowers can file taxes separately, to exclude a spouse’s income.

- 5% of income for undergrad-only borrowers, 10% of income for grad-only borrowers, and a weighted average of those numbers if you have debt from both undergrad and grad school.

- Forgiveness after 20 years for undergrad borrowers and 25 years for graduate borrowers. Exception: if you owe less than $12,000, it would happen after 10 years.

- Parent PLUS borrowers are excluded but could access this new plan through the double consolidation loophole. However, this loophole will be blocked for any new consolidations happening after July 1, 2025.

- After July 1, 2024, borrowers will not be able to sign up for PAYE or ICR, although you can remain on these plans if you're already signed up.

- After 60 months of payments on New REPAYE / SAVE after July 2024, you become ineligible to switch to the IBR plan.

President Biden proposed in January 2023 to completely redo the Revised Pay As You Earn (REPAYE) program to make it more generous for millions of borrowers. On June 30, he finalized this plan and announced it would be called the SAVE Plan (Saving on a Valuable Education).

In this article, we use SAVE, New REPAYE, and Modified REPAYE interchangeably since the name has changed a few different times. If you want to sign up for this plan, all you need to do is apply for the existing REPAYE plan on the student aid website and you will be automatically enrolled in the new version.

We also have a very detailed IDR calculator that shows what your payments will be on this new SAVE plan.

We’ll look first at how the benefits of SAVE / New REPAYE would affect lower-income families, and then we’ll look at the benefits that will be delivered to higher-income professionals with graduate degrees.

SAVE would deliver free community college to many

The average community college student loan borrower graduates with about $13,000 of student debt.

The new SAVE plan would give a shorter 10-year timeline for forgiveness to borrowers with $12,000 or less in student loans. That would include most borrowers at public community colleges.

According to the same site I linked above, the average community college grad earns about $33,000 10 years after graduation.

The new REPAYE / SAVE rules would allow a borrower earning less than $32,805 to pay $0 monthly with no interest accrual. If you earned above that amount, you’d only pay 5% of the marginal income above that level.

Add in a spouse or kids, and your deduction would be far higher. A family of four could earn over $67,500 before paying anything.

Under existing REPAYE rules, a community college borrower would pay about $100 a month, which means forgiveness is not really an option on a debt as small as $12,000.

Related: How to know if you could benefit from a Student Loan Planner® consult

Get Started With Our New IDR Calculator

Other benefits of the new IDR plan for low and middle-income borrowers

Take a look at the existing discretionary income definitions for IDR repayment plans and how it compares to the new proposed rules.

Depending on your family size, low and low-middle-income families could see their payments reduced 100% to $0 a month.

These changes would have the greatest impact on families with lots of children.

While low-income families would see the biggest percentage changes in what they pay, higher-income families would see the biggest dollar savings.

SAVE / New REPAYE would also create almost free or reduced cost college for most

Consider this situation. You work your way up to a position as a project manager at a Fortune 500 company and earn $100,000 a year. Your spouse earns $200,000 as a sales manager. Your combined income is $300,000. Assume there are three kids, as well.

Under current IDR rules, there’s no way a borrower in this situation could receive forgiveness on her student loans.

But under the new Biden REPAYE rules, she could.

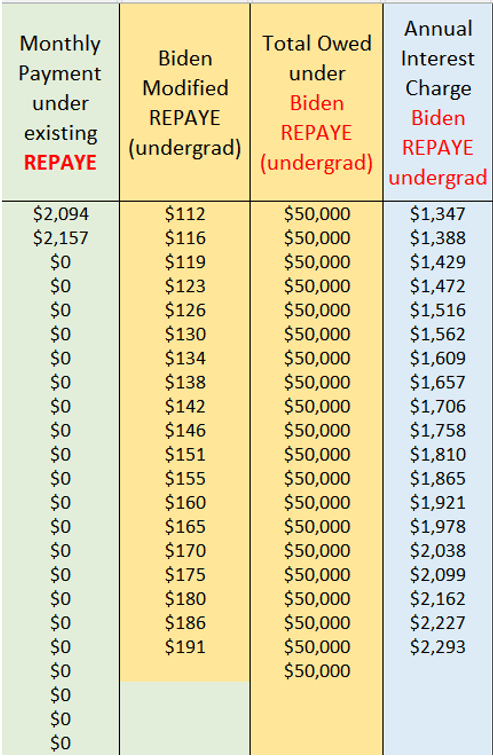

Pretend the project manager owes $50,000 from undergrad, and she files taxes married filing separately.

Her payment under REPAYE falls from $2,094 a month to just $112 a month. That’s a 95% decrease in payments.

Her interest rate “falls,” too. Her statutory rate is unchanged, but after the new interest subsidies from the New REPAYE are applied, her interest would be in the 2% to 4% range.

When you can put money in Vanguard’s Federal Money Market and earn over 4%, there would be no rational reason to pay down this debt more quickly.

What if this borrower contributed the maximum to her 401k? In that case, her payment would fall to $0 a month.

Under the New REPAYE plan, couples earning $200,000, $300,000, or even $400,000 could qualify for free college.

Biden promised only that public college would be free. But this plan goes far further than that.

Note that you can download your own copy of our New IDR spreadsheet with the button below.

Parent PLUS is excluded from SAVE, but there’s a temporary loophole

One of the least known loopholes in the student loan problem is something called “double consolidation.”

Parent PLUS loans cannot access any repayment plan besides ICR.

That’s because a consolidation loan that paid off Parent PLUS cannot access other repayment plans by statute.

But a consolidation of a consolidation is under no such restriction.

Senior Student Loan Advisor Meagan McGuire, CSLP®, breaks it down in this article, but here's an example:

So, pretend you have four loans. You'd consolidate them separately by sending two to one servicer and the other two to a different servicer. Wait for that consolidation to finish, then consolidate the two consolidation loans together.

The new consolidation loan can now access REPAYE.

And if a retired couple has a high income, they could file separately and get a payment of almost $0.

Under the new rules, a family that really understood their options could send all of their kids to almost any school in the country for free.

How?

- Borrow up to the maximum for Stafford loans in the child’s name.

- Then, put unlimited Parent PLUS loans for as many kids as you have in the name of one parent.

- Consolidate twice after the last one graduates.

- And file taxes separately so you can pay almost $0 monthly for 20 years, with no interest growth, while the full balance is forgiven.

Recall the movie Ladybird? Her father took out a mortgage to send her to NYU.

Mortgages must be paid back in full.

Instead, he could have borrowed $200,000 under Parent PLUS and used this loophole to access New REPAYE and pay almost nothing.

New REPAYE rules sunset Double Consolidation

Under the Department of Education's proposal, no consolidations of loans that consolidated Parent PLUS (ie double consolidations) would be eligible for any IDR payment except ICR starting July 1, 2025.

This means Parent PLUS borrowers need to urgently attempt to use this loophole before it closes in July 2025. It would mean paying 10% of income with a 225% poverty line deduction instead of paying 20% of income with a 100% poverty line deduction. We can help with that.

Professionals with graduate degrees get massive interest subsidies and much lower payments in most cases

In the past, borrowers would need to choose between 20-year forgiveness with Pay As You Earn (PAYE) and 25-year forgiveness with REPAYE.

Additionally, married couples had to file jointly with REPAYE. Only under PAYE and IBR could married borrowers exclude their spouse’s income from their payments.

But this new IDR plan would allow borrowers to file separately, get 25 years until forgiveness, and get all unpaid interest subsidized.

Under the old REPAYE plan, the inability to file separately significantly limited the interest subsidy for the highest-income couples.

No more with New REPAYE / SAVE.

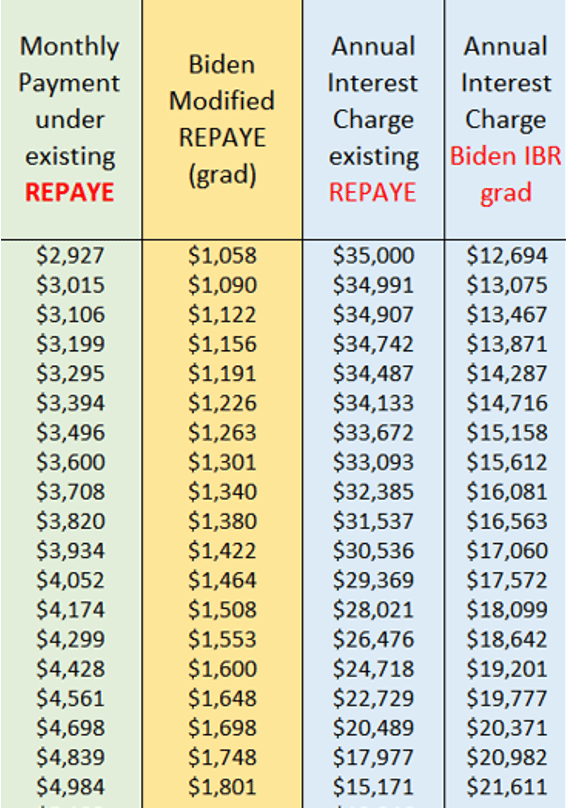

Consider the example of two married dentists, each earning $200,000 a year, where only one of them owes student debt. We’ll say he owes $500,000 at 7% interest, they have a couple of kids, and they file taxes separately.

Note the nearly two-thirds reduction in both their payments and interest. It’s truly stunning.

Examples like this show why the White House is mistaken when it says that borrowers in the top 30% of income will only see their payments fall 5%. They’re not taking into account married filing separately.

New complexities for borrowers with future high incomes: the PSLF conundrum

Under other proposed rule changes to student loans, the Department of Education will allow borrowers to count economic hardship deferment towards PSLF.

Consider the case of a resident physician.

Under the New REPAYE / SAVE plan, she could pay about $0 a month for the first two years and get a subsidy of 100% of her interest.

But in year three, her payment would jump to $230 a month, if she was single.

If she was sure of going into private practice or unsure of which path she would take after training, she should stick to the New REPAYE.

But if she was certain she would be taking a job at a not-for-profit, she would want to switch to deferment in year three to avoid making payments on her loans while still getting PSLF credit.

Such an action would save her approximately $2,700 over two years, assuming a four-year residency.

And such an action would magnify the savings over longer training periods.

Would PAYE, Old IBR, and New IBR have uses anymore?

Yes, the Department of Education is proposing to keep the forgiveness timeline for grad students under REPAYE at 25 years (see page 72).

The New REPAYE rule would also not have a cap on payments like the PAYE and IBR plans do.

So borrowers desiring a shorter repayment timeline and those needing a payment cap could benefit from the existing plans.

For a borrower with a very high income, this payment cap could allow someone to qualify for PSLF who would otherwise not qualify.

In extreme income situations, this payment cap might be helpful for 20-year forgiveness too.

It’s unlikely that all uses of these old plans would go away, but the administration does desire to move most borrowers to this new plan by sunsetting access to the old ones.

Related: Will Borrowers Need to Enroll in PAYE to Remain on It?

New REPAYE / SAVE will lead to an explosion of borrowing

The smartest action a borrower could take after this new IDR plan becomes law would be to borrow every dime they possibly can.

Many community college graduates do not take on debt but could. The rational choice would be to maximize loans because of these new benefits.

For borrowers in a traditional four-year college, the ability to file taxes separately one day would encourage any student to borrow the max they qualify for, since they could just exclude their spouse’s income one day.

In fact, married borrowers who both have loans could double dip on the family size deduction. There’s not as much incentive to do that with a 150% poverty line deduction, but with 225%, far more savings opportunities are available.

Graduate borrowers will now have access to a low or zero-interest line of credit during their studies. While you’re theoretically not allowed to use student loan funds to invest, money is fungible, so there would be no enforcement mechanism to stop someone from taking out a bunch of loans to pay rent and using the money they would’ve used on rent to invest.

Without capping student loans, the crisis will continue.

The NY Fed has found in prior research that an increase in subsidized student loan limits increases tuition by about 60 cents for each $1 limit increase.

This new REPAYE plan would effectively turn all graduate loans into virtual subsidized loans. The only difference is that the subsidy period would be 20 to 25 years AFTER graduation instead of the four years DURING studies.

One would expect schools to catch on and double or triple their tuition over the next decade if allowed.

What should borrowers do next?

We could still see legal action over this new REPAYE / SAVE plan, so borrowers should stay tuned.

Remember that many borrowers do not need to recertify their IDR payment until as late as 2025.

Since many borrowers have seen incomes go up significantly, it’s not a foregone conclusion that you would switch to this plan as soon as you’re able.

Borrowers should look carefully at current payment obligations, how long those would last, and when the right time to switch to New REPAYE would be. We can help with that. And we’ll have more for you as the New REPAYE rules continue to develop.

Not sure what to do with your student loans?

Take our 11 question quiz to get a personalized recommendation for 2024 on whether you should pursue PSLF, Biden’s New IDR plan, or refinancing (including the one lender we think could give you the best rate).

Comments are closed.