The chiropractic profession is filled with chiropractors who provide skilled neuromusculoskeletal therapy with empathy and dexterity. After evaluating a patient's medical history and X-rays, they provide diagnosis and treatment for a range of ailments related to the spine and joints, posture problems, sports injuries, and more.

Most chiropractors feel called to the medical work that they do. But your chiropractic school may have also sold you on the dream of making six figures. But the truth is that the six-figure lifestyle touted by so many schools is not accurate for most graduates who go into chiropractic practice with huge student debt.

We’re in the business of making custom student loan plans for chiropractor professionals so they don’t have to be stressed out about their financial future. Along the way, I’ve realized that owning your own practice is the best way to financial security as a DC. Ownership also is the best option for paying back chiropractic debt. But it might not be in the way that you might think.

Chiropractic business owners have far more opportunities to save money paying off student loans compared to associates. We’ll show you a few examples of why you should be thinking about how to start or purchase your own chiropractic practice with huge student debt over six figures.

Get Started With Our New IDR Calculator

Average salary vs. student debt for chiropractors

It takes a lot of time and money to earn a Doctor of Chiropractic (DC) degree. The journey begins with earning a Bachelor's degree. Next, you'll need to apply and get accepted into a chiropractic school. Most DC programs take four years to complete. Subjects covered include anatomy, physiology, and biology.

After eight full years of post-secondary education, a DC program graduate is finally eligible to sit for the NCBE license exam. By that time, most will have racked up over six figures in student debt. The average student loan debt of the 100+ chiropractors that we've worked with at Student Loan Planner® is $248,000.

You might think that with such demanding education requirements, chiropractors would have starting salaries in the six figures. But that's not the case. According to the Bureau of Labor Statistics (BLS), the median chiropractor annual salary is $70,720. That's just over a third of what physicians make even though chiropractors graduate with similar amounts of student debt on average. (Note that the expected 10-year job growth for both professions is 4%.)

What is the range of incomes for chiropractors?

Average chiropractor salaries don't tell the full story when it comes to the cost vs. reward of chiropractic school. IThe range of compensation for doctors is incredibly wide. In 2020, the bottom 10% earned $35,390 while the top 10% earn above $137,950.

At Student Loan Planner®, we mostly deal with DCs with large student loan debt balances. That said, I would say the average income that we've come across for new graduates with less than 5 years of experience is about $50,000 to $60,000.

We have seen some associates struggling to get full-time hours making $40,000. And we’ve seen a handful of owners making around $80,000 per year. I might have come across one chiropractor making six figures who graduated with a large student debt load in the past couple of years.

How location affects chiropractic salaries

Where you administer chiropractic care can make a difference in the amount of money that you're able to earn. For example, the latest BLS data shows that the average chiropractor earns over $100,000 in total compensation in these five top-paying states:

- Washington: $125,860

- Missouri: $106,870

- Oklahoma: $105,170

- New Jersey: $103,120

- Connecticut: $102,290

One of the reasons that chiropractors earn so much in these states is because there are fewer positions available — fewer chiropractors means less competition, and less competition typically means higher pay. In contrast, each of the top five states for chiropractic employment (Florida, California, Texas, Illinois, and New York) have median salaries below $90,000.

How to raise your chiropractor salary with your own practice

One recurring theme: the top-earning chiropractors are those who own their own clinics. Since the revenue of a chiropractic clinic isn't usually close to the seven-figure level, there isn't a ton of money left over to pay an associate. If you want to earn a good living from your Doctor of Chiropractic degree, you want to run your own chiropractic practice.

By owning your own practice, you can also grow your income by employing professionals from other medical disciplines such as massage therapy, acupuncture, or physical therapy. The 2020 Chiropractic Economics survey found that 35% of DC practice owners employed a massage therapist and 14% employed an acupuncturist.

As an owner of a chiropractic practice, you can reinvest some of the revenue of your business into its growth. Marketing, advertising, and other legitimate business expenses could grow your patient base as well as your recurring long-term revenue. If your chiropractic practice grows, you don't have to pay tax on that growth until you sell it many years down the line. Even then, the tax would be at lower capital gains rates instead of higher ordinary income tax rates.

After a decade or more of work, you would be able to sell your chiropractic practice for a multiple of your earnings. This is an asset that you would not have if you worked for years as an associate. You’ll do the work, and you might as well be rewarded for it through higher net worth.

Buying the real estate where your practice is located as a chiropractor

The IRS allows you to depreciate the value of your commercial real estate — that means you can reduce your taxable income for many years if you own the real estate for your practice.

Not all doctors own the real estate where their practice is located. That said, let’s assume you do, and you purchase a $200,000 building to operate your practice in.

Assuming a 30-year fixed rate mortgage at 5%, you’d be able to deduct another $9,933 of interest from your taxable income with a $200,000 mortgage.

You generally want to minimize your taxable income so you can pay less in taxes. As a W-2 employee, you have very little control over what shows up on your tax return. If you made $60,000, the main way you can reduce that is by saving for retirement.

Your monthly payment for the building would be $1,073. You would be able to deduct other expenses as well such as property taxes, commercial insurance, and utilities.

Over time, the real estate value would likely appreciate, so you would benefit from that as well. You would also save your business rental expense.

Setting up your own retirement plan as a chiropractic practice owner

Don’t forget that owners can choose what retirement plan they want for their business. Chiropractors with solo practices can open an Individual 401k and put $19,500 in this plan plus an employer match. Or if you're part of a group practice, you could open a Traditional 401(k), SEP IRA, or SIMPLE IRA.

Saving for retirement is an important step that many chiropractors overlook. You’ll want to save as much as you can for your future because of the demanding, physical nature of the job.

Why becoming a chiropractic practice owner is important if you have a lot of student debt

To illustrate the idea of why you want to own instead of associate if you have chiropractic student debt, let’s look at an example. Assume Jerry earns $60,000 per year as an associate and really enjoys the work. His employer offers no retirement plan so his only option is top open a Traditional or Roth IRA. For 2021, individual IRAs have $6,000 annual contribution limits. So after maxing out his IRA, his taxable income is $54,000.

Amy has her own chiropractic practice, and she earns about $90,000 after paying her staff. Amy set up her own 401k for the practice. She makes an employer contribution of $3,600 (4% of pay) plus the maximum employee contribution for 2021 of $19,500. That's a total of $23,100.

She also deducts the interest, property taxes, utilities, maintenance, insurance, and depreciation on her building. That yields another deduction of approximately $20,000.

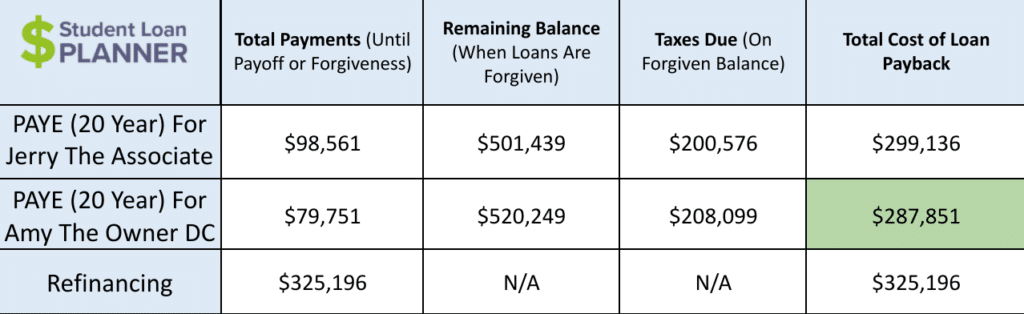

Her net income is thus $46,900. Let’s examine how Jerry and Amy would pay down their $250,000 of student debt from chiropractic school. Assume a 5% 10-year fixed rate for refinancing just to have something to compare the Pay As You Earn program (PAYE) to.

Amy was able to shield more of her income from taxes compared to Jerry even though she made about 50% more money. That means she was able to pay less on her PAYE program towards her student loans over 20 years. Her slightly higher tax bomb was easily offset by her lower payments since her taxable income was less.

Net worth for chiropractic practice owners vs. associates

At the end of their careers, Jerry might have an IRA in the low six figures. Amy the owner might have a 401k in the low seven figures.

Jerry would have no practice equity to speak of. Amy would have a chiropractic practice that could be sold to another practitioner for a low to mid-six-figure sum. She might also own the real estate and could profit handsomely off the sale of the building as well.

In short, Amy the chiropractor who owns her own practice could have a net worth as high as $2 to $3 million with only modest assumptions. Jerry the associate chiropractor would have to have a 70% savings rate. And even then, it would still not be enough most likely.

To top it off, Amy the owner paid less on her student loans because she lowered her Adjusted Gross Income (AGI). This number is what the government uses to calculate your student loan payment. The lower your AGI, the lower your payment and the higher your potential for federal loan forgiveness for chiropractors.

Get the confidence you need to increase your chiropractor salary with your own practice

You might need to use a Small Business Administration (SBA) loan to finance your practice if you cannot secure conventional funding from a bank. That’s ok, but it means you might need to place as much as 10% down on the loan.

Eliminate your credit card debt, get $20,000 cash in the bank, don’t take on a huge car loan, and wait to buy a house. If you do all of these things, you might be able to be your own boss much sooner than you think.

A cautionary tale: I have heard of stories from more than one chiropractor of older doctors who have tried to overstate earnings or misstate key business information in order to try to wrangle a higher price from buyers. Make sure you have a CPA or other experienced professional on your team to make sure you are paying for a legitimate business with real earnings.

It’s bad enough that your chiropractic school sold you on the dream of making a huge six-figure income without much effort. Don’t make things worse by refusing to take the entrepreneurial risk of running your own chiropractic practice with huge student debt. The good news is that you can still secure a wonderful financial future for your family even though you have six figures of student debt.

Take the risk and be your own boss. Your bank account will thank you later. And if you want a custom plan for your chiropractic student debt, we can help with that.

Do you have experience as a private practice owner? Do you agree or disagree with the points I made above? Let us know in the comments section and share your experience!

Owning the real-estate that your practice is in can not be overstated. Your practice exit strategy is also very important to plan.

Good point. Without a clear plan with real estate you could be kicked out of your location if your lease expired, which might hurt business equity value.

Any ideas on how to sell our practice? Ran ads for over one year. Nothing. We own our building too. Just want to be done!

Right now you wont be able to sell until COVID is over. Keep reducing the price and eventually someone will buy. Sorry to hear!