The average nurse anesthetist salary makes for a nice income, but the many years of healthcare education means racking up six-figure student loan debt. How can Certified Registered Nurse Anesthetist (CRNA) professionals figure out the best way to pay back their student loans?

CRNAs work in a tremendous field and help patients in a very meaningful way. When patients are at their most vulnerable state, CRNAs are there to make sure things go smoothly.

According to the American Association of Nurse Anesthesiology (AANA):

Every day, nurse anesthetists monitor patients during surgery. This requires preparing and administering drugs before anesthesia, managing patients’ airways, and pulmonary status during surgery and closely observing their physical reaction to drugs.

With everything at stake, it takes a disciplined, detail-oriented, hard-working person to become a CRNA.

Requirements to become a CRNA

Becoming a CRNA is a worthy pursuit, but it is also a long path that requires students to pay the price in terms of time and money.

The first requirement is to earn a Bachelor of Science in Nursing (BSN). After that, a person pursuing that career path needs to work for at least one year as a registered nurse (RN) in a critical care setting. Then, they must go to an accredited CRNA school to get their master's degree or doctorate degree in nurse anesthesia which usually takes two to three years for most to complete.

However, the American Association of Colleges of Nursing (AACN) plans to require all CRNA programs to transition from Master of Science in Nursing (MSN) to Doctor of Nursing Practice (DNP) programs by 2025.

All in all, CRNAs spend about seven to eight years in the pursuit of their career. Additionally, CRNAs must pass a certification exam administered by the National Board of Certification & Recertification of Nurse Anesthetists.

The good news is that it pays very well.

Nurse anesthetist salaries may vary by state and metropolitan areas due to the cost of living and the need for advanced practice nurses in this specialty. But the national average annual salary is about $205,770, according to the Bureau of Labor Statistics.

Top paying states offering the highest average hourly wage include North Dakota, California, Connecticut, New York and Illinois.

The mean annual wage also varies among medical facilities in the profession, such as outpatient care centers, surgical hospitals, physicians' offices and specialty hospitals.

The downside is the amount of student debt required. It can be a lot to deal with upon graduating.

You might put in your email to see the full distribution of salaries and debt we've seen among our CRNA clients. Then continue reading for some more practical examples.

Income & Student Debt by Profession

How you compare to other

accountants stats*

| Average student debt | |

| Average income | |

| Average Debt-to-Income Ratio |

Statistics represent the population of Student Loan Planner clients in the respective profession referenced in the chart from 2017-2023. Sample excludes those in school or in training.*

CRNA student loan debt

With the grueling curriculum, it’s nearly impossible for CRNA students to earn enough wages to pay cash for school along the way.

Nurse Blake of NurseBlake.com says, “You can’t work in school; it’s too hard,” and says CRNA students have to be okay with accruing debt.

Most of the CRNAs we work with at Student Loan Planner® are staring at more than $200,000 of student loan debt. It’s very intimidating, even with the nice income.

Worse yet, pursuing the wrong student loan repayment strategy could end up costing them tens and possibly hundreds of thousands of dollars.

The best student loan repayment strategy for a CRNA

In our experience, CRNAs have three solid options that will save the most money paying back their student loans:

1. Pay off their loans aggressively with a goal of being debt free in 10 years or less. This could involve refinancing student loans with a private lender if it would lower their interest rate and they could afford the payment.

2. Work for a nonprofit hospital or government employer (like a school) and go for Public Service Loan Forgiveness (PSLF) via the U.S. Department of Education. PSLF eligibility requires at least 120 qualifying payments on an income-driven repayment plan, or IDR for short.

3. Sign up for an IDR plan like PAYE or SAVE (formerly REPAYE), and make federal student loan payments based on income for 10 to 25 years. These loan repayment programs require you to pay taxes on the forgiven balance.

With the first option, a CRNA should throw every extra dollar they can find to be debt free. The remaining options are the exact opposite. Pick an IDR plan that will keep payments as low as possible and maximize student loan forgiveness.

Anywhere in between could be a needless waste of thousands of dollars. We’d rather CRNAs keep that money in their pockets.

The option that's best for you depends on your specific situation.

Case study: A CRNA career decision – private employer vs. nonprofit hospital

Brittany is a CRNA who owes $220,000 in student loans with a 6.5% interest rate and also has about $10,000 of credit card debt.

She has two job opportunities. One is a nonprofit hospital with a CRNA salary of $145,000, and the other is with a private practice at $175,000.

Right now, she’s leaning toward the private practice job and is considering the extended plan to keep her payments low. The only thing stopping her from choosing the private job is the lure of PSLF with the nonprofit hospital.

Let’s compare the numbers to see what that decision looks like from a purely financial perspective.

The extended repayment plan is one of the most expensive plans a CRNA can choose

First, we’d take a look at her repayment options with a private job.

With the thousands of consults we’ve done, the extended plan is one of the worst options 99% of the time. First of all, she’d pay a very high-interest loan back over 25 years. That lower monthly payment may prove to be very costly in the long run.

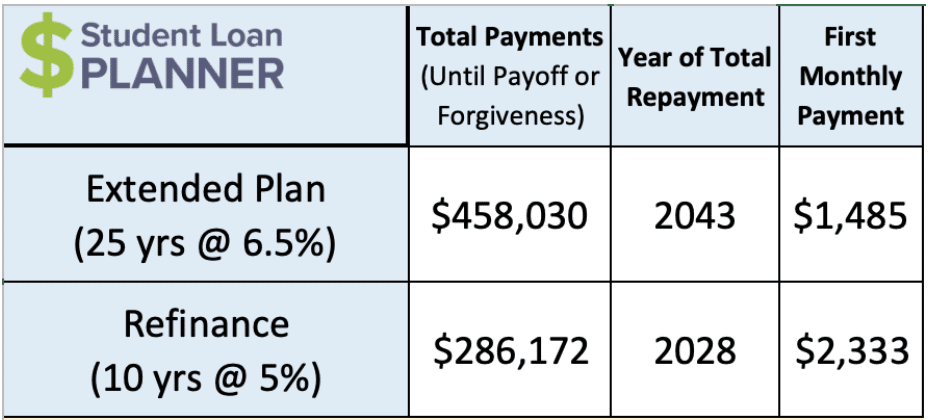

Let’s compare refinancing to a 10-year term with a 5% interest rate to the extended repayment plan where she’d pay back a 6.5% loan over 25 years:

When people look at paying back debt, often they fixate on the monthly payment. Yes, the monthly payment is about $850 more per month versus the extended plan, which can be somewhat intimidating on the surface.

But let’s reframe the numbers here.

Refinancing would save Brittany $172,000 paying back her loans. Instead of paying $1,485 per month for 25 whole years, she could pay $2,333 per month for 10 years, and then have no more student loan payments.

Student debt free with no payments after 10 years instead of 25? That’s a huge difference!

Brittany and I discuss budgeting an extra $850 per month to put toward student loans so she can refinance. After seeing how much she’d save on her loan repayment combined with the drastically higher income on the way, she is committed to using a portion of that high income to throw at her loans and committing to refinancing.

CRNA Public Service Loan Forgiveness (PSLF)

Now that we’ve eliminated the extended plan from the discussion, we know that Brittany has two options: refinance or go for PSLF. Both options would get her student debt free in 10 years.

When we’re talking about whether or not to give up PSLF for a higher-paying job, we’d want to compare how much more she’d pay if she were to refinance versus PSLF.

Refinancing is kind of like a mortgage. You make level payments which are comprised of both principal and interest. The payments are based on how much you owe, and at the end of the term, the entire loan is paid off.

When we talk about PSLF, it’s the opposite. The amount of debt doesn’t matter in terms of calculating payments under this loan forgiveness program. They would be based solely on income. In other words, payments change with changes in income, not with the loan balance.

The payment plan we’re focusing on with Brittany is Pay As You Earn (PAYE). Payments are based on 10% of discretionary income, and it has other features that could make this option appealing as she’s going for PSLF.

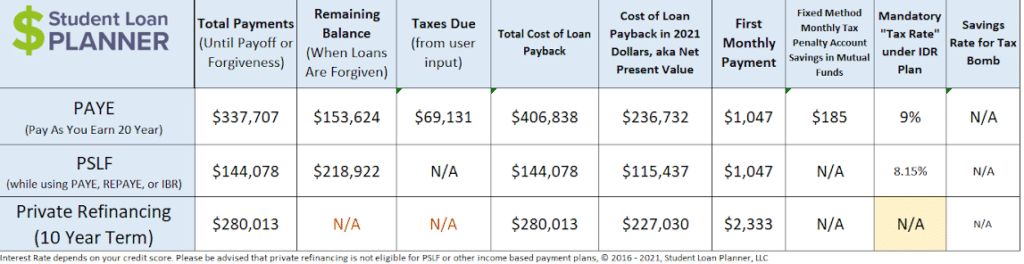

Let’s compare the numbers between PSLF using PAYE versus refinancing:

You can see that PSLF would end up saving her about $136,000 over 10 years paying back her loans. That’s a huge number and looks on the surface to be a no-brainer to go for PSLF. But that’s not the whole picture.

The difference in pay between the two jobs makes a huge difference too. It’s the most important calculation to compare the true benefit of PSLF.

Generally, the types of jobs that qualify for PSLF pay less. But if they pay too much less, taking the job for PSLF purposes only could end up being more costly. We have to break it down to see what amount of salary is worth it to give up the benefit.

Here’s how we do it

PSLF would save Brittany $136,000 over 10 years paying back her loans versus refinancing at 5%. That works out to an average of $13,600 a year for 10 years.

In other words, if she were to take the private job, she’d have to make an extra $13,600 in take-home pay so that she could cover the higher refinancing payments. That number would make PSLF versus refinancing a wash.

That number would be her take-home pay (aka after-tax dollars), so she’d probably have to make around $20,000 more in salary to take home $13,600 after taxes. In other words, the nonprofit compensation is $145,000 in salary, so she’d have to make at least $20,000 more in the private job to give up the PSLF benefit from a pure numbers perspective.

Well, the private job is offering her $30,000 more in salary ($175,000 versus $145,000). It would be “okay” to give up PSLF because she’d be getting paid more than enough to compensate for it versus the nonprofit hospital job. She’d be able to not only cover the higher payments with the higher salary, but she’d probably have extra money to spare after those higher payments, too.

Since she was leaning toward the private job anyway, the numbers show that it’s okay to go that route, too.

Refinance and be student debt free in seven years

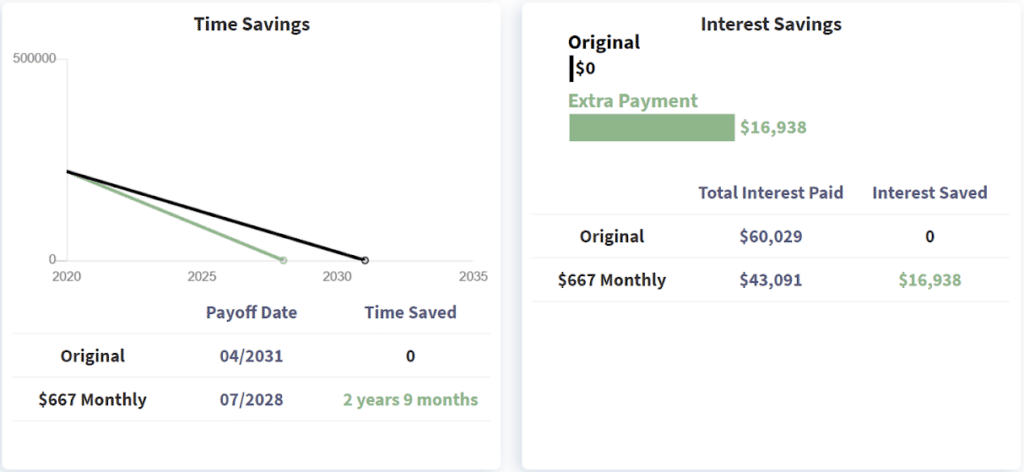

Brittany decides to take the private job. She was so motivated after seeing the numbers and getting clarity around her situation that she’s going to make room in her budget to pay $3,000 each month towards her loans.

Using our Student Loan Payoff Calculator, she’ll be debt free in about seven years and save another $17,000 in interest.

Before finalizing refinancing though, she’d want to clean up about $10,000 of credit card debt. It should take her three to four months with her fantastic income prospects. This will free up money in her budget and improve her credit score, giving her access to better interest rates.

Once she works through that, she can refinance through Student Loan Planner® and get a nice cashback bonus, too.

Compared to her original strategy of going on the extended plan, she’ll save hundreds of thousands paying back her loans. Plus, she’ll be debt free 18 years sooner (seven years versus 25 years).

Way to go, Brittany!

Certified Registered Nurse Anesthetists can get a solid student loan plan

CRNAs can find a clear path to pay back their federal and private student loans. A path that could not only save them significant money but also give them a clear path that they understand and actions steps to get it done. A CRNA salary is pretty good, but is the student loan debt you accumulate to get there worth it?

Student Loan Planner® has helped over 10,587 clients and found $569 million in projected savings. Whether you work for a private practice, a hospital going for PSLF, or another employment situation, we can help you figure out the optimal path. Plus, we include email support after the consult to continue to answer your questions and help you implement the plan.

Income & Student Debt by Profession

How you compare to other

accountants stats*

| Average student debt | |

| Average income | |

| Average Debt-to-Income Ratio |

Statistics represent the population of Student Loan Planner clients in the respective profession referenced in the chart from 2017-2023. Sample excludes those in school or in training.*

Comments are closed.