If you’re a registered nurse, choosing to become a certified registered nurse anesthetist (CRNA) could be a smart career move.

Nurses who are certified to administer anesthesia are some of the most respected advanced practice nurses in the healthcare field. They’re given more autonomy in their work and are some of the highest-paid healthcare providers in the nursing field. Plus, the job outlook is bright.

According to the Bureau of Labor and Statistics (BLS), the median annual wage for nurse anesthetists is $183,580. And they belong to an advanced practitioner field (which also includes nurse practitioners and nurse midwives) that’s expected to grow a whopping 45% over the next 10 years.

That’s all great news. But here’s the bad part. To become a CRNA, you’ll need seven to eight years of education and training. And you could end up with a lot of student loan debt along the way. Student Loan Planner® has worked with many CRNAs, with $150,000 to $200,000 in student debt being most common. And the highest cost private schools can put you over $300,000 in debt.

If you’re a CRNA dealing with a ton of student debt, you may wonder if refinancing would be a good decision. Let’s take a look at look at the pros and cons of student loan refinancing for CRNAs.

Note that the COVID-19 pandemic and federal relief measures have impacted many student loan borrowers. To learn more about your options and whether you should consider refinancing now, check out our guide.

Pros and cons of student loan refinancing for CRNAs

When you refinance your student loans, the lender that you choose pays off your old loans and gives you a new loan with (hopefully) more attractive terms.

In the case of student loan refinancing for a certified registered nurse anesthetist, there are three main pros and two cons to keep in mind.

Pro No. 1: Save a ton of money on student loan interest

When we’re talking about any kind of refinancing, whether it be a mortgage, a car loan, or anything else, the goal is typically to save money by securing lower interest rates. And student loan refinancing generally has the same goal.

Why give student loan companies free money if you can pay less interest by refinancing?

For example, if you have $150,000 of student debt at a 6.5% interest rate, you could save over $26,000 over the life of your loan by refinancing at 3.5%.

That’s a ton of money. So if people can save that much money by refinancing, why don’t more people do it?

One of the problems that our Student Loan Planner® consultants see with some borrowers is that their debt-to-income ratio makes it tough for them to qualify for refinancing. Once you owe more than 1.5 times your income, refinancing becomes more difficult.

But CRNAs often have modest debt in relation to their incomes, making them ideal candidates for refinancing because they may qualify for the best interest rates.

Pro No. 2: Pay off your student loans faster

Another benefit of student loan refinancing for CRNAs is that it could help you get rid of your student loans faster. Remember the example that we looked at above of refinancing $150,000 of student loans from 6.5% to 3.5%?

Well, in that situation, you’d pay off your loans in 10 years and you’d pay nearly $28,000 in interest. But remember, your payment would be $220 cheaper each month, too.

So what if you took that extra $220 and applied it toward your principal? In that case, you’d pay off your loans 1.5 years sooner and you’d save an extra $4,000 in interest.

And what if you decided to really buckle down on your budget and make $500 in extra payments toward the principal each month? In that case, you’d be debt-free in seven years instead of 10. And you’d save another $8,200 in interest charges!

Pro No. 3: Remain eligible for healthcare-specific loan repayment programs

Refinance loans are private student loans which means they're ineligible for the Department of Education's income-driven repayment plans (which we'll discuss next). But it's important to understand that there are many loan repayment programs designed specifically for health care professionals which CRNAs can still qualify for after refinancing.

The Nurse Corps Loan Repayment Program, for example, can provide payment assistance for registered nurses (RNs), advanced practice registered nurses (APRNs), and nurse faculty members who work full-time at least two years in critical shortage facilities or eligible nursing schools. Nurses who meet these eligibility requirements can have up to 85% of their outstanding student loan debt repaid.

Another popular loan repayment program that nurse anesthetists qualify for is the NHSC Rural Community Loan Repayment program. This program can provide up to $100,000 of assistance for CRNAs who commit to three years of full-time work at a facility that has a “Rural” status on the Health Professional Shortage area map. CRNAs who work part-time can receive up to $50,000.

Related: Guide to Nurse Loan Forgiveness Programs

Con No. 1: Lose eligibility for income-driven repayment

If you have federal student loans, you may be eligible to join an income-driven repayment (IDR) plan. But if you refinance those federal loans into private loans, you’ll lose that eligibility.

Is that a big deal? Well, the nice part about income-based repayment is that your monthly payment scales up and down with your income. And if you were in a field that had lower median pay, that could make a big difference in your monthly payment.

But you’ll also be placed on a 20- or 25-year repayment period with an IDR plan. And, during that time, you’ll pay a lot more in interest. If your income is anywhere even near the median pay for a CRNA, you’re unlikely to receive much, if any, forgiveness either.

If you can afford to pay off your loans in 10 years or less, refinancing is generally the best financial decision. But if cash flow is a concern, then you may want to stick with an IDR plan.

Con No. 2: Lose eligibility for Public Service Loan Forgiveness

Ok, so this is the biggie when we’re talking about student loan refinancing for certified registered nurse anesthetists. If you work at a public or non-profit hospital, you may qualify for the Public Service Loan Forgiveness program (PSLF).

And that’s a big deal because PSLF may be the best federal forgiveness program available today. With PSLF, you can receive 100% of your remaining balance forgiven in as little as 10 years (or 120 qualifying payments).

But once you refinance your student loans, you’ll no longer be eligible for the PSLF program. And that could be a big reason to avoid refinancing.

You also need to consider the “opportunity cost” of PSLF. In other words, how much money would you be giving up each year in salary by working for a non-profit hospital instead of a private hospital or care center?

Would you lose more money in salary than you’d gain in PSLF forgiveness? If so, you’d be better served taking the higher-paying job, refinancing your student loans, and paying them off as fast as you can.

How should a CRNA approach student loan refinancing?

Let’s dig a little deeper beyond the basic pros and cons by looking at three CRNA refinancing case studies.

Case Study No. 1: Suzy, who should pursue PSLF

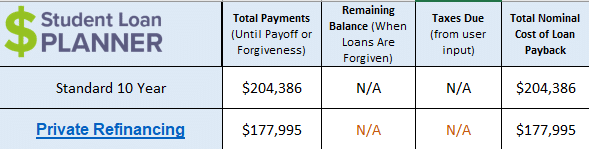

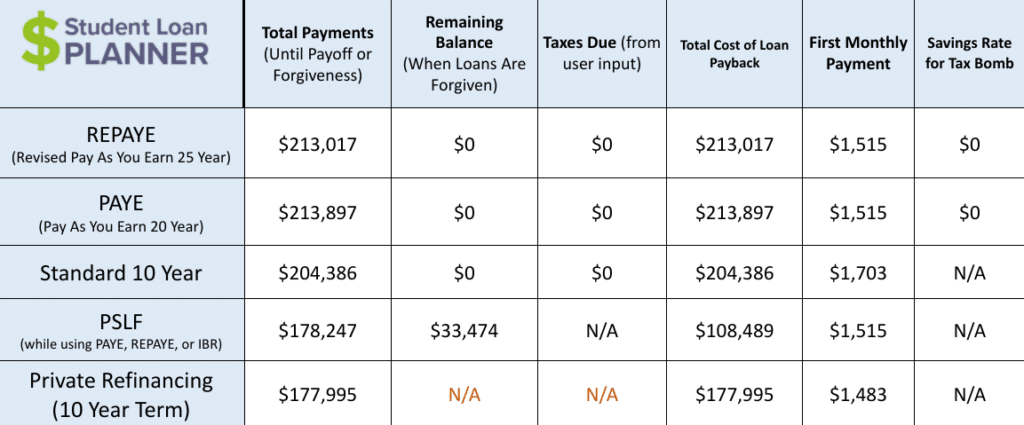

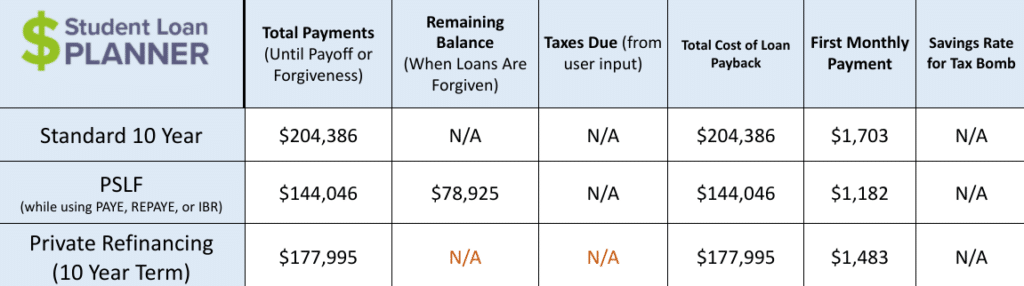

Many people assume that CRNAs can’t benefit from PSLF because they make too much money. But that’s not always the case. For example, let’s say Suzy has $150,000 student loans. Suzy is passionate about public service and takes a job at a non-profit clinic that pays a $125,000 salary.

In this situation, Suzy would definitely be best served by pursuing PSLF.

For Suzy, PSLF would save her $100,000 or more versus the standard 10-year plan and each IDR plan. And she’d save nearly $70,000 versus refinancing at 3.5%. In Suzy’s case, PSLF is clearly the best choice.

Case Study No. 2: Jim, who should stick with IDR for now

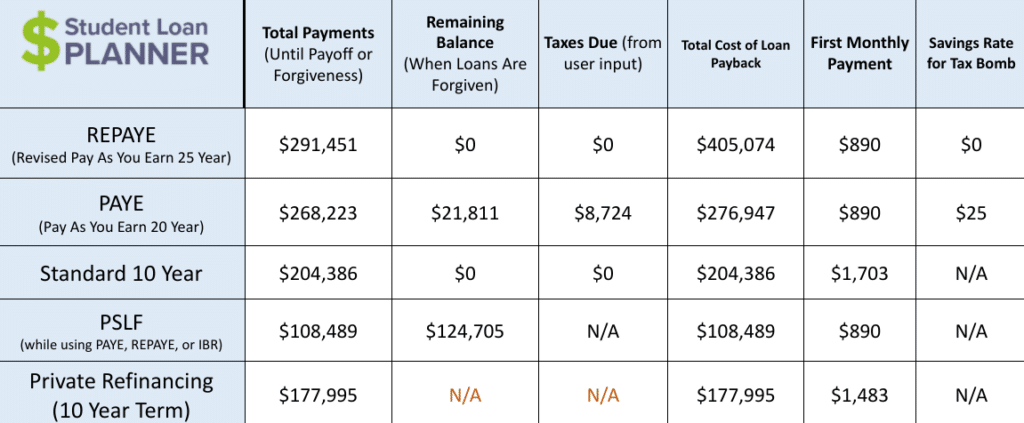

For our second case study, let’s imagine that Jim has a $250,000 student loan balance, a $150,000 starting salary, and doesn’t work for a PSFL-qualifying employer. In this case, Jim should probably stick with income-driven repayment.

Why? Because his debt-to-income ratio is above 1.5. In Jim’s situation, he’ll most likely struggle to find a lender who will offer him a great rate. Even if he were able to refinance at 3.5%, which would be unlikely, his monthly payment would still be $2,472.

On a $150,000 salary, that would mean over 26% of Jim’s take-home pay could be going toward student loan repayment each month. That would put a big strain on his budget.

In Jim’s case, he’d probably be best served by going on PAYE or REPAYE to lower his monthly payments. And Jim could always refinance down the road if his income increases.

Case Study No. 3: Amanda, who should refinance her student loans

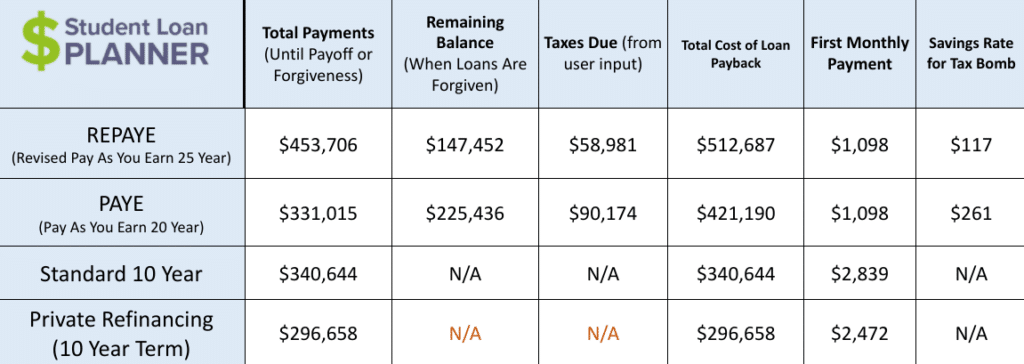

For our final case study, let’s imagine that Amanda has $150,000 in student loans and lands a great job with a $200,000 annual salary. In this case, refinancing would be close to a no-brainer.

Not only would refinancing be cheaper than PSLF overall, but Amanda wouldn’t have to work at a non-profit employer for 10 years. And if Amanda made extra payments toward the principal, she could be debt-free even sooner.

Part of the reason that refinancing is a slam-dunk decision in this case is because Amanda would only receive $33,000 of forgiveness with PSLF.

But what if the most that Amanda could make at a non-profit hospital would be $160,000? In that case, she’d receive more PSLF forgiveness — $78,925.

But keep in mind that she’d be giving up an extra $40,000 per year of income for 10 years. That’s $400,000 of pre-tax income forfeited for the sake of $79,000 of student loan forgiveness. That’s not a good trade-off. Unless Amanda is passionate about public sector work, she should take the higher-paying job and refinance her student loans.

Why student loan refinancing for CRNAs is often the best choice

The good news for CRNAs is there are a lot of “Amandas” out there. As mentioned earlier, many CRNAs have modest debt when compared to their incomes, unlike some other medical professionals.

And, in that situation, you can afford to be more aggressive and aim to get rid of debt as fast as possible rather than using a 20-year forgiveness plan.

One more thing — if you’re going to refinance your student loans, make sure to look for lenders who don't charge origination fees and offer hardship forbearance programs. And you’ll want to make sure that you get a cash bonus.

By taking a smaller payout for referrals than its competitors, Student Loan Planner® has negotiated amazing cash bonuses for its readers. Currently, CRNAs who refinance with one of our partners can get up to $1,275 back in cash.

Refinance student loans, get a bonus in 2024

| Lender Name | Lender | Offer | Learn more |

|---|---|---|---|

|

$500 Bonus

*Includes optional 0.25% Auto Pay discount. For 100k or more.

|

Fixed 5.24 - 9.99% APR*

Variable 6.24 - 9.99% APR*

|

|

|

$1,000 Bonus

For 100k or more. $300 for 50k to $99,999

|

Fixed 4.99 - 10.24% APPR

Variable 5.28 - 10.24% APR

|

|

|

$1,000 Bonus

For 100k or more. $200 for 50k to $99,999

|

Fixed 4.99 - 9.74% APR

Variable 5.89 - 9.74% APR

|

|

|

$1,050 Bonus

For 100k+, $300 for 50k to 99k.

|

Fixed 5.44 - 9.75% APR

Variable 5.49 - 9.95% APR

|

|

|

$1,275 Bonus

For 150k+, $300 to $575 for 50k to 149k.

|

Fixed 5.48 - 8.69% APR

Variable 5.28 - 8.99% APR

|

|

|

$1,250 Bonus

For 100k+, $350 for 50k to 100k. $100 for 5k to 50k

|

Fixed 5.24 - 10.99% APR

Variable 5.28 - 12.43% APR

|

Not sure what to do with your student loans?

Take our 11 question quiz to get a personalized recommendation for 2024 on whether you should pursue PSLF, Biden’s New IDR plan, or refinancing (including the one lender we think could give you the best rate).