Physicians have a stronger need for disability insurance than most occupations. But of all the medical specialities, surgeons are at one of the greatest risks of being financially impacted by a disability.

Any number of gradual or sudden disabilities could prevent you from being able to operate on others. If you can’t precisely hold your surgical instruments or withstand long hours on your feet during procedures, your career as a surgeon could come to a halt. In which case, could your family continue their current lifestyle without your high surgeon income?

Let’s dive into the importance of disability insurance for surgeons, including why your employer coverage might not be enough and how much an own-occupation disability insurance policy might cost.

Surgeon disability insurance premium cost

Surveyed surgeons pay, on average, $344 per month for their existing disability insurance coverage. However, reported disability premiums range from $120 up to $735 or more per month.

So, how much can you expect to pay? We’ve run some cost estimates with multiple disability insurance companies to give you a better idea.

Surgeon own-occupation disability insurance monthly cost (Age 34, resident/fellow)

| Company | Male | Female |

|---|---|---|

| Guardian | $221 | $322 |

| MassMutual | $200 | $311 |

| Principal | $192 | $345 |

| Ameritas | $206 | $299 |

| Standard | $174 | $275 |

Unfortunately, disability insurance tends to cost significantly more for females due to a higher risk of disability. But some insurance companies offer unisex discounts to lower premiums to a gender-neutral rate. Additionally, some states, such as Massachusetts, mandate unisex pricing.

As a surgeon, you might also have opportunities for additional premium discounts. For example, discounts are available if you buy an individual disability insurance policy within six months of completing your training.

An independent insurance agent, like our SLP Insurance partners, can help you hunt down any applicable discounts to get you the most savings. So, fill out the form below to get a custom quote.

Get the best price on own occupation disability insurance

SLP Insurance will find you the best price even if it's not with us. Fill out the form below to get discounts of up to 30%.

Why every surgeon needs disability insurance

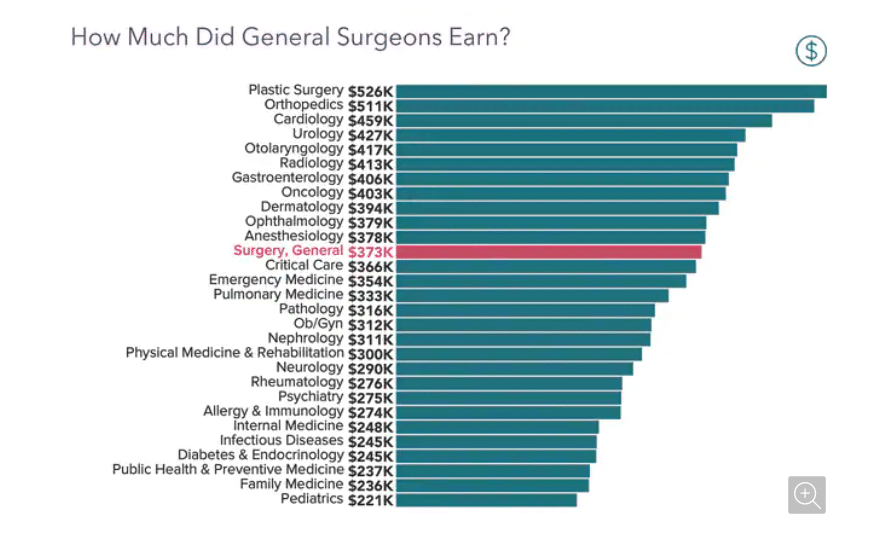

According to Medscape’s 2021 Physician Compensation Report, general surgeons earn an average of $373,000 per year. Over a 30-year career, that’s over $11.1 million in potential earnings. Depending on your specialty and your opportunities for advancement, your earning potential could be much more.

Source: 2021 Medscape Physician Compensation Report

You spent years training for your career and took on hundreds of thousands in student loans.

This is why surgeons need to protect their income with sufficient disability insurance. Your very high salary (matched with a more expensive lifestyle) makes it difficult to replace your lifetime earnings. You can get quotes through SLP Insurance through the form below.

You’ve persevered through medical school and residency, including racking up six-figure medical school debt. You’ve worked endless hours and navigated the emotional weight of literally holding a life in your hands — all to risk having an injury or illness significantly alter your career path.

Even if you can eventually recover from a long-term disability, your finances might not. You might be forced to drain your savings or risk falling behind on your home or car payments in the interim.

Unlike other professions, surgeons can’t gamble with their livelihood by forgoing or carrying minimal disability coverage. Disability insurance should be a top priority for every surgeon, but especially for those with families depending on them.

An own-occupation policy is a must for surgeons

Because you’re more susceptible to a disability tanking your career, surgeons need own-occupation coverage as a provision of your disability insurance policy.

Own-occupation coverage provides monthly benefits if a disability prevents you from working in your medical specialty. But you can still work in other capacities without being financially penalized.

For example, you might not be able to perform surgical procedures anymore but you could still use your knowledge and experience to teach others or transition into a different area of medicine. You’d likely experience a sizable drop in income. But you’d receive disability income due to your own-occupation policy.

To clarify, without an own-occupation disability rider, your policy won’t pay out if you’re able to work in some capacity. Additionally, you want to review the verbiage in your own-occupation rider to verify that the definition is expansive enough. So, it’s one of the most important provisions a surgeon should include in their disability coverage.

Related: Disability Insurance for Thoracic Surgeons: Benefits and Costs

Disability insurance for surgeons: Views from our community

More than 1,500 readers and clients responded to our 2022 Student Loan Planner Insurance Survey aimed at understanding disability and term life insurance coverage within a variety of professions.

From this group, 29 surgeons provided insight into how they view disability insurance, including their existing coverage. Here’s what we learned.

Disability insurance is an essential piece of surgeons’ financial plan

Our survey supported that most medical professionals understand the need for disability insurance, at least on the surface. But in many cases, they aren’t following through by buying the coverage they need. This isn’t the case with surgeons.

Every single one of our responding surgeons believes they need disability insurance. And the vast majority have some level of coverage either through their employer or by purchasing a disability policy of their own.

Surgeons are getting the message that disability insurance isn’t just another financial option, but rather a necessity for their profession.

That being said, many surgeons are relying on their employer’s disability policy benefits to protect their income — which could end up being a costly mistake if your policy has limited benefits.

Breadwinner surgeons are protecting their families

We found that 83% of surgeons are the breadwinners of their household with a spouse, partner or children relying on their income for financial support. Once again, surgeons aced the exam with 100% of these breadwinners understanding the need for disability insurance.

Surgeons are taking proactive steps to protect their income, and therefore their families, from the unexpected.

As the primary income earner, you’re responsible for financially providing for your family. You’ve put in the work to make sure your family is comfortable and able to have certain advantages in life that maybe you weren’t privy to.

Disability insurance can play a pivotal role in securing your family’s financial future if you’re no longer able to provide as a surgeon.

Related: Guide: Best Disability insurance for Vascular Surgeons & How Much It Costs

How much disability coverage do surgeons need?

We recommend carrying the maximum disability benefit allowed to ensure your income is adequately protected. This is generally around 60% of your income.

If you have existing disability coverage, there’s a good chance that you could benefit from a supplemental policy of your own.

For example, one of our surgeon clients has a workplace policy that’ll provide a $5,000 monthly benefit for a qualifying long-term disability. But his annual salary is $400,000, making him severely underinsured with a partner and three kids at home.

A supplemental policy with up to $15,000 of additional income protection would provide more adequate coverage for his family if ever needed.

Depending on your assets, you can adjust your coverage to fit your overall risk tolerance. Once you hit financial independence, you can cancel your disability policy altogether since it won’t be a necessity anymore if your career takes an unexpected turn.

Related: Surgeons: Forget Hand Insurance — Get This Coverage Instead

Disability policy details that affect your coverage and premiums

Our cost estimates above include some of the most popular policy riders, including own-occupation coverage, residual or partial disability coverage, non-cancelable and future income purchase options.

Additionally, you’ll need to choose a waiting period (how long it’ll take to receive benefits once a disability claim is filed) and your benefit period (how long the benefit amount will be paid out).

Each of these policy decisions affects how much you’ll pay for disability coverage. But they can also dramatically change your coverage. So, it’s best to speak with an expert independent insurance agent that’ll provide you an unbiased explanation of benefits and costs.

Related: International Disability Insurance: What to Expect From Your Coverage While Abroad

Workplace disability coverage: What benefits do surgeons get?

Our survey found that 59% of surgeons have some level of disability coverage through their employer. However, many workplace group disability insurance plans have limited coverage due to capped income amounts and narrower definitions of disability.

For example, surgeons employed by Banner Health receive long-term disability insurance benefits based on 60% of their base earnings. However, the maximum benefit is limited to $10,000 per month. Additionally, incentives and other forms of compensation are excluded from the benefit calculation. Many surgeons might know they have some amount of coverage through work without knowing that their coverage is inadequate.

Surgeons with these types of limitations on their employer disability coverage can benefit from a supplemental policy.

A disability policy of your own can fill coverage gaps left behind by your employer, but there are other benefits to consider.

For example, an individual disability policy is portable. So, it’ll follow you to your next hospital or if you decide to move into your own private practice. They also have stronger definitions of disability, giving you better income protection.

Additionally, if your employer is covering your disability premiums, then your monthly benefit will be considered taxable income when it’s paid out. Therefore, your net benefit will be reduced overall due to taxes.

In comparison, individual policy premiums will be paid for with your post-tax dollars. Therefore, your disability benefits will be tax-free, meaning you’ll get to keep the full benefit when your family needs the income the most.

Disability insurance options for surgeons

Some professional associations partner with insurance companies to provide their members with discounted insurance products. But these group plans aren’t always the best route for disability coverage.

For example, surgeons can choose to purchase up to $15,000 in monthly benefits for own-speciality disability coverage with the American Medical Association (AMA). This group coverage policy option is underwritten by New York Life, but it isn’t available in all states.

AMA members receive a 35% rate reduction, and non-members receive a 10% discount. However, these discounts are reviewed annually and are only guaranteed for the first year of coverage. Additionally, premiums can change depending on program experience.

In some cases, disability insurance through an association partnership could be more affordable. But you’ll need to read the fine print and dig into your actual coverage. This is why comparison shopping is so powerful. You want to compare all of your options through an independent broker that can help you compare all available options (SLP Insurance operates this way).

Working with SLP Insurance to find the best disability coverage

You can usually find better coverage by working with an independent agent that isn’t motivated by huge commissions.

Fill out our quote form below. Here’s how we work to save surgeons money on own-occupation disability insurance:

- Pointing you to a better discount. If we know of a better discount (through your residency or fellowship program for example), we’ll refer your business elsewhere even if it results in us earning $0.

- Tailoring your search for applicable discounts. We search for unique discounts that might be available based on your relocation plans. For example, if you’re a female surgeon taking a job in Massachusetts, we might recommend applying in Massachusetts instead due to state laws that require unisex pricing. For male surgeons leaving such a state, we might suggest applying in your new location if that state’s laws provided a larger discount.

- Examining your current policy at no extra cost. We review your existing coverage for free to make sure you have the correct policy in place.

- Leveraging our student loan expertise. We utilize our best in the world knowledge of student loans to make sure your policy provides the protection you need.

- Identifying guaranteed standard issue policies (GSI) for those with medical conditions. If you have any medical conditions, we’ll search hospital and residency programs to see if there are any GSI policies available that don’t require underwriting, regardless of whether we earn anything from it.

SLP Insurance and our partner agents can help you comb through your existing coverage and make recommendations for a supplemental policy. At minimum, you can get your most pressing insurance questions answered by an unbiased source.

Fill out the form below to start the free quote process and receive a one-on-one assessment of your disability insurance needs.

Compare disability insurance quotes and save

SLP Insurance will find you the best price on own occupation coverage, even if it's not with us. Fill out the form below for a quote with up to 30% discounts.