What you need to know:

- Discover offers student loan refinancing and private student loans for students who are still in school.

- There are no application, origination or late fees.

- Discover student loans come with in-school payment flexibility, but post-graduation repayment terms are limited.

Editor's note: As of February 1, 2024, Discover is no longer accepting new student loan applications. You can still refinance your Discover student loans, but new loans aren't available.

Discover offers refinancing and private student loans for undergraduates and graduates. They also offer exclusive student loans for MBA, health professions, law, residency and bar exam students.

In our full Discover student loans review, we’ll look at interest rates, eligibility requirements, application processes, and pros and cons of Discover student loans.

Let’s start with Discover’s student loan refinancing option.

Discover student loan refinancing

Your eligibility for a Discover student loan refinance and the rates you’re quoted are determined by your creditworthiness. Students may have the option to apply for a Discover student loan with a creditworthy cosigner. Applying with a creditworthy cosigner may improve the likelihood for loan approval and may provide a lower interest rate.

Pros and Cons

Pros

- No fees: No application, origination or late fees

- Auto debit reward: Get a 0.25% interest rate reduction while enrolled in automatic payments1.

- Deferment: Students can take advantage of deferment options that are avilable.

Cons

- Limited repayment terms: Borrowers are only given three repayment options, 10 years, 15 years or 20 years. Discover says the repayment period you’re offered is also based on your creditworthiness.

- Hard credit pull: While some lenders will provide an interest rate quote by performing a soft credit check, this isn’t possible with Discover. You’ll need to fill out the full application and undergo a hard credit check before seeing your rate.

- No cosigner release: If you die, become disabled or can’t pay your Discover originated loans for any other reason, the responsibility for repayment will pass to your cosigner.

1Visit DiscoverStudentLoans.com/AutoDebitReward for terms and conditions.

Eligibility requirements

To qualify, the borrower must:

- Be at least 16 years old at the time of loan application. Cosigner required if under 18.

- Be a US Citizen, permanent resident or international student (International students require a creditworthy cosigner who is a US Citizen or permanent resident).

- Pass a credit check.

- Be enrolled at least half-time and making satisfactory academic progress in a Bachelor’s or Associate’s degree program at an eligible school.

Application process

As mentioned earlier, Discover doesn’t have a soft credit check option. To see your rate, you’ll need to complete the full application and pass a hard credit check.

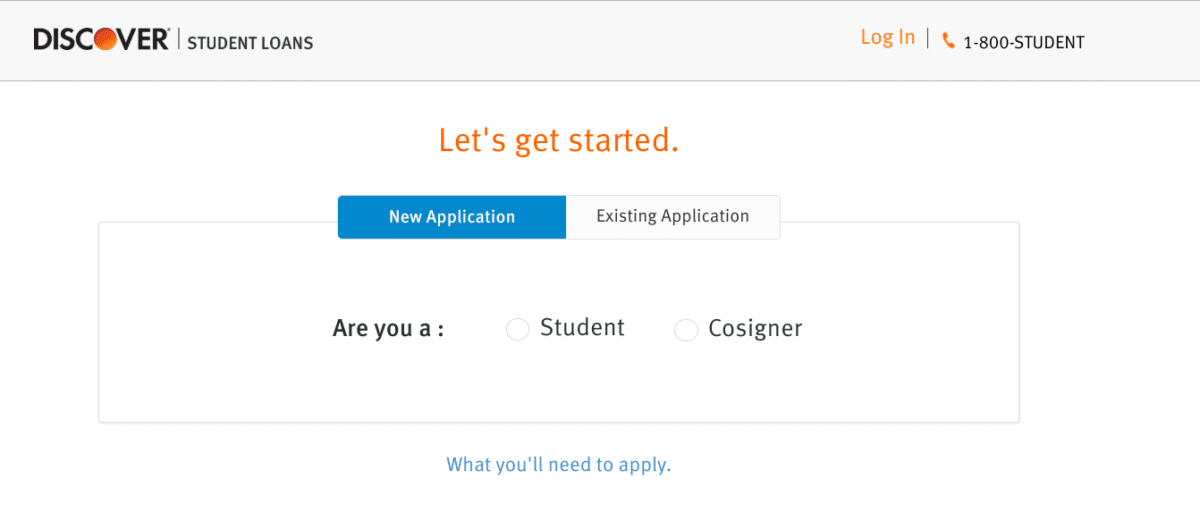

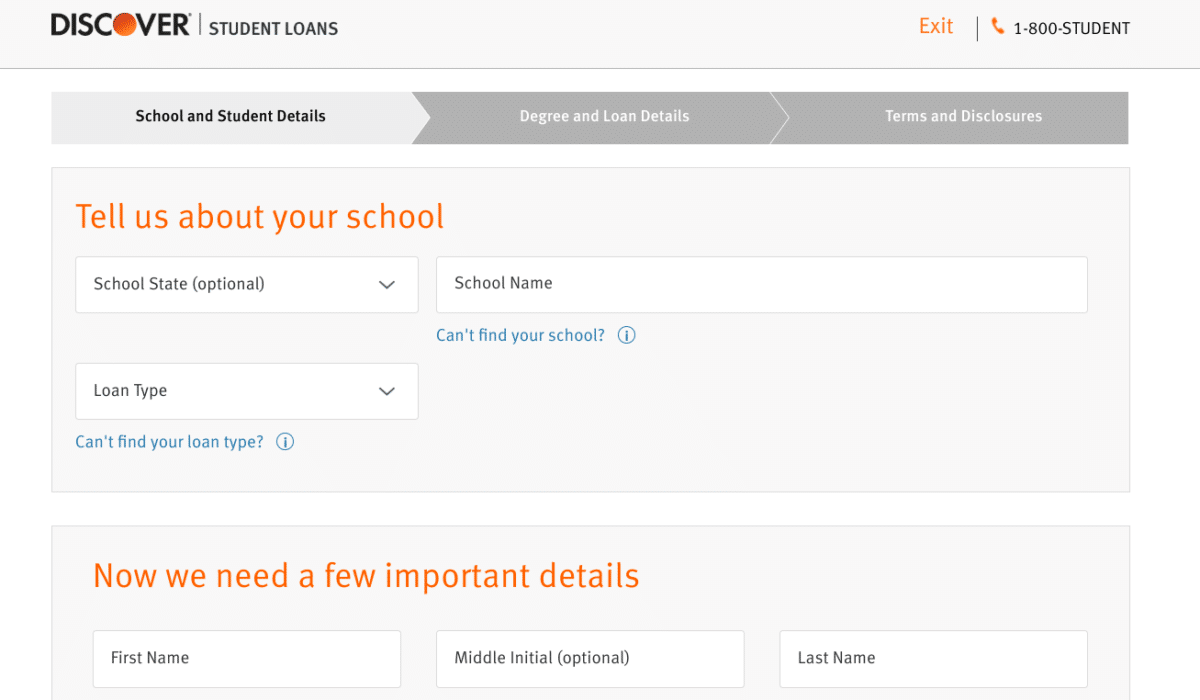

Their application can be submitted online or over the phone by calling 1-800-STUDENT. On their application page, Discover will first ask you to select if you’re a student or a cosigner.

For student applications, you’ll be asked to provide your social security number and other personal information as well as school and loan details.

Once you’ve submitted your application, Discover says that loan processing can take 30 to 45 days.

Discover private student loans

Discover offers private student loans for a variety of students including undergraduates, graduates, MBA, health professionals, law and residency students.

Discover is also somewhat unique in that they offer student loans to help cover the cost of bar exam prep for law school graduates.

Pros and Cons

Pros

- In-school payment flexibility: Borrowers aren’t required to begin repayment until 6 months after graduation. Or, to reduce interest accrual, students can choose an interest-only or $25 flat payment schedule while in school.

- Good grade rewards: Undergraduate, health professions, law, MBA or graduate loan applicants who get at least a 3.0 GPA can earn a cash reward equal to 1% of their loan amount.

- Graduation rewards: Undergraduate, health professions, law, MBA or graduate loan applicants with a variable interest rate student loan can earn a cash reward equal to 2% of their loan amount after they graduate.

- Multi-year option: When you apply for a Discover student loan, they can pre-qualify you for future loans to help you expedite the application process and avoid an additional credit hit.

- High loan amounts: No hard-fast lending caps. You can borrow up to 100% of the cost of attendance.

- No fees: As with their refinancing product, Discover doesn’t charge any application, origination, prepayment or late fees on their in-school student loans.

Cons

- Limited repayment terms: 15 and 20-year repayment terms are your only options.

- No federal benefits: Private loans don’t qualify for income-driven repayment or federal forgiveness programs like Public Service Loan Forgiveness (PSLF).

- Eligibility: Many students will find it difficult to qualify for an in-school Discover student loan without a cosigner.

Eligibility requirements

To qualify for a Discover private student loan, the borrower must:

- Be at least 16 years old at the time of loan application. Cosigner required if under 18.

- Be a US Citizen, permanent resident or international student (International students require a creditworthy cosigner who is a US Citizen or permanent resident).

- Pass a credit check.

- Be enrolled at least half-time and making satisfactory academic progress in a Bachelor’s or Associate’s degree program at an eligible school.

Residency students will need to have graduated within the last 12 months or be in their final year of medical school. Discover Bar Exam Loan applicants must have graduated no longer than 6 months prior to applying for their loan or be in their final year of law school.

Application process

The application process for Discover in-school student loans is the same as for Discover student loan refinancing. Here’s the information you’ll need to provide to apply:

- Social Security number

- School information and requested loan amount, as well as any financial aid you expect to receive

- Financial information

- Permanent and temporary addresses

Discover’s application is pretty straightforward. In fact, they say that it typically takes less than 15 minutes to apply.

Should you refinance with Discover or take out a Discover private student loan?

When it comes to student loan refinancing, Discover’s options aren’t all that exciting. For one, several lenders are currently offering better rates, especially for variable-rate loans. The number of repayment terms they offer is also well below the competition. And, as of now, Discover isn’t offering any refinancing cash bonuses either.

Discover’s in-school private student loans are a bit more compelling. They offer great in-school payment flexibility and come with nice perks like rewards for getting good grades and graduating. They even have student loans that can be used to pay for residency or bar exam prep.

But, remember, by taking out an in-school private loan, you’ll be giving up federal benefits and protections. In most cases, you should only consider private loans once you’ve hit your federal loan limit.

If that’s you, Discover’s student loan could be worth considering. Just make sure to compare their rates with other top private lenders before making a decision.

Refinance student loans, get a bonus in 2024

| Lender Name | Lender | Offer | Learn more |

|---|---|---|---|

|

$500 Bonus

*Includes optional 0.25% Auto Pay discount. For 100k or more.

|

Fixed 5.24 - 9.99% APR*

Variable 6.24 - 9.99% APR*

|

|

|

$1,000 Bonus

For 100k or more. $300 for 50k to $99,999

|

Fixed 5.19 - 10.24% APPR

Variable 5.28 - 10.24% APR

|

|

|

$1,000 Bonus

For 100k or more. $200 for 50k to $99,999

|

Fixed 5.19 - 9.74% APR

Variable 5.99 - 9.74% APR

|

|

|

$1,050 Bonus

For 100k+, $300 for 50k to 99k.

|

Fixed 5.44 - 9.75% APR

Variable 5.49 - 9.95% APR

|

|

|

$1,275 Bonus

For 150k+, $300 to $575 for 50k to 149k.

|

Fixed 5.48 - 8.69% APR

Variable 5.28 - 8.99% APR

|

|

|

$1,250 Bonus

For 100k+, $350 for 50k to 100k. $100 for 5k to 50k

|

Fixed 5.48 - 10.98% APR

Variable 5.28 - 12.41% AR

|

Not sure what to do with your student loans?

Take our 11 question quiz to get a personalized recommendation for 2024 on whether you should pursue PSLF, Biden’s New IDR plan, or refinancing (including the one lender we think could give you the best rate).