What you need to know:

- Education Loan Finance (ELFI) offers student loan refinancing.

- ELFI has Student Loan Advisors to help guide borrowers.

- ELFI serves borrowers in all 50 states and is owned by SouthEast Bank.

- Get up to $1,275 as a refinancing bonus when using our Student Loan Planner® referral link.

Education Loan Finance, also known as ELFI, owned by SouthEast Bank, is one of the lesser-known student loan refinancing companies. ELFI offers competitive refinancing rates, but where it really stands out is in customer service. Currently, the company is rated 4.8 out of 5 stars on Trustpilot and receives a 4.5 out of 5 stars from Student Loan Planner®. For more detailed information, read on for our full Education Loan Finance review.

ELFI student loan refinance review

ELFI offers student loan refinancing with a minimum of $10,000 and offers fixed-rate and variable-rate loans. Its customers save an average of $278 each month and may save an average of $20,774 over the life of the loan after refinancing, according to its website.

They have repayment terms between five and 20 years for student loan refinancing. ELFI also offers parent loan refinancing for parents who took on student loan debt on behalf of their child. Parents who opt for this can have a repayment term of five, 7 or 10 years.

For borrowers looking for more personalized support, ELFI can be a good option to consider. They have an experienced team with over 30 years of experience in the refinancing space and have Student Loan Advisors for each borrower.

Here’s a general overview of what ELFI has to offer for student loan refinancing:

- Interest rates: Fixed and variable

- Terms: 5, 7, 10, 15, and 20 year

- Loan amount: $10,000+

- Cosigner release: No

- Transfer to adult child: Yes

From a rate perspective, ELFI’s refinancing deals ebb and flow with periods of being really aggressive with pricing, as well as less aggressive periods. So, depending on when you apply for refinancing, you might find more competitive rates through a different lender.

But considering the student loan refinancing market has been more volatile in 2024 due to higher costs of capital being passed on to borrowers, it’s best to shop around with all of the top refinancing lenders to find the best deal.

Pros and cons: Education Loan Finance review

ELFI is just one of the student loan refinancing companies out there so it’s important to review the pros and cons.

Pros:

- Offers lower interest rates. ELFI offers competitive variable-rate loans and fixed-rate loans.

- Friendly to Parent PLUS loan borrowers. Allows parents to transfer the loan to their child’s name.

- Provides personalized customer support. Their team will support your refinancing journey at each step.

- No fees. ELFI has no loan application fees and no origination fees.

- No prepayment penalties. You can pay ahead on your loans with no consequences.

- Student loan refinancing expertise. The company has a total of 30 years of experience in this space.

- Forbearance up to 12 months. You have the option to put a hold on your monthly payments for up to a year.

- Easy and convenient. Their site says you can score a refinancing loan in just a few minutes.

Cons:

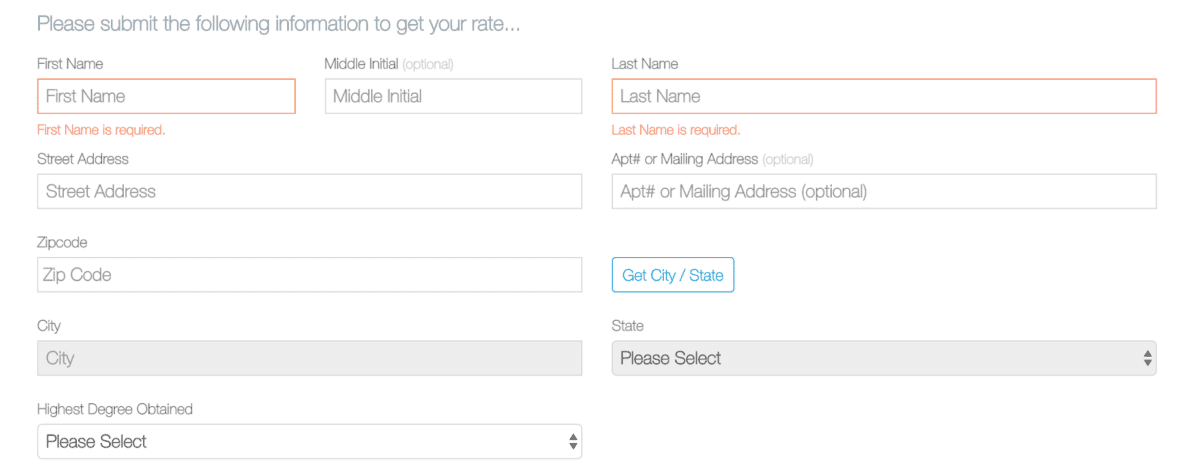

- Application isn’t user-friendly. There are several pages of information requested on the application.

- Cosigner release isn’t an option. That means your cosigner won’t be released and will be held responsible for the entirety of the loan repayment, should you stop paying.

Eligibility requirements for ELFI student loan refinance

In order to get approved for a refinancing loan through ELFI, you must meet certain eligibility requirements. To qualify for an ELFI student loan refinancing loan, you must:

- Be a U.S. citizen or permanent resident.

- Be at least the age of majority (legal adult by state) at the time of applying.

- Have an undergraduate bachelor’s degree or higher.

- Meet the minimum loan amount of $10,000.

- Have a minimum income of at least $35,000.

- Have a credit score of 680 or higher.

- Have a good credit history for the past three years.

- Have a degree from a qualified institution.

Note that ELFI might look at other underwriting criteria and eligibility requirements, such as your financial history and debt-to-income ratio.

Applying for a refinancing loan with ELFI

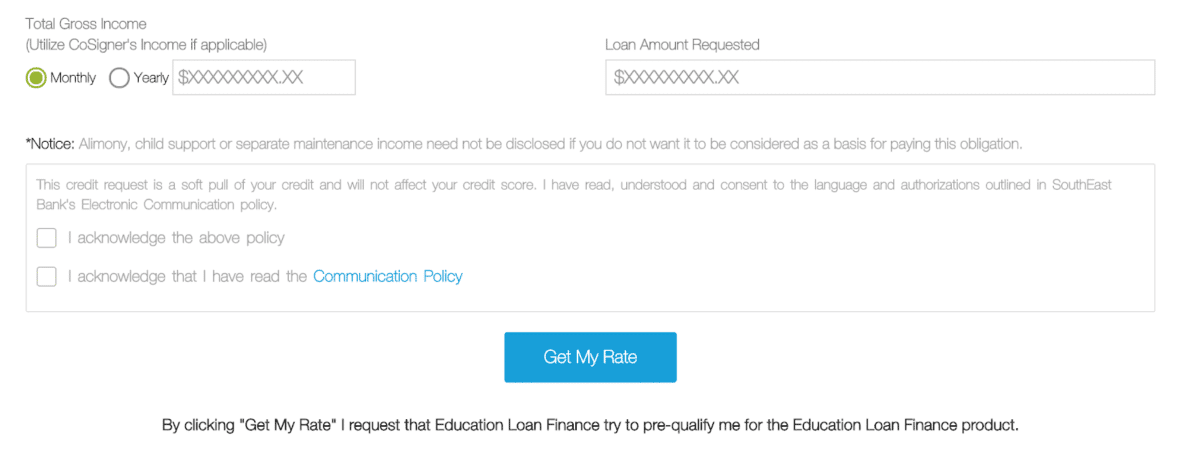

The ELFI application process might not be considered as user-friendly as other refinancing applications. To start, you need to create a profile.

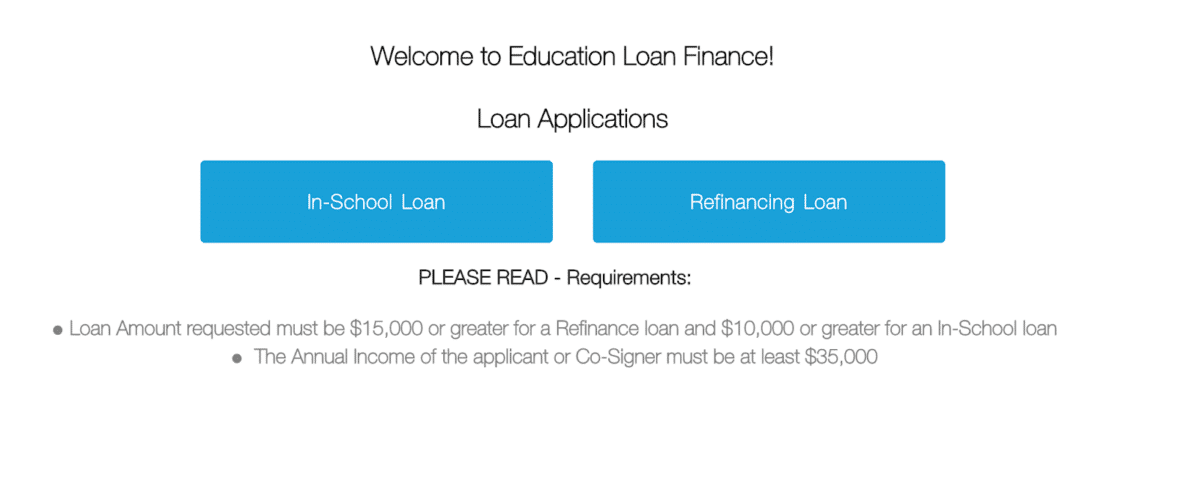

You’ll then have the option to choose from in-school loans or refinancing loans.

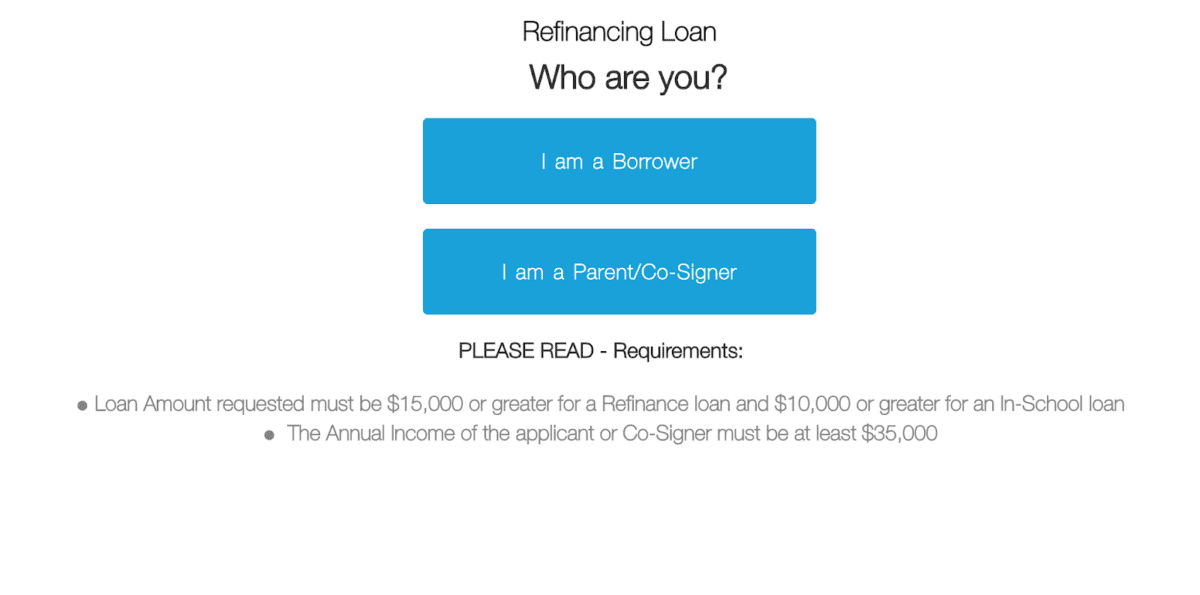

After choosing “refinancing loan,” select whether you’re a borrower or a parent/cosigner.

You’ll then be asked to verify your email address with a verification code they send you.

Submit your personal information, including full name, address, degree obtained, graduation date, Social Security number, income and the loan amount requested.

Once you agree to the loan terms and conditions, you can click “Get My Rate” to see the prospective APR and repayment terms you qualify for. Note that checking your rate won’t hurt your credit.

If you move forward with applying, you’ll need the following:

- Pay stubs of proof of employment from the last 30 days

- W-2 from the previous year

- Government-issued I.D.

- Tax returns, if you’re self-employed

- Account information

- Current billing statement for each qualified loan

The billing statement that you provide must have the following:

- Your name

- Your account number

- The current loan balance or payoff amounts

- The payment mailing address

If you apply with a cosigner (not required), your cosigner will also need to provide identification, pay stubs and a W-2.

It’ll take between 30 to 45 days for your current loans to be paid off. Once your loans are paid, you’ll start paying your refinancing loan with ELFI. ELFI’s refinance loans are serviced by Missouri Higher Education Loan Authority (MOHELA) and American Education Services (AES).

Should you refinance with ELFI?

We surveyed over 3,900 of our readers in January 2024 to learn about their refinancing experiences. Overall, those who refinanced with ELFI were happy with their decision.

Here’s what some of our readers had to say:

“The process was seamless and easy with ELFI. They communicated precisely what would happen and the time frame to expect it to be completed.”

“ELFI was great and very easy to work with.”

January 2024 Student Loan Planner Reader

If you want to refinance your student loans, ELFI may be an option to consider. When applying for an ELFI refinancing loan with our referral bonus link, you could receive a cash-back bonus ranging from:

- $300 bonus for loan amounts of at least $50,000.

- $575 bonus for loan amounts ranging from $100,000 to $149,000.

- $1,275 for loan amounts of $150,000 or more ($500 of cash bonus provided directly by Student Loan Planner®)

If you like working with a bank (because ELFI is serviced by SouthEast Bank) and you like personalized service, then these perks might outweigh the drawbacks.

For borrowers in general, it’s always a good idea to compare rates and terms among various lenders before deciding on one option.

What to consider before you refinance student loans

Before you decide to refinance with ELFI, it's key to review your student loan debt situation. If you have federal loans, for example, refinancing will limit your repayment options.

Refinancing a student loan means taking out a new loan that pays off your current student loan debt. That means you won't be eligible for federal student aid benefits or repayment plans such as income-driven repayment or student loan forgiveness.

If you have a private student loan, then refinancing isn't as much of a risk. Either way, it's important to know what you're walking into.

When you refinance, there will be a hard credit check to determine your final interest rate and eligibility. You want to check the student loan refinancing marketplace and compare ELFI among other financial institutions and lenders.

By doing your research, you can be informed and make a decision that fits with your financial goals and priorities.

FAQs for Education Loan Finance

Is there a downside to refinancing student loans?

If you have federal student loans, one major downside to refinancing your student loans is giving up borrower protections and repayment plans such as student loan forgiveness, forbearance, and income-driven repayment. When you refinance, you have a private loan.

Is ELFI legit?

ELFI is a student loan refinancing lender based in Tennessee that has been around since 2015. The company has an A+ rating on the Better Business Bureau.

Refinance student loans, get a bonus in 2024

| Lender Name | Lender | Offer | Learn more |

|---|---|---|---|

|

$500 Bonus

*Includes optional 0.25% Auto Pay discount. For 100k or more.

|

Fixed 5.24 - 9.99% APR*

Variable 6.24 - 9.99% APR*

|

|

|

$1,000 Bonus

For 100k or more. $300 for 50k to $99,999

|

Fixed 4.99 - 10.24% APPR

Variable 5.28 - 10.24% APR

|

|

|

$1,000 Bonus

For 100k or more. $200 for 50k to $99,999

|

Fixed 4.99 - 9.74% APR

Variable 5.89 - 9.74% APR

|

|

|

$1,050 Bonus

For 100k+, $300 for 50k to 99k.

|

Fixed 5.44 - 9.75% APR

Variable 5.49 - 9.95% APR

|

|

|

$1,275 Bonus

For 150k+, $300 to $575 for 50k to 149k.

|

Fixed 5.48 - 8.69% APR

Variable 5.28 - 8.99% APR

|

|

|

$1,250 Bonus

For 100k+, $350 for 50k to 100k. $100 for 5k to 50k

|

Fixed 5.24 - 10.99% APR

Variable 5.28 - 12.43% APR

|

Not sure what to do with your student loans?

Take our 11 question quiz to get a personalized recommendation for 2024 on whether you should pursue PSLF, Biden’s New IDR plan, or refinancing (including the one lender we think could give you the best rate).